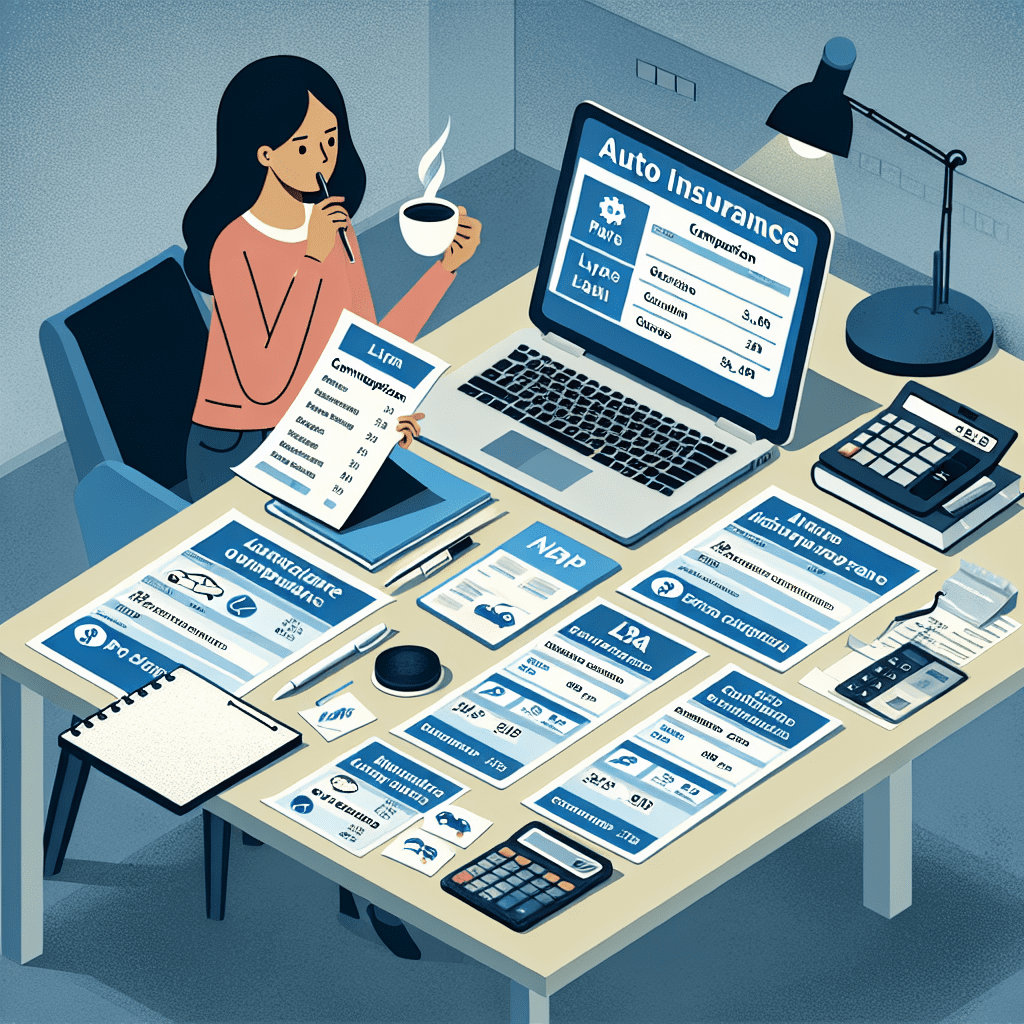

“Smart Coverage, Smart Savings: Find the Best Auto Insurance for Your Budget and Needs!”

Understanding Coverage Options: Choosing the Right Policy for Your Needs

When selecting an auto insurance policy, understanding the various coverage options available is essential to making an informed decision. The right policy should not only fit within your budget but also provide adequate protection based on your specific needs. To achieve this balance, it is important to evaluate the different types of coverage, assess your personal circumstances, and compare policies from multiple providers. By carefully considering these factors, you can ensure that you are adequately covered without overpaying for unnecessary features.

