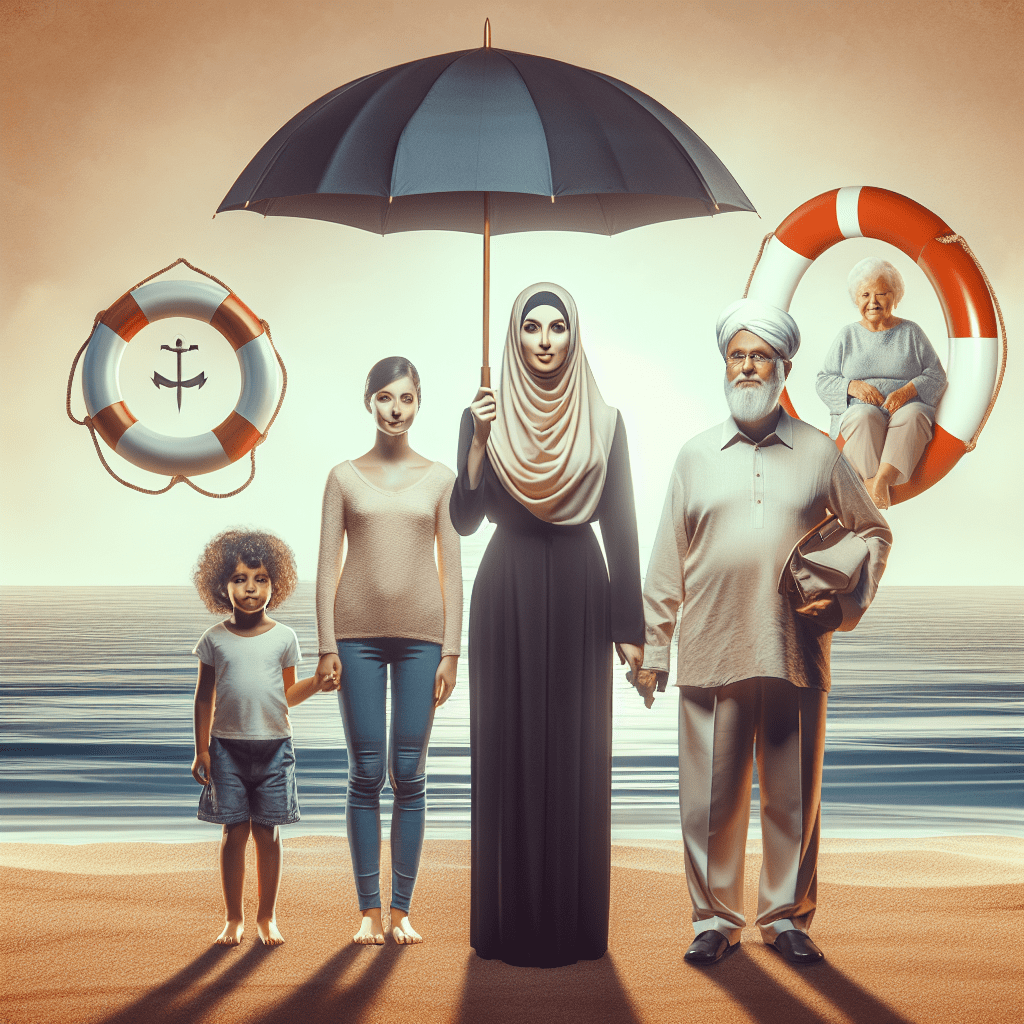

“Protect Their Tomorrow, Peace of Mind Today – Secure Their Future with Life Insurance.”

Importance Of Life Insurance: Ensuring Financial Security For Your Loved Ones

Life insurance plays a crucial role in providing financial security and stability for your loved ones, ensuring that they are protected in the event of an unforeseen tragedy. While no one likes to think about the possibility of passing away unexpectedly, planning for the future is essential to safeguard the well-being of those who depend on you. By securing a life insurance policy, you can offer your family peace of mind, knowing that they will have the financial resources necessary to maintain their standard of living even in your absence.

One of the primary benefits of life insurance is that it serves as a financial safety net for your beneficiaries. In the event of your passing, your loved ones may face significant financial burdens, including funeral expenses, outstanding debts, mortgage payments, and daily living costs. Without a reliable source of income, they may struggle to meet these obligations, leading to financial instability. However, with a well-structured life insurance policy, your family can receive a lump sum payment that can help cover these expenses, allowing them to focus on healing rather than financial concerns.

Moreover, life insurance can be particularly beneficial for families with young children or dependents who rely on a primary breadwinner. If you are the main provider for your household, your sudden absence could create a significant financial gap. Life insurance ensures that your children’s education, healthcare, and other essential needs are met, providing them with the support they require to pursue their goals and aspirations. This financial protection can make a substantial difference in their future, allowing them to continue their education and maintain a stable lifestyle despite the loss of a parent or guardian.

In addition to supporting dependents, life insurance can also help alleviate the burden of outstanding debts. Many individuals carry financial obligations such as mortgages, car loans, or credit card debt. Without a life insurance policy, these debts may become the responsibility of surviving family members, adding to their financial stress. A life insurance payout can be used to settle these liabilities, preventing loved ones from facing unnecessary financial hardship. This ensures that they are not left struggling to manage financial obligations while coping with the emotional impact of losing a family member.

Furthermore, life insurance can serve as a valuable tool for long-term financial planning. Some policies offer investment components that allow policyholders to accumulate cash value over time. This can be beneficial for individuals looking to build wealth, supplement retirement income, or leave a financial legacy for future generations. By choosing the right type of life insurance policy, you can tailor your coverage to align with your financial goals and provide lasting security for your loved ones.

