“Escape Debt Without Bankruptcy – Proven Strategies to Regain Control!”

Debt Consolidation: A Smart Strategy to Reduce Your Debt Without Bankruptcy

Debt can be overwhelming, and for many individuals, the thought of filing for bankruptcy may seem like the only way out. However, bankruptcy has long-term financial consequences that can affect credit scores, borrowing ability, and even job opportunities. Fortunately, there are alternative strategies to manage and reduce debt without resorting to bankruptcy. One such approach is debt consolidation, a method that simplifies repayment and can make financial obligations more manageable. By understanding how debt consolidation works and its potential benefits, individuals can take proactive steps toward financial stability.

Debt consolidation involves combining multiple debts into a single loan or payment plan, often with a lower interest rate. This strategy can be particularly beneficial for those struggling with high-interest credit card debt, personal loans, or medical bills. Instead of juggling multiple payments with varying due dates and interest rates, borrowers can streamline their repayment process, making it easier to stay on track. Additionally, consolidating debt can reduce the total amount paid in interest over time, allowing individuals to pay off their obligations more efficiently.

There are several ways to consolidate debt, each with its own advantages and considerations. One common method is obtaining a debt consolidation loan, which involves taking out a new loan to pay off existing debts. This loan typically has a fixed interest rate and a structured repayment plan, making it easier to budget for monthly payments. Another option is transferring high-interest credit card balances to a card with a lower interest rate, often through a balance transfer offer. This can provide temporary relief from high interest, but it is essential to pay off the balance before the promotional period ends to avoid additional financial strain.

For homeowners, a home equity loan or home equity line of credit (HELOC) can be another viable option for consolidating debt. By leveraging the equity in their home, borrowers can secure a loan with a lower interest rate compared to unsecured debt. However, this approach carries the risk of losing the home if payments are not made on time. Similarly, some individuals may choose to work with a debt management program, where a credit counseling agency negotiates with creditors to lower interest rates and create a structured repayment plan. This option can be beneficial for those who need professional guidance in managing their debt effectively.

While debt consolidation can be an effective strategy, it is important to consider potential drawbacks. For instance, obtaining a new loan may require a good credit score, and those with poor credit may struggle to secure favorable terms. Additionally, consolidating debt does not eliminate the underlying financial habits that led to debt accumulation in the first place. Without a commitment to responsible spending and budgeting, individuals may find themselves in a similar financial situation in the future.

To maximize the benefits of debt consolidation, it is crucial to develop a comprehensive financial plan. This includes creating a realistic budget, cutting unnecessary expenses, and prioritizing debt repayment. Seeking financial counseling or working with a reputable debt consolidation company can also provide valuable guidance. By taking these steps, individuals can regain control of their finances and work toward a debt-free future without the need for bankruptcy.

Negotiating With Creditors: How to Lower Your Debt and Avoid Bankruptcy

Negotiating with creditors can be an effective strategy for reducing debt and avoiding bankruptcy. Many people assume that once they fall behind on payments, their only options are to either struggle indefinitely or file for bankruptcy. However, creditors are often willing to negotiate new terms, as they would rather recover a portion of the debt than risk losing the entire amount. By understanding how to approach these negotiations, individuals can take control of their financial situation and work toward a more manageable repayment plan.

One of the first steps in negotiating with creditors is assessing your financial situation. Before reaching out, it is important to have a clear understanding of your income, expenses, and total debt. This allows you to determine what you can realistically afford to pay and present a reasonable proposal. Creditors are more likely to agree to new terms if they see that you have a structured plan in place. Additionally, being prepared with documentation, such as pay stubs, bank statements, and a list of outstanding debts, can help strengthen your case when discussing potential modifications.

Once you have a clear picture of your finances, the next step is to contact your creditors directly. It is often best to start with a phone call, followed by a written request outlining your financial hardship and proposed repayment plan. When speaking with creditors, maintaining a calm and professional tone is essential. Expressing a willingness to pay and demonstrating a sincere effort to resolve the debt can increase the likelihood of reaching a favorable agreement. Some creditors may offer temporary hardship programs, reduced interest rates, or extended payment terms to help make repayment more manageable.

