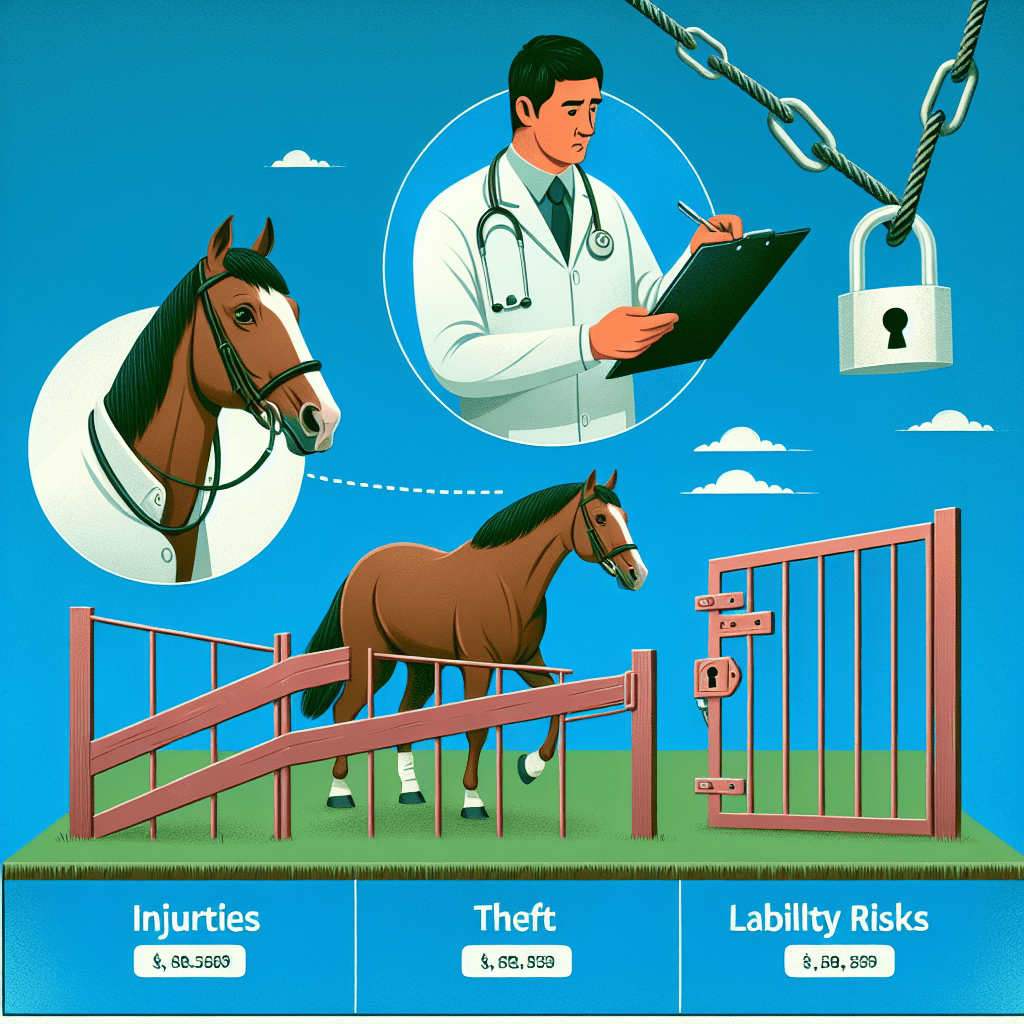

“Protect Your Horse: Coverage for Injuries, Theft, and Liability Risks.”

Understanding Horse Insurance: Coverage for Injuries, Theft, and Liability Risks

Horse insurance provides essential financial protection for horse owners, covering a range of risks that could otherwise result in significant expenses. Understanding the scope of coverage is crucial for making informed decisions about the type of policy that best suits an owner’s needs. Among the most common concerns are injuries, theft, and liability risks, each of which can have serious financial and legal implications. By examining these aspects in detail, horse owners can better appreciate the value of insurance and ensure they have adequate protection in place.

