“Discover the Path to Financial Freedom: A Step-by-Step Guide to Debt Relief.”

Understanding Debt Relief: Key Concepts and Benefits

Debt relief is a financial strategy designed to help individuals and businesses manage overwhelming debt by reducing, restructuring, or eliminating their financial obligations. It encompasses various methods, including debt settlement, consolidation, and bankruptcy, each tailored to different financial situations. Understanding how debt relief works requires a clear grasp of its key concepts and the potential benefits it offers to those struggling with unmanageable debt.

At its core, debt relief aims to provide a structured approach to reducing financial burdens, allowing individuals to regain control over their finances. One of the most common methods is debt settlement, which involves negotiating with creditors to reduce the total amount owed. This process typically requires working with a debt relief company or a financial advisor who communicates with creditors on behalf of the debtor. If successful, the debtor pays a reduced lump sum or structured payments, effectively resolving the debt for less than the original balance. While this approach can significantly lower the total debt, it may also impact credit scores and require careful financial planning.

Another widely used method is debt consolidation, which simplifies multiple debts by combining them into a single loan with a lower interest rate. This approach is particularly beneficial for individuals managing multiple high-interest debts, such as credit card balances. By consolidating these debts into one manageable payment, borrowers can reduce their monthly financial obligations and potentially save money on interest over time. However, qualifying for a consolidation loan often requires a good credit score, and failure to make timely payments can lead to further financial difficulties.

For those facing extreme financial hardship, bankruptcy may be a last resort. This legal process allows individuals or businesses to discharge or restructure their debts under the supervision of a court. Chapter 7 bankruptcy, for instance, involves liquidating assets to pay off creditors, while Chapter 13 allows debtors to create a repayment plan over several years. Although bankruptcy can provide a fresh financial start, it also has long-term consequences, including a significant impact on credit scores and potential difficulties in obtaining future loans.

Beyond these specific methods, debt relief offers several key benefits that can help individuals regain financial stability. One of the most immediate advantages is the reduction of financial stress. Overwhelming debt can lead to anxiety and emotional strain, affecting overall well-being. By pursuing debt relief, individuals can create a structured plan to manage their obligations, providing a sense of control and relief. Additionally, successful debt relief strategies can lead to lower interest rates, reduced monthly payments, and, in some cases, complete debt elimination. These benefits not only improve financial health but also create opportunities for long-term financial planning and stability.

However, it is essential to approach debt relief with caution and awareness of potential risks. Some debt relief programs may involve fees, and not all creditors are willing to negotiate settlements. Furthermore, certain methods, such as debt settlement and bankruptcy, can have lasting effects on creditworthiness. Therefore, individuals considering debt relief should thoroughly research their options, seek professional financial advice, and carefully evaluate the long-term implications of their chosen strategy.

Ultimately, debt relief serves as a valuable tool for those struggling with financial burdens, offering a pathway toward financial recovery. By understanding the key concepts and benefits associated with different debt relief methods, individuals can make informed decisions that align with their financial goals. Whether through settlement, consolidation, or legal restructuring, the right approach can provide much-needed relief and pave the way for a more stable financial future.

