“Payday Loans: Quick Cash Relief or Costly Debt Trap?”

Understanding Payday Loans: How They Work and What to Watch Out For

Payday loans are short-term, high-interest loans designed to provide quick cash to borrowers who need immediate financial assistance. Typically, these loans are due on the borrower’s next payday, hence the name. They are often marketed as a convenient solution for individuals facing unexpected expenses, such as medical bills, car repairs, or other urgent financial obligations. However, while payday loans may seem like an easy way to access fast cash, they come with significant risks that borrowers should carefully consider before taking one out.

To obtain a payday loan, borrowers usually need to provide proof of income, a valid identification, and a bank account. Unlike traditional loans, payday lenders do not require a credit check, making these loans accessible to individuals with poor or no credit history. The application process is typically quick, with many lenders offering same-day approval and funding. Borrowers are required to write a postdated check or authorize an automatic withdrawal from their bank account for the loan amount plus fees, which the lender will collect on the due date.

One of the most concerning aspects of payday loans is their high cost. Lenders charge substantial fees, which can translate into an annual percentage rate (APR) of 300% or more. For example, a borrower who takes out a 0 loan may be required to pay a fee for a two-week loan term. While this may not seem excessive at first glance, if the borrower is unable to repay the loan on time and rolls it over into a new loan, additional fees accumulate, leading to a cycle of debt that can be difficult to escape.

Another issue to consider is the short repayment period. Unlike traditional loans that allow borrowers to make monthly payments over an extended period, payday loans must be repaid in full within a few weeks. This can create financial strain, especially for individuals who are already struggling to make ends meet. If a borrower cannot repay the loan on time, they may be forced to take out another payday loan to cover the original debt, leading to a cycle of borrowing that can quickly spiral out of control.

Furthermore, payday lenders often operate with minimal regulation, which can result in predatory lending practices. Some lenders may not fully disclose the terms and conditions of the loan, leaving borrowers unaware of the true cost of borrowing. Additionally, aggressive collection tactics, such as repeated withdrawal attempts from a borrower’s bank account, can lead to overdraft fees and further financial hardship.

Given these risks, it is essential for borrowers to explore alternative options before resorting to a payday loan. Some alternatives include borrowing from friends or family, negotiating payment plans with creditors, or seeking assistance from nonprofit financial counseling services. Additionally, some credit unions and community banks offer small-dollar loans with more reasonable terms and lower interest rates.

While payday loans may provide a temporary financial solution, they often create more problems than they solve. The high costs, short repayment periods, and potential for debt cycles make them a risky option for borrowers. Before taking out a payday loan, individuals should carefully assess their financial situation and consider alternative solutions that may offer more sustainable relief.

The Risks of Payday Loans: Hidden Fees, High Interest, and Debt Traps

Payday loans are often marketed as a quick and easy solution for individuals facing short-term financial difficulties. However, while they may provide immediate relief, they also come with significant risks that can lead to long-term financial hardship. One of the most concerning aspects of payday loans is the high interest rates that lenders charge. Unlike traditional loans, which typically have annual percentage rates (APRs) in the single or low double digits, payday loans often carry APRs that can exceed 300% or even 400%. This means that borrowers who are unable to repay the loan in full by the due date may find themselves owing far more than they initially borrowed.

In addition to exorbitant interest rates, payday loans often come with hidden fees that can further increase the cost of borrowing. Many lenders charge origination fees, rollover fees, or late payment penalties that may not be immediately apparent to borrowers. These fees can quickly add up, making it even more difficult for individuals to repay their loans on time. As a result, many borrowers find themselves trapped in a cycle of debt, where they must take out new payday loans to cover the costs of previous ones. This cycle can be difficult to break, as each new loan comes with additional fees and interest charges that make repayment even more challenging.

Another major risk associated with payday loans is the potential for lenders to engage in predatory lending practices. Some payday lenders target individuals with low incomes or poor credit histories, knowing that they are more likely to struggle with repayment. In some cases, lenders may even encourage borrowers to roll over their loans multiple times, increasing their overall debt burden. Additionally, payday lenders often require borrowers to provide access to their bank accounts as a condition of the loan. This can lead to unauthorized withdrawals, overdraft fees, and further financial instability if the borrower does not have sufficient funds to cover the repayment.

