“Credit Card Rewards: Perks or Pitfalls?”

Understanding Credit Card Rewards: Are They Truly Beneficial?

Credit card rewards programs have become an enticing feature for many consumers, offering the promise of cashback, travel perks, and exclusive discounts. These incentives often make credit cards seem like a financially savvy tool, but it is essential to examine whether they truly provide significant benefits or if they encourage spending habits that may not be in the best interest of the cardholder. While rewards programs can offer value, their true benefit depends on how they are used and whether the potential drawbacks outweigh the advantages.

One of the primary attractions of credit card rewards is the ability to earn points, miles, or cashback on everyday purchases. Many credit card issuers market these programs as a way for consumers to get something in return for their spending. For individuals who pay off their balances in full each month, these rewards can indeed be beneficial. By strategically using a rewards credit card for necessary expenses such as groceries, gas, and bills, cardholders can accumulate points that translate into tangible benefits, such as free flights, hotel stays, or statement credits. However, the key to maximizing these rewards lies in responsible credit card usage.

Despite the potential advantages, credit card rewards programs are not without their pitfalls. Many consumers are drawn in by the allure of earning points and may end up spending more than they otherwise would. This phenomenon, known as the “rewards spending effect,” can lead to unnecessary purchases simply to earn additional points. Additionally, some rewards programs have complex structures that make it difficult for cardholders to redeem their points effectively. Restrictions such as blackout dates, expiration policies, and minimum redemption thresholds can limit the actual value of the rewards earned.

Another critical factor to consider is the cost associated with rewards credit cards. Many of these cards come with annual fees, which can quickly diminish the value of any rewards earned. While some premium credit cards offer substantial perks, such as airport lounge access or travel insurance, these benefits may not justify the high fees unless the cardholder frequently takes advantage of them. Furthermore, interest rates on rewards credit cards tend to be higher than those on non-rewards cards. If a cardholder carries a balance from month to month, the interest charges can easily outweigh any rewards earned, making the program far less beneficial.

It is also important to recognize that not all rewards programs are created equal. Some offer higher earning rates on specific categories, such as dining or travel, while others provide a flat-rate cashback on all purchases. Choosing the right rewards card requires careful consideration of spending habits and financial goals. A card that aligns with an individual’s typical expenses will yield the most value, whereas a mismatched card may result in missed opportunities to maximize rewards.

Ultimately, credit card rewards can be advantageous for disciplined consumers who use their cards strategically and pay off their balances in full each month. However, for those who struggle with overspending or carry a balance, the costs associated with these programs can quickly outweigh the benefits. Understanding the terms and conditions of a rewards program, evaluating personal spending habits, and considering potential fees are all essential steps in determining whether a rewards credit card is truly a good deal.

Hidden Costs of Credit Card Rewards: What You Need to Know

Credit card rewards programs are often marketed as a way for consumers to earn valuable benefits simply by using their cards for everyday purchases. From cashback incentives to travel points and exclusive discounts, these rewards can seem like an easy way to save money or enjoy luxury perks. However, beneath the surface, there are hidden costs that many cardholders fail to consider. While these programs can be beneficial for some, they are not always the great deal they appear to be. Understanding the potential drawbacks is essential for making informed financial decisions.

One of the most significant hidden costs of credit card rewards is the potential for higher interest rates. Many rewards cards come with annual percentage rates (APRs) that are higher than those of non-rewards credit cards. If a cardholder carries a balance from month to month, the interest charges can quickly outweigh any rewards earned. For example, a card that offers 2% cashback on purchases may seem appealing, but if the cardholder is paying 20% interest on an outstanding balance, the financial benefit of the rewards is effectively canceled out. This is particularly concerning for individuals who struggle to pay off their balances in full each month.

In addition to high interest rates, many rewards credit cards also come with annual fees. While some cards offer generous rewards, they often charge a yearly fee that can range from $95 to several hundred dollars. For consumers who do not spend enough to justify the cost, these fees can erode the value of any rewards earned. Even if a card offers substantial benefits, such as free travel insurance or airport lounge access, the annual fee may make it an impractical choice for those who do not take full advantage of these perks.

