“Save More, Spend Less: Take the 30-Day No-Spend Challenge!”

How to Successfully Complete a No-Spend Challenge in 30 Days

Successfully completing a no-spend challenge in 30 days requires careful planning, discipline, and a clear understanding of your financial goals. While the idea of not spending any money for an entire month may seem daunting, the challenge is not about eliminating all expenses but rather about cutting out non-essential spending. By focusing on necessities and avoiding impulse purchases, you can develop better financial habits and potentially save hundreds of dollars in just 30 days.

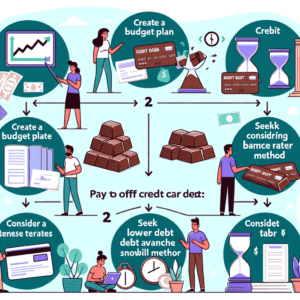

To begin, it is essential to establish clear rules for the challenge. Defining what constitutes a necessary expense versus a discretionary one will help set boundaries and prevent unnecessary spending. Essential expenses typically include rent or mortgage payments, utilities, groceries, transportation, and medical costs. On the other hand, discretionary spending includes dining out, entertainment, clothing, and impulse purchases. By identifying these categories in advance, you can create a structured plan that ensures you stay on track throughout the month.

Once the rules are in place, preparing for the challenge is the next crucial step. Taking inventory of household supplies, meal planning, and setting a realistic budget for essential expenses can help prevent unexpected spending. Stocking up on staple food items and household necessities before the challenge begins can reduce the temptation to make unplanned purchases. Additionally, meal planning allows you to maximize the use of ingredients you already have, minimizing the need for grocery store visits and reducing the likelihood of impulse buys.

Throughout the challenge, tracking expenses and monitoring progress is vital. Keeping a daily record of spending, even if it is only for essential items, provides insight into financial habits and highlights areas where further savings may be possible. Using a journal, spreadsheet, or budgeting app can help maintain accountability and reinforce the commitment to the challenge. Furthermore, reflecting on spending patterns can reveal triggers that lead to unnecessary purchases, allowing for better financial decision-making in the future.

Finding alternative ways to enjoy daily activities without spending money is another key aspect of successfully completing the challenge. Instead of dining out, consider cooking meals at home and experimenting with new recipes. For entertainment, explore free community events, outdoor activities, or hobbies that do not require additional expenses. Engaging in these cost-free alternatives not only helps maintain motivation but also demonstrates that enjoyable experiences do not always require spending money.

In addition to cutting expenses, it is important to stay motivated throughout the 30-day period. Setting a specific savings goal, whether it is paying off debt, building an emergency fund, or saving for a future purchase, can provide a sense of purpose and encourage perseverance. Sharing the challenge with friends or family members can also create a support system that fosters accountability and motivation. Additionally, celebrating small milestones along the way, such as reaching the halfway point, can reinforce progress and maintain enthusiasm.

By the end of the 30-day challenge, the financial benefits will likely be evident. Not only will you have saved money, but you will also have gained a greater awareness of spending habits and financial priorities. The discipline developed during the challenge can serve as a foundation for long-term financial stability, making it easier to maintain mindful spending habits beyond the initial 30 days. Ultimately, the no-spend challenge is not just about temporary savings but about fostering a more intentional and financially responsible lifestyle.

Essential Tips to Maximize Your Savings During a No-Spend Challenge

A no-spend challenge can be an effective way to reset your financial habits and build a stronger awareness of your spending patterns. By committing to a period of time—typically 30 days—without making any unnecessary purchases, you can potentially save hundreds of dollars while also developing a more mindful approach to money management. However, to maximize your savings during this challenge, it is essential to plan strategically and adopt practical techniques that will help you stay on track.

One of the most important steps in preparing for a no-spend challenge is setting clear guidelines. Defining what constitutes a necessary expense versus a discretionary one will help eliminate ambiguity and prevent impulsive purchases. Essential expenses typically include rent or mortgage payments, utilities, groceries, and transportation costs, while non-essential spending may include dining out, entertainment, and impulse shopping. By establishing these boundaries in advance, you can create a structured approach that ensures you remain committed to the challenge.

Another key strategy is to take inventory of what you already have. Before the challenge begins, assess your pantry, refrigerator, and household supplies to determine what items you can use instead of purchasing new ones. Many people are surprised to find that they already have enough food, toiletries, and other essentials to last for several weeks. By making use of what is available, you can significantly reduce unnecessary spending and avoid the temptation to shop out of habit.

