“Debt Relief & Your Credit Score: Weighing the Pros and Cons for a Stronger Financial Future.”

How Debt Relief Impacts Your Credit Score: Understanding the Pros and Cons

Debt relief can be a valuable tool for individuals struggling with overwhelming financial obligations, but it is essential to understand how it affects credit scores. While debt relief options such as debt settlement, debt consolidation, and bankruptcy can provide much-needed financial relief, they also come with potential consequences for creditworthiness. Evaluating both the advantages and disadvantages of debt relief is crucial for making informed financial decisions.

One of the primary benefits of debt relief is the opportunity to regain financial stability. By reducing or restructuring outstanding debt, individuals can lower their monthly payments, making it easier to manage their finances. This can prevent missed payments, which are one of the most significant factors affecting credit scores. Additionally, debt relief can help individuals avoid defaulting on loans, which would otherwise have a severe negative impact on their credit history. Over time, successfully managing reduced debt obligations can lead to improved financial habits and, eventually, a stronger credit profile.

However, despite these potential benefits, debt relief can also have negative consequences for credit scores. One of the most immediate effects is a potential drop in credit score, particularly with debt settlement or bankruptcy. Debt settlement involves negotiating with creditors to pay a reduced amount of the total debt owed. While this can provide financial relief, it often results in a negative mark on a credit report, as settled accounts are typically reported as “paid for less than the full balance.” This notation can signal to future lenders that the borrower was unable to meet their original financial obligations, making it more difficult to obtain credit in the future.

Similarly, bankruptcy has a significant and long-lasting impact on credit scores. A Chapter 7 bankruptcy can remain on a credit report for up to ten years, while a Chapter 13 bankruptcy stays for seven years. During this time, obtaining new credit can be challenging, and interest rates on any approved loans may be significantly higher. While bankruptcy provides a fresh financial start, it is often considered a last resort due to its long-term effects on creditworthiness.

Debt consolidation, on the other hand, may have a less severe impact on credit scores compared to other debt relief options. By combining multiple debts into a single loan with a lower interest rate, individuals can simplify their payments and reduce the risk of missed payments. If managed responsibly, debt consolidation can even have a positive effect on credit scores over time. However, applying for a new loan may result in a temporary dip in credit score due to the hard inquiry required during the application process. Additionally, if individuals continue to accumulate new debt after consolidating, they may find themselves in a worse financial situation than before.

Ultimately, the impact of debt relief on credit scores depends on the specific method chosen and how it is managed. While debt relief can provide financial relief and prevent further damage to credit, it is important to weigh the potential drawbacks carefully. Individuals considering debt relief should explore all available options, seek professional financial advice, and develop a long-term plan to rebuild their credit. By making informed decisions and practicing responsible financial habits, individuals can work toward improving their credit scores and achieving long-term financial stability.

The Long-Term Effects of Debt Relief on Your Credit Score: What You Need to Know

Debt relief can be a valuable tool for individuals struggling with overwhelming financial obligations, but it is essential to understand how it may impact your credit score in the long run. While debt relief options such as debt settlement, debt consolidation, and bankruptcy can provide much-needed financial relief, they also come with potential consequences that may affect your creditworthiness for years to come. By examining both the advantages and disadvantages, individuals can make informed decisions about whether debt relief is the right choice for their financial situation.

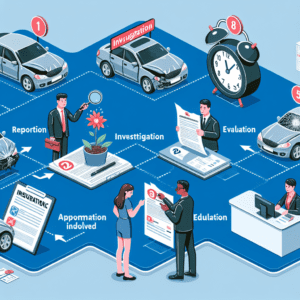

One of the primary ways debt relief affects your credit score is through the impact on your payment history, which is the most significant factor in credit scoring models. When you enroll in a debt relief program, you may be required to stop making payments to creditors while negotiations take place. This can lead to missed or late payments being reported to credit bureaus, which can significantly lower your credit score. Additionally, if you settle a debt for less than the full amount owed, it may be noted on your credit report as “settled” rather than “paid in full,” which can be viewed negatively by future lenders.

However, despite the initial negative impact, debt relief can also provide long-term benefits that may ultimately improve your financial standing. By reducing or eliminating debt, individuals can lower their credit utilization ratio, which is another crucial factor in credit scoring. A lower credit utilization ratio indicates that you are using less of your available credit, which can help improve your score over time. Furthermore, once debts are settled or consolidated, individuals may find it easier to make timely payments on remaining obligations, gradually rebuilding their credit history.

