“Know Your Limits: Unlocking Loan Potential and Borrowing Smart!”

**Factors Affecting Loan Limits: Understanding What Determines Your Borrowing Power**

When applying for a loan, understanding the factors that influence your borrowing power is essential. Lenders assess multiple criteria to determine how much you can borrow, ensuring that the loan amount aligns with your financial capacity. These factors help mitigate risk for both the borrower and the lender, creating a structured approach to responsible lending. By examining these key elements, you can gain insight into how loan limits are established and what steps you can take to maximize your borrowing potential.

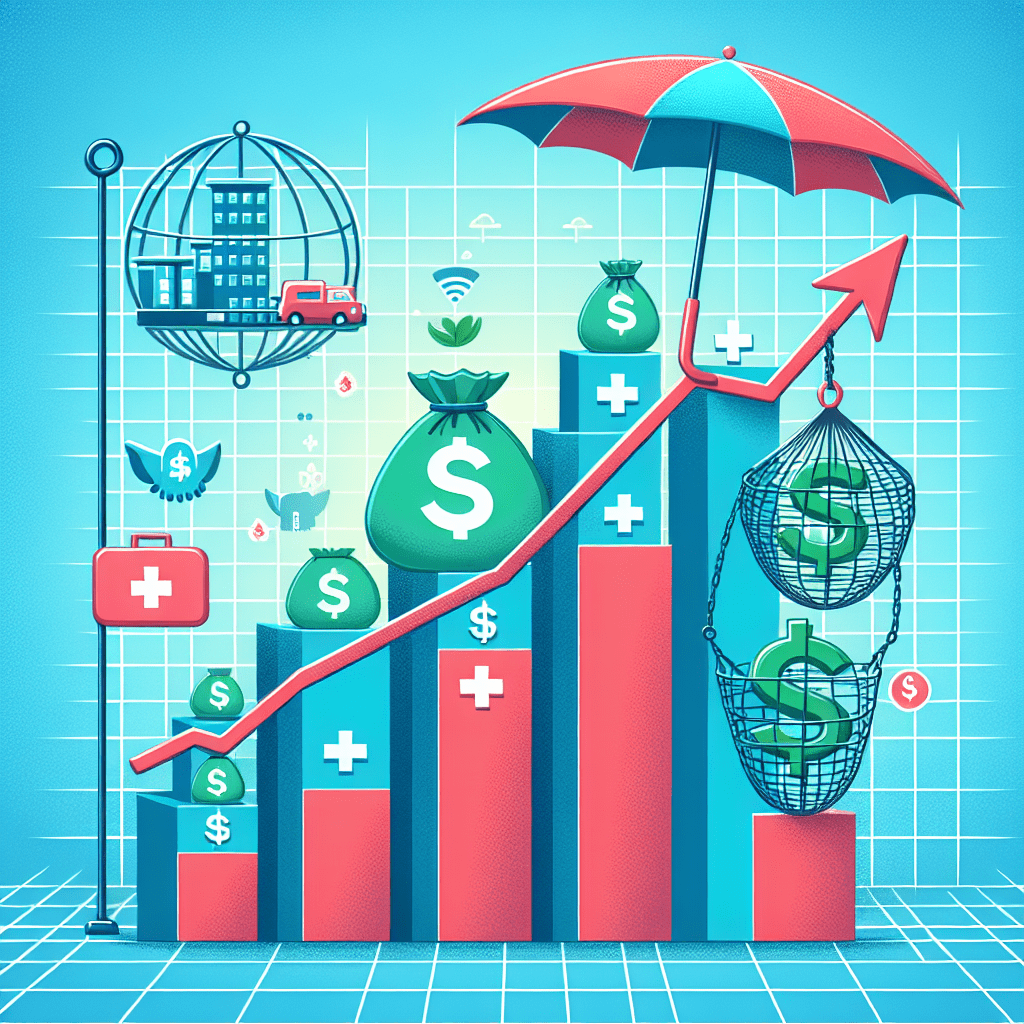

One of the most significant factors affecting loan limits is your income. Lenders evaluate your earnings to determine whether you have the financial means to repay the loan. A higher income generally increases your borrowing capacity, as it indicates a greater ability to manage monthly payments. However, lenders do not consider income in isolation; they also assess your debt-to-income (DTI) ratio. This ratio compares your total monthly debt obligations to your gross monthly income. A lower DTI ratio suggests that you have sufficient disposable income to take on additional debt, making you a more attractive borrower. Conversely, a high DTI ratio may limit the amount you can borrow, as it signals a higher financial burden.

