“Debt Consolidation Loans: Simplify Payments, Lower Interest—But Beware of Fees and Long-Term Costs!”

Benefits And Drawbacks Of Debt Consolidation Loans For Credit Card Debt

Debt consolidation loans can be an effective solution for individuals struggling with high-interest credit card debt. By combining multiple credit card balances into a single loan, borrowers can simplify their repayment process and potentially reduce their overall interest costs. However, while this financial strategy offers several advantages, it also comes with certain risks and drawbacks that should be carefully considered before making a decision. Understanding both the benefits and potential downsides of debt consolidation loans is essential for determining whether this approach is the right choice for managing credit card debt.

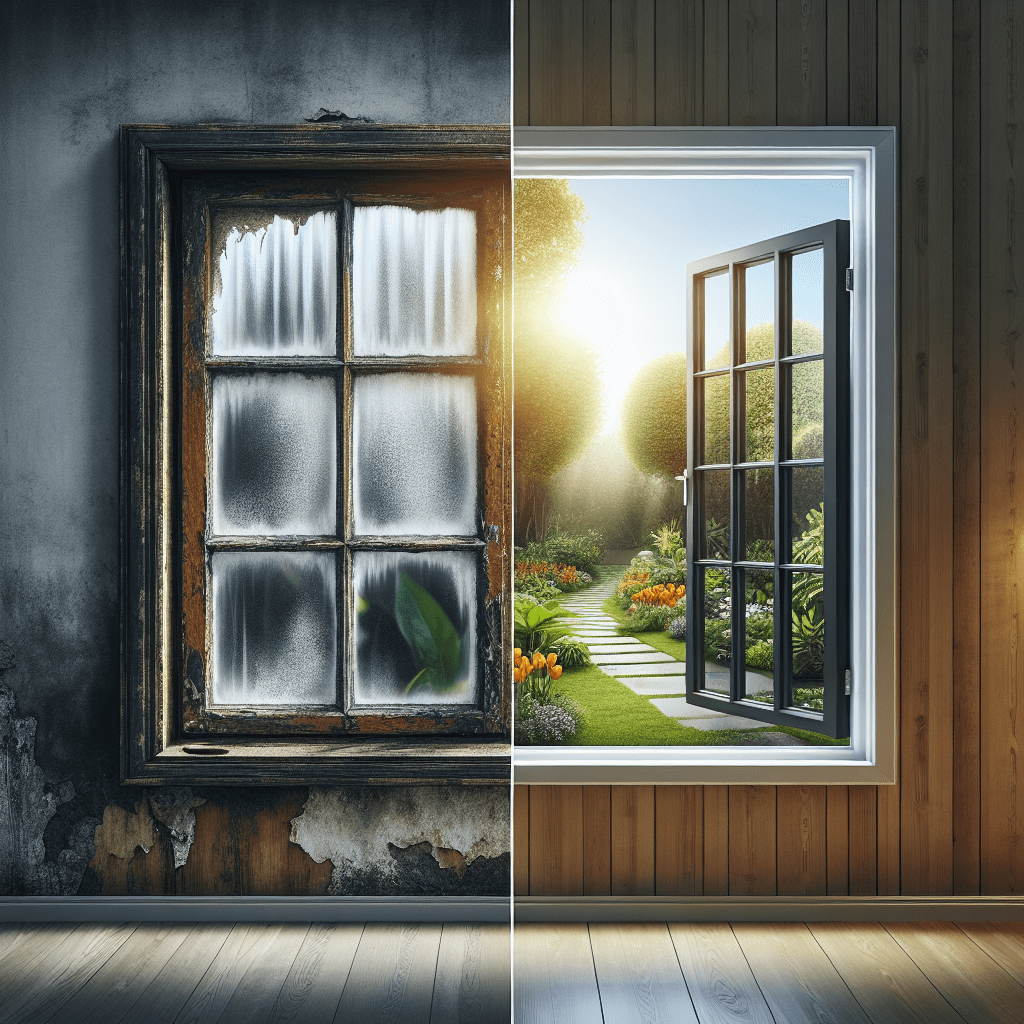

One of the primary benefits of a debt consolidation loan is the potential for lower interest rates. Credit cards often carry high annual percentage rates (APRs), which can make it difficult for borrowers to make significant progress in paying down their balances. A consolidation loan, particularly one with a lower fixed interest rate, can reduce the overall cost of borrowing and allow individuals to pay off their debt more efficiently. Additionally, having a single monthly payment instead of multiple credit card bills can simplify financial management, reducing the likelihood of missed payments and late fees. This streamlined repayment process can help borrowers stay organized and focused on eliminating their debt.

