“Document, Report, and Claim – Secure Your Insurance Payout After an Accident!”

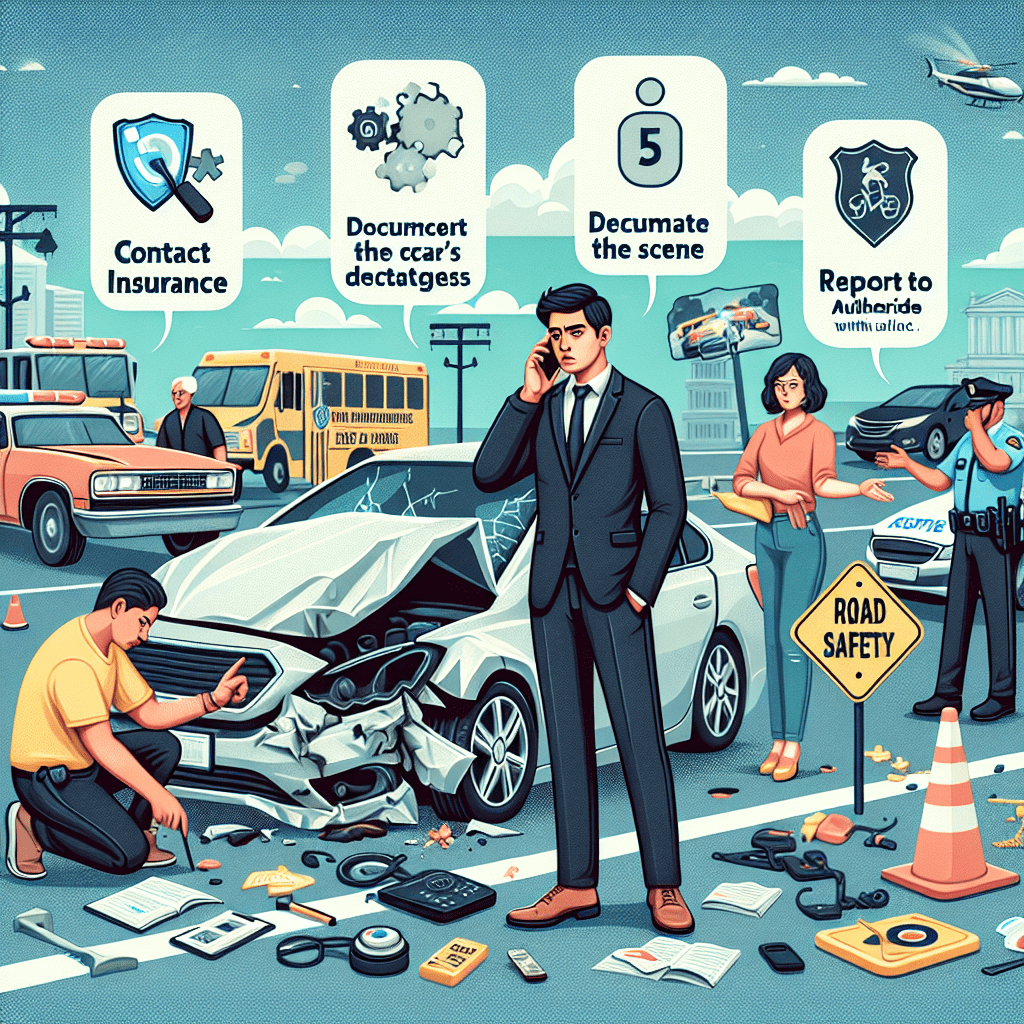

**Immediate Steps to Take After a Car Accident to Secure Your Insurance Claim**

Experiencing a car accident can be overwhelming, but taking the right steps immediately afterward is crucial to ensuring that your insurance claim is processed smoothly. The actions you take at the scene and in the following days can significantly impact whether your insurance provider approves your claim. Therefore, it is essential to remain calm, act responsibly, and gather all necessary information to support your case.