In addition to income and debt levels, your credit score plays a crucial role in determining loan limits. A strong credit score reflects a history of responsible borrowing and timely repayments, which reassures lenders of your creditworthiness. Borrowers with higher credit scores often qualify for larger loan amounts and more favorable interest rates. On the other hand, a lower credit score may result in stricter borrowing limits or higher interest rates, as lenders perceive a greater risk of default. To improve your borrowing power, maintaining a good credit history by making timely payments and managing credit responsibly is essential.

Another important consideration is the type of loan you are applying for. Different loan products have varying limits based on their purpose and associated risks. For example, mortgage loans typically have higher borrowing limits than personal loans, as they are secured by collateral in the form of real estate. Similarly, government-backed loans, such as FHA or VA loans, may have specific borrowing limits set by regulatory agencies. Understanding the loan type and its associated restrictions can help you set realistic expectations regarding the amount you can borrow.

Collateral also influences loan limits, particularly for secured loans. When you pledge an asset, such as a home or vehicle, as collateral, lenders may be willing to extend a higher loan amount since they have a means of recovering their funds in case of default. The value of the collateral plays a crucial role in determining the loan limit, as lenders typically offer a percentage of the asset’s appraised value. In contrast, unsecured loans, which do not require collateral, often have lower borrowing limits due to the increased risk for lenders.

Finally, external economic factors and lender policies can impact loan limits. Interest rates, inflation, and market conditions influence lending practices, affecting how much financial institutions are willing to lend. Additionally, each lender has its own underwriting criteria, which may result in variations in loan limits even for borrowers with similar financial profiles. By understanding these factors and taking proactive steps to strengthen your financial position, you can enhance your borrowing power and secure a loan that meets your needs.

**Loan Eligibility Criteria: Key Requirements for Securing Maximum Borrowing Amount**

When applying for a loan, understanding the eligibility criteria is essential to securing the maximum borrowing amount. Lenders assess various factors to determine how much an individual can borrow, ensuring that the loan amount aligns with the borrower’s financial capacity. By meeting key requirements, applicants can improve their chances of obtaining a higher loan amount while maintaining financial stability.

One of the most critical factors in loan eligibility is creditworthiness, which is primarily determined by an applicant’s credit score. A high credit score indicates responsible financial behavior, such as timely repayment of debts and low credit utilization. Lenders view borrowers with strong credit histories as lower-risk applicants, making them more likely to qualify for higher loan amounts. Conversely, individuals with lower credit scores may face borrowing limitations or higher interest rates, as lenders perceive them as higher-risk borrowers.

In addition to credit score, income plays a significant role in determining loan eligibility. Lenders evaluate an applicant’s income level to ensure they have the financial capacity to repay the loan. A stable and sufficient income reassures lenders that the borrower can meet monthly repayment obligations without financial strain. Many lenders also consider the applicant’s employment history, preferring individuals with consistent employment and a reliable source of income. Self-employed individuals may need to provide additional documentation, such as tax returns and financial statements, to verify their earnings.

Debt-to-income (DTI) ratio is another crucial factor that lenders assess when determining loan eligibility. This ratio compares an applicant’s total monthly debt payments to their gross monthly income. A lower DTI ratio indicates that a borrower has a manageable level of debt relative to their income, making them more likely to qualify for a higher loan amount. Lenders typically prefer a DTI ratio below a certain threshold, often around 40% to 50%, depending on the type of loan and lender requirements. Borrowers with high DTI ratios may need to reduce existing debt before qualifying for a larger loan.