One of the primary components of horse insurance is coverage for injuries, which typically falls under mortality and medical insurance policies. Mortality insurance functions similarly to life insurance for horses, providing compensation in the event of death due to illness, injury, or accidents. However, this coverage alone does not address veterinary expenses related to injuries or illnesses. To cover medical costs, owners often opt for major medical or surgical insurance, which helps pay for treatments, diagnostics, and procedures necessary to restore the horse’s health. Some policies may also include coverage for alternative therapies, rehabilitation, or emergency transportation, depending on the insurer and the level of coverage selected. Given the high cost of veterinary care, having medical insurance can significantly reduce the financial burden associated with treating an injured horse.

In addition to injuries, theft is another major concern for horse owners. Horses are valuable assets, and theft can result in both financial loss and emotional distress. Theft coverage is typically included in mortality insurance policies, ensuring that owners receive compensation if their horse is stolen and not recovered. Some policies may also cover instances of fraudulent sale or unauthorized transfer of ownership. While insurance provides financial relief, owners should also take preventive measures such as branding, microchipping, and secure fencing to reduce the risk of theft. Additionally, maintaining proper documentation of ownership and purchase records can help facilitate claims in the event of a loss.

Beyond injuries and theft, liability risks pose significant challenges for horse owners, particularly those involved in equestrian activities, boarding, or breeding. Liability insurance is designed to protect owners from legal and financial consequences if their horse causes injury to a person or damage to property. For example, if a horse escapes from its enclosure and causes a traffic accident, the owner could be held responsible for damages. Similarly, if a horse kicks or bites someone, the injured party may seek compensation for medical expenses. Liability insurance helps cover legal fees, settlements, and other costs associated with such incidents, providing peace of mind to owners who might otherwise face substantial financial losses.

While horse insurance offers valuable protection, policies vary in terms of coverage limits, exclusions, and conditions. It is essential for owners to carefully review policy details and consult with insurance providers to ensure they have the appropriate level of coverage. Some policies may exclude pre-existing conditions, certain high-risk activities, or specific breeds, making it important to clarify these aspects before purchasing a policy. By understanding the different types of coverage available and selecting a policy that aligns with their needs, horse owners can safeguard their investment and mitigate potential risks effectively.

Does Horse Insurance Protect Against Theft, Injuries, and Legal Liability?

Horse insurance provides essential financial protection for horse owners, covering a range of risks that could otherwise result in significant expenses. Among the most common concerns for horse owners are injuries, theft, and legal liability. Understanding how horse insurance addresses these risks is crucial for making informed decisions about coverage options and ensuring adequate protection for both the horse and its owner.

One of the primary reasons horse owners invest in insurance is to cover medical expenses resulting from injuries. Horses, whether used for competition, work, or leisure, are susceptible to accidents and illnesses that may require costly veterinary care. Equine medical insurance typically covers diagnostic procedures, surgeries, medications, and rehabilitation costs. Some policies also include coverage for alternative treatments such as chiropractic care or acupuncture, which can be beneficial for recovery. However, coverage limits and exclusions vary between policies, so it is important for owners to carefully review the terms to ensure they have the necessary protection for their horse’s specific needs.

In addition to medical coverage, many horse insurance policies offer mortality insurance, which provides financial compensation in the event of the horse’s death due to injury, illness, or other covered causes. This type of coverage is particularly valuable for owners who have invested significant amounts in their horse’s purchase, training, or breeding potential. Some policies also include provisions for humane euthanasia if a horse suffers from a severe, untreatable condition. While mortality insurance does not prevent the emotional loss of a horse, it can help mitigate the financial impact of such an unfortunate event.

Theft is another major concern for horse owners, particularly those with valuable or high-performance horses. Horse theft can occur for various reasons, including resale, ransom, or illegal breeding. Insurance policies that include theft coverage provide financial compensation if a horse is stolen and not recovered. Some policies may also cover the costs associated with efforts to locate and recover the stolen horse, such as advertising and legal fees. However, insurers may require proof of ownership, security measures, and prompt reporting of the theft to law enforcement to validate a claim. Owners should take preventive measures, such as microchipping and secure fencing, to reduce the risk of theft and ensure compliance with policy requirements.

