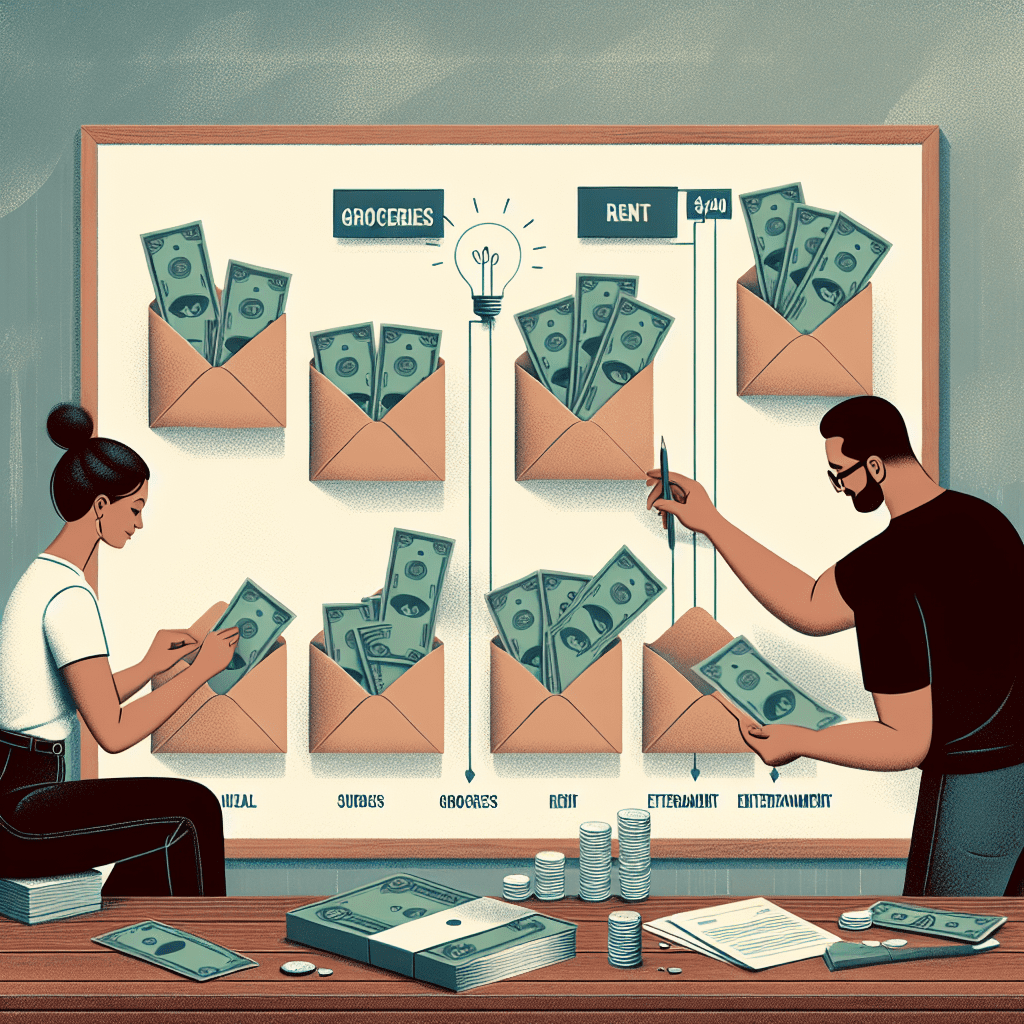

“Save Smarter, Spend Wisely: The Envelope Savings Method in Action!”

Understanding The Envelope Savings Method: A Step-by-Step Guide to Budgeting Success

The Envelope Savings Method is a straightforward yet highly effective approach to managing personal finances. By allocating cash into designated envelopes for specific spending categories, individuals can gain better control over their expenses and develop disciplined saving habits. This method, which has been used for decades, provides a tangible way to track spending and prevent overspending, making it an excellent tool for those looking to improve their financial stability. Understanding how to implement this system step by step can help individuals achieve budgeting success and keep more of their hard-earned cash.

