“Essential Documents for a Smooth Loan Application: A Step-by-Step Guide”

Essential Documents Required for a Loan Application: A Step-by-Step Guide

When applying for a loan, ensuring that you have all the necessary documents prepared in advance can significantly streamline the process. Lenders require specific paperwork to assess your financial stability, verify your identity, and determine your ability to repay the loan. While the exact requirements may vary depending on the type of loan and the lender’s policies, there are several essential documents that most financial institutions will request. Understanding these requirements can help you avoid unnecessary delays and improve your chances of approval.

To begin with, proof of identity is a fundamental requirement for any loan application. Lenders need to verify that you are who you claim to be, and for this purpose, they typically request government-issued identification. A valid passport, driver’s license, or national identification card is usually sufficient. In some cases, lenders may ask for multiple forms of identification to further confirm your identity. Ensuring that your identification documents are up to date and match the details on your application is crucial to prevent any discrepancies that could slow down the approval process.

In addition to identity verification, proof of residence is another key document that lenders require. This helps them confirm your current address and establish your stability as a borrower. Utility bills, lease agreements, or bank statements that display your name and address are commonly accepted forms of proof. Some lenders may also request a recent credit card statement or a letter from your employer as additional verification. Providing accurate and up-to-date proof of residence can help demonstrate your reliability and strengthen your application.

Equally important is proof of income, as lenders need to assess your financial capacity to repay the loan. This typically includes recent pay stubs, tax returns, or bank statements that reflect your earnings. If you are employed, your employer may also need to provide an income verification letter. For self-employed individuals, lenders often require additional documentation, such as profit and loss statements, business tax returns, or financial statements prepared by an accountant. Demonstrating a stable and sufficient income reassures lenders that you have the means to meet your repayment obligations.

Furthermore, your credit history plays a significant role in the loan approval process. Lenders will usually request a credit report to evaluate your borrowing history, outstanding debts, and repayment behavior. While some financial institutions obtain this report directly from credit bureaus, others may ask you to provide a copy. A strong credit history can improve your chances of securing favorable loan terms, while a poor credit record may require you to provide additional documentation or a co-signer to strengthen your application.

For secured loans, such as mortgages or auto loans, lenders will also require collateral-related documents. These may include property deeds, vehicle registration papers, or asset valuation reports. Providing clear and accurate documentation of the collateral ensures that the lender has sufficient security in case of default. Additionally, for business loans, lenders may request business licenses, financial statements, and a detailed business plan to assess the viability of the enterprise.

By gathering these essential documents in advance, you can facilitate a smoother loan application process and increase your chances of approval. Ensuring that all paperwork is accurate, up to date, and readily available will not only save time but also demonstrate your preparedness and financial responsibility to the lender.

How to Prepare Your Paperwork for a Smooth Loan Approval Process

When applying for a loan, ensuring that you have the necessary documents prepared in advance can significantly streamline the approval process. Lenders require specific paperwork to assess your financial stability, verify your identity, and determine your ability to repay the loan. By gathering and organizing these documents beforehand, you can avoid unnecessary delays and improve your chances of securing approval.

To begin with, proof of identity is a fundamental requirement for any loan application. Lenders need to confirm that you are who you claim to be, which typically requires a government-issued identification document. A valid passport, driver’s license, or national identification card is usually sufficient. In some cases, lenders may request additional forms of identification, such as a Social Security card or birth certificate, to further verify your identity.

In addition to identification, proof of income is another crucial component of the loan application process. Lenders need to assess your financial capacity to repay the loan, which is why they require documentation that demonstrates your earnings. For salaried employees, this typically includes recent pay stubs, tax returns, and W-2 forms. Self-employed individuals, on the other hand, may need to provide profit and loss statements, bank statements, and tax returns from the past two years. These documents help lenders evaluate the consistency and reliability of your income.

Equally important is proof of employment, as lenders want to ensure that you have a stable source of income. A letter from your employer confirming your position, salary, and length of employment can serve as verification. Some lenders may also contact your employer directly to confirm these details. If you are self-employed, providing business registration documents or client contracts can help establish the legitimacy of your income source.

Another essential set of documents pertains to your financial history. Lenders typically request bank statements from the past three to six months to assess your spending habits, savings, and overall financial health. These statements provide insight into your cash flow and help lenders determine whether you can manage loan repayments. Additionally, a credit report may be required to evaluate your creditworthiness. While lenders often obtain this report themselves, it is advisable to review your credit history beforehand to address any discrepancies or outstanding issues.

