“Securing Life Insurance in Your 50s: It’s Not Too Late—Here’s What You Need to Know!”

Benefits Of Getting Life Insurance In Your 50s

Many people assume that life insurance is only beneficial when purchased at a younger age, but obtaining a policy in your 50s can still provide significant advantages. While premiums may be higher compared to those offered to younger individuals, the benefits of securing life insurance at this stage in life can outweigh the costs. One of the most compelling reasons to consider life insurance in your 50s is the financial protection it offers to loved ones. Whether you have dependents, a spouse, or other family members who rely on your income, a life insurance policy ensures that they will not face financial hardship in the event of your passing. This can be particularly important if you still have outstanding debts, such as a mortgage, car loan, or credit card balances, as the death benefit can help cover these obligations and prevent your family from shouldering the burden.

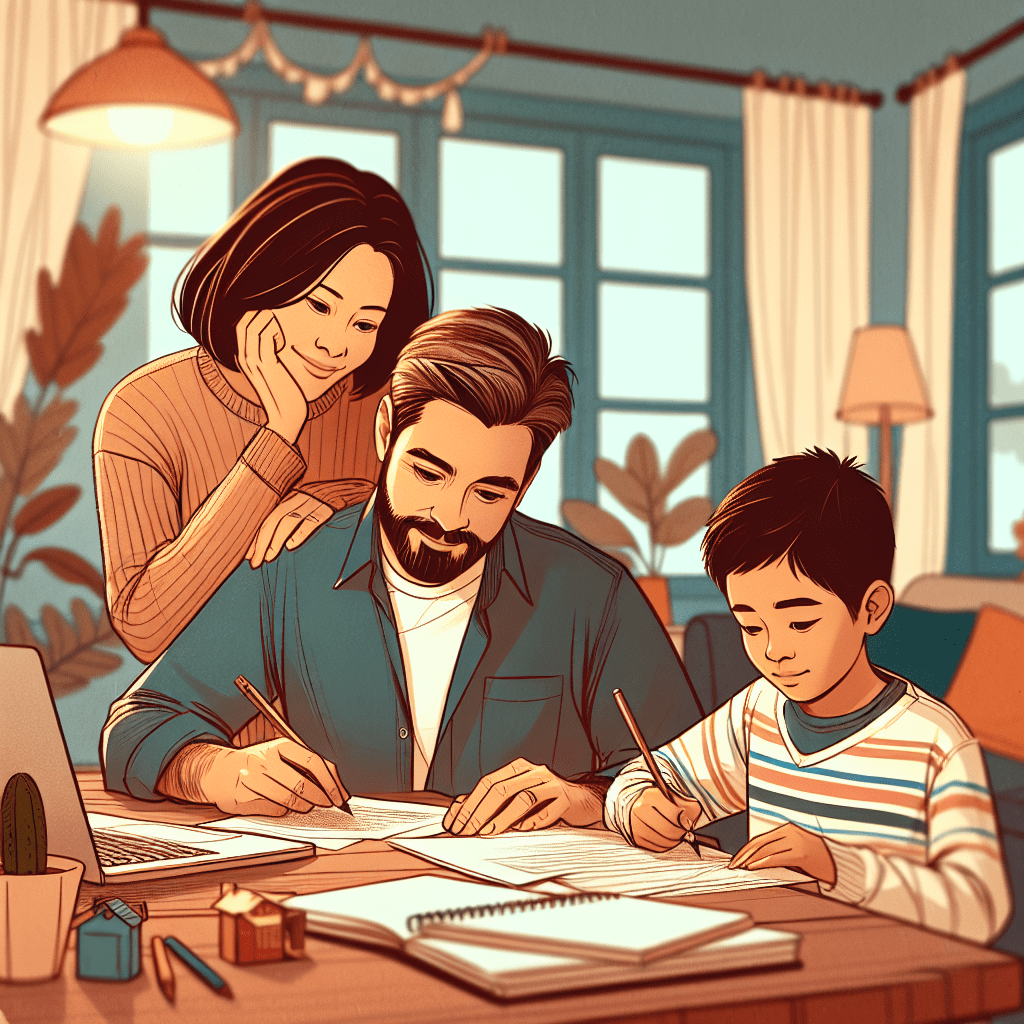

In addition to providing financial security, life insurance can also serve as a valuable tool for estate planning. Many individuals in their 50s begin to think more seriously about how their assets will be distributed after they are gone. A life insurance policy can help ensure that beneficiaries receive a tax-free payout, which can be used to cover estate taxes, legal fees, or other expenses associated with settling an estate. This can be especially beneficial for those who wish to leave a legacy for their children or grandchildren, as it provides a straightforward way to pass on financial support without complications.

Another important advantage of obtaining life insurance in your 50s is the ability to supplement retirement savings. While many people have retirement accounts such as 401(k)s or IRAs, these funds may not always be sufficient to cover all expenses in later years. Some types of life insurance, such as permanent life insurance policies, accumulate cash value over time, which can be accessed if needed. This can serve as an additional financial resource, providing flexibility and peace of mind in case unexpected expenses arise.

Moreover, life insurance can help cover final expenses, which is an often-overlooked aspect of financial planning. Funeral and burial costs can be substantial, and without proper preparation, these expenses may become a burden for surviving family members. A life insurance policy can ensure that these costs are covered, allowing loved ones to focus on grieving rather than worrying about financial matters.

While it is true that premiums tend to be higher for individuals in their 50s compared to those who purchase life insurance at a younger age, there are still affordable options available. Term life insurance, for example, provides coverage for a specific period and is generally more cost-effective than permanent life insurance. For those seeking lifelong coverage, whole or universal life insurance policies may be suitable, offering both a death benefit and a cash value component.

