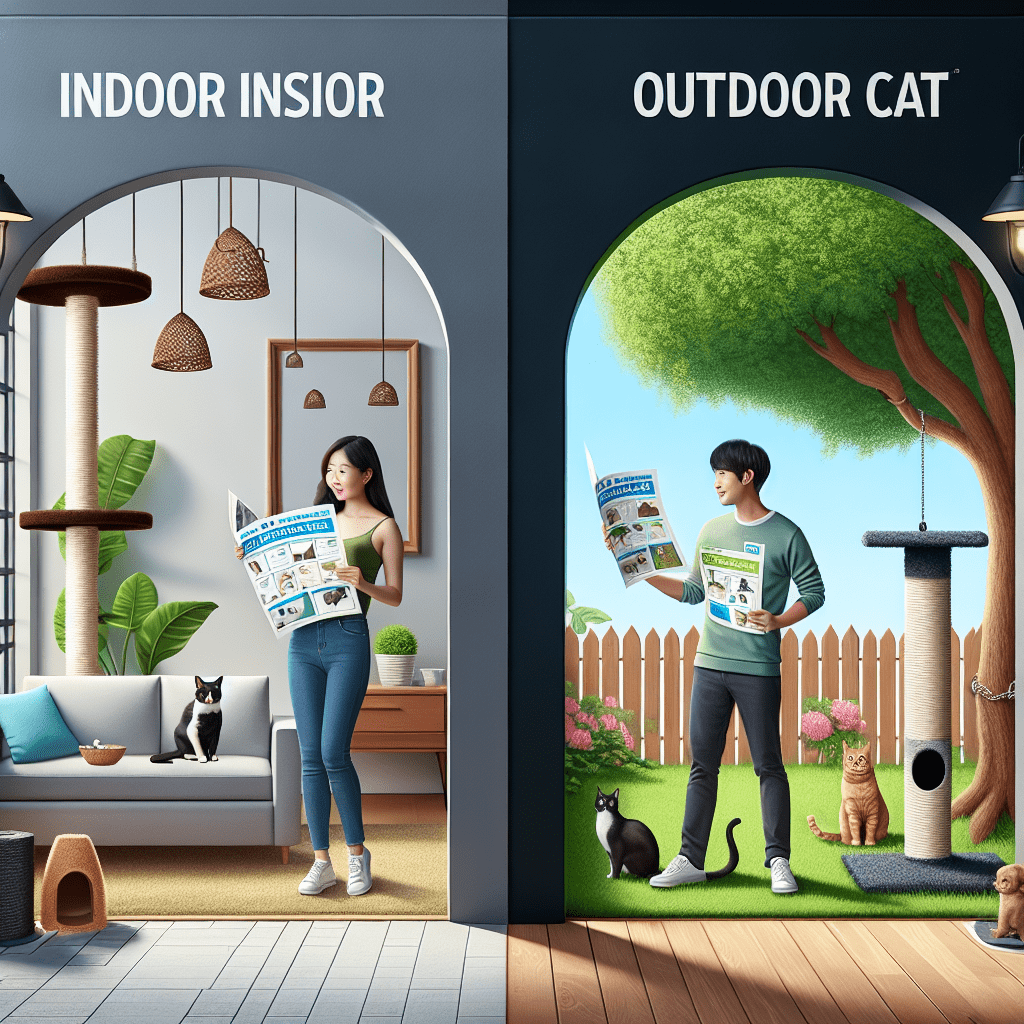

“Tailored Protection: The Best Cat Insurance Plans for Indoor and Outdoor Cats!”

Understanding The Differences: Best Cat Insurance Plans for Indoor vs. Outdoor Cats

When selecting the best cat insurance plan, it is essential to consider the unique risks associated with an indoor or outdoor lifestyle. While all cats require medical care at some point in their lives, the type and frequency of veterinary visits can vary significantly depending on their environment. Understanding these differences can help cat owners choose the most suitable insurance plan to ensure their pet receives the best possible care.