To begin, the first step in using the Envelope Savings Method is to assess one’s income and expenses. This requires a thorough review of monthly earnings and a detailed breakdown of necessary expenditures, such as rent, utilities, groceries, transportation, and other essential costs. By categorizing expenses, individuals can determine how much money should be allocated to each category. It is important to be realistic when setting these amounts to ensure that all financial obligations are met while still allowing for discretionary spending and savings.

Once the budget is established, the next step is to create physical envelopes for each spending category. Each envelope should be labeled clearly with the name of the category and the allocated amount of cash. For example, an envelope labeled “Groceries” might contain $300 for the month, while another labeled “Entertainment” might hold $50. The key to success with this method is to use only the cash within each envelope for its designated purpose. When the money in an envelope is depleted, no additional funds should be added until the next budgeting period. This practice encourages mindful spending and helps individuals avoid unnecessary purchases.

A crucial aspect of the Envelope Savings Method is maintaining discipline and tracking expenses carefully. Since this system relies on cash transactions, it eliminates the temptation of overspending with credit or debit cards. However, it also requires individuals to be diligent in recording their expenditures and ensuring that they do not borrow from one envelope to cover another category. If an envelope runs out of cash before the end of the month, it serves as a clear indicator that adjustments may be needed in future budgeting periods. This process fosters financial awareness and encourages individuals to make more conscious spending decisions.

In addition to managing everyday expenses, the Envelope Savings Method can also be used to build savings for specific financial goals. By creating envelopes for savings categories such as emergency funds, vacations, or holiday gifts, individuals can set aside money consistently and work toward their objectives without feeling financially strained. This approach makes saving more manageable and provides a sense of accomplishment as funds accumulate over time.

While the Envelope Savings Method is highly effective for many people, it may require some adjustments to fit individual lifestyles. For those who rely heavily on digital transactions, a modified version of this system can be implemented using budgeting apps or separate bank accounts for different spending categories. Regardless of the format, the fundamental principle remains the same: allocating money intentionally and spending within predetermined limits.

By following these steps and maintaining consistency, individuals can achieve greater financial control and reduce unnecessary expenses. The Envelope Savings Method not only helps prevent overspending but also promotes a more disciplined approach to money management. Over time, this simple yet powerful strategy can lead to significant financial improvements, allowing individuals to save more and achieve their financial goals with confidence.

How The Envelope Savings Method Helps You Control Spending and Save More Money

The Envelope Savings Method is a straightforward yet highly effective approach to managing personal finances. By using physical cash and designated envelopes for different spending categories, individuals can gain better control over their expenses and develop disciplined saving habits. This method is particularly useful for those who struggle with overspending or find it difficult to track where their money goes each month. By allocating a specific amount of cash to each category and limiting spending to the funds available in the envelope, individuals can avoid unnecessary purchases and ensure that their financial priorities are met.

One of the primary benefits of the Envelope Savings Method is that it creates a tangible connection between spending and available funds. Unlike digital transactions, where swiping a card or making an online payment can feel effortless, using cash forces individuals to be more mindful of their purchases. When the money in an envelope runs out, there is no option to spend more unless funds are reallocated from another category. This limitation encourages thoughtful decision-making and helps prevent impulse buying, which is a common challenge for many people trying to save money.

Moreover, this method provides a clear visual representation of financial progress. Seeing the amount of cash remaining in each envelope throughout the month serves as a constant reminder of budget constraints and financial goals. This visibility makes it easier to adjust spending habits and prioritize essential expenses over discretionary ones. For example, if the envelope designated for dining out is nearly empty halfway through the month, it becomes evident that adjustments need to be made to avoid exceeding the budget. This level of awareness fosters responsible money management and helps individuals stay on track with their financial plans.

Another advantage of the Envelope Savings Method is that it eliminates the risk of accumulating debt through credit card use. Many people rely on credit cards for everyday purchases, often spending beyond their means and struggling with high-interest debt as a result. By using cash exclusively for budgeted expenses, individuals can avoid the temptation of overspending and reduce their reliance on credit. This approach not only helps in maintaining financial discipline but also contributes to long-term financial stability by preventing unnecessary debt accumulation.