Collateral can also influence the maximum borrowing amount, particularly for secured loans such as mortgages and auto loans. When a borrower offers collateral, such as a home or vehicle, lenders have an added layer of security, reducing their risk. As a result, secured loans often allow for higher borrowing limits compared to unsecured loans, which do not require collateral. However, borrowers should be aware that failure to repay a secured loan could result in the loss of the pledged asset.

Loan type and lender policies further impact borrowing limits. Different types of loans, such as personal loans, mortgages, and business loans, have varying eligibility requirements and maximum loan amounts. Additionally, each lender has its own criteria for assessing applications, meaning that borrowing limits may differ from one financial institution to another. Comparing loan options from multiple lenders can help borrowers identify the most favorable terms and maximize their borrowing potential.

Ultimately, securing the maximum borrowing amount requires a strong financial profile, including a high credit score, stable income, low debt-to-income ratio, and, in some cases, valuable collateral. By understanding and meeting these key eligibility criteria, borrowers can enhance their chances of obtaining the loan amount they need while maintaining financial responsibility.

**How to Increase Your Loan Limit: Strategies to Improve Your Borrowing Potential**

When seeking to increase your loan limit, it is essential to understand the factors that influence a lender’s decision. Financial institutions assess various aspects of a borrower’s profile to determine the maximum amount they are willing to lend. By improving key financial indicators, individuals can enhance their borrowing potential and secure higher loan amounts. Several strategies can help achieve this goal, ranging from improving creditworthiness to demonstrating financial stability.

One of the most effective ways to increase a loan limit is by maintaining a strong credit score. Lenders rely on credit scores to assess a borrower’s ability to manage debt responsibly. A higher credit score indicates a lower risk of default, making financial institutions more willing to extend larger loan amounts. To improve creditworthiness, borrowers should ensure timely payment of existing debts, reduce outstanding balances, and avoid excessive credit inquiries. Additionally, regularly reviewing credit reports for errors and disputing inaccuracies can help maintain an accurate and favorable credit profile.

Beyond credit scores, lenders also evaluate an applicant’s debt-to-income ratio (DTI), which measures the proportion of monthly income allocated to debt payments. A lower DTI ratio signals that a borrower has sufficient income to manage additional debt, increasing the likelihood of loan approval for a higher amount. To reduce this ratio, individuals can either increase their income or pay down existing debts. Seeking additional sources of income, such as a salary increase, freelance work, or passive income streams, can improve financial standing. Simultaneously, prioritizing debt repayment, particularly high-interest obligations, can lower the DTI ratio and enhance borrowing capacity.

Another crucial factor in determining loan limits is the borrower’s employment and income stability. Lenders prefer applicants with a consistent and verifiable income source, as it demonstrates financial reliability. Those with a steady job history and a stable income are more likely to qualify for higher loan amounts. To strengthen this aspect, individuals should aim for long-term employment with a reputable employer or establish a reliable income stream if self-employed. Providing comprehensive documentation, such as tax returns, pay stubs, and bank statements, can further support an application and reassure lenders of financial stability.

In addition to personal financial factors, the type of collateral offered can influence loan limits, particularly for secured loans. Assets such as real estate, vehicles, or investments can serve as collateral, reducing the lender’s risk and increasing the amount they are willing to lend. Borrowers who can provide valuable collateral may negotiate higher loan limits and more favorable terms. However, it is important to assess the risks associated with secured loans, as failure to meet repayment obligations could result in the loss of pledged assets.

Establishing a strong relationship with financial institutions can also be beneficial in increasing borrowing potential. Long-term customers with a history of responsible financial behavior may receive preferential treatment when applying for higher loan amounts. Maintaining active accounts, using banking services regularly, and demonstrating responsible credit usage can build trust with lenders. Additionally, discussing financial goals with a loan officer and exploring available options may lead to personalized solutions that align with borrowing needs.

By implementing these strategies, individuals can improve their financial standing and enhance their ability to secure higher loan limits. Strengthening creditworthiness, managing debt effectively, ensuring income stability, leveraging collateral, and fostering relationships with lenders are all essential steps in maximizing borrowing potential. Through careful financial planning and responsible borrowing practices, individuals can access the funds they need while maintaining long-term financial health.