“Smart Spending, Bigger Savings – The Best Apps to Keep More Cash in Your Pocket!”

Top 5 Money-Saving Apps to Cut Expenses Effortlessly

In today’s fast-paced world, managing personal finances efficiently has become more important than ever. With the rising cost of living and unexpected expenses, finding ways to save money can make a significant difference in financial stability. Fortunately, technology has made it easier to track spending, find discounts, and automate savings. Several money-saving apps are designed to help individuals cut expenses effortlessly, ensuring that more cash stays in their pockets. By leveraging these tools, users can develop better financial habits and achieve their savings goals with minimal effort.

One of the most popular money-saving apps is Honey, a browser extension that automatically finds and applies coupon codes at checkout. Online shopping can be expensive, but Honey simplifies the process of finding discounts by scanning the internet for the best available deals. Instead of manually searching for promo codes, users can rely on Honey to apply the most relevant discounts instantly. Additionally, the app offers a rewards program called Honey Gold, which allows users to earn points on purchases that can later be redeemed for gift cards. This feature provides an extra incentive to save money while shopping online.

Another highly effective app is Rakuten, formerly known as Ebates, which offers cashback on purchases made through its platform. By shopping through Rakuten’s partnered retailers, users can earn a percentage of their spending back in the form of cashback. The app works with a wide range of stores, including popular brands in fashion, electronics, and travel. Cashback earnings are distributed quarterly, either through PayPal or a physical check, making it a convenient way to save money on everyday purchases. Additionally, Rakuten frequently offers bonus cashback promotions, allowing users to maximize their savings even further.

For those looking to cut down on unnecessary subscriptions, Truebill is an excellent choice. Many people unknowingly pay for subscriptions they no longer use, leading to wasted money each month. Truebill helps users identify recurring charges and provides an option to cancel unwanted subscriptions directly through the app. Additionally, the app offers bill negotiation services, where it works with service providers to lower monthly bills on behalf of the user. By analyzing spending patterns and providing insights into financial habits, Truebill empowers users to take control of their expenses and eliminate unnecessary costs.

Another app that simplifies saving is Digit, which automates the process of setting aside money for future use. By analyzing spending habits and income patterns, Digit determines small, manageable amounts to transfer into a savings account without impacting daily expenses. The app ensures that users save consistently without having to think about it, making it an ideal solution for those who struggle with manual savings. Additionally, Digit offers a savings bonus for users who maintain a balance over time, further encouraging long-term financial growth.

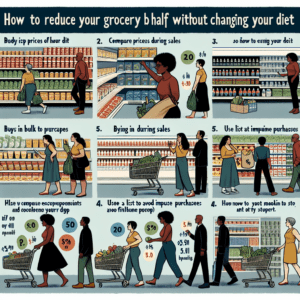

Lastly, Flipp is a must-have app for those who want to save money on groceries and household essentials. By aggregating weekly ads and digital coupons from local stores, Flipp helps users find the best deals on items they regularly purchase. The app allows users to create shopping lists and match them with available discounts, ensuring that they never miss an opportunity to save. With its user-friendly interface and extensive database of deals, Flipp makes it easy to cut grocery expenses without compromising on quality.

By incorporating these money-saving apps into daily routines, individuals can significantly reduce expenses and improve their financial well-being. Each app offers unique features that cater to different aspects of spending, from online shopping and cashback rewards to subscription management and automated savings. With minimal effort, users can take advantage of these tools to develop smarter financial habits and keep more cash in their pockets.

How Money-Saving Apps Can Help You Build Better Financial Habits

In an era where financial stability is a growing concern for many individuals, money-saving apps have emerged as valuable tools to help users develop better financial habits. These apps not only assist in tracking expenses but also encourage smarter spending, automate savings, and provide insights into financial behavior. By integrating technology into personal finance management, individuals can gain greater control over their money and work toward long-term financial goals with ease.

One of the most significant advantages of money-saving apps is their ability to provide real-time tracking of expenses. Many people struggle to understand where their money goes each month, leading to overspending and financial stress. By using an app that categorizes transactions and provides detailed spending reports, users can identify patterns in their financial behavior. This awareness allows them to make informed decisions about their spending habits and adjust accordingly to avoid unnecessary expenses.

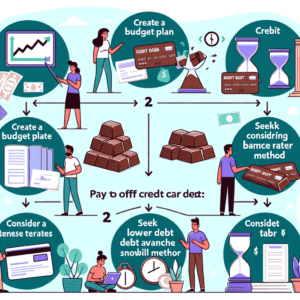

In addition to tracking expenses, many money-saving apps offer automated savings features that help users set aside money effortlessly. These apps analyze spending patterns and automatically transfer small amounts into a savings account without requiring manual intervention. By making saving a seamless process, individuals can build an emergency fund or work toward specific financial goals without feeling the burden of setting aside large sums at once. Over time, these small contributions accumulate, reinforcing the habit of saving and promoting financial security.

