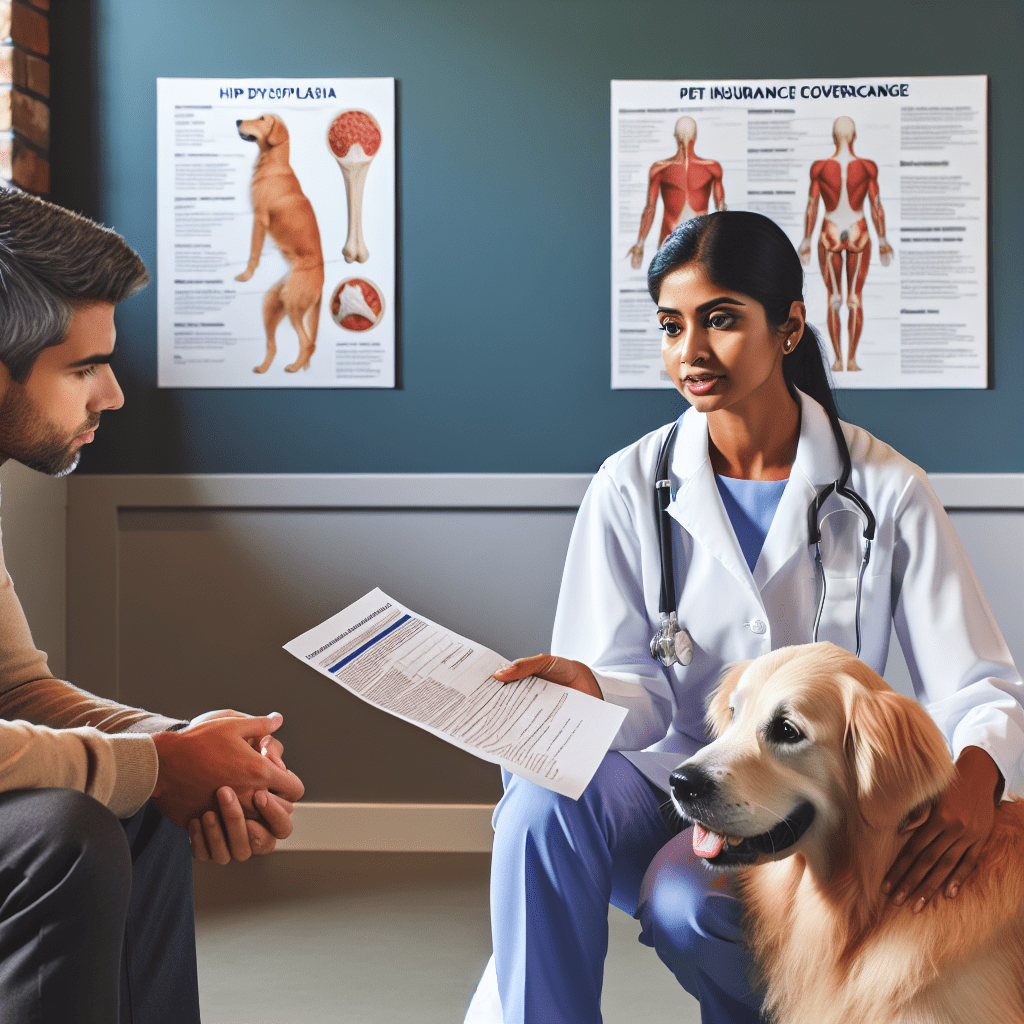

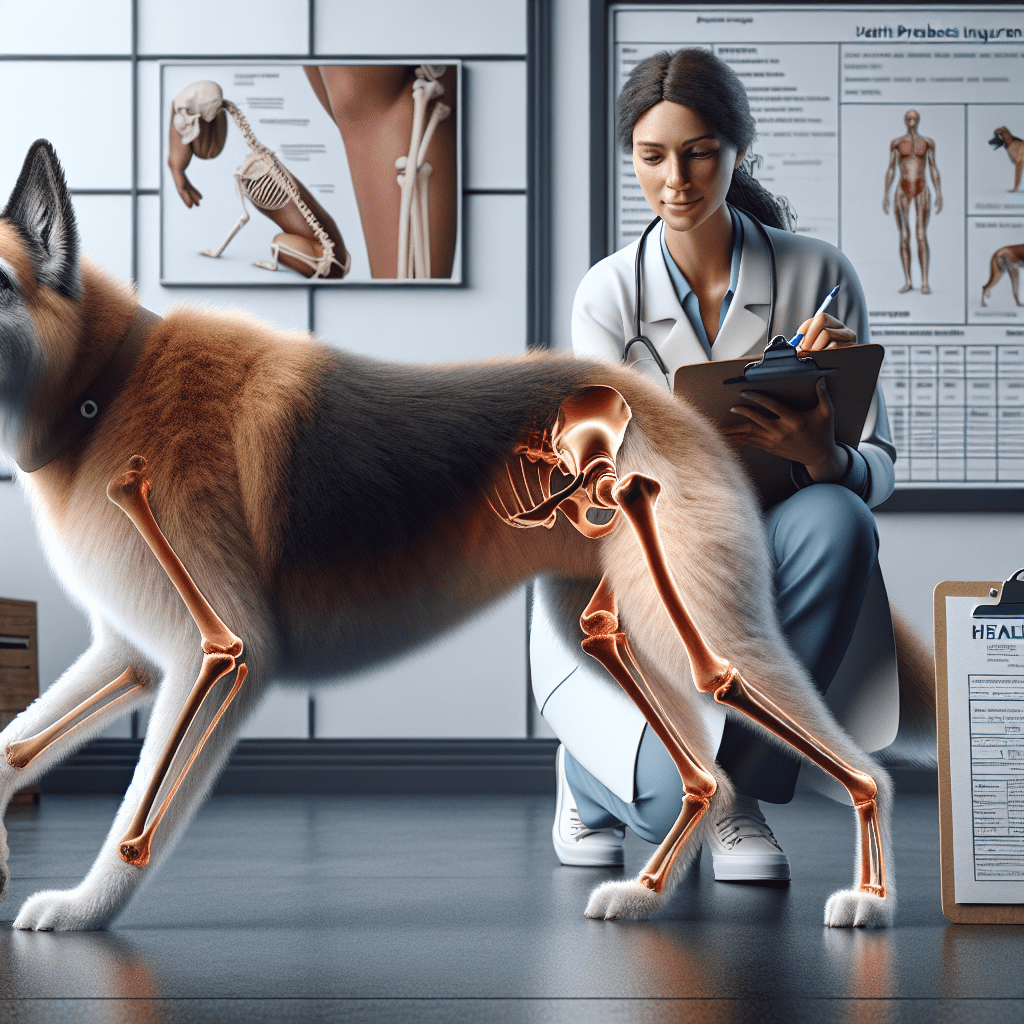

“Protect your pup’s mobility—discover if pet insurance covers hip dysplasia and joint problems!”

Understanding Pet Insurance Coverage for Hip Dysplasia and Joint Problems in Dogs

Pet insurance can be a valuable resource for dog owners, particularly when it comes to managing the costs of treating hereditary and chronic conditions such as hip dysplasia and joint problems. These conditions are common in many breeds and can lead to significant medical expenses over time. However, understanding whether pet insurance covers these issues requires careful examination of policy details, as coverage can vary depending on the provider, plan type, and specific terms and conditions.

Hip dysplasia is a genetic condition that affects the hip joint, leading to instability, pain, and, in severe cases, loss of mobility. Similarly, joint problems, including arthritis and ligament injuries, can develop due to genetics, aging, or injury. Treatment for these conditions may involve medications, physical therapy, weight management, or even surgical intervention, all of which can be costly. Given the potential financial burden, many pet owners seek insurance coverage to help manage these expenses. However, not all pet insurance policies provide the same level of coverage for hereditary or chronic conditions.