The first and most important step is to check for injuries. If you or anyone else involved in the accident is hurt, call emergency services immediately. Even if injuries seem minor, seeking medical attention is advisable, as some conditions may not be immediately apparent. Once safety is ensured, move your vehicle to a safe location if possible, such as the side of the road, to prevent further accidents or traffic disruptions. However, if the accident is severe or if moving the vehicle could cause further damage, it is best to leave it in place until authorities arrive.

After ensuring safety, contacting law enforcement is the next critical step. In many jurisdictions, a police report is required for insurance claims, especially in cases involving significant damage or injuries. When officers arrive, provide an accurate and factual account of the accident, but avoid admitting fault, as liability will be determined based on evidence and witness statements. Request a copy of the police report or obtain the report number so you can access it later when filing your claim.

Gathering evidence at the scene is equally important. Use your phone to take clear photos of the vehicles involved, including license plates, visible damages, road conditions, traffic signs, and any contributing factors such as skid marks or debris. If there are witnesses, ask for their contact information, as their statements may support your claim. Additionally, exchange details with the other driver, including names, phone numbers, addresses, driver’s license numbers, vehicle registration, and insurance information. Ensuring accuracy in this exchange can prevent complications during the claims process.

Once you have left the scene, notify your insurance company as soon as possible. Many insurers have specific timeframes within which accidents must be reported, and delaying this step could jeopardize your claim. When speaking with your insurance representative, provide all necessary details, including the date, time, location, and a description of the accident. Be honest and factual, but avoid speculating about fault or making statements that could be misinterpreted. If you have already obtained a police report, share the details with your insurer to strengthen your claim.

Following up on medical treatment is another crucial aspect of securing your insurance payout. If you sought medical attention after the accident, keep records of all doctor visits, treatments, and expenses. Some injuries may take time to manifest, so if you experience pain or discomfort in the days following the accident, seek medical evaluation promptly. Your insurance provider may require medical documentation to validate injury claims, so maintaining thorough records can help ensure proper compensation.

Finally, staying organized throughout the claims process can make a significant difference. Keep copies of all correspondence with your insurance company, including emails, claim forms, and receipts for any expenses related to the accident. If your vehicle requires repairs, obtain estimates from approved repair shops and follow your insurer’s guidelines for submitting repair claims. By taking these immediate steps and maintaining clear communication with your insurance provider, you can improve the likelihood of a successful claim and receive the compensation you are entitled to.

**Essential Documentation You Need for a Successful Insurance Payout**

After a car accident, ensuring that your insurance claim is processed smoothly requires careful documentation. The information you gather at the scene and in the following days can significantly impact the outcome of your claim. To maximize your chances of receiving a fair payout, it is essential to collect and organize all necessary documents.

One of the most critical pieces of documentation is the police report. If law enforcement responds to the accident, they will typically create an official report detailing the incident. This report often includes statements from involved parties, witness accounts, and an initial assessment of fault. Insurance companies rely heavily on this document to determine liability, so obtaining a copy as soon as it becomes available is crucial. If the police do not respond to the scene, you may need to file a report yourself at a local station or through an online portal, depending on your jurisdiction.

In addition to the police report, gathering photographic evidence is essential. Taking clear pictures of the accident scene, vehicle damage, license plates, road conditions, and any visible injuries can provide valuable support for your claim. These images help establish the extent of the damage and can prevent disputes over liability. It is also beneficial to capture traffic signs, signals, and any skid marks or debris that may have contributed to the accident. The more comprehensive your photographic evidence, the stronger your case will be when dealing with the insurance company.

Equally important is collecting witness statements. If there were bystanders who saw the accident occur, their accounts could serve as impartial evidence to support your version of events. Be sure to obtain their names, contact information, and a brief summary of what they observed. Insurance adjusters may reach out to these witnesses to verify details, which can help clarify any discrepancies between the involved parties’ statements.

