Owning a classic car is a dream for many enthusiasts, but protecting your prized possession requires specialized insurance. Unlike standard auto insurance, classic car insurance offers tailored coverage to preserve the value and uniqueness of vintage vehicles. In this guide, we’ll explore how to insure a classic car, the key factors to consider, and the best policy options available.

What Qualifies as a Classic Car?

Before securing insurance, it’s essential to determine whether your vehicle qualifies as a classic car. While definitions vary by insurer, most companies classify a car as “classic” if it meets the following criteria:

- Typically 20 to 40 years old (older vehicles may be considered “antique”).

- Maintained in good condition, often restored or preserved.

- Used primarily for exhibitions, parades, or occasional leisure driving.

- Stored in a secure garage or facility when not in use.

Some insurers also offer coverage for exotic, muscle, and collector cars, even if they don’t fit the traditional “classic” definition.

Why Classic Car Insurance Is Different

Unlike standard auto insurance, which depreciates a vehicle’s value over time, classic car insurance is designed to protect the car’s agreed or appraised value. This ensures that in the event of a total loss, you receive the full insured amount rather than a depreciated market value.

Types of Classic Car Insurance Coverage

When insuring a classic car, you’ll encounter several coverage options tailored to vintage vehicles:

1. Agreed Value Coverage

With agreed value coverage, you and the insurer determine the car’s value upfront. In case of a total loss, you receive the full agreed amount without depreciation.

2. Spare Parts Coverage

Many classic car owners keep spare parts for maintenance and restoration. This coverage protects those valuable parts from theft or damage.

3. Limited Mileage Policies

Since classic cars are not typically used for daily commuting, insurers offer policies with mileage restrictions, which can lower premiums.

4. Roadside Assistance for Classic Cars

Specialized roadside assistance ensures that if your vintage vehicle breaks down, it is towed by professionals who understand classic cars.

5. Restoration Coverage

If you’re restoring a classic car, some insurers offer policies that cover the vehicle’s increasing value during the restoration process.

How to Get the Best Classic Car Insurance Policy

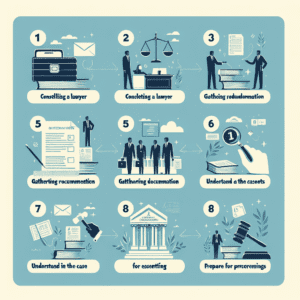

To secure the best insurance for your classic car, follow these steps:

1. Choose a Specialized Classic Car Insurer

Not all insurance companies offer classic car coverage. Look for providers specializing in vintage and collector vehicles, such as Hagerty, Grundy, or American Collectors Insurance.

2. Get an Accurate Appraisal

Have your car professionally appraised to determine its true value. This helps ensure you receive adequate coverage in case of a claim.

3. Maintain Proper Storage

Many insurers require classic cars to be stored in a secure garage or facility. Proper storage can also help lower your insurance premiums.

4. Understand Policy Restrictions

Classic car policies often have restrictions on mileage, usage, and modifications. Make sure you understand these terms before purchasing a policy.

5. Compare Quotes

Get quotes from multiple insurers to find the best coverage at a competitive price. Consider factors like deductibles, coverage limits, and additional benefits.

Common Mistakes to Avoid

When insuring a classic car, avoid these common pitfalls:

- Underinsuring Your Vehicle: Failing to get an accurate appraisal can leave you with insufficient coverage.

- Using Standard Auto Insurance: Regular policies may not provide adequate protection for a classic car’s true value.

- Ignoring Policy Restrictions: Exceeding mileage limits or using the car for daily commuting can void your coverage.

- Not Updating Coverage: If your car appreciates in value, update your policy to reflect its current worth.

Conclusion

Insuring a classic car requires careful consideration to ensure your prized vehicle is adequately protected. By choosing a specialized insurer, securing agreed value coverage, and understanding policy restrictions, you can safeguard your investment while enjoying your vintage ride. Whether you own a restored muscle car or a rare antique, the right insurance policy will provide peace of mind and financial security.

Ready to insure your classic car? Compare quotes from top classic car insurers today and find the best coverage for your cherished vehicle.