“Boost Your Credit Score with a Loan – Here’s How It Works!”

How Taking a Loan Can Boost Your Credit Score

Taking out a loan can be a strategic way to improve your credit score when managed responsibly. While borrowing money may seem counterintuitive to building good credit, the way you handle the loan can have a significant impact on your overall creditworthiness. Understanding how loans influence your credit score and implementing responsible repayment habits can help you strengthen your financial profile over time.

One of the primary ways a loan can improve your credit score is by contributing to your payment history, which is the most influential factor in credit scoring models. Lenders report your monthly payments to credit bureaus, and consistently making on-time payments demonstrates financial responsibility. Each timely payment adds positive data to your credit report, reinforcing your ability to manage debt effectively. Over time, this pattern of responsible repayment can lead to an increase in your credit score, making you a more attractive borrower to future lenders.

In addition to payment history, taking out a loan can also help diversify your credit mix, which accounts for a portion of your credit score. Credit scoring models favor individuals who can successfully manage different types of credit, such as revolving credit (credit cards) and installment credit (loans). If your credit history primarily consists of credit card accounts, adding an installment loan—such as a personal loan, auto loan, or student loan—can demonstrate your ability to handle multiple forms of credit. This diversification can have a positive effect on your credit score, as long as you continue to make payments on time.

Another way a loan can benefit your credit score is by helping to establish or extend your credit history. The length of your credit history plays a role in determining your score, with longer credit histories generally being more favorable. If you are new to credit or have a limited credit history, taking out a loan and managing it responsibly can help build a track record of financial reliability. Even if you already have an established credit history, adding a new loan and maintaining a positive payment record can further strengthen your credit profile.

Furthermore, a loan can assist in improving your credit utilization ratio, which is the amount of credit you are using compared to your total available credit. While this factor primarily applies to revolving credit accounts, such as credit cards, using a loan to consolidate high-interest credit card debt can indirectly improve your credit utilization. By paying off credit card balances with a personal loan, you reduce the percentage of available credit being used, which can lead to a higher credit score. However, it is important to avoid accumulating new credit card debt after consolidation to maintain the benefits of a lower utilization ratio.

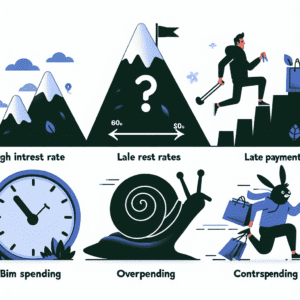

Despite these potential advantages, it is crucial to approach borrowing with caution. Taking out a loan solely to improve your credit score is not advisable if you do not have a clear repayment plan. Missing payments or defaulting on a loan can have the opposite effect, significantly damaging your credit score and making it more difficult to obtain credit in the future. Therefore, before applying for a loan, it is essential to assess your financial situation and ensure that you can comfortably manage the monthly payments.

In conclusion, when used responsibly, a loan can be a valuable tool for improving your credit score. By making timely payments, diversifying your credit mix, extending your credit history, and managing your credit utilization effectively, you can strengthen your financial standing. However, responsible borrowing is key, as mismanaging a loan can lead to negative consequences. By understanding how loans impact your credit and maintaining disciplined repayment habits, you can use borrowing as a strategic step toward building a stronger credit profile.

The Role of Timely Loan Payments in Credit Score Improvement

A loan can be a powerful tool for improving your credit score, provided it is managed responsibly. One of the most significant factors influencing your credit score is your payment history, which accounts for a substantial portion of most credit scoring models. Making timely loan payments demonstrates financial responsibility and reliability, both of which contribute positively to your credit profile. When lenders assess your creditworthiness, they look for consistent, on-time payments as an indicator that you are capable of managing debt effectively. Consequently, ensuring that you meet your loan obligations on schedule can gradually enhance your credit score over time.

When you take out a loan, whether it is a personal loan, auto loan, or mortgage, the lender reports your payment activity to the credit bureaus. Each on-time payment is recorded and reflected in your credit report, reinforcing a positive payment history. Over time, a pattern of punctual payments signals to future lenders that you are a low-risk borrower. This can lead to better borrowing opportunities, such as lower interest rates and higher credit limits. Conversely, missing payments or making late payments can have the opposite effect, potentially lowering your credit score and making it more difficult to secure favorable loan terms in the future.

