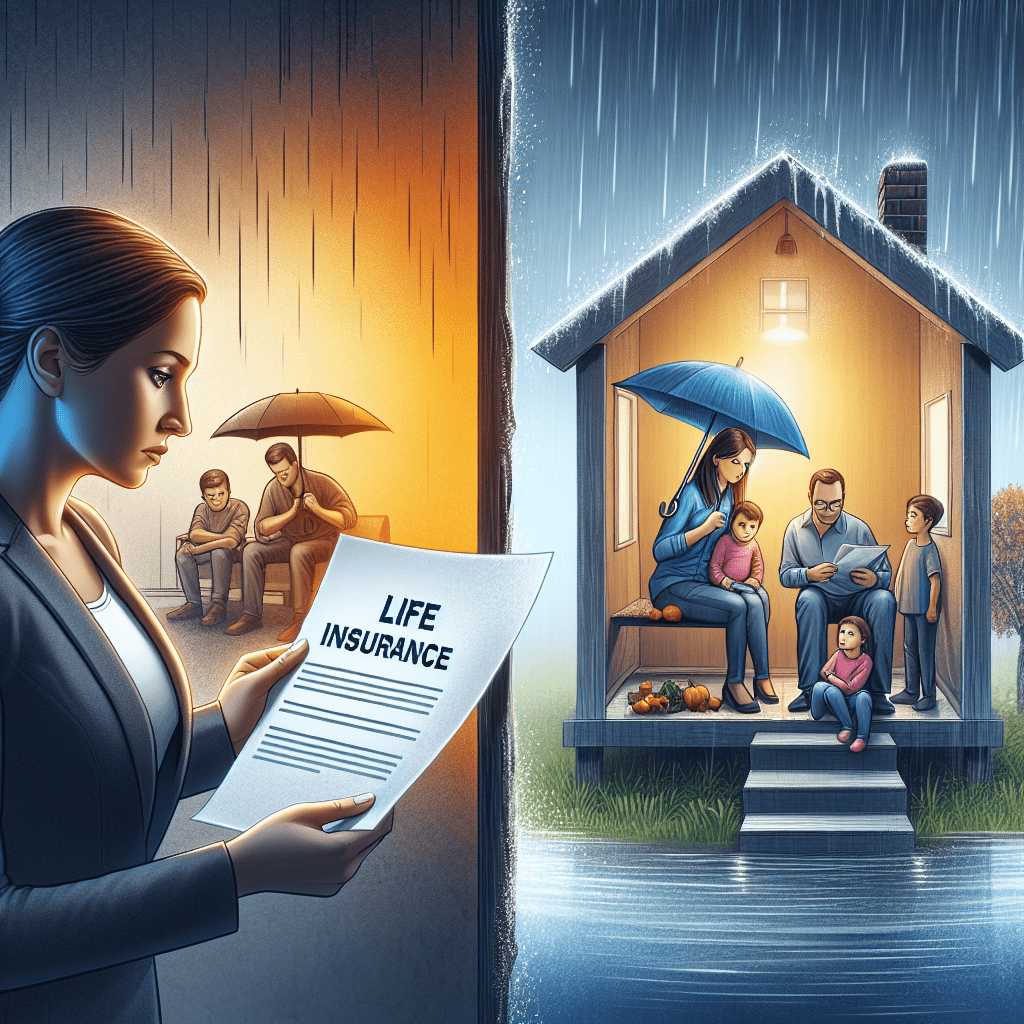

Insurance bundling is a common strategy that many providers offer to help customers save money and simplify their policies. But is bundling your home and auto insurance the right choice for you? In this article, we’ll explore the pros and cons of bundling, potential savings, and key factors to consider before making a decision.

What Does It Mean to Bundle Home and Auto Insurance?

Bundling home and auto insurance means purchasing both policies from the same insurance provider. Many insurers offer discounts to customers who bundle their policies, making it an attractive option for those looking to save money and streamline their coverage.

Pros of Bundling Home and Auto Insurance

1. Potential Cost Savings

One of the biggest advantages of bundling is the potential for significant savings. Many insurance companies offer discounts ranging from 5% to 25% when you bundle your home and auto policies.

2. Simplified Policy Management

Managing multiple insurance policies can be overwhelming. Bundling allows you to handle both policies under one provider, making it easier to track payments, renewals, and claims.

3. Increased Loyalty Discounts

Insurance companies often reward long-term customers with additional discounts. By bundling, you may qualify for even more savings over time.

4. Streamlined Claims Process

In the event of an accident or disaster affecting both your home and car (such as a storm or fire), dealing with a single insurer can simplify the claims process and reduce potential disputes between different providers.

5. Additional Perks and Benefits

Some insurers offer extra perks for bundled policies, such as accident forgiveness, deductible reductions, or enhanced coverage options.

Cons of Bundling Home and Auto Insurance

1. Not Always the Cheapest Option

While bundling can save money, it’s not always the most affordable choice. Some insurers may offer lower rates for standalone policies, so it’s essential to compare quotes before committing.

2. Limited Flexibility

Bundling ties you to a single provider, which may limit your ability to shop around for better deals on individual policies.

3. Potential for Rate Increases

Insurance rates can change over time. If your provider increases rates on one policy, you may end up paying more overall, even with a bundling discount.

4. Coverage Gaps or Overlaps

Not all bundled policies offer the best coverage for your specific needs. It’s important to review the details carefully to ensure there are no gaps or unnecessary overlaps in coverage.

When Does Bundling Make Sense?

Bundling home and auto insurance is a great option in the following scenarios:

- You qualify for a significant discount that outweighs separate policy savings.

- You prefer the convenience of managing both policies with one provider.

- Your insurer offers additional perks that enhance your coverage.

- You have a good claims history and qualify for loyalty discounts.

When Should You Avoid Bundling?

Bundling may not be the best choice if:

- You find lower rates by purchasing separate policies from different providers.

- Your current provider has a history of frequent rate increases.

- You need specialized coverage that a bundled policy does not offer.

How to Compare Bundled vs. Separate Policies

Before deciding, follow these steps to compare your options:

- Request quotes for both bundled and separate policies from multiple insurers.

- Compare coverage limits, deductibles, and exclusions.

- Check for additional perks or benefits offered with bundling.

- Read customer reviews and assess the insurer’s reputation for claims handling.

Final Thoughts: Is Bundling Right for You?

Bundling home and auto insurance can be a smart financial move, but it’s not always the best option for everyone. The key is to compare rates, evaluate coverage, and consider your personal needs before making a decision.

If you’re looking for convenience and potential savings, bundling may be worth it. However, if you find better standalone rates or need specialized coverage, keeping separate policies might be the better choice.

Ultimately, the best way to determine if bundling is right for you is to shop around, compare quotes, and choose the option that provides the best value for your specific situation.