Another advantage of debt consolidation loans is the potential for improved credit scores over time. When individuals consolidate their credit card debt, they may see a positive impact on their credit utilization ratio, which is a key factor in credit scoring. By paying off multiple credit card balances and replacing them with a single loan, borrowers can lower their utilization rate, which may lead to an increase in their credit score. Furthermore, making consistent, on-time payments on the consolidation loan can demonstrate responsible financial behavior, further strengthening creditworthiness.

Despite these benefits, there are also potential drawbacks to consider. One of the main concerns is that a debt consolidation loan does not address the underlying spending habits that may have contributed to the accumulation of credit card debt. Without a commitment to responsible financial management, individuals may find themselves accumulating new credit card balances even after consolidating their existing debt. This can lead to a cycle of borrowing that ultimately worsens their financial situation rather than improving it.

Additionally, while debt consolidation loans can offer lower interest rates, not all borrowers will qualify for the most favorable terms. Lenders typically assess an applicant’s credit score, income, and overall financial health when determining loan eligibility and interest rates. Those with poor credit may receive higher interest rates, which could reduce the potential savings from consolidation. In some cases, borrowers may also be required to provide collateral, such as a home or vehicle, to secure the loan. This introduces the risk of losing valuable assets if they are unable to meet their repayment obligations.

Another potential drawback is the extended repayment period that often accompanies debt consolidation loans. While lower monthly payments can provide short-term relief, a longer loan term may result in paying more in interest over time. Borrowers should carefully evaluate the total cost of the loan and consider whether the benefits of lower monthly payments outweigh the potential for increased long-term expenses.

Ultimately, debt consolidation loans can be a useful tool for managing credit card debt, but they are not a one-size-fits-all solution. Individuals should carefully assess their financial situation, compare loan options, and develop a plan to avoid future debt accumulation. By weighing the benefits and drawbacks, borrowers can make an informed decision that aligns with their financial goals and long-term stability.

How Debt Consolidation Loans Impact Your Credit Score: Pros And Cons

Debt consolidation loans can be an effective tool for managing credit card debt, offering a structured repayment plan and potentially lower interest rates. However, their impact on a borrower’s credit score can be both positive and negative, depending on how the loan is managed. Understanding these effects is crucial for making an informed financial decision.

One of the primary benefits of a debt consolidation loan is the potential for an improved credit score over time. By consolidating multiple credit card balances into a single loan, borrowers can simplify their repayment process, reducing the likelihood of missed or late payments. Since payment history is the most significant factor in credit scoring models, consistently making on-time payments on the new loan can gradually boost a borrower’s credit score. Additionally, a debt consolidation loan can lower a borrower’s credit utilization ratio, which is another key component of credit scores. Credit utilization measures the amount of available credit being used, and high utilization can negatively impact a score. By paying off credit card balances with a consolidation loan, the borrower effectively reduces their revolving credit utilization, which can lead to an increase in their credit score.

Another advantage is the potential for a more favorable credit mix. Credit scoring models consider the diversity of credit accounts, and having a mix of installment loans and revolving credit can be beneficial. Since a debt consolidation loan is an installment loan, adding it to a credit profile that previously consisted only of revolving credit accounts may contribute positively to a borrower’s overall creditworthiness.

Despite these benefits, there are also potential drawbacks to consider. One immediate impact of taking out a debt consolidation loan is the effect of a hard inquiry on a borrower’s credit report. When applying for a new loan, lenders typically perform a hard credit check, which can cause a temporary dip in the borrower’s credit score. While this impact is usually minor and short-lived, it is something to be aware of, especially for individuals who plan to apply for additional credit in the near future.