Meal planning is another crucial component of a successful no-spend challenge. By planning meals in advance and utilizing ingredients you already own, you can minimize grocery expenses and reduce food waste. Cooking at home instead of dining out not only saves money but also encourages healthier eating habits. Additionally, preparing meals in batches can help streamline your cooking process and ensure that you always have convenient, cost-effective options available.

To further enhance your savings, it is beneficial to find free or low-cost alternatives to your usual activities. Instead of spending money on entertainment, consider exploring local parks, attending free community events, or engaging in hobbies that do not require additional purchases. Many libraries offer free access to books, movies, and online courses, providing an excellent source of entertainment and education without any financial commitment. By discovering new ways to enjoy your time without spending money, you can develop habits that extend beyond the challenge itself.

Avoiding temptation is another critical factor in maintaining discipline throughout the challenge. Unsubscribing from marketing emails, avoiding shopping websites, and steering clear of stores where you typically make impulse purchases can help reduce the urge to spend. Additionally, finding an accountability partner—such as a friend or family member—can provide motivation and support, making it easier to stay committed to your financial goals.

Finally, tracking your progress throughout the challenge can help reinforce positive behaviors and provide a sense of accomplishment. Keeping a journal or using a budgeting app to record your savings can offer valuable insights into your spending habits and highlight areas where you can continue to cut costs. By reflecting on your progress, you can gain a deeper understanding of your financial priorities and develop long-term strategies for maintaining a more frugal lifestyle.

By implementing these essential tips, you can maximize your savings during a no-spend challenge and cultivate a more mindful approach to managing your finances. Not only can this experience help you save money in the short term, but it can also instill lasting habits that contribute to greater financial stability and independence.

Common Pitfalls to Avoid When Taking on a No-Spend Challenge

One of the most effective ways to reset your financial habits and build better spending awareness is by taking on a no-spend challenge. By committing to a set period—often 30 days—without making unnecessary purchases, individuals can save significant amounts of money while also gaining a deeper understanding of their financial priorities. However, despite the simplicity of the concept, many people encounter common pitfalls that can hinder their success. Recognizing these challenges in advance can help ensure a smoother and more effective no-spend experience.

One of the most frequent mistakes people make is failing to set clear guidelines for their challenge. Without a well-defined plan, it becomes easy to justify certain purchases, which can quickly lead to a breakdown in discipline. To avoid this, it is essential to establish specific rules regarding what constitutes a necessary expense versus a discretionary one. For example, while groceries and utility bills are typically considered essential, dining out or purchasing new clothing may not be. By outlining these parameters in advance, participants can eliminate ambiguity and reduce the temptation to make impulsive purchases.

Another common pitfall is neglecting to prepare adequately before starting the challenge. Many individuals embark on a no-spend month without taking stock of their current resources, which can lead to unnecessary struggles. For instance, failing to plan meals in advance may result in running out of essential ingredients, increasing the temptation to order takeout. Similarly, not considering upcoming events—such as birthdays or social gatherings—can create pressure to spend unexpectedly. To mitigate these risks, it is beneficial to conduct a thorough inventory of household supplies, plan meals strategically, and anticipate any potential spending triggers before the challenge begins.

Additionally, emotional spending can pose a significant obstacle to success. Many people use shopping as a way to cope with stress, boredom, or other emotional triggers, making it difficult to resist unnecessary purchases. Without recognizing these habits, individuals may find themselves justifying small expenses that ultimately add up over time. To combat this, it is helpful to identify alternative coping mechanisms, such as engaging in physical activity, practicing mindfulness, or pursuing hobbies that do not require spending money. By addressing the underlying emotional drivers of spending, participants can develop healthier financial habits that extend beyond the challenge itself.

Social pressures can also make it challenging to adhere to a no-spend commitment. Friends and family may not understand the purpose of the challenge and may encourage spending on social outings or shared activities. This can create feelings of isolation or guilt, making it harder to stay on track. To navigate this, open communication is key. Informing loved ones about the challenge in advance and suggesting free or low-cost alternatives—such as hosting a game night or going for a walk—can help maintain social connections without compromising financial goals.

Finally, one of the most overlooked pitfalls is failing to track progress throughout the challenge. Without monitoring spending habits and savings, it can be difficult to stay motivated and recognize the impact of the effort. Keeping a journal or using budgeting apps to document progress can provide valuable insights and reinforce the benefits of the challenge. By staying mindful of these common pitfalls and implementing proactive strategies, individuals can maximize their success and emerge from the no-spend challenge with stronger financial discipline and a renewed sense of control over their money.