“Uncover the Hidden Costs of Homeownership Before They Drain Your Wallet!”

Unexpected Maintenance And Repair Expenses

Owning a home is often seen as a significant financial milestone, offering stability, equity growth, and a sense of personal accomplishment. However, many homeowners underestimate the true cost of maintaining their property, particularly when it comes to unexpected maintenance and repair expenses. While mortgage payments, property taxes, and insurance premiums are typically factored into a homeowner’s budget, unforeseen repairs can quickly strain finances if not properly anticipated. These unexpected costs can arise from a variety of sources, ranging from structural issues to essential system failures, making it crucial for homeowners to be prepared for the financial burden they may impose.

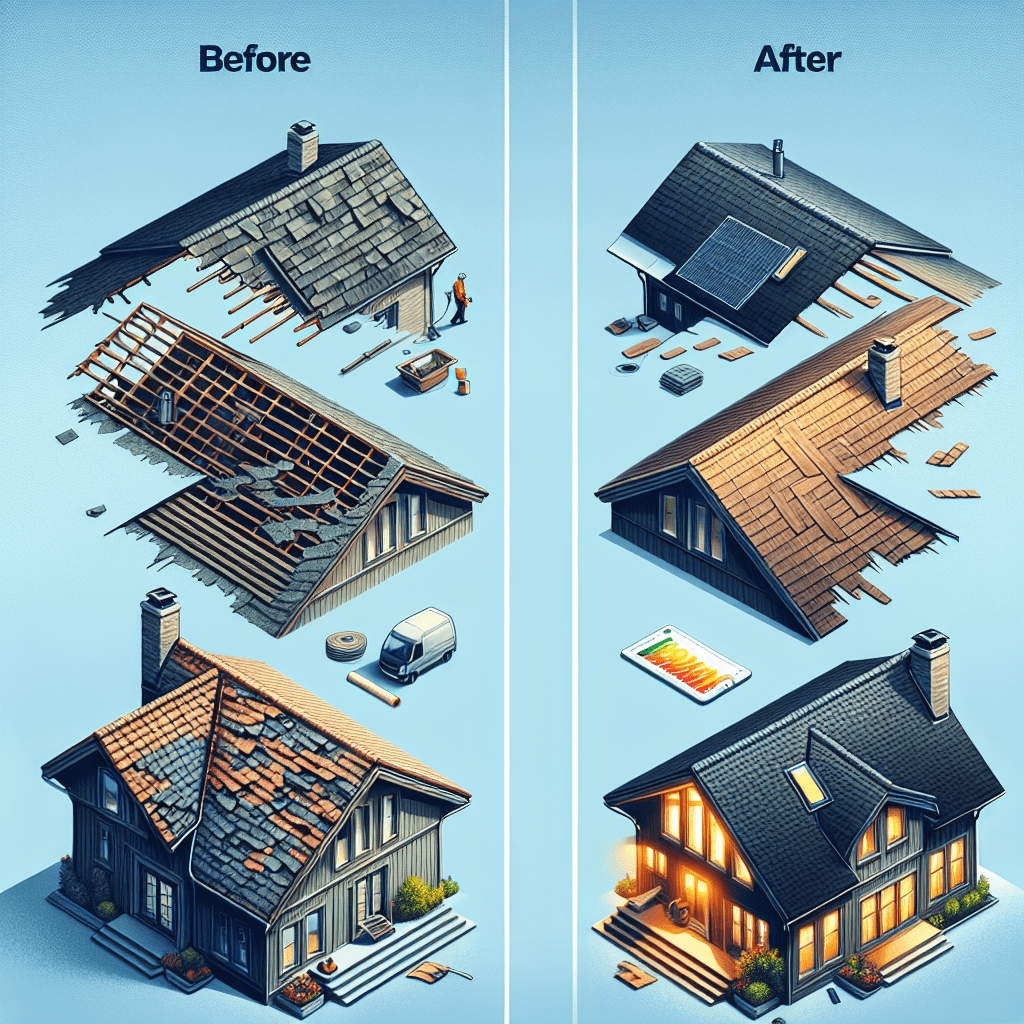

One of the most common and costly repairs involves the home’s roof. Over time, exposure to harsh weather conditions, such as heavy rain, snow, and strong winds, can cause significant wear and tear. While regular maintenance can extend the lifespan of a roof, sudden leaks or structural damage may require immediate attention. Depending on the severity of the issue, repairs can cost thousands of dollars, and a full roof replacement can be an even greater financial burden. Because roofing problems can escalate quickly, homeowners must be proactive in setting aside funds for potential repairs.

