“Life Insurance: The Protection You Don’t Want to Need, But Can’t Afford to Be Without.”

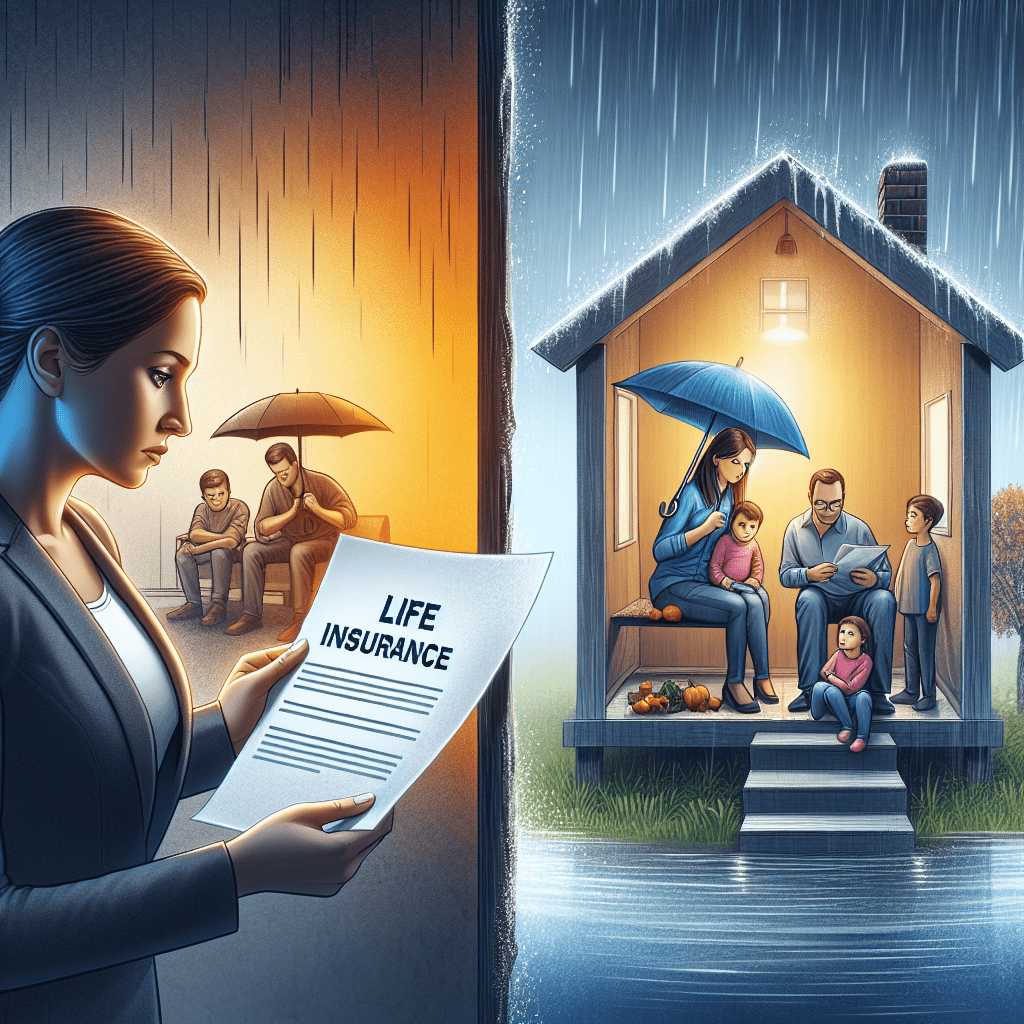

The Unseen Safety Net: How Life Insurance Protects Your Loved Ones

Life is full of uncertainties, and while no one likes to dwell on worst-case scenarios, preparing for the unexpected is one of the most responsible decisions a person can make. Life insurance serves as an unseen safety net, offering financial protection and peace of mind to those left behind. Though it may not be a topic people eagerly discuss, its impact on families during times of crisis is immeasurable. By ensuring that loved ones are financially secure, life insurance provides stability in moments of profound loss.