In addition to payment history, the length of your credit history also plays a role in determining your credit score. By consistently making timely payments over an extended period, you establish a track record of responsible credit management. This is particularly beneficial for individuals who are new to credit or those looking to rebuild their credit after past financial difficulties. A well-maintained loan account can contribute to a longer and more positive credit history, which in turn strengthens your overall credit profile.

Another way timely loan payments can improve your credit score is by contributing to a healthy credit mix. Credit scoring models consider the types of credit accounts you have, including revolving credit, such as credit cards, and installment credit, such as loans. Having a diverse mix of credit accounts can be advantageous, as it demonstrates your ability to manage different types of debt responsibly. A well-managed loan account, combined with other forms of credit, can enhance your creditworthiness and contribute to a higher credit score.

Furthermore, making timely loan payments can help reduce your overall credit utilization ratio, which is another important factor in credit scoring. While credit utilization primarily applies to revolving credit accounts, maintaining a good payment record on installment loans can indirectly support a lower utilization rate by improving your overall credit standing. As your credit score improves, you may also become eligible for better financial products, such as credit cards with higher limits or loans with more favorable terms.

Ultimately, the key to using a loan to improve your credit score lies in consistent and timely payments. By ensuring that you meet your loan obligations each month, you build a strong payment history, establish a positive credit record, and enhance your overall financial stability. Over time, these responsible financial habits can lead to a higher credit score, opening the door to better borrowing opportunities and greater financial flexibility.

Types of Loans That Can Positively Impact Your Credit Score

When used responsibly, certain types of loans can contribute to building and improving your credit score. Since your credit score is a reflection of your borrowing history and financial responsibility, taking out a loan and managing it well can demonstrate your ability to handle debt effectively. However, not all loans have the same impact, and understanding which types can positively influence your credit score is essential.

One of the most common types of loans that can help improve your credit score is an installment loan. These loans require fixed monthly payments over a set period, making them a reliable way to establish a consistent payment history. Personal loans, for example, can be beneficial when used wisely. By making on-time payments each month, you demonstrate financial responsibility, which is a key factor in determining your credit score. Additionally, personal loans can help diversify your credit mix, which accounts for a portion of your credit score calculation. Lenders and credit bureaus view a mix of credit types—such as credit cards and installment loans—favorably, as it indicates your ability to manage different forms of debt.

Another type of loan that can positively impact your credit score is an auto loan. Like personal loans, auto loans are installment loans that require regular payments. Successfully managing an auto loan by making timely payments can strengthen your credit history and improve your score over time. However, it is important to borrow within your means to ensure that you can meet your monthly obligations without financial strain.

Similarly, student loans can play a role in building credit, particularly for young borrowers who may not have an extensive credit history. Since student loans often have long repayment terms, they provide an opportunity to establish a lengthy credit history, which is another factor that influences your credit score. Consistently making payments on time can demonstrate reliability to future lenders, making it easier to qualify for other types of credit in the future.

A mortgage is another significant loan that can contribute to a strong credit profile. As one of the largest financial commitments a person can make, a mortgage loan requires consistent, long-term payments. Successfully managing a mortgage not only helps build a positive payment history but also contributes to the length of your credit history, both of which are crucial components of your credit score. However, missing mortgage payments can have serious consequences, so it is essential to ensure that you can afford the loan before committing to it.

In addition to traditional loans, credit-builder loans are specifically designed to help individuals establish or improve their credit scores. These loans work differently from standard loans, as the borrowed funds are held in a secured account while the borrower makes payments. Once the loan is fully repaid, the borrower gains access to the funds. Since payment history is the most significant factor in credit scoring, successfully repaying a credit-builder loan can have a positive impact on your score.

Ultimately, taking out a loan can be a strategic way to improve your credit score, provided that it is managed responsibly. By making timely payments, maintaining a diverse credit mix, and borrowing within your means, you can use loans to strengthen your credit profile and enhance your financial stability.