Indoor cats generally lead safer lives with fewer risks of injury or illness caused by external factors. They are less likely to encounter traffic accidents, animal attacks, or exposure to infectious diseases. However, this does not mean they are immune to health concerns. Indoor cats can still develop chronic conditions such as diabetes, obesity, or urinary tract infections, which may require ongoing medical attention. Additionally, they may suffer from genetic disorders or age-related illnesses, including kidney disease and arthritis. Given these potential health issues, an insurance plan for an indoor cat should prioritize coverage for chronic conditions, diagnostic tests, and preventive care. Plans that include wellness visits, vaccinations, and dental care can be particularly beneficial, as these services help maintain long-term health and detect potential problems early.

On the other hand, outdoor cats face a broader range of risks that necessitate more comprehensive insurance coverage. Because they roam outside, they are more susceptible to injuries from falls, fights with other animals, and accidents involving vehicles. They are also at a higher risk of contracting parasites, bacterial infections, and viral diseases such as feline leukemia virus (FeLV) or feline immunodeficiency virus (FIV). Due to these increased risks, an insurance plan for an outdoor cat should offer extensive accident and illness coverage, including emergency care, hospitalization, and surgery. Additionally, coverage for prescription medications and alternative treatments, such as physical therapy, can be valuable in case of injury or long-term recovery needs.

Another important factor to consider when choosing an insurance plan is the cost. Premiums for indoor cats tend to be lower because they are exposed to fewer risks, whereas outdoor cats often require higher premiums due to their increased likelihood of accidents and illnesses. However, regardless of whether a cat lives indoors or outdoors, selecting a plan with a reasonable deductible and reimbursement rate is crucial to ensuring affordability while still providing adequate coverage. Some insurance providers offer customizable plans that allow pet owners to adjust coverage levels based on their cat’s specific needs, which can be a practical option for managing costs.

In addition to standard insurance coverage, some plans offer optional add-ons that may be beneficial depending on a cat’s lifestyle. For example, outdoor cats may benefit from coverage for lost pet advertising and reward services in case they go missing. Meanwhile, indoor cats may require additional coverage for hereditary conditions, especially if they belong to a breed prone to genetic disorders. Evaluating these optional benefits can help pet owners tailor their insurance plans to provide the most comprehensive protection for their feline companions.

Ultimately, the best cat insurance plan depends on a cat’s lifestyle and individual health risks. While indoor cats may require coverage focused on chronic conditions and preventive care, outdoor cats need more extensive protection against accidents and infectious diseases. By carefully assessing these factors and comparing available plans, cat owners can make an informed decision that ensures their pet receives the necessary medical care throughout their life.

Coverage Comparison: What to Look for in Cat Insurance for Indoor and Outdoor Cats

When selecting the best cat insurance plan, it is essential to consider the unique risks associated with indoor and outdoor cats. While all cats require comprehensive coverage to ensure their health and well-being, the specific needs of an indoor cat differ significantly from those of an outdoor cat. Understanding these differences can help pet owners make informed decisions about the type of insurance that best suits their feline companion.

One of the primary factors to consider when comparing coverage options is the likelihood of accidents and injuries. Indoor cats generally lead safer lives, as they are not exposed to the dangers of traffic, predators, or territorial disputes with other animals. As a result, their insurance plans may focus more on coverage for illnesses, hereditary conditions, and routine veterinary care. On the other hand, outdoor cats face a higher risk of injuries from falls, fights, or encounters with wildlife. Therefore, an insurance plan for an outdoor cat should include robust accident coverage, ensuring that emergency treatments, surgeries, and hospitalization costs are adequately covered.

In addition to accident coverage, pet owners should evaluate the extent of illness protection offered by different insurance plans. Both indoor and outdoor cats are susceptible to various diseases, but outdoor cats are at a greater risk of contracting infectious illnesses due to their exposure to other animals and environmental hazards. Conditions such as feline leukemia virus (FeLV) and feline immunodeficiency virus (FIV) are more common in outdoor cats, making it crucial to choose a plan that includes coverage for diagnostic tests, medications, and long-term treatment. Indoor cats, while less exposed to contagious diseases, can still develop chronic conditions such as diabetes, kidney disease, or cancer. A comprehensive insurance plan should provide coverage for these illnesses, ensuring that pet owners can afford necessary treatments without financial strain.