One of the most significant ways life insurance protects families is by replacing lost income. When a primary earner passes away, the financial burden on surviving family members can be overwhelming. Mortgage payments, utility bills, and daily living expenses do not pause in the face of tragedy. Without a steady income, families may struggle to maintain their standard of living, forcing them to make difficult financial decisions. A well-structured life insurance policy can help bridge this gap, ensuring that dependents have the resources they need to continue their lives without immediate financial hardship.

Beyond income replacement, life insurance also plays a crucial role in covering outstanding debts. Many individuals carry financial obligations such as mortgages, car loans, or credit card balances. In the absence of life insurance, these debts may become the responsibility of surviving family members, adding to their emotional and financial stress. A life insurance payout can help settle these obligations, preventing loved ones from facing additional burdens during an already challenging time.

In addition to managing everyday expenses and debts, life insurance can also provide for future financial needs. For families with young children, the cost of education is a major consideration. College tuition and other educational expenses can be significant, and without proper planning, funding a child’s education may become difficult. A life insurance policy can ensure that children have the financial support necessary to pursue their academic goals, even in the absence of a parent. This long-term benefit underscores the importance of life insurance as a tool for securing a family’s future.

Furthermore, life insurance can help cover the often-overlooked costs associated with end-of-life expenses. Funeral and burial costs can be substantial, placing an unexpected financial strain on grieving families. By having a life insurance policy in place, individuals can alleviate this burden, allowing their loved ones to focus on healing rather than financial concerns. This aspect of life insurance highlights its role in providing not only financial security but also emotional relief during difficult times.

While the financial benefits of life insurance are clear, its value extends beyond monetary considerations. Knowing that loved ones will be taken care of provides a sense of reassurance that is difficult to quantify. It allows individuals to live with confidence, secure in the knowledge that their families will not face unnecessary hardship in their absence. This peace of mind is one of the most profound gifts a person can offer to those they care about.

Ultimately, life insurance is not just about preparing for the worst; it is about ensuring a stable and secure future for those who matter most. Though it may be an uncomfortable topic, addressing it proactively can make all the difference. By recognizing life insurance as an essential component of financial planning, individuals can take meaningful steps toward protecting their loved ones from the uncertainties of life.

Planning for the Unexpected: Why Life Insurance Is a Must-Have

No one likes to think about it, but life insurance can change everything. While it is natural to avoid contemplating worst-case scenarios, planning for the unexpected is a crucial part of securing a stable future for loved ones. Life is unpredictable, and while we hope for the best, preparing for unforeseen circumstances ensures that those who depend on us are not left struggling in the event of a tragedy. Life insurance serves as a financial safety net, providing peace of mind and stability when it is needed most.

One of the most compelling reasons to invest in life insurance is the financial protection it offers to family members. The sudden loss of a loved one can be emotionally devastating, but it can also bring significant financial challenges. Without a steady income, dependents may struggle to cover daily expenses, mortgage payments, or even basic necessities. Life insurance helps bridge this gap by providing a lump sum or regular payments to beneficiaries, ensuring that they can maintain their standard of living even in the absence of the primary breadwinner.

Beyond covering immediate expenses, life insurance can also play a critical role in long-term financial planning. Many policies offer benefits that extend beyond simple death coverage, such as cash value accumulation or investment opportunities. These features can help policyholders build wealth over time, offering additional financial security for retirement or other future needs. Furthermore, life insurance can be used to cover outstanding debts, such as student loans, car payments, or credit card balances, preventing loved ones from inheriting financial burdens.

For parents, life insurance is particularly essential. Raising children comes with significant financial responsibilities, from education costs to healthcare expenses. If a parent were to pass away unexpectedly, life insurance can help ensure that their children’s future remains secure. Funds from a policy can be used to cover tuition fees, extracurricular activities, or even childcare costs, allowing surviving family members to focus on emotional healing rather than financial stress.