Furthermore, some apps provide budgeting tools that enable users to set spending limits for different categories, such as groceries, entertainment, and transportation. By establishing a budget and receiving alerts when approaching the limit, individuals can exercise greater discipline in their spending. This proactive approach prevents overspending and ensures that financial resources are allocated efficiently. As a result, users can prioritize essential expenses while still allowing for discretionary spending within reasonable limits.

Beyond budgeting and saving, money-saving apps often include features that help users find discounts, cashback offers, and better deals on everyday purchases. By leveraging these tools, individuals can maximize their savings without making significant lifestyle changes. Some apps even connect users with financial advisors or provide personalized recommendations based on spending habits, further enhancing their ability to make sound financial decisions.

Another key benefit of these apps is their ability to promote financial literacy. Many individuals lack formal education in personal finance, making it challenging to develop effective money management strategies. Money-saving apps often include educational resources, such as articles, videos, and financial tips, to help users improve their understanding of financial concepts. By increasing financial literacy, individuals can make more informed choices, avoid common financial pitfalls, and work toward long-term financial stability.

Ultimately, money-saving apps serve as powerful tools for fostering better financial habits by promoting awareness, encouraging savings, and providing valuable insights into spending behavior. By incorporating these apps into daily life, individuals can take proactive steps toward achieving financial security and reducing financial stress. As technology continues to evolve, these apps will likely become even more sophisticated, offering enhanced features to support users in their financial journeys. By embracing these tools, individuals can develop responsible financial habits that will benefit them for years to come.

Comparing the Best Budgeting Apps to Maximize Your Savings

When it comes to managing personal finances, budgeting apps have become essential tools for individuals looking to save money and track their expenses effectively. With a wide range of options available, choosing the right app can make a significant difference in how well you manage your finances. Each app offers unique features designed to help users set financial goals, monitor spending habits, and maximize savings. By comparing some of the best budgeting apps, it becomes easier to determine which one aligns best with your financial needs.

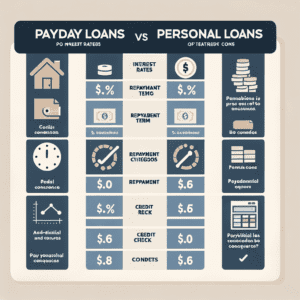

One of the most popular budgeting apps is Mint, which provides users with a comprehensive overview of their financial situation. Mint automatically syncs with bank accounts, credit cards, and bills, categorizing transactions to give users a clear picture of their spending habits. Additionally, it offers personalized budgeting recommendations and alerts for upcoming bills, ensuring that users stay on top of their financial obligations. The app’s ability to track credit scores and provide insights into financial trends makes it a valuable tool for those looking to improve their financial health. However, while Mint is free to use, it does include advertisements, which some users may find distracting.

Another highly regarded budgeting app is YNAB (You Need a Budget), which takes a proactive approach to financial management. Unlike Mint, which primarily tracks past spending, YNAB focuses on assigning every dollar a specific purpose. This zero-based budgeting method encourages users to plan their spending in advance, helping them avoid unnecessary expenses and build savings over time. YNAB also offers educational resources, including workshops and tutorials, to help users develop better financial habits. While the app requires a subscription fee, many users find that the benefits of improved financial discipline outweigh the cost.

For those who prefer a more automated approach, PocketGuard is an excellent option. This app simplifies budgeting by analyzing income, expenses, and savings goals to determine how much disposable income is available. By categorizing transactions and identifying areas where users can cut back, PocketGuard helps individuals make informed financial decisions. One of its standout features is the “In My Pocket” tool, which calculates how much money is left after accounting for bills and savings contributions. This real-time insight allows users to avoid overspending and stay within their budget. While the free version offers essential features, the premium version provides additional customization options for those who want more control over their finances.

Another noteworthy app is Goodbudget, which is based on the envelope budgeting system. This method involves allocating money into virtual envelopes for different spending categories, such as groceries, rent, and entertainment. By using this approach, users can ensure that they do not exceed their budget in any category. Goodbudget is particularly useful for couples or families who want to manage their finances together, as it allows multiple users to sync and share budget information. Although it requires manual transaction entry, this process encourages users to be more mindful of their spending.

Ultimately, the best budgeting app depends on individual financial goals and preferences. Whether one prefers automated tracking, proactive planning, or envelope budgeting, these apps provide valuable tools to help users save money and achieve financial stability. By selecting the right app and consistently using it, individuals can take control of their finances and work toward a more secure financial future.