Ultimately, obtaining life insurance in your 50s is not only possible but also highly beneficial. It provides financial security, aids in estate planning, supplements retirement savings, and ensures that final expenses are covered. By carefully evaluating available options and selecting a policy that aligns with personal financial goals, individuals in their 50s can still take advantage of the many benefits that life insurance has to offer.

Common Myths About Buying Life Insurance Later In Life

Many people believe that purchasing life insurance later in life is either too expensive or entirely unattainable. This misconception often leads individuals in their 50s to forgo coverage, assuming they have missed their opportunity. However, the reality is that life insurance remains accessible and valuable, even for those who have waited until midlife to consider it. Understanding the common myths surrounding life insurance at this stage can help individuals make informed decisions about their financial future.

One of the most prevalent myths is that life insurance is prohibitively expensive for individuals in their 50s. While it is true that premiums generally increase with age, this does not mean that coverage is unaffordable. Many insurance providers offer a range of policy options designed to accommodate different budgets and needs. Term life insurance, for example, can provide substantial coverage at a lower cost compared to permanent policies. Additionally, some insurers specialize in policies for older applicants, making it possible to find competitive rates even later in life. By comparing different plans and working with an experienced insurance professional, individuals can identify policies that align with their financial situation.

Another common misconception is that individuals in their 50s no longer need life insurance. Some believe that by this stage, their financial responsibilities have diminished, making coverage unnecessary. However, many people in their 50s still have outstanding debts, mortgage payments, or dependents who rely on their income. Additionally, life insurance can serve as a financial safety net for a surviving spouse, helping to cover living expenses, medical bills, or funeral costs. Even for those who have accumulated savings, life insurance can provide an extra layer of financial security, ensuring that loved ones are not burdened with unexpected expenses.

Some individuals also assume that pre-existing health conditions automatically disqualify them from obtaining life insurance. While it is true that health plays a role in determining eligibility and premium rates, many insurers offer policies specifically designed for individuals with medical conditions. Guaranteed issue and simplified issue life insurance policies, for instance, do not require a medical exam and can provide coverage regardless of health status. Although these policies may have higher premiums or lower coverage amounts, they still offer valuable financial protection. Furthermore, some insurers take a more holistic approach to underwriting, considering factors such as lifestyle and overall health management rather than focusing solely on medical history.

Another widely held belief is that life insurance is only beneficial for younger individuals with young children. While it is common for parents to purchase life insurance to protect their families, the benefits extend beyond this stage of life. In addition to providing financial support for dependents, life insurance can be used for estate planning, charitable giving, or leaving a financial legacy. Some policies also accumulate cash value over time, which can be accessed if needed. For those in their 50s who are thinking about long-term financial planning, life insurance can be a strategic tool to ensure that their assets are distributed according to their wishes.

Ultimately, the idea that it is too late to purchase life insurance in one’s 50s is a misconception that can prevent individuals from securing valuable financial protection. By dispelling these myths and exploring available options, individuals can make informed decisions that align with their financial goals and provide peace of mind for themselves and their loved ones.

How To Find The Best Life Insurance Policy In Your 50s

Finding the best life insurance policy in your 50s requires careful consideration of your financial needs, health status, and long-term goals. While some may assume that purchasing life insurance later in life is too expensive or difficult, there are still many options available that can provide valuable coverage. The key is to assess your specific situation and compare policies to ensure you select the most suitable plan.

One of the first steps in finding the right life insurance policy is determining the type of coverage that best fits your needs. There are two primary types of life insurance: term life and permanent life insurance. Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years, and is often more affordable than permanent policies. This option is ideal for individuals who need coverage for a set period, such as until their mortgage is paid off or their children become financially independent. On the other hand, permanent life insurance, which includes whole life and universal life policies, offers lifelong coverage and builds cash value over time. While these policies tend to be more expensive, they can serve as a financial asset and provide additional benefits, such as borrowing against the policy’s cash value.

Once you have determined the type of policy that aligns with your needs, the next step is evaluating your budget. Life insurance premiums increase with age, so it is essential to find a policy that provides adequate coverage without straining your finances. Comparing quotes from multiple insurance providers can help you identify the most cost-effective option. Additionally, some insurers specialize in policies for older individuals, offering competitive rates and flexible terms. Working with an independent insurance agent can also be beneficial, as they can provide personalized recommendations and access to a variety of policies from different companies.

Another crucial factor to consider is your health status. Insurance companies assess applicants based on their medical history, lifestyle habits, and overall health. While pre-existing conditions may result in higher premiums, many insurers offer policies with simplified underwriting or no medical exam requirements. These policies, such as guaranteed issue or simplified issue life insurance, can be a viable option for individuals with health concerns. However, they often come with higher premiums and lower coverage amounts. To secure the best possible rates, maintaining a healthy lifestyle, managing chronic conditions, and quitting smoking can improve your insurability and reduce costs.

In addition to comparing policies and considering health factors, it is important to review the financial stability and reputation of the insurance provider. Choosing a company with strong financial ratings ensures that your beneficiaries will receive the death benefit when needed. Researching customer reviews and consulting third-party rating agencies, such as AM Best or Standard & Poor’s, can provide insight into an insurer’s reliability and claims-paying ability.

Finally, understanding the policy’s terms and conditions is essential before making a decision. Carefully reviewing the coverage amount, premium structure, exclusions, and any potential riders can help you avoid unexpected surprises. Some policies offer additional benefits, such as accelerated death benefits or long-term care riders, which can provide financial support in case of a serious illness. By thoroughly evaluating your options and seeking professional guidance if needed, you can find a life insurance policy that offers financial security and peace of mind for you and your loved ones.