Another important aspect to consider is preventive care coverage. Many insurance providers offer wellness plans that cover routine veterinary visits, vaccinations, dental cleanings, and parasite prevention. While both indoor and outdoor cats benefit from preventive care, outdoor cats may require additional protection against fleas, ticks, and heartworm, as they are more likely to encounter these parasites in their environment. Ensuring that an insurance plan includes coverage for preventive treatments can help reduce the risk of serious health issues and minimize long-term veterinary expenses.

Furthermore, pet owners should assess the policy’s reimbursement rates, deductibles, and coverage limits. Some insurance plans offer higher reimbursement percentages, which can be particularly beneficial for outdoor cats that may require frequent medical attention. Additionally, policies with lower deductibles can help pet owners manage unexpected veterinary costs more effectively. It is also important to review any exclusions or waiting periods associated with the policy, as some plans may not cover pre-existing conditions or have restrictions on specific treatments.

Ultimately, choosing the right cat insurance plan requires careful consideration of a cat’s lifestyle and potential health risks. While indoor cats may benefit from plans that emphasize illness coverage and preventive care, outdoor cats require more comprehensive accident protection and coverage for infectious diseases. By comparing different insurance options and selecting a plan that aligns with their cat’s needs, pet owners can ensure that their feline companions receive the best possible care throughout their lives.

Cost vs. Benefits: Choosing the Right Insurance Plan for Your Cat’s Lifestyle

When selecting the right insurance plan for your cat, it is essential to consider the costs and benefits in relation to your pet’s lifestyle. Indoor and outdoor cats face different risks, which can significantly impact the type of coverage they require. Understanding these differences will help you make an informed decision that balances affordability with comprehensive protection.

Indoor cats generally experience fewer risks than their outdoor counterparts. They are less likely to suffer from injuries caused by traffic accidents, animal attacks, or exposure to harmful substances. As a result, their veterinary expenses tend to be lower, and they may not require extensive insurance coverage. However, indoor cats are still susceptible to chronic illnesses, dental diseases, and hereditary conditions, which can lead to costly medical treatments over time. A basic insurance plan that covers accidents and illnesses may be sufficient for an indoor cat, as it provides financial support for unexpected health issues while keeping monthly premiums affordable.

On the other hand, outdoor cats are exposed to a wider range of hazards, making comprehensive insurance coverage a more prudent choice. These cats are at a higher risk of injuries from fights with other animals, infections from parasites, and exposure to harsh weather conditions. Additionally, outdoor cats are more likely to encounter toxic plants, chemicals, or contaminated food sources, which can lead to poisoning or gastrointestinal issues. Given these increased risks, a more robust insurance plan that includes accident coverage, emergency care, and wellness benefits may be necessary to ensure that your cat receives prompt and adequate medical attention when needed.

While cost is a significant factor in choosing an insurance plan, it is important to weigh the long-term benefits of coverage against potential veterinary expenses. A lower-cost plan with limited coverage may seem appealing initially, but it could result in higher out-of-pocket expenses if your cat develops a serious illness or sustains an injury. Conversely, a more comprehensive plan with higher premiums may provide greater financial security by covering a broader range of medical treatments, ultimately reducing the financial burden of unexpected veterinary bills.

Another consideration when selecting an insurance plan is the inclusion of preventive care benefits. Some policies offer wellness coverage, which can help offset the costs of routine check-ups, vaccinations, and parasite prevention. For indoor cats, wellness coverage may not be as critical, as they are less likely to be exposed to external threats. However, for outdoor cats, preventive care is essential in reducing the risk of infections and diseases. Investing in a plan that includes wellness benefits can contribute to your cat’s overall health and longevity while minimizing future medical expenses.

Ultimately, the best insurance plan for your cat depends on their lifestyle and specific health risks. Indoor cats may benefit from a more affordable plan that focuses on illness and emergency care, while outdoor cats require broader coverage to address the increased likelihood of accidents and exposure-related illnesses. By carefully evaluating the costs and benefits of different insurance options, you can select a plan that provides the right level of protection for your cat while ensuring financial peace of mind.