Freelancing offers flexibility and independence, but it also comes with financial challenges, especially when it comes to managing cash flow. Unlike traditional employees, freelancers don’t have a fixed paycheck, making it harder to qualify for loans. However, personal loans can be a great solution to cover expenses, invest in business growth, or handle emergencies.

Why Freelancers May Need Personal Loans

Freelancers often experience irregular income, making it difficult to cover expenses during slow months. Here are some common reasons why freelancers seek personal loans:

- Covering Business Expenses: Investing in equipment, software, or marketing.

- Managing Cash Flow Gaps: Handling late client payments or seasonal income fluctuations.

- Emergency Expenses: Medical bills, car repairs, or unexpected costs.

- Debt Consolidation: Paying off high-interest credit card debt with a lower-interest loan.

Challenges Freelancers Face When Applying for Loans

Unlike salaried employees, freelancers don’t have a steady income, which can make lenders hesitant to approve loans. Here are some common challenges:

- Irregular Income: Lenders prefer stable earnings, which freelancers may lack.

- Lack of Traditional Pay Stubs: Most lenders require proof of income, which can be difficult for freelancers to provide.

- Lower Credit Scores: Inconsistent income can lead to missed payments, affecting credit scores.

- Higher Interest Rates: Some lenders charge higher rates due to perceived risk.

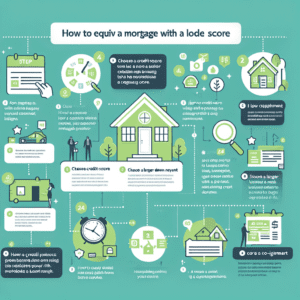

How Freelancers Can Improve Their Loan Eligibility

Despite these challenges, freelancers can take steps to improve their chances of getting approved for a personal loan:

1. Maintain a Strong Credit Score

A good credit score increases your chances of approval and helps secure lower interest rates. Pay bills on time, reduce credit card balances, and check your credit report for errors.

2. Show Proof of Stable Income

Provide bank statements, tax returns, and invoices to demonstrate consistent earnings. Lenders may require at least two years of financial history.

3. Reduce Existing Debt

Lowering your debt-to-income ratio makes you a more attractive borrower. Pay off outstanding debts before applying for a new loan.

4. Consider a Co-Signer

If your credit score or income is insufficient, a co-signer with a strong financial profile can improve your chances of approval.

5. Choose the Right Lender

Some lenders specialize in loans for self-employed individuals. Research online lenders, credit unions, and banks that offer flexible requirements for freelancers.

Best Personal Loan Options for Freelancers

Several lenders cater to freelancers and self-employed individuals. Here are some of the best options:

- Online Lenders: Platforms like SoFi, Upstart, and LendingClub offer flexible loan options with minimal paperwork.

- Credit Unions: These institutions often have lower interest rates and more lenient requirements for self-employed borrowers.

- Peer-to-Peer Lending: Websites like Prosper and Funding Circle connect borrowers with individual investors.

- Traditional Banks: Some banks offer personal loans to freelancers with strong financial records.

How to Apply for a Personal Loan as a Freelancer

Follow these steps to increase your chances of approval:

- Check Your Credit Score: Ensure your credit is in good shape before applying.

- Gather Financial Documents: Prepare tax returns, bank statements, and proof of income.

- Compare Lenders: Research interest rates, terms, and eligibility requirements.

- Submit Your Application: Apply online or in person with the required documents.

- Review Loan Terms: Carefully read the terms before accepting the loan.

Final Thoughts

Personal loans can be a valuable financial tool for freelancers, helping them manage cash flow, cover expenses, and invest in their business. While securing a loan as a freelancer can be challenging, taking steps to improve credit, maintain financial records, and choose the right lender can increase approval chances. If you’re a freelancer in need of financial support, explore your options and apply for a loan that fits your needs.