“Master Your Money: A Simple Guide to Budgeting for Beginners!”

Budgeting Basics: How to Create Your First Budget and Stick to It

Creating a budget is an essential step toward achieving financial stability and ensuring that your income is allocated effectively. For beginners, the process may seem overwhelming, but with a structured approach, it becomes manageable and even empowering. The first step in creating a budget is understanding your financial situation by assessing your income and expenses. Begin by calculating your total monthly income, including your salary, freelance earnings, or any other sources of revenue. Having a clear picture of your earnings allows you to determine how much money you have available to allocate toward various financial obligations.

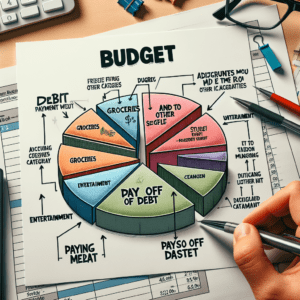

Once you have identified your income, the next step is to track your expenses. This involves categorizing your spending into fixed and variable expenses. Fixed expenses include rent or mortgage payments, utility bills, insurance premiums, and loan repayments—costs that remain consistent each month. Variable expenses, on the other hand, fluctuate and may include groceries, entertainment, dining out, and discretionary purchases. By reviewing past bank statements and receipts, you can gain insight into your spending habits and identify areas where adjustments may be necessary.

After tracking your expenses, it is important to establish financial goals. These goals can be short-term, such as saving for a vacation, or long-term, such as building an emergency fund or planning for retirement. Defining clear objectives helps guide your budgeting decisions and ensures that your money is being used purposefully. With your income, expenses, and goals in mind, you can now create a budget that aligns with your financial priorities.

A practical approach to budgeting is the 50/30/20 rule, which suggests allocating 50% of your income to necessities, 30% to discretionary spending, and 20% to savings and debt repayment. This method provides a balanced framework that allows for both financial responsibility and personal enjoyment. However, depending on individual circumstances, adjustments may be necessary to accommodate specific needs and obligations. The key is to create a budget that is realistic and sustainable.

Once your budget is established, the next challenge is sticking to it. One effective strategy is to use budgeting tools or apps that help track spending in real time. These tools provide insights into where your money is going and alert you if you exceed your allocated limits. Additionally, setting up automatic transfers to savings accounts ensures that you consistently contribute to your financial goals without the temptation to spend the money elsewhere.

Another important aspect of maintaining a budget is regularly reviewing and adjusting it as needed. Financial situations change over time due to factors such as salary increases, unexpected expenses, or lifestyle changes. Conducting monthly or quarterly budget reviews allows you to assess your progress and make necessary modifications to stay on track. If you find that certain categories consistently exceed their limits, consider reallocating funds or identifying areas where you can cut back.

Finally, practicing self-discipline and developing mindful spending habits are crucial for long-term success. Avoiding impulse purchases, distinguishing between needs and wants, and seeking cost-effective alternatives can help you stay within your budget. By maintaining a proactive approach and viewing budgeting as a tool for financial empowerment rather than restriction, you can achieve greater control over your money and work toward a more secure financial future.

Essential Budgeting Tools and Apps to Manage Your Finances Effectively

Managing personal finances effectively requires the right tools and resources to track income, expenses, and savings. With the advancement of technology, budgeting has become more accessible through various digital tools and applications designed to simplify financial management. These tools help individuals monitor their spending habits, set financial goals, and ensure they stay within their budget. By utilizing budgeting apps and other financial management tools, individuals can gain better control over their money and make informed financial decisions.

One of the most widely used budgeting tools is a spreadsheet, such as Microsoft Excel or Google Sheets. These platforms allow users to create customized budgets, track expenses, and analyze financial trends over time. Spreadsheets provide flexibility, enabling users to categorize expenses, calculate savings, and adjust their budget as needed. Additionally, many budgeting templates are available online, making it easier for beginners to start managing their finances without having to create a budget from scratch.

For those who prefer automated solutions, budgeting apps offer a convenient way to track finances in real time. Apps such as Mint, YNAB (You Need a Budget), and PocketGuard connect directly to bank accounts, credit cards, and other financial institutions to provide an up-to-date overview of an individual’s financial situation. These apps categorize transactions automatically, helping users understand where their money is going and identify areas where they can cut back on spending. Furthermore, many budgeting apps offer features such as bill reminders, goal-setting tools, and financial insights to help users stay on track with their financial plans.