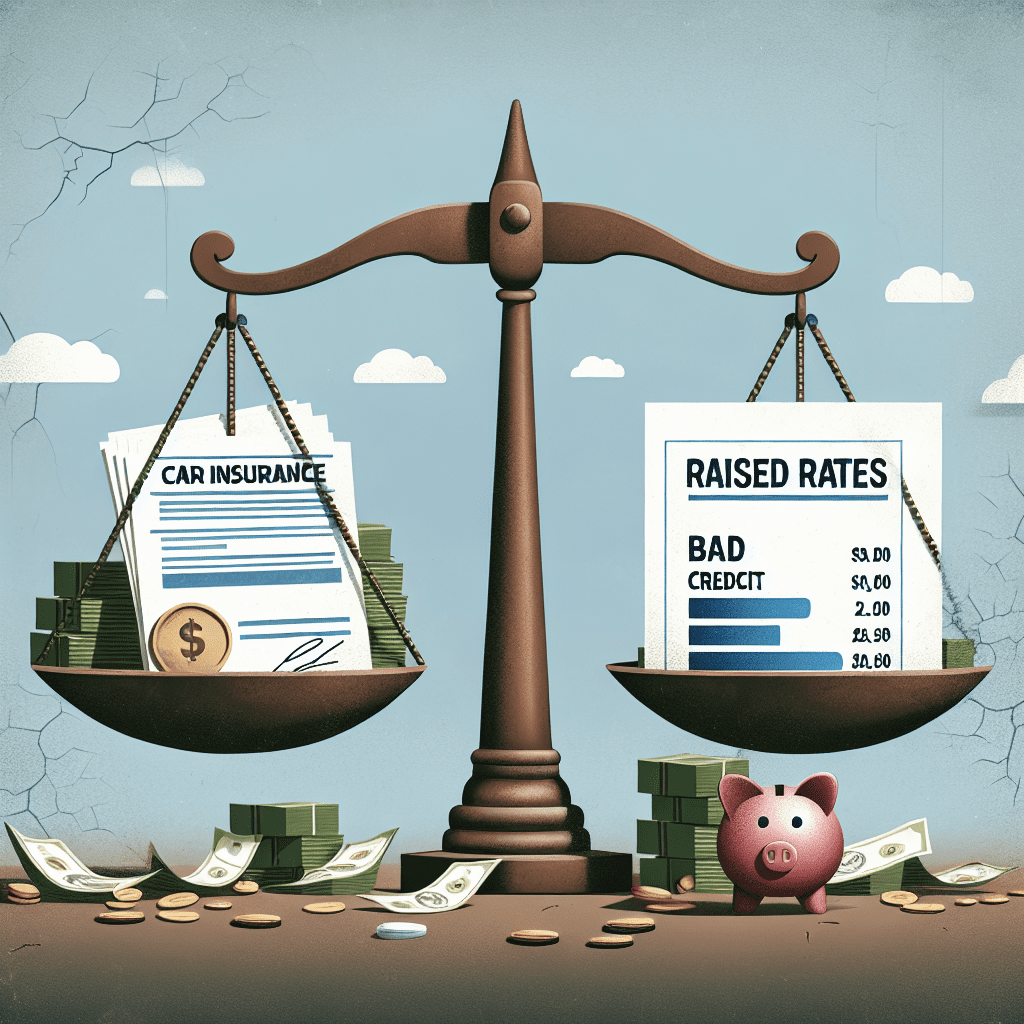

One of the most important factors in determining whether pet insurance will cover hip dysplasia and joint problems is whether the condition is considered pre-existing. Most pet insurance providers do not cover pre-existing conditions, which means that if a dog is diagnosed with hip dysplasia or joint issues before the policy is in place, treatment costs will likely not be reimbursed. This is why enrolling a pet in insurance at a young age, before any signs of these conditions appear, is often recommended. Some policies may distinguish between curable and incurable pre-existing conditions, potentially covering joint issues if the pet has been symptom-free for a specified period.

