Unexpected medical expenses can be overwhelming, especially when they start piling up. Whether it’s an emergency procedure, ongoing treatments, or an unexpected hospital stay, healthcare costs can quickly become a financial burden. If you’re struggling to pay off medical bills, a personal loan might be a viable solution to help you manage expenses and regain financial stability.

Understanding the Burden of Medical Debt

Medical debt is a growing concern for many individuals and families. According to a KFF report, around 41% of U.S. adults have some form of medical debt. The high cost of healthcare, combined with unexpected emergencies, can leave many struggling to make ends meet.

Common reasons for accumulating medical debt include:

- Emergency room visits

- Surgeries and hospital stays

- Chronic illness treatments

- Prescription medications

- Diagnostic tests and imaging

How a Personal Loan Can Help Cover Medical Expenses

A personal loan can provide the financial relief needed to cover medical bills without resorting to high-interest credit cards or depleting savings. Here’s how a personal loan can help:

1. Consolidating Medical Debt

If you have multiple medical bills from different providers, a personal loan can help consolidate them into a single, manageable payment. This simplifies your finances and may reduce the overall interest rate compared to credit cards or payment plans.

2. Lower Interest Rates Compared to Credit Cards

Many people turn to credit cards to pay off medical expenses, but the high interest rates can make repayment difficult. Personal loans often come with lower interest rates, making them a more affordable option.

3. Flexible Repayment Terms

Personal loans offer flexible repayment terms, typically ranging from 12 to 60 months. This allows you to choose a repayment plan that fits your budget and financial situation.

4. Quick Access to Funds

Medical emergencies require immediate financial solutions. Many lenders offer fast approval and funding, sometimes within 24 to 48 hours, ensuring you can cover urgent medical expenses without delay.

Things to Consider Before Taking a Personal Loan for Medical Bills

While a personal loan can be a helpful tool, it’s important to consider the following factors before applying:

- Interest Rates: Compare different lenders to find the best interest rate and terms.

- Loan Amount: Borrow only what you need to avoid unnecessary debt.

- Repayment Terms: Choose a repayment plan that aligns with your financial situation.

- Credit Score Impact: A personal loan can affect your credit score, so ensure you can make timely payments.

- Alternative Options: Check if your healthcare provider offers payment plans or financial assistance programs before opting for a loan.

How to Apply for a Personal Loan for Medical Expenses

Applying for a personal loan is a straightforward process. Follow these steps to secure the best loan for your needs:

1. Check Your Credit Score

Your credit score plays a significant role in determining loan approval and interest rates. A higher score can help you secure better terms.

2. Compare Lenders

Research different lenders, including banks, credit unions, and online lenders, to find the best rates and terms.

3. Gather Necessary Documents

Most lenders require proof of income, employment verification, and identification documents when applying for a loan.

4. Apply for the Loan

Submit your application online or in person. Some lenders offer pre-qualification, allowing you to check potential loan terms without affecting your credit score.

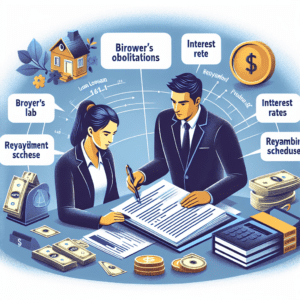

5. Review Loan Terms and Accept the Offer

Carefully review the loan agreement, including interest rates, repayment terms, and fees, before accepting the offer.

Alternatives to Personal Loans for Medical Bills

Before committing to a personal loan, consider these alternative options:

- Medical Payment Plans: Many hospitals and healthcare providers offer interest-free payment plans.

- Health Savings Accounts (HSA) or Flexible Spending Accounts (FSA): If you have an HSA or FSA, you can use these funds to cover medical expenses.

- Medical Credit Cards: Some credit cards are specifically designed for healthcare expenses and offer promotional 0% interest periods.

- Charity and Assistance Programs: Nonprofits and government programs may provide financial assistance for medical bills.

Final Thoughts

Medical bills can be stressful, but a personal loan can provide the financial support needed to manage expenses effectively. By understanding your options, comparing lenders, and choosing a repayment plan that fits your budget, you can take control of your medical debt and focus on your health.

Before taking out a loan, explore alternative solutions and ensure that borrowing is the best choice for your financial situation. If used wisely, a personal loan can be a valuable tool in overcoming medical debt and achieving financial peace of mind.