One of the first steps in choosing the right policy is to familiarize yourself with the primary types of auto insurance coverage. Liability insurance, which is required in most states, covers damages and injuries you may cause to others in an accident. This coverage is essential for financial protection, as it helps pay for medical expenses and property damage resulting from an at-fault collision. However, liability insurance does not cover your own vehicle or medical costs, which is why many drivers opt for additional coverage.

Comprehensive and collision coverage are two common options that provide greater protection. Collision coverage helps pay for repairs to your vehicle if you are involved in an accident, regardless of fault. This can be particularly beneficial if you have a newer or more expensive car, as repair costs can be significant. On the other hand, comprehensive coverage protects against non-collision-related incidents, such as theft, vandalism, or natural disasters. While these coverages are not legally required, they can offer peace of mind and financial security, especially if you live in an area prone to extreme weather or high crime rates.

Beyond these basic coverages, there are additional options that may be worth considering depending on your circumstances. Uninsured and underinsured motorist coverage can be valuable if you are involved in an accident with a driver who lacks sufficient insurance. Medical payments coverage or personal injury protection (PIP) can help cover medical expenses for you and your passengers, regardless of fault. Roadside assistance and rental car reimbursement are also available as optional add-ons, providing extra convenience in case of emergencies.

Once you have a clear understanding of the coverage options, the next step is to assess your individual needs. Factors such as your driving habits, the value of your vehicle, and your financial situation should all be taken into account. If you drive frequently or have a long commute, higher coverage limits may be advisable to ensure adequate protection. Similarly, if your car is older and has a lower market value, you may decide that comprehensive and collision coverage are unnecessary, as the cost of repairs could exceed the vehicle’s worth.

After determining the appropriate level of coverage, it is crucial to compare policies from different insurance providers. Premiums can vary significantly based on factors such as your driving record, location, and credit history. Obtaining quotes from multiple companies allows you to identify the best value for your money. Additionally, many insurers offer discounts for safe driving, bundling policies, or maintaining a good credit score, which can help lower your overall costs.

By carefully evaluating coverage options, assessing your personal needs, and comparing policies, you can find an auto insurance policy that provides the right balance of affordability and protection. Taking the time to research and understand your options ensures that you are adequately covered while staying within your budget.

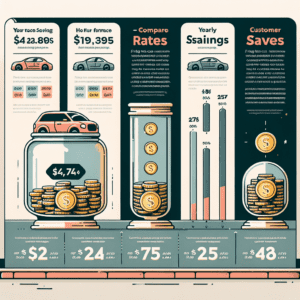

Comparing Quotes: How to Get the Best Auto Insurance Rates

When searching for the best auto insurance policy, comparing quotes is one of the most effective ways to ensure you receive the best coverage at the most affordable rate. With numerous insurance providers offering a variety of policies, understanding how to evaluate and compare quotes can help you make an informed decision that aligns with both your budget and coverage needs. By taking a strategic approach, you can secure a policy that provides adequate protection without overpaying for unnecessary features.

To begin, it is essential to gather multiple quotes from different insurance companies. Many insurers offer online tools that allow you to receive estimates quickly, while independent insurance agents can provide personalized recommendations based on your specific circumstances. When requesting quotes, be sure to provide accurate information about your vehicle, driving history, and coverage preferences. Inconsistent or incorrect details can lead to inaccurate estimates, making it difficult to compare policies effectively.

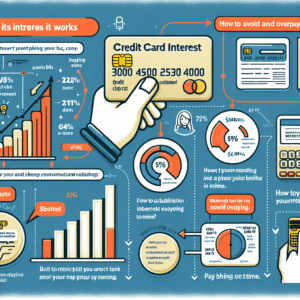

Once you have obtained several quotes, the next step is to analyze the coverage options included in each policy. While it may be tempting to choose the lowest-priced option, it is crucial to ensure that the policy provides sufficient protection. Liability coverage, which is required in most states, covers damages to other vehicles and property in the event of an accident. However, comprehensive and collision coverage may also be necessary, especially if you have a newer or financed vehicle. Additionally, consider optional coverages such as uninsured motorist protection, roadside assistance, and rental car reimbursement, as these can provide added security in various situations.