Another key consideration is whether the policy includes coverage for hereditary and congenital conditions. Some basic pet insurance plans may exclude these conditions, while more comprehensive plans specifically cover them. Since hip dysplasia is a hereditary condition, it is crucial for pet owners to verify that their chosen policy includes this type of coverage. Additionally, some insurers impose waiting periods for orthopedic conditions, meaning that coverage for hip dysplasia or joint problems may not take effect immediately after enrollment.

Furthermore, pet insurance policies may have limits on coverage, including annual, per-condition, or lifetime caps. If a dog requires ongoing treatment for joint problems, reaching these limits could result in out-of-pocket expenses for the owner. Reviewing the policy’s reimbursement structure, deductibles, and co-pays is essential to understanding the financial implications of treatment. Some policies also offer optional add-ons, such as wellness plans, which may help cover preventive care, including joint supplements or early diagnostic screenings.

In addition to traditional pet insurance, some owners may consider alternative financial options, such as pet savings accounts or veterinary discount programs, to help manage the costs of treating hip dysplasia and joint problems. While these options do not provide the same level of financial protection as insurance, they can still be beneficial in covering routine and unexpected veterinary expenses.

Ultimately, selecting the right pet insurance policy requires careful research and comparison of different providers. Reading the fine print, asking about exclusions, and understanding the terms of coverage can help pet owners make informed decisions. By choosing a policy that includes coverage for hereditary and chronic conditions, dog owners can ensure they are better prepared to manage the costs associated with hip dysplasia and joint problems, providing their pets with the best possible care.

Key Factors to Consider When Choosing Pet Insurance for Canine Joint Health

When selecting pet insurance to cover hip dysplasia and other joint problems in dogs, several key factors must be carefully considered to ensure comprehensive coverage and financial protection. Since joint issues can be both chronic and costly to manage, understanding the specifics of an insurance policy is essential for making an informed decision. One of the most important aspects to evaluate is whether the policy includes coverage for hereditary and congenital conditions. Many insurers classify hip dysplasia as a hereditary condition, which means that some policies may exclude it unless specific provisions are in place. Therefore, pet owners should look for plans that explicitly state coverage for hereditary and congenital disorders to avoid unexpected exclusions.

In addition to hereditary conditions, it is crucial to assess whether the policy covers both diagnostic procedures and treatment options. Joint problems often require extensive diagnostic testing, including X-rays, MRIs, and blood work, to determine the severity of the condition. Without coverage for these essential procedures, pet owners may face significant out-of-pocket expenses before even beginning treatment. Furthermore, treatment for hip dysplasia and other joint issues can range from medication and physical therapy to surgical interventions such as hip replacement. A comprehensive insurance plan should include coverage for a variety of treatment options to ensure that dogs receive the best possible care without financial constraints limiting their options.

Another critical factor to consider is the presence of waiting periods and exclusions for pre-existing conditions. Many pet insurance providers impose waiting periods before coverage for orthopedic conditions becomes effective, which means that any symptoms or diagnoses occurring before the waiting period ends may not be covered. Additionally, if a dog has already been diagnosed with hip dysplasia or another joint issue before obtaining insurance, most providers will classify it as a pre-existing condition and exclude it from coverage. To maximize benefits, pet owners should enroll their dogs in insurance plans as early as possible, ideally before any signs of joint problems appear.

Equally important is the policy’s reimbursement structure and annual limits. Different insurance providers offer varying reimbursement percentages, typically ranging from 70% to 90% of eligible veterinary costs. Choosing a higher reimbursement rate can significantly reduce out-of-pocket expenses, particularly for chronic conditions that require ongoing treatment. Additionally, some policies impose annual or lifetime limits on payouts, which can impact long-term affordability. Since joint problems often require continuous care, selecting a policy with high or unlimited annual coverage can provide greater financial security over time.