Medical records also play a significant role in the claims process, particularly if you sustained injuries. Seeking medical attention immediately after an accident ensures that any injuries are properly documented. Even if you do not feel pain right away, some injuries may take time to manifest. Keeping copies of medical reports, treatment plans, prescriptions, and bills will help substantiate your claim for medical expenses. Additionally, if your injuries result in lost wages, obtaining a letter from your employer confirming your time off work and lost income can further support your case.

Another crucial document is the insurance information exchange. At the scene of the accident, it is essential to exchange details with the other driver, including names, contact information, insurance policy numbers, and vehicle registration details. This information allows your insurance company to communicate with the other party’s insurer and facilitates the claims process. If the other driver is uncooperative, noting their license plate number and vehicle description can still be helpful.

Finally, maintaining a personal record of the accident and its aftermath can be beneficial. Writing a detailed account of what happened, including the time, location, weather conditions, and any conversations with the other driver, can serve as a reference if any disputes arise. Keeping all receipts related to vehicle repairs, rental cars, and other accident-related expenses will also help ensure that you are reimbursed appropriately.

By gathering and organizing these essential documents, you can strengthen your insurance claim and improve the likelihood of receiving a fair payout. Proper documentation not only helps establish the facts of the accident but also protects you from potential disputes or delays in the claims process.

**Common Mistakes to Avoid That Could Jeopardize Your Insurance Claim**

One of the most critical aspects of handling a car accident is ensuring that your insurance claim is processed smoothly and without unnecessary complications. However, many individuals unknowingly make mistakes that can jeopardize their chances of receiving a fair payout. Understanding these common errors and taking proactive steps to avoid them can significantly improve the likelihood of a successful claim.

One of the most frequent mistakes is failing to report the accident to the insurance company in a timely manner. Many policies require prompt notification, and delaying this step can raise suspicions or even result in a denied claim. Even if the accident seems minor, it is essential to inform your insurer as soon as possible to ensure compliance with policy requirements. Additionally, providing incomplete or inaccurate information can also create issues. When reporting the accident, it is crucial to be honest and provide all necessary details. Any inconsistencies in your account of the incident may lead to delays or even accusations of fraud.

Another common error is neglecting to gather sufficient evidence at the scene. Proper documentation is key to supporting your claim, and failing to take photos of the damage, road conditions, and any relevant traffic signs can weaken your case. Additionally, obtaining witness statements and contact information can be invaluable, as third-party accounts can help corroborate your version of events. Without adequate evidence, the insurance company may dispute liability or reduce the amount of compensation you receive.

Admitting fault at the scene of the accident is another mistake that can have serious consequences. While it may be instinctive to apologize or take responsibility, doing so can be used against you during the claims process. Instead, it is best to stick to the facts when speaking with the other party, law enforcement, and insurance representatives. Let the insurance adjusters and investigators determine liability based on the available evidence rather than making statements that could be misinterpreted.

Seeking medical attention is another crucial step that should not be overlooked. Some injuries may not be immediately apparent, and delaying medical treatment can not only put your health at risk but also weaken your claim. Insurance companies may argue that your injuries were not serious or were unrelated to the accident if there is no medical documentation linking them to the incident. Therefore, it is advisable to see a doctor as soon as possible and follow all recommended treatments.

Another mistake that can jeopardize your claim is accepting a settlement offer too quickly. Insurance companies often try to minimize payouts by offering a settlement before the full extent of damages and injuries is known. Accepting an early offer without fully understanding the long-term costs of repairs or medical treatment can leave you with insufficient compensation. It is always wise to review any settlement offer carefully and, if necessary, consult with a legal or insurance professional before agreeing to any terms.

Finally, failing to follow up on your claim can also be detrimental. Insurance companies handle numerous claims, and delays can occur. Staying proactive by regularly checking on the status of your claim and providing any additional information requested can help ensure a timely resolution. By avoiding these common mistakes, you can improve your chances of receiving the compensation you deserve and ensure that your insurance claim is processed efficiently.