“Smart Spending, Stronger Credit: Use Your Card the Right Way!”

Responsible Spending: How to Use Credit Cards Without Accumulating Debt

Using credit cards responsibly is essential for building a strong credit score while avoiding the pitfalls of excessive debt. Many individuals fall into the trap of overspending, which can lead to financial difficulties and long-term credit damage. However, by adopting disciplined spending habits and understanding how credit utilization impacts credit scores, it is possible to use credit cards as a tool for financial growth rather than a source of financial strain.

One of the most effective ways to use credit cards responsibly is to treat them as a means of payment rather than a source of borrowed money. This mindset helps prevent unnecessary purchases that may be difficult to repay. Instead of using a credit card to buy items that are beyond one’s financial means, it is advisable to charge only what can be comfortably paid off in full by the due date. Paying the full balance each month not only prevents interest charges from accumulating but also demonstrates responsible credit usage, which positively impacts a credit score.

In addition to paying the full balance, keeping credit utilization low is another crucial factor in maintaining a healthy credit profile. Credit utilization refers to the percentage of available credit that is being used at any given time. Experts recommend keeping this ratio below 30%, as high utilization can signal financial distress to lenders. For instance, if a credit card has a limit of $5,000, it is best to keep the outstanding balance below $1,500. By doing so, individuals can show that they are not overly reliant on credit, which can improve their creditworthiness over time.

Furthermore, making payments on time is one of the most significant contributors to a strong credit score. Payment history accounts for a substantial portion of a credit score calculation, and even a single missed payment can have a negative impact. To avoid late payments, setting up automatic payments or calendar reminders can be helpful. Consistently paying at least the minimum amount due—though ideally the full balance—demonstrates financial responsibility and helps build a positive credit history.

Another important aspect of responsible credit card use is avoiding the temptation to open multiple accounts unnecessarily. While having multiple credit cards can increase available credit and potentially lower utilization, opening too many accounts in a short period can lead to hard inquiries on a credit report, which may temporarily lower a credit score. Additionally, managing multiple accounts requires careful attention to due dates and balances, which can become overwhelming if not handled properly. Instead, it is advisable to start with one or two credit cards and use them responsibly before considering additional accounts.

Lastly, regularly monitoring credit reports can help individuals stay informed about their financial standing and detect any errors or fraudulent activity. Many financial institutions offer free credit monitoring services, and individuals are entitled to a free credit report from each of the major credit bureaus annually. Reviewing these reports allows cardholders to ensure that their responsible spending habits are accurately reflected and to address any discrepancies promptly.

By following these principles, individuals can use credit cards as a valuable financial tool without accumulating unnecessary debt. Responsible spending, timely payments, and mindful credit utilization all contribute to a strong credit score, which can open doors to better financial opportunities in the future.

Payment Strategies: The Best Ways to Pay Your Credit Card Bill on Time

Paying your credit card bill on time is one of the most important factors in building and maintaining a strong credit score. Since payment history accounts for a significant portion of your credit score, consistently making on-time payments demonstrates financial responsibility and reliability to lenders. To ensure that you never miss a payment, it is essential to adopt effective payment strategies that align with your financial habits and goals. By implementing these strategies, you can avoid late fees, prevent interest charges from accumulating, and steadily improve your creditworthiness.

One of the most effective ways to ensure timely payments is to set up automatic payments through your bank or credit card issuer. Many financial institutions offer the option to schedule automatic payments for at least the minimum amount due or the full statement balance. By enabling this feature, you eliminate the risk of forgetting a due date, which can help you maintain a positive payment history. However, it is crucial to monitor your bank account to ensure that sufficient funds are available when the payment is processed. Insufficient funds could lead to overdraft fees or declined payments, which may negatively impact your credit score.

In addition to setting up automatic payments, creating calendar reminders can serve as an extra layer of protection against missed due dates. Whether you prefer digital reminders on your smartphone or physical notes in a planner, marking your payment due date a few days in advance can help you stay on track. Some credit card issuers also provide text or email alerts to notify you when your payment is due, making it easier to manage your financial obligations. By taking advantage of these reminders, you can reinforce the habit of paying your bill on time and avoid unnecessary penalties.