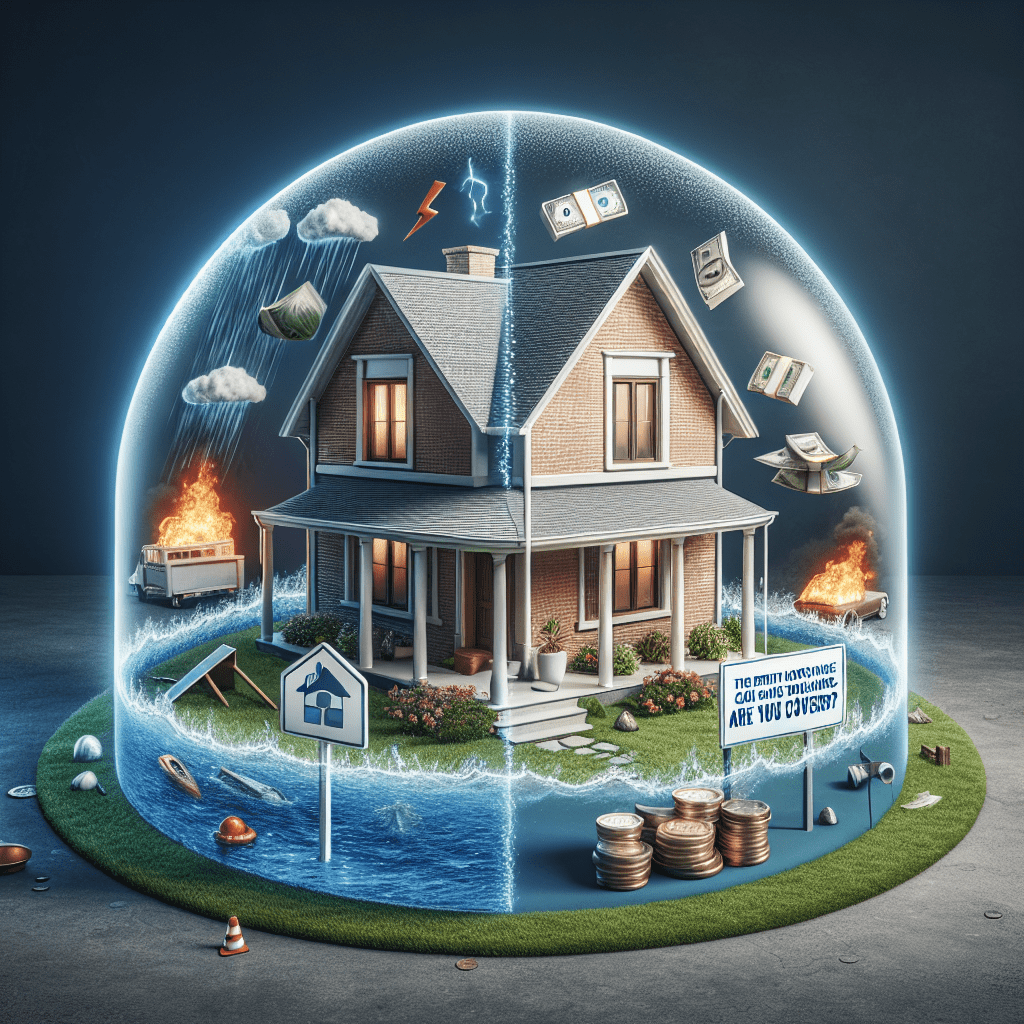

For those applying for a secured loan, collateral documentation is necessary. If you are using an asset, such as a house or car, as collateral, you will need to provide ownership documents, such as property deeds or vehicle titles. Lenders may also require an appraisal report to determine the asset’s current market value. Ensuring that these documents are accurate and up to date can prevent complications during the approval process.

Finally, depending on the type of loan you are applying for, additional documents may be required. For example, mortgage applications often necessitate property-related paperwork, such as purchase agreements and homeowners insurance details. Similarly, business loans may require a detailed business plan, financial projections, and company tax returns. Understanding the specific requirements of your loan type can help you prepare accordingly.

By organizing these documents in advance, you can facilitate a smoother loan approval process. Ensuring that all paperwork is accurate, complete, and up to date will not only expedite the lender’s review but also enhance your credibility as a borrower. Taking the time to prepare thoroughly can ultimately increase your chances of securing the loan you need.

A Complete Checklist of Documents Needed for Different Types of Loans

When applying for a loan, having the necessary documents ready can streamline the process and improve your chances of approval. Lenders require specific paperwork to assess your financial stability, creditworthiness, and ability to repay the loan. While the exact requirements may vary depending on the type of loan and the lender’s policies, there are common documents that most financial institutions request. Understanding these requirements in advance can help you prepare effectively and avoid unnecessary delays.

For personal loans, lenders typically require proof of identity, which can be provided through a government-issued ID such as a passport, driver’s license, or national identification card. Additionally, proof of income is essential to demonstrate your ability to repay the loan. This can include recent pay stubs, tax returns, or bank statements showing regular deposits. Employment verification may also be necessary, requiring a letter from your employer or recent employment history. Furthermore, lenders often request credit reports to assess your borrowing history and determine the level of risk involved in lending to you.

When applying for a mortgage, the documentation requirements are more extensive due to the significant financial commitment involved. In addition to proof of identity and income, lenders require detailed financial records, including tax returns for the past two years, W-2 or 1099 forms, and recent bank statements. If you are self-employed, additional documents such as profit and loss statements or business tax returns may be necessary. Furthermore, lenders will request information about your assets and liabilities, including investment accounts, outstanding debts, and monthly expenses. Property-related documents, such as the purchase agreement and property appraisal, are also required to assess the value of the home being financed.

For auto loans, the documentation process is relatively straightforward but still requires essential financial and personal information. Proof of identity and income remain necessary, along with details about the vehicle being purchased. This includes the purchase agreement, vehicle registration, and insurance details. If you are trading in a vehicle, the lender may also require the title and loan payoff information for the existing car. Additionally, some lenders may request proof of residence, such as a utility bill or lease agreement, to verify your address.

Business loans, on the other hand, require a more comprehensive set of documents to evaluate the financial health of the company. In addition to personal identification and income verification, lenders typically request business financial statements, including balance sheets, profit and loss statements, and cash flow statements. Business tax returns for the past two to three years are also necessary to demonstrate financial stability. Furthermore, lenders may require a detailed business plan outlining the company’s objectives, revenue projections, and strategies for growth. If the loan is secured, collateral documentation, such as property deeds or equipment valuations, may also be needed.

Regardless of the type of loan, being well-prepared with the required documents can significantly expedite the approval process. It is advisable to check with the lender beforehand to confirm specific requirements, as they may vary based on individual circumstances. By gathering all necessary paperwork in advance, you can ensure a smoother application process and increase your chances of securing the loan you need.