Beyond coverage options, it is important to examine the deductibles and policy limits associated with each quote. A lower premium may come with a higher deductible, meaning you will have to pay more out of pocket before your insurance coverage applies. Conversely, a higher premium with a lower deductible may be beneficial if you prefer to minimize upfront costs in the event of a claim. Evaluating these factors will help you determine which policy offers the best balance between affordability and financial protection.

Another key aspect to consider when comparing quotes is the reputation and reliability of the insurance provider. While a lower rate may seem appealing, it is essential to choose a company with a strong track record of customer service and claims processing. Researching customer reviews, financial stability ratings, and complaint records can provide valuable insight into an insurer’s reliability. Additionally, speaking with current policyholders or seeking recommendations from friends and family can help you gauge the overall experience with a particular provider.

Discounts can also play a significant role in reducing your auto insurance costs. Many insurers offer discounts for safe driving, bundling multiple policies, maintaining a good credit score, or installing safety features in your vehicle. When comparing quotes, inquire about available discounts and determine which ones you may qualify for. Taking advantage of these savings opportunities can help lower your premium without sacrificing necessary coverage.

Finally, it is important to review the terms and conditions of each policy before making a final decision. Pay close attention to exclusions, coverage limitations, and any additional fees that may apply. Understanding the fine print will prevent unexpected surprises and ensure that you select a policy that meets your needs. By carefully comparing quotes and considering all relevant factors, you can confidently choose an auto insurance policy that provides the best value for your budget and coverage requirements.

Money-Saving Tips: Finding Affordable Auto Insurance Without Sacrificing Coverage

Finding affordable auto insurance without sacrificing coverage requires a strategic approach that balances cost and protection. Many drivers focus solely on securing the lowest premium, but it is equally important to ensure that the policy provides adequate coverage in case of an accident or other unforeseen events. By taking the time to compare options, understand policy details, and explore potential discounts, drivers can secure a policy that meets both their financial constraints and coverage needs.

One of the most effective ways to save money on auto insurance is to shop around and compare quotes from multiple providers. Insurance companies use different criteria to determine rates, meaning that premiums can vary significantly between insurers for the same level of coverage. Utilizing online comparison tools or working with an independent insurance agent can help identify the most cost-effective options. Additionally, reviewing customer reviews and financial strength ratings of insurers can provide insight into their reliability and claims-handling process.

Another key strategy for reducing insurance costs is adjusting coverage levels and deductibles. While it may be tempting to opt for the minimum required coverage to lower premiums, this approach can lead to significant out-of-pocket expenses in the event of an accident. Instead, drivers should assess their individual needs and consider factors such as vehicle value, driving habits, and financial situation. Increasing the deductible—the amount paid out of pocket before insurance coverage applies—can lower monthly premiums, but it is essential to ensure that the deductible amount is affordable in case of a claim.

Taking advantage of available discounts is another effective way to reduce insurance costs without compromising coverage. Many insurers offer discounts for safe driving records, bundling multiple policies, completing defensive driving courses, or installing safety features in the vehicle. Additionally, maintaining a good credit score can positively impact insurance rates, as many providers use credit history as a factor in determining premiums. Regularly reviewing and updating policy details can help ensure that all eligible discounts are applied.

Maintaining a clean driving record is one of the most influential factors in securing lower insurance rates. Avoiding traffic violations, accidents, and claims can lead to lower premiums over time, as insurers typically reward safe drivers with better rates. Enrolling in a usage-based insurance program, which monitors driving habits through a mobile app or telematics device, may also result in discounts for responsible driving behavior.

For those seeking additional savings, considering alternative insurance options such as pay-per-mile policies may be beneficial. These policies base premiums on the number of miles driven, making them a cost-effective choice for individuals who drive infrequently. Additionally, reviewing policy terms annually and reassessing coverage needs can help identify opportunities for further savings.

Ultimately, finding affordable auto insurance without sacrificing coverage requires a proactive approach that includes comparing quotes, adjusting coverage levels, leveraging discounts, and maintaining a strong driving record. By carefully evaluating options and making informed decisions, drivers can secure a policy that provides financial protection while remaining within budget. Taking the time to research and explore available options ensures that both cost savings and adequate coverage are achieved.