“Secured vs. Unsecured Loans: Understand the Risks, Compare the Benefits, and Choose Wisely!”

**Secured vs. Unsecured Loans: Key Differences and How They Impact Borrowers**

When considering a loan, understanding the distinction between secured and unsecured options is essential. These two types of loans differ primarily in whether collateral is required, which in turn affects factors such as interest rates, borrowing limits, and eligibility requirements. Borrowers must carefully evaluate these differences to determine which type of loan best suits their financial situation and long-term goals.

Secured loans require the borrower to provide collateral, which serves as a guarantee for the lender in case of default. This collateral can take various forms, such as real estate, vehicles, or other valuable assets. Because the lender has a tangible asset to recover in the event of non-payment, secured loans generally come with lower interest rates and higher borrowing limits. Mortgage loans and auto loans are common examples of secured loans, where the property or vehicle being financed serves as the collateral. The presence of collateral reduces the lender’s risk, making it easier for borrowers with lower credit scores to qualify for these loans. However, the primary drawback is that failure to repay the loan could result in the loss of the pledged asset, which can have significant financial consequences.

In contrast, unsecured loans do not require collateral, meaning that approval is based primarily on the borrower’s creditworthiness and financial history. Because lenders assume a higher level of risk with unsecured loans, they often impose stricter eligibility criteria, including higher credit score requirements and more stringent income verification. Personal loans, credit cards, and student loans are common examples of unsecured loans. Due to the increased risk for lenders, these loans typically come with higher interest rates and lower borrowing limits compared to secured loans. While this makes unsecured loans more expensive over time, they offer the advantage of not putting personal assets at risk in case of default. However, failure to repay an unsecured loan can still have serious consequences, such as damage to credit scores and potential legal action from lenders.

The choice between a secured and an unsecured loan depends on several factors, including the borrower’s financial stability, credit history, and willingness to use assets as collateral. For individuals with strong credit and a stable income, unsecured loans may be a preferable option, as they provide access to funds without the risk of asset forfeiture. On the other hand, those who need larger loan amounts or lower interest rates may find secured loans to be a more viable solution, provided they are comfortable using their assets as security.

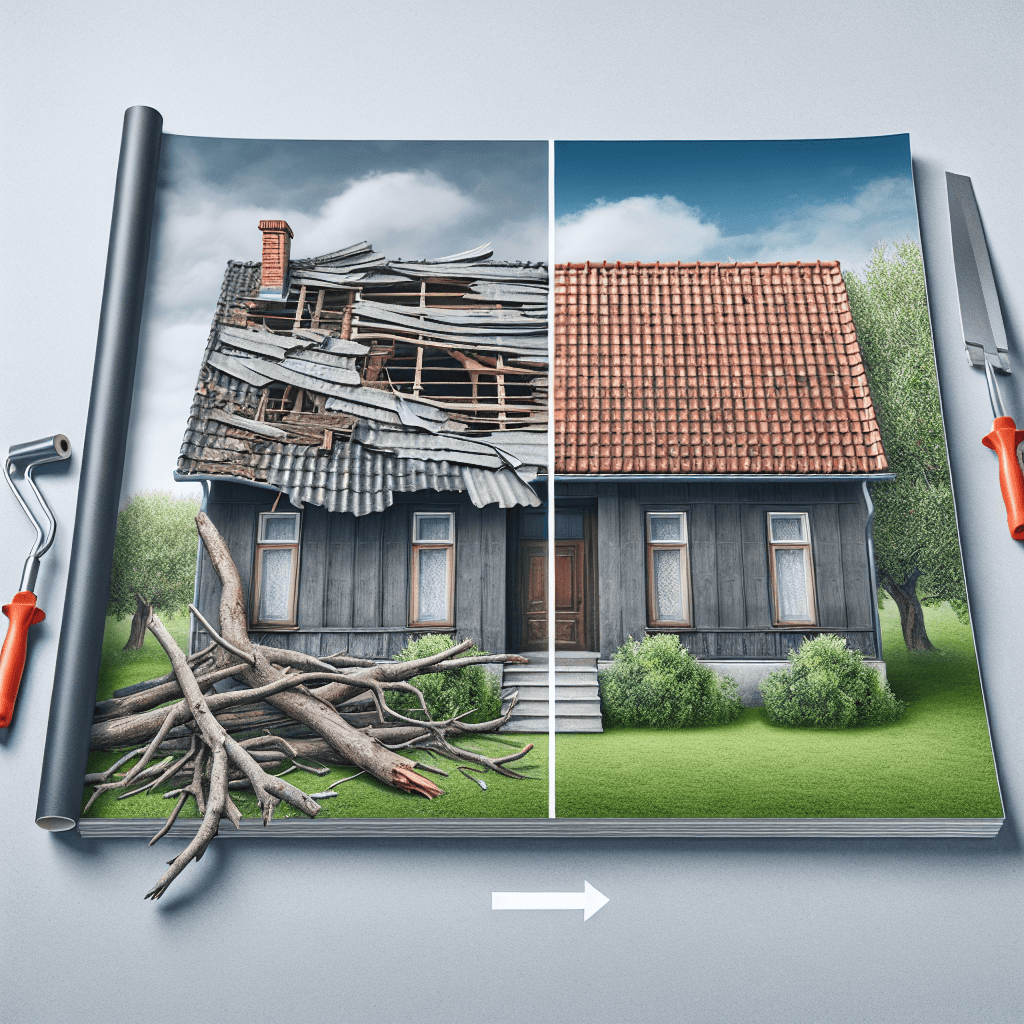

Another important consideration is the intended use of the loan. Secured loans are often used for major purchases, such as homes or vehicles, where the asset being financed serves as collateral. Unsecured loans, however, are more commonly used for smaller expenses, such as medical bills, home improvements, or debt consolidation. Understanding the purpose of the loan can help borrowers determine which type aligns best with their financial needs.