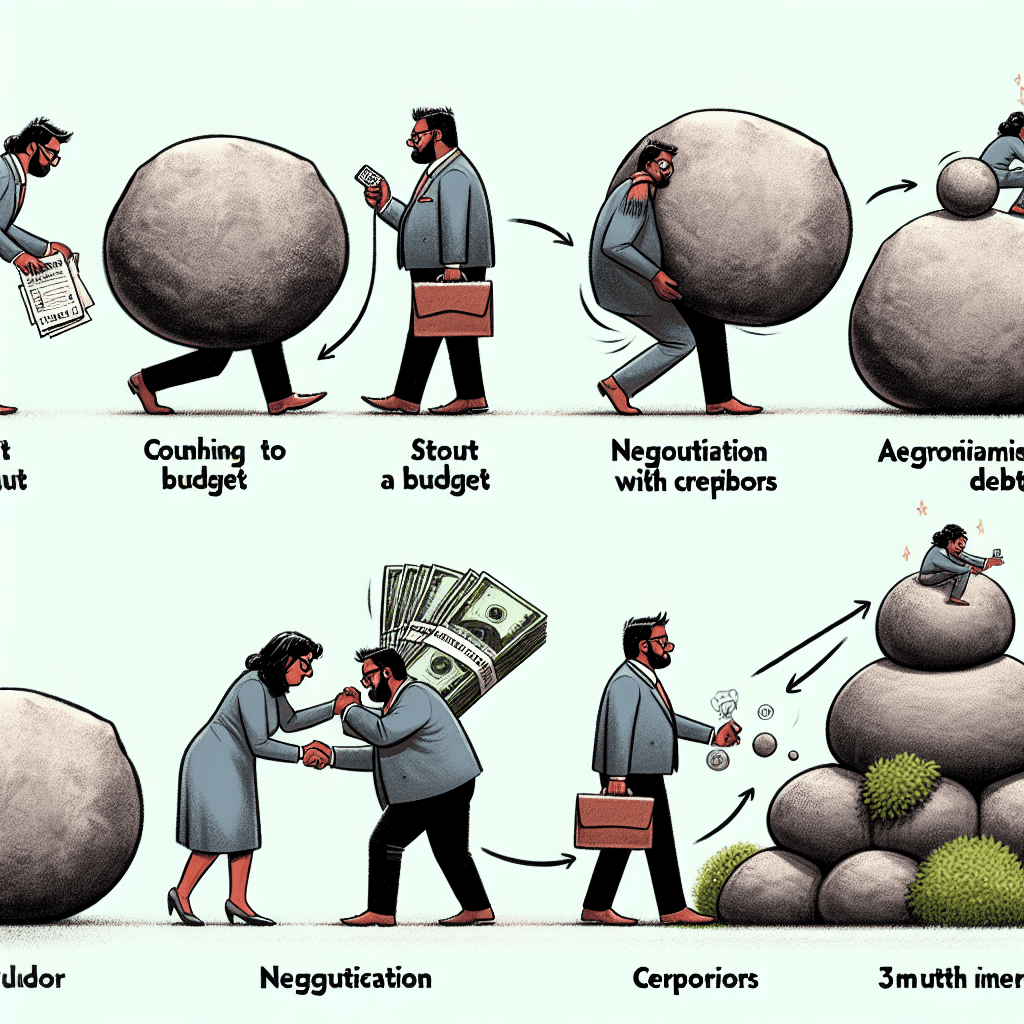

Step-by-Step Process of Debt Relief Programs

Debt relief programs provide individuals struggling with overwhelming financial obligations a structured way to regain control of their finances. The process typically begins with an assessment of the debtor’s financial situation. This initial step involves reviewing income, expenses, and outstanding debts to determine the severity of the financial hardship. Many individuals seek assistance from credit counseling agencies or debt relief companies at this stage to gain professional insight into their options. These organizations analyze the debtor’s financial standing and recommend the most suitable course of action, whether it be debt settlement, consolidation, or another relief strategy.

Once the financial assessment is complete, the next step involves selecting the appropriate debt relief program. Debt consolidation, for instance, allows individuals to combine multiple debts into a single loan with a lower interest rate, making repayment more manageable. Alternatively, debt settlement programs negotiate with creditors to reduce the total amount owed, often resulting in a lump-sum payment or structured settlement plan. In some cases, individuals may opt for credit counseling, which provides financial education and structured repayment plans without reducing the principal balance. The choice of program depends on factors such as the total debt amount, income stability, and the debtor’s ability to make consistent payments.