Another potential downside is the risk of increasing overall debt if the underlying spending habits that led to credit card debt are not addressed. Once credit card balances are paid off with a consolidation loan, borrowers may be tempted to use their newly available credit, leading to further financial strain. If new debt accumulates while still repaying the consolidation loan, the borrower may find themselves in a worse financial position than before.

Additionally, closing old credit card accounts after consolidating debt can negatively impact a credit score. The length of credit history is an important factor in credit scoring, and closing older accounts can shorten the average age of credit, potentially lowering the score. To mitigate this, borrowers may choose to keep their credit card accounts open, even if they are not actively using them.

Ultimately, the impact of a debt consolidation loan on a credit score depends on how it is managed. When used responsibly, it can provide financial relief and improve credit standing over time. However, without disciplined financial habits, it may lead to further challenges. Careful consideration of both the benefits and risks is essential before deciding if debt consolidation is the right solution.

Debt Consolidation Loans Vs. Other Debt Relief Options: Weighing The Pros And Cons

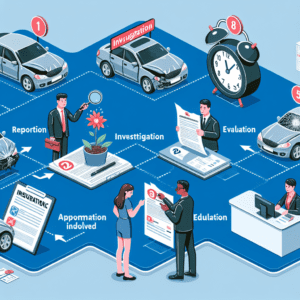

Debt consolidation loans can be an effective solution for individuals struggling with high-interest credit card debt, but they are not the only option available. When considering debt relief strategies, it is essential to weigh the advantages and disadvantages of debt consolidation loans against other alternatives, such as debt management plans, balance transfer credit cards, and debt settlement. Each approach has its own benefits and drawbacks, and the right choice depends on an individual’s financial situation, credit score, and long-term goals.

One of the primary advantages of a debt consolidation loan is the potential for a lower interest rate. Credit card debt often carries high interest, making it difficult to pay off the principal balance. By consolidating multiple credit card balances into a single loan with a lower interest rate, borrowers can reduce the overall cost of their debt and make repayment more manageable. Additionally, having a fixed monthly payment and a clear repayment timeline can provide structure and help individuals stay on track. Unlike credit cards, which allow for minimum payments that can extend debt repayment indefinitely, a debt consolidation loan typically has a set term, ensuring that the debt is paid off within a specific period.

However, debt consolidation loans are not without their drawbacks. One potential downside is that they require good to excellent credit to qualify for the best interest rates. Borrowers with poor credit may find that the interest rate on a consolidation loan is not significantly lower than their existing credit card rates, making the loan less beneficial. Additionally, taking out a new loan does not eliminate the underlying financial habits that led to debt accumulation in the first place. Without disciplined budgeting and responsible spending, individuals may find themselves accumulating new credit card debt even after consolidating their previous balances.

In comparison, other debt relief options offer different advantages and challenges. For example, a balance transfer credit card can be a viable alternative for those with strong credit. Many balance transfer cards offer an introductory 0% APR period, allowing borrowers to pay off their debt without accruing additional interest. However, these promotional rates are temporary, and if the balance is not paid off before the introductory period ends, the remaining debt may be subject to high interest rates. Additionally, balance transfer cards often come with fees, which can add to the overall cost of the debt.

Debt management plans, typically offered by nonprofit credit counseling agencies, provide another alternative. These plans involve negotiating lower interest rates with creditors and consolidating payments into a single monthly amount. While this approach can make repayment more affordable, it requires closing credit card accounts, which may impact credit scores. Furthermore, debt management plans usually take several years to complete, requiring long-term commitment and financial discipline.

Debt settlement is another option, but it comes with significant risks. This approach involves negotiating with creditors to settle debts for less than the full amount owed. While this can reduce overall debt, it often results in negative credit consequences and potential tax liabilities. Additionally, there is no guarantee that creditors will agree to settle, and the process can take time.

Ultimately, choosing between a debt consolidation loan and other debt relief options requires careful consideration of one’s financial circumstances. While consolidation loans offer structured repayment and potential interest savings, they are not suitable for everyone. Evaluating factors such as creditworthiness, repayment ability, and long-term financial goals can help individuals determine the most effective strategy for managing and eliminating credit card debt.