“Save Smart, Live Well: Balance Your Future and Today.”

Smart Saving Strategies: Balancing Retirement Goals with Present Enjoyment

Planning for retirement while maintaining a fulfilling lifestyle in the present requires a thoughtful approach to financial management. Striking the right balance between saving for the future and enjoying life today can be challenging, but with smart saving strategies, it is possible to achieve both goals. By prioritizing financial discipline, making informed decisions, and adopting a long-term perspective, individuals can secure their retirement without sacrificing their current quality of life.

One of the most effective ways to balance retirement savings with present enjoyment is to establish a clear budget. A well-structured budget allows individuals to allocate funds appropriately, ensuring that essential expenses, discretionary spending, and savings contributions are all accounted for. To begin, it is important to assess current income and expenses, identifying areas where adjustments can be made. By distinguishing between necessary and non-essential expenditures, individuals can make informed choices about where to cut back without significantly impacting their lifestyle.

In addition to budgeting, setting specific savings goals is crucial. Rather than viewing retirement savings as a distant obligation, individuals should establish clear targets based on their desired retirement lifestyle. This includes estimating future expenses such as housing, healthcare, and leisure activities. By determining a realistic savings goal, individuals can work toward financial security while still allowing room for present-day enjoyment. Automating savings contributions, such as directing a portion of each paycheck into a retirement account, can help ensure consistency and prevent the temptation to spend those funds elsewhere.

While saving for retirement is essential, it is equally important to make strategic investment decisions. Investing wisely can help grow retirement savings over time, reducing the burden of setting aside large sums of money in the present. Diversifying investments across different asset classes, such as stocks, bonds, and real estate, can help mitigate risk while maximizing potential returns. Additionally, taking advantage of employer-sponsored retirement plans, such as 401(k) accounts with matching contributions, can significantly enhance long-term savings. Seeking guidance from a financial advisor can also provide valuable insights into investment strategies that align with both short-term and long-term financial goals.

Another key aspect of balancing retirement savings with present enjoyment is practicing mindful spending. This does not mean eliminating all discretionary expenses but rather making intentional choices about where money is allocated. For example, prioritizing experiences over material possessions can lead to greater personal fulfillment while maintaining financial stability. Additionally, finding cost-effective ways to enjoy life, such as taking advantage of discounts, exploring free activities, or traveling during off-peak seasons, can help individuals maintain a satisfying lifestyle without compromising their savings goals.

Furthermore, it is important to periodically review and adjust financial plans as circumstances change. Life events such as career advancements, family changes, or unexpected expenses may require modifications to savings strategies. Regularly reassessing financial goals ensures that individuals remain on track while allowing for flexibility in their spending habits. By maintaining a proactive approach to financial planning, individuals can adapt to changing circumstances without jeopardizing their long-term security.

Ultimately, achieving a balance between saving for retirement and enjoying life today requires careful planning, disciplined saving, and mindful spending. By creating a realistic budget, setting clear savings goals, making strategic investments, and practicing intentional spending, individuals can work toward a secure financial future while still embracing the present. With a thoughtful approach, it is possible to enjoy life today while ensuring financial stability in retirement.