In addition to controlling spending, the Envelope Savings Method can also be used to build savings for specific goals. By setting aside cash in separate envelopes for future expenses, such as vacations, emergency funds, or holiday shopping, individuals can gradually accumulate savings without feeling overwhelmed. This proactive approach ensures that money is available when needed, reducing the likelihood of resorting to credit or dipping into other essential funds. Over time, this habit of setting aside money for planned expenses can lead to greater financial security and peace of mind.

While the Envelope Savings Method may require some initial adjustments, its simplicity and effectiveness make it a valuable tool for anyone looking to improve their financial habits. By fostering awareness, encouraging discipline, and promoting intentional spending, this method empowers individuals to take control of their finances and achieve their savings goals. With consistent practice, it becomes easier to manage money wisely, avoid unnecessary debt, and ultimately keep more of one’s hard-earned cash.

Top Benefits of The Envelope Savings Method: Why This Simple Trick Works

The Envelope Savings Method is a straightforward yet highly effective way to manage personal finances, helping individuals take control of their spending and save more money. By allocating cash into designated envelopes for specific expenses, this method encourages disciplined budgeting and prevents overspending. While digital banking and automated transactions have made financial management more convenient, the tangible nature of the envelope system offers a level of awareness and accountability that many other budgeting techniques lack. This approach not only simplifies money management but also provides several key benefits that make it a powerful tool for anyone looking to improve their financial habits.

One of the most significant advantages of the Envelope Savings Method is its ability to promote mindful spending. When individuals use cash instead of credit or debit cards, they become more conscious of their purchases. Physically handling money and seeing it decrease with each transaction creates a stronger psychological connection to spending, making people think twice before making unnecessary purchases. Unlike digital transactions, which can feel abstract, cash payments provide a clear visual representation of financial limits, reinforcing the importance of staying within budget.

In addition to fostering awareness, this method also helps prevent overspending. By setting aside a predetermined amount of cash for each expense category—such as groceries, entertainment, or transportation—individuals establish clear boundaries for their spending. Once an envelope is empty, no additional money can be spent in that category until the next budgeting period. This built-in restriction encourages better financial discipline and reduces the likelihood of impulse purchases. Unlike credit cards, which allow for overspending and potential debt accumulation, the envelope system ensures that individuals only spend what they have, promoting financial stability.

Another key benefit of this method is its ability to reduce reliance on credit. Many people struggle with credit card debt due to the ease of swiping a card without immediate consequences. The Envelope Savings Method eliminates this temptation by encouraging cash-based transactions, which naturally limit spending to available funds. As a result, individuals are less likely to accumulate debt and more likely to develop responsible financial habits. Over time, this approach can lead to improved credit scores, reduced financial stress, and greater overall financial security.

Furthermore, this budgeting technique enhances financial organization. By categorizing expenses and allocating specific amounts to each, individuals gain a clearer understanding of where their money is going. This level of organization makes it easier to track spending patterns, identify areas where adjustments may be needed, and set realistic financial goals. Unlike digital budgeting tools that may require constant monitoring and adjustments, the envelope system provides a simple, hands-on approach that is easy to maintain.

Beyond its practical benefits, the Envelope Savings Method also fosters a sense of financial empowerment. Many people feel overwhelmed by their finances, especially when dealing with debt or struggling to save. This method provides a structured yet flexible way to regain control, offering a sense of accomplishment as individuals successfully manage their money. The act of physically setting aside cash for specific purposes reinforces positive financial behaviors, making it easier to develop long-term savings habits.

Ultimately, the Envelope Savings Method is a powerful yet simple tool that helps individuals take charge of their finances. By promoting mindful spending, preventing overspending, reducing reliance on credit, enhancing financial organization, and fostering a sense of empowerment, this approach offers a practical solution for anyone looking to save more and spend wisely. While modern financial tools continue to evolve, the effectiveness of this time-tested method remains undeniable, proving that sometimes, the simplest strategies are the most effective.