Another essential tool for effective budgeting is a financial planning app that focuses on long-term financial goals. Apps like Personal Capital and EveryDollar provide users with a comprehensive view of their finances, including investments, retirement savings, and debt management. These tools help individuals plan for the future by offering insights into their net worth, cash flow, and potential investment opportunities. By integrating budgeting with financial planning, users can ensure they are not only managing their day-to-day expenses but also working towards long-term financial stability.

In addition to digital tools, some individuals may benefit from using traditional budgeting methods, such as the envelope system. This method involves allocating cash into different envelopes for specific spending categories, such as groceries, entertainment, and transportation. Once the cash in an envelope is spent, no additional money can be used for that category until the next budgeting period. While this approach may not be as convenient as digital tools, it can be highly effective for individuals who prefer a hands-on approach to managing their finances.

Regardless of the method chosen, consistency is key to successful budgeting. Regularly reviewing financial statements, tracking expenses, and adjusting the budget as needed can help individuals stay on top of their financial goals. By leveraging budgeting tools and apps, individuals can simplify the process of managing their money, reduce financial stress, and work towards a more secure financial future. With the right tools in place, budgeting becomes a manageable and rewarding habit that leads to greater financial confidence and stability.

Common Budgeting Mistakes Beginners Make and How to Avoid Them

Budgeting is an essential skill that allows individuals to manage their finances effectively, yet many beginners encounter common pitfalls that can hinder their progress. One of the most frequent mistakes is failing to track expenses accurately. Without a clear understanding of where money is being spent, it becomes difficult to create a realistic budget. Many people underestimate small, everyday purchases, which can add up over time and disrupt financial plans. To avoid this, it is crucial to record all expenses, whether through a budgeting app, a spreadsheet, or a simple notebook. By maintaining a detailed record, individuals can identify spending patterns and make necessary adjustments.

Another common mistake is setting unrealistic budget goals. While it is commendable to aim for aggressive savings or strict spending limits, an impractical budget can lead to frustration and eventual abandonment of the plan. Instead, it is important to set achievable goals that align with one’s income and lifestyle. A budget should be flexible enough to accommodate unexpected expenses while still ensuring financial stability. By gradually adjusting spending habits rather than making drastic changes, individuals are more likely to stick to their budget in the long run.

In addition to setting unrealistic goals, many beginners overlook the importance of an emergency fund. Unexpected expenses, such as medical bills or car repairs, can quickly derail a budget if there are no savings set aside. Without an emergency fund, individuals may be forced to rely on credit cards or loans, leading to debt accumulation. To prevent this, it is advisable to allocate a portion of income toward an emergency fund each month. Even a small contribution can provide financial security and prevent setbacks in budgeting efforts.

Another mistake that can undermine a budget is neglecting irregular expenses. While fixed costs such as rent and utilities are easy to account for, periodic expenses like annual insurance premiums, holiday gifts, or vehicle maintenance are often overlooked. When these costs arise unexpectedly, they can strain finances and lead to overspending. To address this issue, it is beneficial to anticipate irregular expenses and incorporate them into the budget. Setting aside a small amount each month for these costs can help ensure that they do not disrupt financial plans.

Furthermore, many beginners fail to differentiate between needs and wants. It is easy to justify discretionary spending, especially when purchases seem small or insignificant. However, consistently prioritizing non-essential expenses over necessities can lead to financial instability. To avoid this, it is helpful to categorize expenses and evaluate whether each purchase aligns with financial goals. By distinguishing between essential and non-essential spending, individuals can make more informed decisions and allocate resources more effectively.

Lastly, a common mistake is not reviewing and adjusting the budget regularly. Financial situations change over time, and a budget that worked initially may no longer be suitable. Whether due to a salary increase, a change in expenses, or new financial goals, it is important to reassess the budget periodically. Regular reviews allow individuals to identify areas for improvement and make necessary modifications to stay on track. By maintaining a proactive approach, budgeting becomes a dynamic tool that supports financial well-being rather than a rigid constraint.