Ultimately, life insurance is more than just a financial product—it is a commitment to protecting those who matter most. By securing a policy, you demonstrate your dedication to ensuring that your family remains financially stable, even in your absence. While no one can predict the future, taking proactive steps today can provide invaluable peace of mind for both you and your loved ones. Investing in life insurance is a responsible and compassionate decision that can make a lasting difference in the lives of those you care about.

How Life Insurance Provides Peace Of Mind In Uncertain Times

Life is full of uncertainties, and while no one can predict the future, it is possible to take steps to protect loved ones from financial hardship. Life insurance serves as a crucial safeguard, offering peace of mind by ensuring that family members are financially secure even in the face of unexpected events. In times of uncertainty, having a well-structured life insurance policy can provide reassurance that dependents will not be burdened with financial difficulties in the absence of a primary income earner.

One of the most significant benefits of life insurance is its ability to provide financial stability. The loss of a loved one can be emotionally devastating, and the added stress of financial insecurity can make the situation even more challenging. A life insurance policy helps mitigate this burden by offering a financial safety net that can cover essential expenses such as mortgage payments, daily living costs, and outstanding debts. This ensures that surviving family members can maintain their standard of living without the immediate pressure of financial strain.

Moreover, life insurance plays a vital role in securing a child’s future. Parents often worry about how their children will manage in their absence, particularly when it comes to education and other long-term financial needs. A well-planned life insurance policy can help cover tuition fees, ensuring that children have access to quality education even if a parent is no longer there to provide for them. This financial support allows children to pursue their dreams without the added worry of financial constraints.

In addition to providing for dependents, life insurance also helps cover end-of-life expenses. Funeral and burial costs can be unexpectedly high, placing an additional financial burden on grieving family members. A life insurance policy can alleviate this concern by covering these expenses, allowing loved ones to focus on healing rather than worrying about financial obligations. This aspect of life insurance is particularly important, as it ensures that families are not left struggling to manage costs during an already difficult time.

Furthermore, life insurance offers flexibility in financial planning. Many policies provide options for policyholders to access funds in times of need, such as through cash value accumulation in permanent life insurance plans. This feature can serve as an additional financial resource during emergencies, offering policyholders a sense of security even while they are still alive. By incorporating life insurance into a broader financial strategy, individuals can create a comprehensive plan that safeguards their family’s future while also addressing potential financial challenges during their lifetime.

Another key advantage of life insurance is the peace of mind it brings to policyholders themselves. Knowing that loved ones will be taken care of in the event of an untimely passing allows individuals to focus on living their lives without constant worry about the future. This sense of security can be invaluable, particularly in uncertain times when financial stability is a primary concern.

Ultimately, life insurance is more than just a financial product—it is a commitment to protecting those who matter most. By securing a policy, individuals can ensure that their loved ones are provided for, no matter what the future holds. In an unpredictable world, life insurance offers a sense of certainty, allowing families to navigate challenges with confidence and peace of mind.

Choosing The Right Life Insurance Plan To Protect Your Family’s Future

Selecting the right life insurance plan is a crucial step in ensuring the financial security of your loved ones. With numerous options available, it is essential to understand the different types of policies and how they align with your family’s needs. Life insurance serves as a safety net, providing financial support in the event of an untimely passing. By carefully evaluating your options, you can make an informed decision that guarantees long-term stability for those who depend on you.

When considering life insurance, it is important to assess your financial situation and future obligations. Factors such as outstanding debts, mortgage payments, education expenses, and daily living costs should all be taken into account. A well-structured policy ensures that your family can maintain their standard of living without financial hardship. Additionally, life insurance can help cover funeral expenses, medical bills, and other unforeseen costs, alleviating the burden on your loved ones during a difficult time.

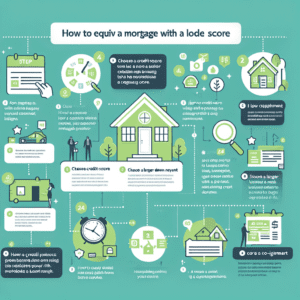

There are two primary types of life insurance: term life and permanent life insurance. Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years. It is often more affordable and is ideal for individuals seeking coverage during critical financial years, such as while raising children or paying off a mortgage. If the policyholder passes away during the term, the beneficiaries receive a death benefit. However, if the term expires, coverage ends unless the policy is renewed or converted into a permanent plan.

On the other hand, permanent life insurance offers lifelong coverage and includes a cash value component that grows over time. This type of policy can be further divided into whole life, universal life, and variable life insurance. Whole life insurance provides fixed premiums and guaranteed cash value accumulation, making it a stable option for long-term financial planning. Universal life insurance offers more flexibility, allowing policyholders to adjust their premiums and death benefits as needed. Variable life insurance, meanwhile, allows investment in various financial instruments, potentially increasing the policy’s cash value but also introducing a level of risk.

Choosing between term and permanent life insurance depends on your financial goals and personal circumstances. If affordability is a primary concern, term life insurance may be the best option. However, if you seek lifelong coverage with an investment component, permanent life insurance could be more suitable. Consulting with a financial advisor can help you determine the most appropriate policy based on your income, expenses, and long-term objectives.

Beyond selecting the right type of policy, it is also essential to determine the appropriate coverage amount. A common guideline is to choose a death benefit that is at least 10 times your annual income, though individual needs may vary. Consideration should be given to future inflation, potential medical expenses, and any additional financial responsibilities your family may face. By carefully calculating these factors, you can ensure that your policy provides adequate protection.

Ultimately, securing life insurance is an investment in your family’s future. It offers peace of mind, knowing that your loved ones will be financially protected even in your absence. By taking the time to evaluate your options and select the right plan, you can provide stability and security for those who matter most.