Similarly, plumbing issues can arise without warning and lead to extensive damage if not addressed promptly. A burst pipe, for example, can cause water damage to walls, flooring, and personal belongings, resulting in costly repairs and replacements. Additionally, problems such as clogged drains, leaking faucets, or failing water heaters can disrupt daily life and require professional intervention. While some minor plumbing issues can be resolved with basic tools and knowledge, more severe problems often necessitate the expertise of a licensed plumber, further increasing the financial impact.

Another major concern for homeowners is the heating, ventilation, and air conditioning (HVAC) system. These systems are essential for maintaining a comfortable living environment, yet they are also prone to unexpected failures. A malfunctioning furnace in the middle of winter or a broken air conditioning unit during a heatwave can create not only discomfort but also an urgent need for costly repairs or replacements. Regular maintenance, such as changing filters and scheduling professional inspections, can help extend the lifespan of an HVAC system, but even with proper care, unexpected breakdowns can still occur.

In addition to these major systems, homeowners must also consider the potential for electrical issues. Faulty wiring, outdated electrical panels, or overloaded circuits can pose serious safety hazards, including the risk of fire. Addressing electrical problems often requires the expertise of a licensed electrician, and depending on the complexity of the issue, costs can quickly add up. Furthermore, older homes may require complete rewiring to meet modern safety standards, an expense that can be both unexpected and substantial.

Beyond these critical repairs, general wear and tear on a home’s interior and exterior can also lead to unplanned expenses. Flooring may need to be replaced due to damage or aging, siding may deteriorate over time, and foundation issues can develop, all of which require financial resources to address. While some of these repairs can be postponed, neglecting them for too long can lead to more severe and costly consequences.

Given the unpredictability of home maintenance and repair expenses, homeowners should establish a dedicated emergency fund to cover these costs. Experts recommend setting aside at least one to three percent of a home’s value annually for maintenance and repairs. By planning ahead and budgeting for these inevitable expenses, homeowners can avoid financial strain and ensure their property remains in good condition for years to come.

Property Taxes And Homeowner Association Fees

When purchasing a home, many buyers focus primarily on the mortgage payment, insurance, and utility costs. However, two significant expenses that can strain a homeowner’s budget are property taxes and homeowner association (HOA) fees. These costs, often overlooked during the home-buying process, can fluctuate over time and significantly impact long-term affordability. Understanding how these expenses work and how they can change is essential for financial planning and avoiding unexpected financial burdens.

Property taxes are a mandatory expense for homeowners, assessed by local governments to fund public services such as schools, infrastructure, and emergency services. The amount a homeowner pays is based on the assessed value of the property and the local tax rate, which can vary widely depending on the location. While property taxes may seem manageable at the time of purchase, they are subject to periodic reassessments, which can lead to higher payments over time. If property values in a neighborhood rise, local governments may increase assessments, resulting in higher tax bills. Additionally, municipalities can raise tax rates to cover budget shortfalls, further increasing the financial burden on homeowners. These fluctuations can be particularly challenging for those on fixed incomes, as rising property taxes may outpace income growth.

In addition to property taxes, many homeowners must also contend with HOA fees, which are mandatory payments required by homeowners’ associations in certain communities. These fees are used to maintain common areas, provide amenities, and enforce community rules. While HOA fees can enhance the quality of life by ensuring well-maintained neighborhoods and shared facilities, they can also be a significant financial obligation. The cost of these fees varies depending on the community, the amenities provided, and the level of maintenance required. Some associations charge modest fees, while others impose substantial monthly or annual payments that can rival or even exceed property tax costs.

Moreover, HOA fees are not fixed and can increase over time. Associations may raise fees to cover rising maintenance costs, fund major repairs, or build reserves for future expenses. In some cases, homeowners may also be required to pay special assessments, which are additional charges levied to cover unexpected costs such as roof replacements, structural repairs, or legal expenses. These assessments can be substantial and may come with little warning, placing an unexpected strain on a homeowner’s budget.