Another important consideration is the type of debt relief chosen, as different methods have varying effects on credit scores. Debt consolidation, for example, involves combining multiple debts into a single loan with a lower interest rate. While this approach may result in a temporary dip in credit scores due to a hard inquiry on your credit report, it can ultimately have a positive impact by simplifying payments and reducing the risk of missed due dates. On the other hand, debt settlement, which involves negotiating with creditors to pay a reduced amount, can have a more severe impact on credit scores, as settled accounts may remain on credit reports for up to seven years.

Bankruptcy is another form of debt relief that has significant long-term consequences. While it provides a fresh financial start for those in extreme financial distress, it also remains on credit reports for up to ten years, making it more challenging to obtain new credit during that time. However, individuals who successfully rebuild their financial habits after bankruptcy may still be able to improve their credit scores over time by demonstrating responsible credit use.

Ultimately, the long-term effects of debt relief on your credit score depend on how you manage your finances after the process is complete. By adopting responsible financial habits, such as making timely payments, keeping credit utilization low, and avoiding excessive debt, individuals can gradually rebuild their creditworthiness. While debt relief may cause an initial decline in credit scores, the potential for long-term financial stability and reduced debt burden can outweigh the temporary setbacks, making it a viable option for those in need of financial assistance.

Debt Relief and Credit Scores: Weighing the Benefits and Drawbacks

Debt relief can be a valuable tool for individuals struggling with overwhelming financial obligations, but it is essential to understand how it may impact credit scores. While debt relief options such as debt settlement, debt consolidation, and bankruptcy can provide much-needed financial relief, they also come with potential drawbacks that may affect creditworthiness. Evaluating both the benefits and the risks is crucial for making an informed decision about whether debt relief is the right choice.

One of the primary advantages of debt relief is the opportunity to reduce or eliminate outstanding debt, which can alleviate financial stress and make it easier to manage monthly expenses. For individuals who are unable to keep up with payments, debt relief can provide a structured path toward financial stability. Debt consolidation, for example, allows borrowers to combine multiple debts into a single loan with a lower interest rate, making repayment more manageable. Similarly, debt settlement enables individuals to negotiate with creditors to pay a reduced amount, which can help resolve financial difficulties more quickly.

However, while these options can provide immediate relief, they often have a negative impact on credit scores. Debt settlement, in particular, can significantly lower a credit score because it typically requires individuals to stop making payments while negotiations take place. Missed payments are reported to credit bureaus, which can lead to a substantial drop in credit scores. Additionally, settled accounts are marked as “settled” rather than “paid in full” on credit reports, which may be viewed unfavorably by future lenders.

Debt consolidation, on the other hand, may have a less severe impact on credit scores, especially if payments are made on time. Since this method involves taking out a new loan to pay off existing debts, it can initially cause a slight dip in credit scores due to the hard inquiry required for loan approval. However, if managed responsibly, debt consolidation can improve credit over time by reducing overall credit utilization and ensuring consistent payments.

Bankruptcy is another form of debt relief that can have long-lasting consequences on credit scores. While it provides a legal way to discharge debts and start fresh, it remains on credit reports for up to ten years, making it difficult to obtain new credit during that period. Lenders may view bankruptcy as a sign of financial instability, which can result in higher interest rates or difficulty securing loans in the future. Despite these challenges, bankruptcy can be a viable option for those with insurmountable debt, as it offers a chance to rebuild financial health over time.

Although debt relief can negatively impact credit scores in the short term, it is important to consider the long-term benefits. For individuals who are already struggling with missed payments and high debt balances, credit scores may already be suffering. In such cases, taking steps to resolve debt issues can ultimately lead to financial recovery. By adopting responsible financial habits, such as making timely payments and managing credit wisely, individuals can gradually rebuild their credit after completing a debt relief program.

Ultimately, the decision to pursue debt relief should be based on an individual’s financial situation and long-term goals. While there are risks involved, the potential benefits of reducing debt and regaining financial stability may outweigh the temporary impact on credit scores. Careful consideration and a commitment to responsible financial management can help individuals navigate the challenges of debt relief while working toward a stronger financial future.