“Smart Spending, Big Savings: Unlock an Extra $5,000 This Year!”

Cut Unnecessary Expenses: Simple Ways to Trim Your Budget and Save More

One of the most effective ways to save an extra $5,000 this year without increasing your income is by cutting unnecessary expenses. Many people assume that saving more requires earning more, but in reality, small adjustments to daily spending habits can lead to significant financial gains. By identifying areas where money is being wasted and making intentional choices to reduce costs, it is possible to build savings without sacrificing quality of life.

A good starting point is to evaluate recurring expenses, such as subscription services and memberships. Many individuals sign up for streaming platforms, gym memberships, or magazine subscriptions that they rarely use. Reviewing bank statements to identify these charges and canceling those that are not essential can free up a substantial amount of money each month. Even eliminating just a few unused subscriptions can result in hundreds of dollars in savings over the course of a year.

Another effective strategy is to reduce dining-out expenses. While eating at restaurants or ordering takeout is convenient, it is also significantly more expensive than preparing meals at home. By planning meals in advance, cooking in batches, and bringing lunch to work, individuals can cut food costs dramatically. Additionally, limiting coffee shop visits and opting to brew coffee at home can lead to noticeable savings. These small changes may seem insignificant at first, but when added up over time, they contribute to a larger financial cushion.