Business owners also have much to gain from life insurance. In the event of an untimely death, a business can face serious financial difficulties, especially if the deceased played a key role in its operations. Life insurance can provide the necessary funds to keep the business running, cover outstanding debts, or facilitate a smooth transition of ownership. Additionally, policies such as key person insurance can help protect companies from the financial impact of losing a crucial employee or executive.

While the benefits of life insurance are clear, many people delay purchasing a policy due to misconceptions about cost or necessity. Some believe that life insurance is only for older individuals or those with significant assets, but in reality, it is a valuable tool for people of all ages and financial backgrounds. Younger individuals often benefit from lower premiums, making it more affordable to secure coverage early. Moreover, life insurance is not just for those with dependents; it can also be used to cover funeral expenses, medical bills, or charitable contributions.

Ultimately, life insurance is an investment in the future, offering protection and stability in times of uncertainty. By planning ahead and securing a policy, individuals can ensure that their loved ones are cared for, no matter what the future holds. Though it may be uncomfortable to think about, taking proactive steps today can make all the difference when the unexpected occurs.

Securing Your Family’s Future: The Life-Changing Impact of Life Insurance

No one likes to think about it, but life insurance can change everything. While discussions about financial planning often focus on savings, investments, and retirement, life insurance remains one of the most crucial yet overlooked aspects of securing a family’s future. The reality is that life is unpredictable, and ensuring that loved ones are financially protected in the event of an untimely passing is an essential responsibility. Life insurance provides a safety net that can prevent financial hardship, offering peace of mind and stability during difficult times.

One of the most significant benefits of life insurance is its ability to replace lost income. For families that rely on a primary breadwinner, the sudden loss of that income can be devastating. Mortgage payments, utility bills, education costs, and daily living expenses do not stop, and without a financial cushion, surviving family members may struggle to maintain their standard of living. A well-structured life insurance policy ensures that dependents have the necessary financial resources to cover these expenses, allowing them to focus on healing rather than financial stress.

Beyond income replacement, life insurance can also help cover outstanding debts. Many individuals carry mortgages, car loans, student loans, and credit card balances that do not disappear upon death. Without adequate coverage, these financial obligations may fall on surviving family members, creating an additional burden during an already challenging time. A life insurance payout can be used to settle these debts, preventing creditors from placing undue pressure on grieving loved ones.

In addition to covering immediate expenses, life insurance plays a crucial role in long-term financial planning. Parents often worry about their children’s future, particularly when it comes to education. The rising cost of tuition and other educational expenses can be overwhelming, but a life insurance policy can help ensure that children have the financial support needed to pursue their academic goals. By securing a policy that accounts for future educational costs, parents can provide their children with opportunities that might otherwise be out of reach.

Furthermore, life insurance can serve as a tool for wealth transfer and estate planning. For individuals with significant assets, life insurance can help cover estate taxes, ensuring that heirs receive their intended inheritance without the need to liquidate valuable assets. This is particularly important for business owners who wish to pass their enterprises on to the next generation. Without proper planning, heirs may be forced to sell a family business to cover tax liabilities, disrupting a legacy that took years to build. A well-structured life insurance policy can provide the necessary liquidity to preserve these assets and facilitate a smooth transition.

While the financial benefits of life insurance are undeniable, the emotional reassurance it provides is equally important. Knowing that loved ones will be taken care of in the event of an unexpected tragedy offers a sense of security that cannot be measured in monetary terms. It allows individuals to live with confidence, knowing that their families will not face financial hardship in their absence.

Ultimately, life insurance is not just about preparing for the worst—it is about ensuring a stable and secure future for those who matter most. By taking the time to assess financial needs and invest in the right policy, individuals can provide their families with the protection they deserve. Though it may be an uncomfortable topic to consider, the impact of life insurance is profound, offering both financial stability and peace of mind when it is needed most.