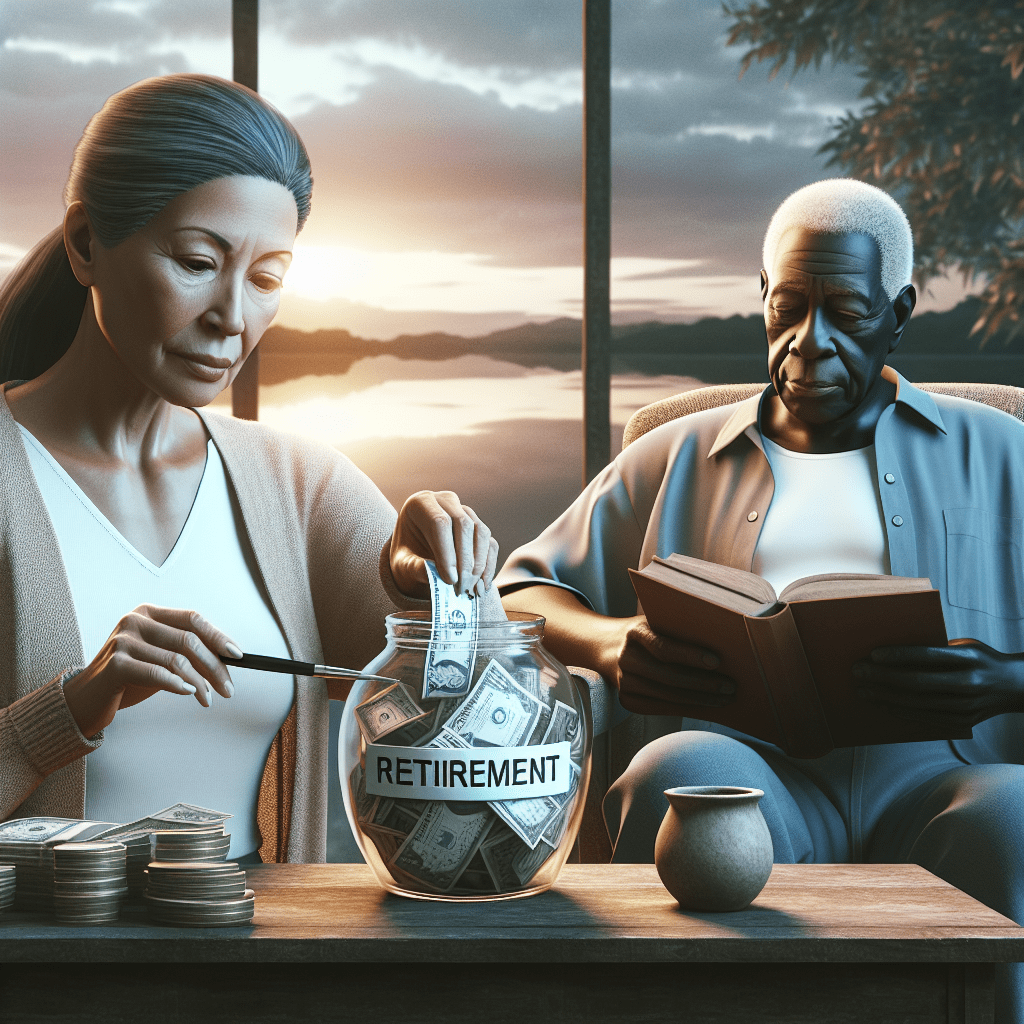

Practical Budgeting Tips: Securing Your Future Without Sacrificing Today

Creating a budget that allows for both a secure retirement and an enjoyable present requires a careful balance between saving for the future and making the most of today. Many individuals struggle with the idea of setting aside a significant portion of their income for retirement while still maintaining a fulfilling lifestyle. However, with strategic planning and disciplined financial habits, it is possible to achieve both goals without feeling deprived.

One of the most effective ways to begin is by assessing current financial habits and identifying areas where adjustments can be made. A detailed review of income, expenses, and savings can provide a clear picture of where money is being allocated. By categorizing expenses into necessities, discretionary spending, and savings, individuals can determine whether their current financial plan aligns with their long-term goals. This process often reveals opportunities to cut back on non-essential spending without significantly impacting quality of life.

Once a clear understanding of financial habits is established, setting realistic savings goals becomes the next crucial step. Experts often recommend saving at least 15% of income for retirement, but this percentage may vary depending on individual circumstances, such as age, current savings, and expected retirement lifestyle. To make saving more manageable, automating contributions to retirement accounts can be highly effective. By treating savings as a fixed expense, similar to rent or utilities, individuals can ensure that they consistently set aside funds for the future without having to make a conscious decision each month.

While prioritizing retirement savings is essential, it is equally important to allocate funds for present enjoyment. A well-balanced budget includes room for experiences and activities that bring happiness and fulfillment. Instead of eliminating discretionary spending entirely, individuals can focus on making intentional choices about where their money goes. For example, prioritizing experiences over material possessions or seeking cost-effective alternatives for entertainment can help maintain a satisfying lifestyle without compromising long-term financial security.