Ultimately, both secured and unsecured loans have their advantages and drawbacks. Borrowers should carefully assess their financial situation, risk tolerance, and repayment ability before making a decision. By weighing these factors, individuals can choose the loan type that best supports their financial goals while minimizing potential risks.

**Pros and Cons of Secured and Unsecured Loans: Which One Suits Your Needs?**

When considering a loan, understanding the differences between secured and unsecured options is essential to making an informed financial decision. Each type of loan has its own advantages and disadvantages, and the right choice depends on factors such as creditworthiness, financial stability, and the intended use of the funds. By carefully weighing the pros and cons of both secured and unsecured loans, borrowers can determine which option best suits their needs.

Secured loans require collateral, which is an asset pledged by the borrower to guarantee repayment. This collateral can take various forms, such as a home, vehicle, or savings account. Because the lender has a tangible asset to recover in case of default, secured loans typically come with lower interest rates and higher borrowing limits. Additionally, they often have longer repayment terms, making monthly payments more manageable. These benefits make secured loans an attractive option for individuals seeking large sums of money for major expenses, such as purchasing a home or financing a business.

However, the primary drawback of secured loans is the risk of losing the pledged asset if the borrower fails to meet repayment obligations. Defaulting on a secured loan can lead to foreclosure, repossession, or other legal consequences, which can have a lasting impact on financial stability. Furthermore, the application process for secured loans can be more complex and time-consuming, as lenders must assess the value of the collateral and verify ownership. This additional scrutiny may not be ideal for borrowers who need quick access to funds.

On the other hand, unsecured loans do not require collateral, making them a more accessible option for individuals who do not own valuable assets or prefer not to risk their property. Because lenders rely solely on the borrower’s creditworthiness and financial history, unsecured loans are often easier to obtain for those with strong credit scores. These loans are commonly used for personal expenses, such as medical bills, home improvements, or debt consolidation, and they typically have a faster approval process compared to secured loans.

Despite these advantages, unsecured loans come with certain drawbacks. Since lenders assume a higher risk by not requiring collateral, they often charge higher interest rates to compensate for the potential loss in case of default. Additionally, borrowing limits for unsecured loans tend to be lower, which may not be sufficient for individuals seeking substantial funding. Another consideration is that approval for an unsecured loan heavily depends on credit history; borrowers with poor credit may struggle to qualify or may receive less favorable terms.

When deciding between a secured and an unsecured loan, it is important to assess personal financial circumstances and long-term goals. Those who have valuable assets and are confident in their ability to repay may benefit from the lower interest rates and higher borrowing limits of secured loans. Conversely, individuals who prioritize flexibility and do not wish to risk their assets may find unsecured loans to be a more suitable option, despite the higher costs.

Ultimately, the best choice depends on individual financial needs and risk tolerance. By carefully evaluating the advantages and disadvantages of each loan type, borrowers can make a well-informed decision that aligns with their financial situation and objectives.

**How to Choose Between Secured and Unsecured Loans for Your Financial Goals**

When deciding between secured and unsecured loans, it is essential to consider your financial goals, creditworthiness, and risk tolerance. Each type of loan serves a different purpose, and understanding their distinctions can help you make an informed decision that aligns with your needs. Secured loans require collateral, such as a home or vehicle, which serves as security for the lender. Because of this guarantee, lenders typically offer lower interest rates and higher borrowing limits. In contrast, unsecured loans do not require collateral, relying instead on the borrower’s creditworthiness to determine approval and loan terms. While they provide greater flexibility, they often come with higher interest rates and stricter eligibility requirements.

To determine which loan type is best suited for your financial situation, it is important to assess the purpose of the loan. If you are making a significant purchase, such as a home or car, a secured loan may be the better option due to its lower interest rates and extended repayment terms. Additionally, secured loans are often used for debt consolidation, allowing borrowers to combine multiple high-interest debts into a single, more manageable payment. On the other hand, if you need funds for a short-term expense, such as medical bills or home improvements, an unsecured loan may be more appropriate. Since unsecured loans do not require collateral, they can be obtained more quickly, making them ideal for urgent financial needs.

Another crucial factor to consider is your credit score and financial stability. Lenders evaluate credit history to determine the risk associated with lending money. If you have a strong credit score and a stable income, you may qualify for favorable terms on an unsecured loan. However, if your credit history is less than perfect, a secured loan may be easier to obtain, as the collateral reduces the lender’s risk. Additionally, secured loans can be a viable option for individuals looking to rebuild their credit, as timely payments can improve their credit profile over time.

Risk tolerance is another important consideration when choosing between secured and unsecured loans. With a secured loan, failure to make payments could result in the loss of the collateral, which may have significant financial consequences. This makes it essential to ensure that you can meet the repayment obligations before committing to a secured loan. Conversely, while unsecured loans do not put specific assets at risk, defaulting on payments can still have serious consequences, including damage to your credit score and potential legal action from the lender. Therefore, it is important to evaluate your ability to repay the loan before making a decision.

Ultimately, the choice between a secured and an unsecured loan depends on your financial goals, creditworthiness, and risk tolerance. If you are seeking lower interest rates and are comfortable using collateral, a secured loan may be the better option. However, if you prefer a loan that does not require assets as security and have strong credit, an unsecured loan may be more suitable. By carefully assessing your financial situation and long-term objectives, you can select the loan type that best meets your needs while minimizing financial risk.