When a family emergency strikes, financial stress can add to an already difficult situation. Whether it’s a medical crisis, urgent home repairs, or unexpected travel expenses, securing a loan quickly can be crucial. However, many fast loan options come with hidden fees and high interest rates. In this guide, we’ll explore how to get a quick loan without falling into financial traps.

Understanding Your Loan Options

Before rushing into a loan agreement, it’s essential to understand the different types of loans available. Here are some of the best options for emergency funding:

- Personal Loans: Offered by banks, credit unions, and online lenders, personal loans provide a lump sum with fixed repayment terms.

- Credit Union Loans: Many credit unions offer emergency loans with lower interest rates and fewer fees than traditional banks.

- Payday Alternative Loans (PALs): Some credit unions provide small-dollar loans as an alternative to payday loans, which often have predatory terms.

- 0% APR Credit Cards: If you qualify, a credit card with a 0% introductory APR can be a cost-effective way to cover emergency expenses.

- Employer or Community Assistance: Some employers offer paycheck advances, and local nonprofits may provide emergency financial aid.

How to Secure a Loan Quickly

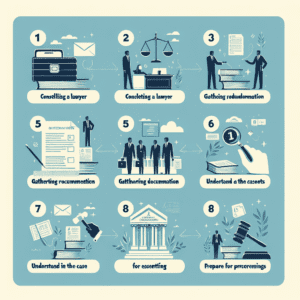

When time is of the essence, follow these steps to get a loan fast while avoiding hidden fees:

1. Check Your Credit Score

Your credit score plays a significant role in determining loan approval and interest rates. If you have good credit, you may qualify for lower rates. If your credit is less than perfect, consider lenders that specialize in bad-credit loans.

2. Compare Lenders and Loan Terms

Not all lenders are created equal. Look for reputable lenders with transparent terms. Key factors to compare include:

- Interest rates

- Repayment terms

- Origination fees

- Prepayment penalties

Use online loan comparison tools to find the best deal.

3. Avoid Predatory Lenders

Some lenders take advantage of borrowers in urgent situations by charging excessive fees. Watch out for:

- High origination fees (above 5%)

- Prepayment penalties

- Sky-high interest rates (above 36%)

- Unclear repayment terms

Always read the fine print before signing any loan agreement.

4. Gather Necessary Documents

To speed up the approval process, have these documents ready:

- Proof of income (pay stubs, tax returns)

- Government-issued ID

- Bank statements

- Proof of residence

Having these documents prepared can help you get approved faster.

5. Apply Online for Faster Processing

Many online lenders offer same-day or next-day funding. If you need money urgently, consider applying with a lender that provides instant pre-approval and fast disbursement.

Best Practices to Avoid Hidden Fees

Hidden fees can turn a seemingly affordable loan into a financial burden. Here’s how to protect yourself:

1. Read the Loan Agreement Carefully

Before signing, review the loan terms in detail. Look for any mention of:

- Origination fees

- Late payment penalties

- Prepayment fees

- Annual fees

2. Ask for a Full Fee Breakdown

Reputable lenders will provide a clear breakdown of all costs. If a lender is hesitant to disclose fees, consider it a red flag.

3. Choose Fixed-Rate Loans

Variable-rate loans can lead to unexpected payment increases. A fixed-rate loan ensures predictable monthly payments.

4. Avoid Payday Loans

Payday loans often come with exorbitant fees and interest rates exceeding 300%. These loans can trap borrowers in a cycle of debt.

Alternatives to Taking Out a Loan

If you’re hesitant about borrowing, consider these alternatives:

- Borrow from Family or Friends: A personal loan from a trusted individual may come with little to no interest.

- Negotiate Payment Plans: If your emergency involves medical bills or utilities, ask about flexible payment options.

- Use an Emergency Fund: If you have savings set aside, this is the time to use them.

- Sell Unused Items: Selling electronics, furniture, or jewelry can provide quick cash.

Final Thoughts

When facing a family emergency, securing a loan quickly is possible without falling into financial traps. By researching lenders, comparing terms, and avoiding hidden fees, you can find a loan that meets your needs without unnecessary costs. Always read the fine print and explore alternative funding options before making a decision.

Need a loan fast? Start by checking your credit score and comparing reputable lenders today.