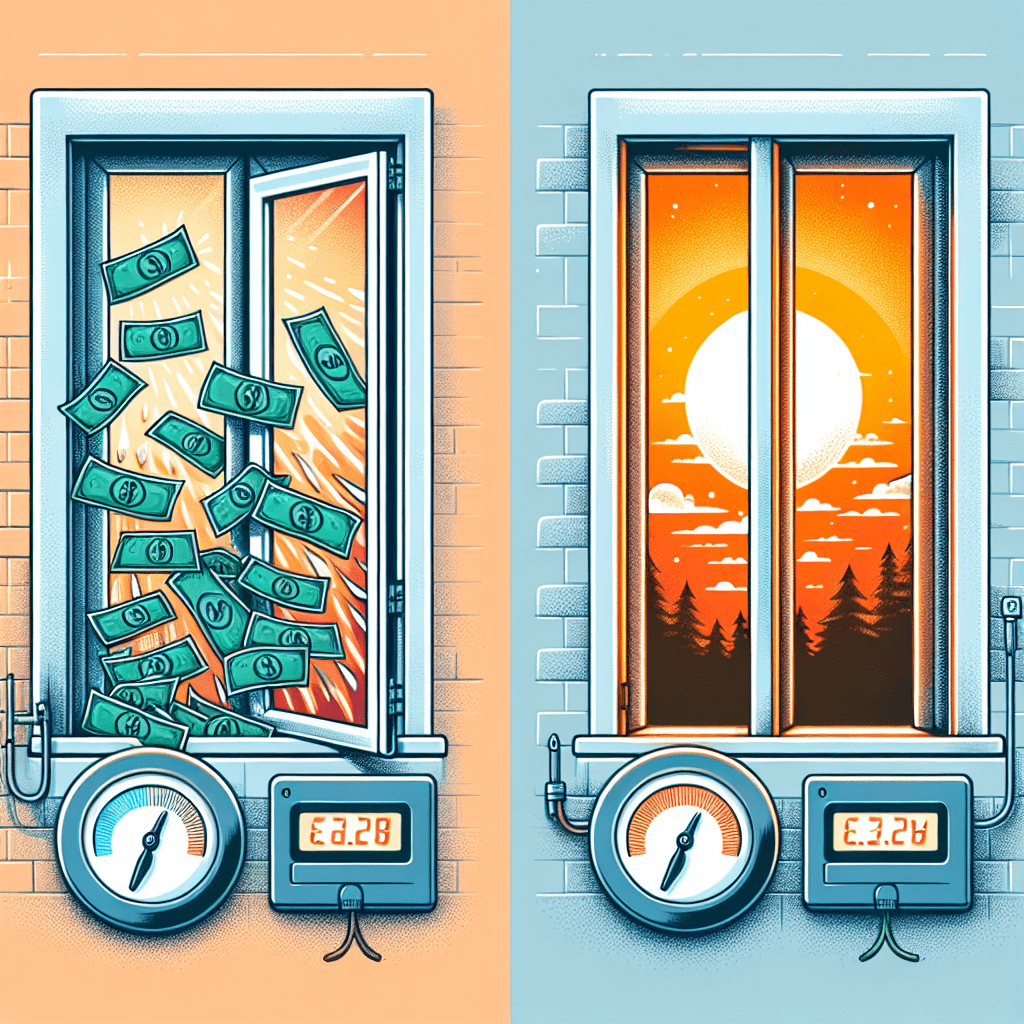

In addition to food-related expenses, it is beneficial to reassess utility bills and household costs. Simple adjustments, such as using energy-efficient appliances, turning off lights when not in use, and adjusting the thermostat, can lower electricity and heating bills. Many utility providers also offer budget plans or discounts for energy-saving initiatives, which can further reduce monthly expenses. Similarly, reviewing phone and internet plans to ensure they align with actual usage can help eliminate unnecessary costs. Switching to a more affordable plan or negotiating with service providers for better rates can lead to significant savings.

Transportation costs are another area where expenses can be trimmed. For those who drive frequently, reducing fuel consumption by carpooling, using public transportation, or biking when possible can lower monthly gas expenses. Additionally, shopping around for better auto insurance rates or bundling policies can result in lower premiums. Regular vehicle maintenance, such as keeping tires properly inflated and ensuring the engine runs efficiently, can also improve fuel economy and reduce long-term costs.

Another often-overlooked way to save money is by being mindful of impulse purchases. Many people spend money on non-essential items without realizing how quickly these small expenses add up. Implementing a 24-hour rule before making non-essential purchases can help curb unnecessary spending. By waiting a day before buying an item, individuals have time to assess whether it is truly needed. Additionally, using cash instead of credit cards for discretionary spending can create a greater awareness of how much money is being spent.

By making these small but impactful changes, it is entirely possible to save an extra $5,000 in a year without earning more. The key is to be intentional with spending, regularly review expenses, and make adjustments where necessary. Over time, these efforts will not only lead to greater financial stability but also encourage smarter money management habits that can benefit individuals in the long run.

Smart Budgeting: How to Track Spending and Identify Hidden Savings

One of the most effective ways to save an extra $5,000 this year without increasing your income is by implementing smart budgeting strategies. By carefully tracking your spending and identifying hidden savings, you can make small but impactful changes that add up over time. The key to success lies in understanding where your money goes, eliminating unnecessary expenses, and making intentional financial decisions.

To begin, tracking your spending is essential. Many people underestimate how much they spend on non-essential items, which can lead to financial inefficiencies. Using budgeting apps, spreadsheets, or even a simple notebook can help you record every expense. By categorizing your spending into necessities such as rent, utilities, and groceries, as well as discretionary expenses like dining out, entertainment, and subscriptions, you can gain a clear picture of your financial habits. Reviewing this data regularly allows you to identify patterns and pinpoint areas where you may be overspending.

Once you have a comprehensive view of your expenses, the next step is to identify hidden savings. Often, small recurring costs go unnoticed but can add up significantly over time. For instance, subscription services, streaming platforms, and memberships that are rarely used can be canceled or downgraded to a more affordable plan. Additionally, reviewing utility bills and negotiating lower rates for internet, phone, or insurance services can lead to substantial savings. Many companies offer discounts or promotions that are not advertised, so taking the time to inquire about better rates can be beneficial.

Another effective way to cut costs is by adjusting daily spending habits. Simple changes, such as preparing meals at home instead of dining out, can result in significant savings. Buying groceries in bulk, using coupons, and planning meals in advance can further reduce food expenses. Similarly, opting for public transportation, carpooling, or biking instead of driving can lower fuel and maintenance costs. Even small adjustments, such as brewing coffee at home instead of purchasing it from a café, can contribute to long-term savings.