Another hidden cost that many consumers overlook is the potential for increased spending. Studies have shown that people tend to spend more when using credit cards compared to cash or debit cards. The promise of earning rewards can encourage unnecessary purchases, leading to higher overall spending. This psychological effect can be particularly problematic for individuals who are trying to stick to a budget. While earning points or cashback may seem like a smart financial move, it is only beneficial if the spending aligns with one’s actual needs and financial goals.

Furthermore, credit card rewards programs often come with complex terms and conditions that can make it difficult to maximize benefits. Many programs impose restrictions such as expiration dates on points, blackout dates for travel redemptions, and minimum spending requirements to qualify for certain rewards. Additionally, some rewards programs devalue points over time, meaning that the purchasing power of accumulated rewards may decrease. These limitations can make it challenging for cardholders to fully utilize their rewards, reducing the overall value of the program.

Ultimately, while credit card rewards can offer valuable benefits, they are not always as advantageous as they seem. The potential for high interest rates, annual fees, increased spending, and restrictive terms can diminish the value of these programs. Consumers should carefully evaluate their spending habits and financial situation before committing to a rewards credit card. By understanding the hidden costs, individuals can make more informed decisions and avoid potential financial pitfalls.

Maximizing Credit Card Rewards: Smart Strategies or Marketing Trap?

Credit card rewards programs have become an enticing feature for consumers looking to maximize their spending power. With promises of cashback, travel perks, and exclusive discounts, these programs appear to offer significant benefits. However, the reality is more complex, as the effectiveness of these rewards depends on how they are used. While some individuals successfully leverage credit card rewards to their advantage, others may find themselves caught in a cycle of unnecessary spending and high-interest debt. Understanding the true value of these programs requires a careful examination of their structure, potential benefits, and hidden pitfalls.

One of the primary advantages of credit card rewards is the ability to earn points, miles, or cashback on everyday purchases. Many credit card issuers offer generous sign-up bonuses, which can provide substantial value if the spending requirements are met within the specified timeframe. Additionally, some cards offer higher reward rates for specific categories such as dining, travel, or groceries, allowing cardholders to accumulate rewards more quickly. For those who pay their balances in full each month, these benefits can translate into significant savings or valuable travel opportunities. However, the key to maximizing these rewards lies in strategic spending and disciplined financial management.

Despite the potential advantages, credit card rewards programs are carefully designed to encourage increased spending. Many consumers are tempted to make unnecessary purchases simply to earn rewards, which can lead to financial strain if balances are not paid in full. Furthermore, some rewards programs have complex redemption structures, making it difficult for cardholders to fully utilize their accumulated points or miles. Expiration dates, blackout periods, and fluctuating redemption values can diminish the overall worth of these rewards, leaving some consumers with less value than they initially anticipated.

Another critical factor to consider is the cost associated with rewards credit cards. Many premium rewards cards come with high annual fees, which can offset the benefits if the rewards earned do not exceed the cost of maintaining the card. Additionally, interest rates on rewards credit cards tend to be higher than those on non-rewards cards, meaning that carrying a balance can quickly erode any potential benefits. For individuals who do not consistently pay off their balances, the interest charges may far outweigh the value of any rewards earned.

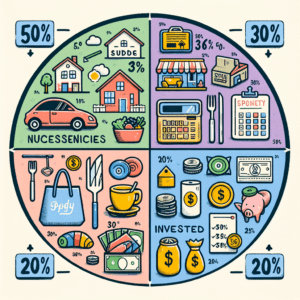

To truly benefit from credit card rewards, consumers must adopt a strategic approach. This includes selecting a card that aligns with their spending habits, ensuring that the rewards structure complements their lifestyle. Additionally, it is essential to track spending carefully and avoid making purchases solely for the sake of earning rewards. Paying off the balance in full each month is crucial to prevent interest charges from negating the benefits. Furthermore, understanding the redemption process and taking advantage of promotions or transfer partners can help maximize the value of accumulated rewards.

Ultimately, credit card rewards can be a valuable tool for those who use them wisely, but they are not a guaranteed financial advantage. While some individuals successfully leverage these programs to earn free travel or cashback, others may find themselves spending more than necessary or struggling with high-interest debt. By approaching credit card rewards with a clear strategy and financial discipline, consumers can determine whether these programs truly offer a good deal or simply serve as a marketing trap designed to encourage increased spending.