Another key aspect of budgeting for retirement while enjoying life today is managing debt wisely. High-interest debt, such as credit card balances, can significantly hinder financial progress and should be addressed as a priority. By developing a structured repayment plan and avoiding unnecessary borrowing, individuals can free up more resources for both savings and discretionary spending. Additionally, maintaining a strong credit score and minimizing debt obligations can provide greater financial flexibility in the future.

Investing wisely is also a fundamental component of a successful retirement plan. Simply saving money in a traditional savings account may not be sufficient to keep up with inflation and long-term financial needs. Exploring investment options such as employer-sponsored retirement plans, individual retirement accounts (IRAs), and diversified portfolios can help grow savings more effectively. Seeking professional financial advice can also be beneficial in making informed investment decisions that align with both short-term and long-term goals.

Ultimately, achieving financial security in retirement while enjoying life today requires a thoughtful and disciplined approach. By assessing financial habits, setting realistic savings goals, managing debt, and making intentional spending choices, individuals can create a budget that supports both present enjoyment and future stability. With careful planning and consistent effort, it is possible to strike a balance that allows for a fulfilling life now while ensuring a comfortable retirement later.

Investing Wisely: Growing Your Retirement Fund While Living Comfortably

Investing wisely is essential for growing your retirement fund while ensuring that you can still enjoy life today. Striking the right balance between saving for the future and maintaining a comfortable lifestyle requires careful planning, disciplined financial habits, and a well-thought-out investment strategy. By making informed decisions, you can build a secure retirement fund without sacrificing your present quality of life.

One of the most effective ways to grow your retirement savings is to start investing as early as possible. The power of compound interest allows your investments to grow exponentially over time, making it easier to accumulate wealth. Even if you begin later in life, consistently contributing to your retirement accounts can still yield significant results. Prioritizing tax-advantaged accounts, such as 401(k) plans or individual retirement accounts (IRAs), can help maximize your savings while reducing your taxable income. Additionally, taking advantage of employer-sponsored retirement plans, especially those that offer matching contributions, can provide an immediate boost to your savings.

Diversification is another key principle in building a strong retirement portfolio. Spreading your investments across different asset classes, such as stocks, bonds, and real estate, can help mitigate risk while ensuring steady growth. While stocks tend to offer higher returns over the long term, they also come with greater volatility. Bonds, on the other hand, provide stability and predictable income, making them a valuable component of a well-balanced portfolio. Real estate investments can also serve as a reliable source of passive income, further strengthening your financial position. By maintaining a diversified portfolio, you can protect your retirement savings from market fluctuations while still benefiting from potential growth opportunities.

At the same time, it is important to manage investment risks carefully. While higher-risk investments may offer greater returns, they can also lead to significant losses if not handled properly. As you approach retirement, gradually shifting towards more conservative investments can help preserve your wealth and ensure financial security. Regularly reviewing and adjusting your portfolio based on market conditions and personal financial goals can also help you stay on track. Consulting with a financial advisor can provide valuable insights and guidance, allowing you to make informed investment decisions that align with your long-term objectives.

While growing your retirement fund is crucial, it is equally important to maintain a comfortable lifestyle in the present. Creating a realistic budget that accounts for both savings and discretionary spending can help you achieve this balance. Allocating a portion of your income to essential expenses, such as housing, healthcare, and debt repayment, ensures financial stability. At the same time, setting aside funds for leisure activities, travel, and personal interests allows you to enjoy life without compromising your future security.

Finding ways to increase your income can also support both your retirement savings and current lifestyle. Exploring additional revenue streams, such as freelance work, rental income, or investments in dividend-paying stocks, can provide extra financial flexibility. Additionally, reducing unnecessary expenses and adopting smart spending habits can free up more funds for both savings and enjoyment.

Ultimately, investing wisely requires a strategic approach that balances long-term financial security with present-day comfort. By making informed investment choices, managing risks effectively, and maintaining a disciplined savings plan, you can grow your retirement fund while still enjoying life today.