Beyond injuries and theft, horse owners must also consider legal liability risks. Horses, by nature, can be unpredictable, and accidents involving third parties can lead to costly legal claims. Liability insurance protects owners in cases where their horse causes injury to a person or damage to property. For example, if a horse escapes from its enclosure and causes a traffic accident or if it kicks a visitor at a boarding facility, the owner could be held financially responsible. Liability coverage helps cover legal fees, medical expenses, and potential settlements, reducing the financial burden on the owner. Some policies also extend coverage to trainers, riders, or handlers who may be responsible for the horse’s care.

Ultimately, horse insurance serves as a crucial safeguard against financial losses resulting from injuries, theft, and liability risks. By carefully selecting a policy that aligns with their specific needs, horse owners can ensure they have the necessary protection to manage unexpected events. Reviewing policy terms, understanding exclusions, and implementing preventive measures can further enhance the effectiveness of insurance coverage, providing peace of mind and financial security in the face of potential risks.

Key Factors in Horse Insurance: Injury Claims, Theft Protection, and Liability Coverage

Horse insurance is an essential safeguard for equine owners, providing financial protection against various risks associated with horse ownership. Among the most critical aspects of horse insurance are injury claims, theft protection, and liability coverage. Understanding how these components function within an insurance policy can help owners make informed decisions about the level of coverage they need. Since horses represent a significant financial and emotional investment, ensuring they are adequately protected is a priority for responsible owners.

One of the primary concerns for horse owners is the risk of injury. Horses, whether used for competition, breeding, or recreational riding, are susceptible to accidents and illnesses that may require extensive veterinary care. Injury coverage typically falls under medical or surgical insurance, which helps cover the costs of diagnostics, treatments, and procedures necessary to restore the horse’s health. Policies may vary in terms of coverage limits, exclusions, and deductibles, so it is crucial for owners to carefully review the terms before selecting a plan. Some policies may cover only specific types of injuries or illnesses, while others provide broader protection. Additionally, pre-existing conditions are often excluded, meaning that any health issues the horse had before obtaining coverage may not be eligible for reimbursement.

Beyond medical concerns, theft is another significant risk that horse owners must consider. Horses are valuable assets, and theft can result in both financial loss and emotional distress. Theft protection within an insurance policy ensures that owners receive compensation if their horse is stolen and not recovered. The amount reimbursed is typically based on the horse’s insured value, which is determined at the time the policy is issued. Some policies may also cover costs associated with efforts to recover the stolen horse, such as advertising and reward expenses. However, it is important to note that insurance providers may require proof of ownership, security measures, and prompt reporting of the theft to law enforcement in order to process a claim.

In addition to injury and theft coverage, liability protection is a crucial component of horse insurance. Horses, by nature, can be unpredictable, and accidents involving third parties can lead to legal and financial consequences for owners. Liability insurance helps cover costs associated with property damage or bodily injury caused by the insured horse. For example, if a horse escapes from its enclosure and causes a traffic accident or injures a person during a riding lesson, the owner could be held responsible for damages. Liability coverage provides financial protection in such situations, covering legal fees, medical expenses, and settlement costs. The extent of coverage depends on the policy, with some offering general liability protection while others provide more specialized coverage for trainers, boarding facilities, or equestrian events.

When selecting a horse insurance policy, owners should carefully assess their specific needs and risks. Comparing different policies, understanding exclusions, and consulting with insurance providers can help ensure that the chosen coverage adequately protects against injury, theft, and liability risks. Since horses represent a significant investment, having comprehensive insurance coverage provides peace of mind and financial security in the event of unforeseen circumstances. By taking the time to evaluate available options, owners can make informed decisions that safeguard both their horses and their financial interests.