Given the potential for rising property taxes and HOA fees, prospective buyers should carefully evaluate these costs before purchasing a home. Researching local tax rates, historical trends in property assessments, and the financial health of an HOA can provide valuable insight into future expenses. Additionally, homeowners should budget for potential increases and set aside funds to cover unexpected assessments or tax hikes.

Ultimately, while homeownership offers many benefits, it also comes with financial responsibilities that extend beyond the mortgage payment. Property taxes and HOA fees can rise over time, creating financial challenges for homeowners who are unprepared for these increases. By understanding these hidden costs and planning accordingly, buyers can make more informed decisions and avoid financial strain in the future. Proper budgeting and awareness of these expenses can help ensure that homeownership remains a sustainable and rewarding investment.

Rising Utility Costs And Insurance Premiums

Owning a home is often seen as a key milestone in achieving financial stability, but many homeowners underestimate the ongoing costs associated with maintaining their property. While mortgage payments are typically the most significant expense, rising utility costs and increasing insurance premiums can place an unexpected strain on household budgets. These hidden costs, if not carefully managed, can lead to financial difficulties and make homeownership more expensive than initially anticipated.

One of the most significant financial burdens homeowners face is the rising cost of utilities. Electricity, water, gas, and other essential services have all seen steady price increases in recent years. Several factors contribute to these rising costs, including inflation, increased demand, and changes in energy regulations. Additionally, extreme weather conditions, such as heatwaves and cold snaps, can lead to higher energy consumption, further driving up monthly bills. Homeowners who rely on heating and cooling systems to maintain a comfortable indoor environment may find themselves paying significantly more during peak seasons.

Moreover, as homes age, they often become less energy-efficient, leading to higher utility costs over time. Older appliances, outdated insulation, and inefficient windows can all contribute to increased energy consumption. While investing in energy-efficient upgrades, such as smart thermostats, LED lighting, and improved insulation, can help reduce long-term costs, these improvements require an upfront financial commitment that not all homeowners are prepared to make. Without proactive measures to enhance energy efficiency, utility bills can continue to rise, placing additional pressure on household finances.

In addition to escalating utility costs, homeowners must also contend with increasing insurance premiums. Home insurance is essential for protecting against unexpected events such as natural disasters, theft, and property damage. However, the cost of coverage has been steadily rising due to several factors, including climate change, higher construction costs, and increased claims. In regions prone to hurricanes, wildfires, or flooding, insurance companies have raised premiums to account for the heightened risk, making coverage more expensive for homeowners in these areas.

Furthermore, as property values increase, so do insurance costs. Many homeowners may not realize that their insurance premiums are tied to the replacement cost of their home rather than its market value. As construction materials and labor costs rise, insurers adjust their rates accordingly, leading to higher premiums. Additionally, homeowners who file claims for damages may see their rates increase, making it even more costly to maintain adequate coverage.

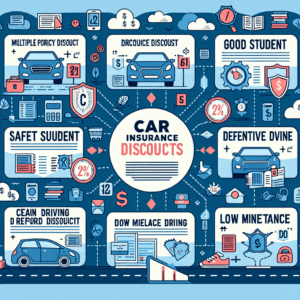

To mitigate the financial impact of rising insurance premiums, homeowners can explore several strategies. Shopping around for competitive rates, bundling home and auto insurance policies, and increasing deductibles can help reduce costs. Additionally, investing in home improvements that enhance safety, such as installing security systems, reinforcing roofs, or upgrading plumbing and electrical systems, may qualify homeowners for discounts on their insurance policies. However, these measures require careful planning and financial investment, which may not be feasible for all homeowners.

Ultimately, while homeownership offers many benefits, the hidden costs associated with rising utility expenses and insurance premiums can place a significant strain on household budgets. Without careful financial planning, these ongoing expenses can quickly add up, making it difficult to manage the true cost of owning a home. By staying informed about potential cost increases and taking proactive steps to improve energy efficiency and insurance coverage, homeowners can better prepare for these financial challenges and avoid unexpected budgetary setbacks.