After selecting a debt relief strategy, the implementation phase begins. For those enrolled in a debt settlement program, this typically involves ceasing direct payments to creditors and instead making deposits into a dedicated account managed by the debt relief company. Over time, as funds accumulate, negotiators work with creditors to reach agreements that reduce the overall debt burden. This process can take several months or even years, depending on the amount owed and the willingness of creditors to negotiate. Meanwhile, individuals pursuing debt consolidation apply for a new loan to pay off existing debts, effectively streamlining multiple payments into one. Those engaged in credit counseling follow a structured repayment plan, often with reduced interest rates, to gradually eliminate their debt.

Throughout the process, communication with creditors plays a crucial role. Debt relief companies or credit counselors act as intermediaries, negotiating terms that benefit both the debtor and the creditor. In many cases, creditors agree to lower interest rates, waive fees, or accept reduced payments to recover at least a portion of the outstanding balance. However, it is important for individuals to remain informed about the progress of their program and ensure that all agreements are documented in writing. Transparency and accountability help prevent misunderstandings and ensure that the debt relief process proceeds smoothly.

As the program nears completion, individuals begin to see the benefits of their efforts. Whether through reduced balances, lower monthly payments, or complete debt resolution, the financial burden gradually diminishes. Once all negotiated payments are made or the consolidated loan is repaid, the individual officially exits the debt relief program. At this stage, it is essential to focus on rebuilding financial stability by practicing responsible money management, maintaining a budget, and avoiding excessive debt accumulation in the future. By following these steps, individuals can achieve long-term financial freedom and prevent future financial hardships.

Choosing the Right Debt Relief Option for Your Financial Situation

Choosing the right debt relief option for your financial situation requires careful consideration of your current financial standing, the types of debt you owe, and your long-term financial goals. With multiple debt relief strategies available, understanding how each option works and assessing its potential impact on your credit and financial future is essential. The right choice depends on factors such as the total amount of debt, your ability to make payments, and whether you are facing financial hardship.

One of the most common debt relief options is debt consolidation, which involves combining multiple debts into a single loan with a lower interest rate. This approach simplifies repayment by reducing the number of monthly payments and can potentially lower overall costs. Debt consolidation is particularly beneficial for individuals with high-interest credit card debt, as it allows them to pay off balances more efficiently. However, qualifying for a consolidation loan often requires a good credit score, and failure to make timely payments can result in further financial strain.

Another option to consider is debt settlement, which involves negotiating with creditors to reduce the total amount owed. This process typically requires working with a debt settlement company that communicates with creditors on behalf of the debtor. While this method can significantly lower outstanding balances, it also comes with risks, including potential damage to credit scores and tax implications on forgiven debt. Additionally, creditors are not obligated to accept settlement offers, and the process may take several months or even years to complete.

For individuals experiencing severe financial hardship, bankruptcy may be a last resort. There are two primary types of personal bankruptcy: Chapter 7 and Chapter 13. Chapter 7 bankruptcy involves liquidating non-exempt assets to pay off creditors, while Chapter 13 allows individuals to restructure their debt into a manageable repayment plan. Although bankruptcy can provide a fresh financial start, it has long-term consequences, including a significant impact on credit scores and the potential loss of assets. Therefore, it is crucial to consult with a financial advisor or bankruptcy attorney before pursuing this option.

Credit counseling is another alternative that can help individuals manage their debt more effectively. Nonprofit credit counseling agencies offer financial education, budgeting assistance, and debt management plans (DMPs). A DMP allows individuals to make a single monthly payment to the agency, which then distributes the funds to creditors. This approach can help reduce interest rates and eliminate late fees, making it easier to pay off debt over time. However, enrolling in a DMP may require closing credit card accounts, which can temporarily affect credit scores.

When selecting a debt relief option, it is important to evaluate the potential benefits and drawbacks of each approach. Factors such as the impact on credit, the total cost of repayment, and the time required to become debt-free should all be taken into account. Additionally, seeking professional financial advice can provide valuable insights and help determine the most suitable course of action. By carefully assessing available options and making informed decisions, individuals can take meaningful steps toward regaining financial stability and achieving long-term financial health.