Another effective strategy is to make multiple payments throughout the billing cycle rather than waiting until the due date. By making smaller payments periodically, you can reduce your overall balance and keep your credit utilization ratio low, which is another key factor in determining your credit score. This approach not only helps you stay ahead of your financial obligations but also minimizes the risk of carrying a high balance that could negatively impact your credit profile. Additionally, frequent payments can help you manage your budget more effectively by preventing large, lump-sum payments that may strain your finances.

If you ever find yourself struggling to make a payment on time, it is important to communicate with your credit card issuer as soon as possible. Many issuers offer hardship programs or temporary payment extensions for customers facing financial difficulties. By reaching out proactively, you may be able to negotiate a solution that prevents late fees and protects your credit score. Ignoring a missed payment can lead to more severe consequences, including increased interest rates and negative marks on your credit report, so addressing the issue promptly is always the best course of action.

Ultimately, developing a consistent payment strategy is essential for building and maintaining a strong credit score. By utilizing automatic payments, setting reminders, making multiple payments when possible, and communicating with your issuer in times of difficulty, you can ensure that your credit card payments are always made on time. These habits not only contribute to a positive credit history but also establish a foundation for long-term financial success.

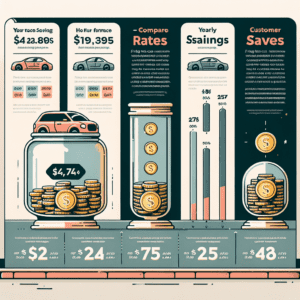

Credit Utilization: How to Keep Your Credit Usage Low for a Higher Score

One of the most important factors in maintaining a strong credit score is credit utilization, which refers to the percentage of your available credit that you are currently using. Lenders view this metric as an indicator of financial responsibility, and keeping your credit utilization low can significantly improve your credit score over time. While it may seem simple to manage, many individuals unknowingly allow their credit usage to rise too high, which can negatively impact their overall creditworthiness. Understanding how to strategically manage your credit utilization is essential for building and maintaining a strong financial profile.

To begin with, it is crucial to recognize how credit utilization is calculated. This percentage is determined by dividing your total credit card balances by your total credit limits across all accounts. For example, if you have a total credit limit of $10,000 and a combined balance of $3,000, your credit utilization rate would be 30%. Most financial experts recommend keeping this ratio below 30%, but for optimal credit score improvement, a utilization rate of 10% or lower is ideal. A lower utilization rate signals to lenders that you are not overly reliant on credit and can manage your finances responsibly.

One effective way to maintain a low credit utilization rate is by making multiple payments throughout the billing cycle. Instead of waiting until the due date to pay off your balance, consider making smaller payments throughout the month. This approach helps keep your reported balance low when credit bureaus calculate your utilization rate. Additionally, paying off your balance in full each month not only reduces your utilization but also prevents interest charges from accumulating, which can save you money in the long run.

Another strategy to keep your credit usage low is to request a credit limit increase. If you have demonstrated responsible credit behavior, such as making on-time payments and keeping balances low, your credit card issuer may approve a higher credit limit. By increasing your available credit while maintaining the same spending habits, your utilization rate will naturally decrease. However, it is important to resist the temptation to spend more simply because you have a higher limit, as this could lead to financial strain and increased debt.

In addition to increasing your credit limit, spreading your expenses across multiple credit cards can also help manage utilization. Instead of charging all purchases to a single card, consider distributing them among different accounts. This approach ensures that no single card carries a high balance relative to its limit, which can help maintain a favorable utilization rate. However, it is essential to monitor all accounts carefully to avoid missing payments, as late payments can have a detrimental effect on your credit score.

Finally, keeping old credit accounts open can contribute to a lower utilization rate. Closing a credit card reduces your total available credit, which can cause your utilization percentage to rise even if your spending remains the same. Unless a card has high fees or other unfavorable terms, it is generally beneficial to keep it open and use it occasionally to prevent account closure due to inactivity.

By implementing these strategies, you can effectively manage your credit utilization and build a stronger credit score over time. Maintaining a low utilization rate demonstrates financial responsibility, which can improve your chances of securing favorable loan terms and interest rates in the future.