Beyond coverage specifics, pet owners should also consider the insurer’s reputation and customer service. Reading reviews and researching the company’s history of claim approvals can provide valuable insight into how efficiently and fairly claims are processed. A provider with a strong track record of timely reimbursements and transparent policies can make a significant difference in ensuring that pet owners receive the financial support they need when managing their dog’s joint health.

Ultimately, choosing the right pet insurance for canine joint health requires careful evaluation of coverage details, exclusions, reimbursement structures, and provider reliability. By thoroughly reviewing these factors, pet owners can select a policy that offers comprehensive protection, ensuring that their dogs receive the necessary care for hip dysplasia and other joint conditions without undue financial burden.

Comparing Pet Insurance Plans: What’s Covered for Hip Dysplasia and Joint Issues?

When considering pet insurance for a dog, one of the most important factors to evaluate is coverage for hereditary and chronic conditions such as hip dysplasia and joint problems. These issues are particularly common in certain breeds and can lead to significant veterinary expenses over time. Understanding how different pet insurance plans cover these conditions is essential for making an informed decision and ensuring that a pet receives the necessary medical care without placing an undue financial burden on the owner.

Pet insurance policies vary widely in terms of coverage for hip dysplasia and joint issues. Some plans offer comprehensive coverage that includes hereditary and congenital conditions, while others may exclude these ailments or impose specific limitations. One of the key distinctions among policies is whether they cover pre-existing conditions. Most pet insurance providers do not cover conditions that were diagnosed or showed symptoms before the policy was purchased. This means that if a dog has already been diagnosed with hip dysplasia or arthritis before enrollment, treatment for these conditions is unlikely to be covered. However, some insurers differentiate between curable and incurable pre-existing conditions, potentially covering joint issues if the pet has been symptom-free for a specified period.

Another important factor to consider is whether a policy includes coverage for hereditary and congenital conditions. Some insurance providers automatically include these conditions in their standard plans, while others require pet owners to purchase additional coverage. Since hip dysplasia is a hereditary condition that primarily affects large and giant breeds, owners of susceptible dogs should carefully review policy terms to ensure that this condition is covered. Additionally, some insurers impose age restrictions, meaning that coverage for hip dysplasia may only be available if the pet is enrolled before a certain age.

Beyond hereditary conditions, joint problems such as arthritis, ligament injuries, and degenerative joint disease are also common concerns for dog owners. Many comprehensive pet insurance plans cover these conditions as long as they are not pre-existing. However, some policies may have waiting periods before coverage takes effect. For example, a plan may require a six-month waiting period for orthopedic conditions, meaning that any joint issues diagnosed within that timeframe would not be covered. Understanding these waiting periods is crucial, as they can impact when a pet becomes eligible for treatment under the policy.

In addition to coverage limitations, pet owners should also consider the extent of financial support provided by different plans. Some policies cover the full cost of diagnostic tests, treatments, and surgeries related to hip dysplasia and joint problems, while others may impose annual or lifetime payout limits. Additionally, reimbursement rates and deductibles can vary, affecting the overall affordability of care. Some insurers offer wellness add-ons that cover preventive measures such as joint supplements and physical therapy, which can be beneficial for managing joint health and delaying the progression of degenerative conditions.

Ultimately, comparing pet insurance plans requires careful attention to policy details, including exclusions, waiting periods, and coverage limits. Since hip dysplasia and joint problems can lead to costly treatments such as surgery and long-term medication, selecting a plan that provides comprehensive coverage can make a significant difference in a pet’s quality of life. By thoroughly reviewing policy terms and considering a pet’s specific health risks, owners can choose an insurance plan that best meets their needs while ensuring their dog receives the necessary medical care.