Furthermore, adopting a mindful approach to shopping can prevent unnecessary expenditures. Before making a purchase, consider whether the item is a necessity or a luxury. Delaying non-essential purchases by a few days can help determine if they are truly needed. Additionally, taking advantage of discounts, cashback offers, and loyalty programs can make a difference in overall spending. Avoiding impulse purchases by creating a shopping list and sticking to it can also help maintain financial discipline.

In addition to reducing expenses, setting specific savings goals can provide motivation and structure. Allocating a fixed amount of money to a dedicated savings account each month ensures consistent progress. Automating savings transfers can make this process effortless and prevent the temptation to spend extra funds. Over time, these small contributions accumulate, bringing you closer to your $5,000 savings goal.

By implementing these smart budgeting techniques, tracking spending, and identifying hidden savings, it is entirely possible to save an extra $5,000 within a year. The key is to remain consistent, make informed financial decisions, and continuously seek opportunities to optimize expenses. With discipline and strategic planning, achieving financial goals becomes a realistic and attainable objective.

Frugal Living Hacks: Practical Tips to Reduce Costs Without Sacrificing Quality

Saving an extra $5,000 in a year without increasing your income may seem like a daunting task, but with strategic planning and mindful spending, it is entirely achievable. By making small yet impactful changes to daily habits, individuals can significantly reduce expenses without compromising their quality of life. The key lies in identifying areas where money is often wasted and implementing cost-effective alternatives that align with personal needs and priorities.

One of the most effective ways to cut costs is by reassessing recurring expenses. Monthly subscriptions, such as streaming services, gym memberships, and premium apps, can add up quickly. Evaluating which services are truly necessary and eliminating those that are rarely used can result in substantial savings. Additionally, negotiating bills, such as internet, phone, and insurance, can lead to lower rates. Many service providers offer discounts or promotions to retain customers, making it worthwhile to inquire about potential savings.

Another significant area where expenses can be reduced is grocery shopping. Planning meals in advance, creating a shopping list, and sticking to it can prevent impulse purchases and food waste. Buying in bulk, opting for store brands instead of name brands, and taking advantage of sales and coupons can further lower grocery bills. Additionally, preparing meals at home rather than dining out can lead to considerable savings over time. Cooking in batches and freezing portions for later use not only saves money but also reduces the temptation to order takeout on busy days.

Transportation costs also present an opportunity for savings. For those who drive regularly, carpooling, using public transportation, or biking when possible can help cut fuel and maintenance expenses. Additionally, shopping around for better auto insurance rates or bundling policies can lead to lower premiums. Regular vehicle maintenance, such as keeping tires properly inflated and staying up to date on oil changes, can improve fuel efficiency and prevent costly repairs in the long run.

Reducing energy consumption at home is another practical way to lower expenses. Simple adjustments, such as turning off lights when leaving a room, unplugging electronics when not in use, and using energy-efficient appliances, can lead to noticeable savings on utility bills. Additionally, adjusting the thermostat by a few degrees, using ceiling fans, and sealing drafts around windows and doors can help maintain a comfortable indoor temperature without excessive energy use.

Entertainment and leisure activities do not have to be expensive to be enjoyable. Many communities offer free or low-cost events, such as outdoor concerts, museum days, and public park activities. Borrowing books, movies, and games from the library instead of purchasing them can also provide entertainment without added costs. Additionally, exploring hobbies that require minimal investment, such as hiking, gardening, or learning a new skill online, can be both fulfilling and budget-friendly.

By making conscious decisions about spending and prioritizing financial goals, it is possible to save an extra $5,000 in a year without earning more. Small changes, when consistently applied, can lead to significant financial benefits over time. With careful planning and disciplined habits, individuals can achieve their savings goals while maintaining a comfortable and fulfilling lifestyle.