For many borrowers, the short repayment period of payday loans also presents a significant challenge. Unlike traditional loans, which may offer repayment terms of several months or years, payday loans typically require full repayment within two weeks or by the borrower’s next paycheck. This short timeframe can make it difficult for individuals to gather the necessary funds, especially if they are already struggling with other financial obligations. When borrowers are unable to repay their loans on time, they may be forced to take out additional loans or incur costly penalties, further exacerbating their financial difficulties.

Given these risks, it is important for individuals to carefully consider their options before taking out a payday loan. In many cases, alternative solutions such as personal loans from banks or credit unions, negotiating payment plans with creditors, or seeking assistance from nonprofit financial counseling services may provide a more sustainable path to financial stability. While payday loans may seem like a convenient option in times of financial distress, the long-term consequences can be severe. By understanding the risks associated with these loans, borrowers can make more informed decisions and avoid falling into a cycle of debt that can be difficult to escape.

Are Payday Loans Worth It? Exploring Alternatives for Quick Cash

Payday loans are often marketed as a quick and convenient solution for individuals facing short-term financial difficulties. These loans provide fast access to cash, typically requiring minimal documentation and no credit check. However, their high interest rates and short repayment periods make them a costly option that can lead to a cycle of debt. While they may seem like an easy fix for urgent financial needs, it is essential to consider whether they are truly worth the risk and to explore alternative options that may offer more sustainable financial relief.

One of the primary concerns with payday loans is their high cost. Lenders often charge exorbitant fees, which can translate into an annual percentage rate (APR) of several hundred percent. Borrowers who are unable to repay the loan in full by the due date may be forced to roll it over, incurring additional fees and interest. This cycle can quickly escalate, making it difficult for individuals to break free from debt. As a result, what initially seemed like a short-term solution can turn into a long-term financial burden.

Moreover, payday loans do not typically help borrowers build credit. Unlike traditional loans or credit cards, payday lenders do not report timely payments to credit bureaus. This means that even if a borrower repays the loan on time, it does not contribute to improving their credit score. On the other hand, failure to repay the loan can lead to collection efforts, which may negatively impact credit standing. Given these risks, it is crucial to consider whether the short-term relief provided by a payday loan outweighs the potential long-term consequences.

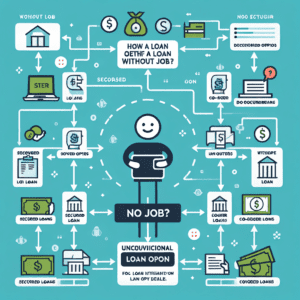

Fortunately, there are several alternatives to payday loans that may provide a more manageable way to address financial emergencies. One option is borrowing from friends or family, which can offer a more flexible repayment arrangement without the high interest rates associated with payday loans. While this approach requires open communication and trust, it can be a viable solution for those in need of immediate financial assistance.

Another alternative is seeking a small loan from a credit union or community bank. These institutions often offer lower interest rates and more favorable repayment terms than payday lenders. Additionally, some credit unions provide payday alternative loans (PALs), which are designed to help individuals avoid the high costs of traditional payday loans. These loans typically have lower fees and longer repayment periods, making them a more sustainable option for borrowers.

For those who need quick access to cash, negotiating payment plans with creditors or utility providers may also be a viable solution. Many companies are willing to work with customers facing financial difficulties, offering extended payment deadlines or installment plans. This approach can help individuals manage their expenses without resorting to high-cost borrowing.

Additionally, exploring employer-based financial assistance programs or paycheck advances may provide another alternative. Some employers offer short-term loans or early access to earned wages, allowing employees to cover unexpected expenses without taking on high-interest debt. These programs can be a more affordable way to bridge financial gaps while avoiding the risks associated with payday loans.

Ultimately, while payday loans may offer immediate financial relief, their high costs and potential for long-term debt make them a risky option. Exploring alternative solutions can help individuals address financial challenges in a more sustainable and responsible manner, reducing the likelihood of falling into a cycle of debt.