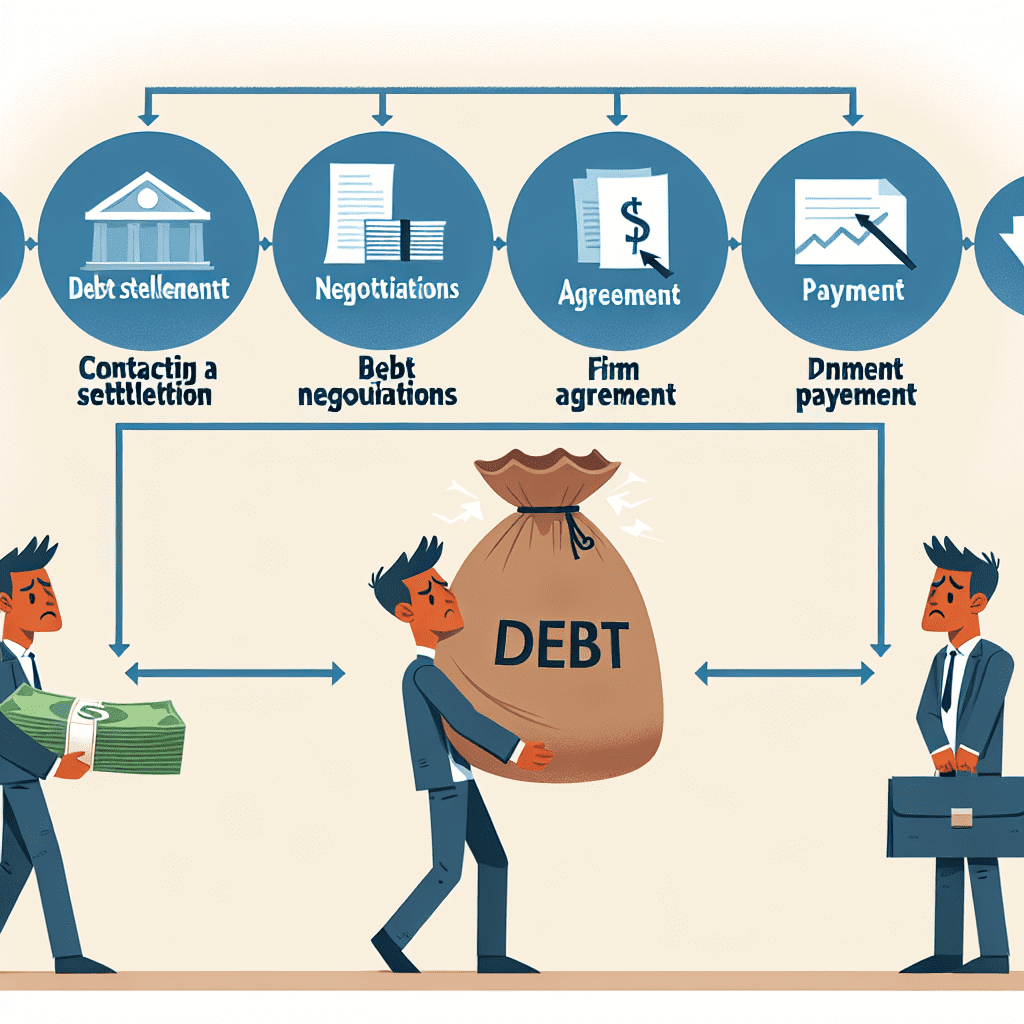

In some cases, creditors may be open to settling the debt for a lower amount than what is owed. This is known as a debt settlement, where the creditor agrees to accept a lump sum payment that is less than the total balance. While this can be a beneficial option for those struggling with large amounts of debt, it is important to approach it carefully. Creditors may require proof of financial hardship before agreeing to a settlement, and settling a debt for less than the full amount can have an impact on your credit score. However, for individuals facing significant financial difficulties, this may be a viable alternative to bankruptcy.

Another option to consider is requesting a lower interest rate. High-interest rates can make it difficult to pay down debt, as a significant portion of each payment goes toward interest rather than the principal balance. By negotiating a lower rate, more of your payment will go toward reducing the actual debt, allowing you to pay it off more quickly. Many creditors are willing to adjust interest rates, especially for long-term customers with a history of on-time payments.

If negotiating directly with creditors feels overwhelming, working with a credit counseling agency may be beneficial. These organizations can help create a debt management plan, negotiate with creditors on your behalf, and provide financial education to prevent future debt issues. However, it is important to choose a reputable agency, as some companies may charge high fees or make unrealistic promises.

Ultimately, negotiating with creditors requires patience, persistence, and a proactive approach. By taking the initiative to communicate with creditors and explore available options, individuals can reduce their debt burden and avoid the long-term consequences of bankruptcy.

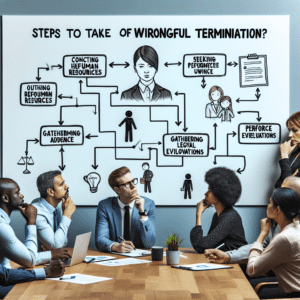

Budgeting and Financial Planning: Key Steps to Becoming Debt-Free

Reducing debt without resorting to bankruptcy is a challenging but achievable goal, and effective budgeting and financial planning play a crucial role in this process. By taking a strategic approach to managing income and expenses, individuals can regain control of their financial situation and work toward a debt-free future. The first step in this journey is to assess the full extent of one’s financial obligations. This involves listing all outstanding debts, including credit cards, personal loans, medical bills, and any other liabilities. Understanding the total amount owed, along with interest rates and minimum payments, provides a clear picture of the financial landscape and allows for the development of a realistic repayment strategy.

Once a comprehensive overview of debts is established, creating a detailed budget becomes essential. A well-structured budget accounts for all sources of income and categorizes expenses into fixed and variable costs. Fixed expenses, such as rent or mortgage payments, utilities, and insurance, remain consistent each month, while variable expenses, including groceries, entertainment, and discretionary spending, fluctuate. Identifying areas where spending can be reduced is a key component of financial planning, as reallocating funds toward debt repayment accelerates progress. Cutting back on non-essential expenses, such as dining out or subscription services, can free up additional resources to pay down outstanding balances more quickly.

In addition to reducing discretionary spending, increasing income can significantly impact debt repayment efforts. Exploring opportunities for additional income, such as freelance work, part-time jobs, or selling unused items, can provide extra funds to allocate toward outstanding balances. Even small increases in income, when consistently applied to debt payments, can lead to substantial progress over time. Furthermore, individuals may consider negotiating with creditors to secure lower interest rates or more favorable repayment terms. Many lenders are willing to work with borrowers who demonstrate a commitment to repaying their debts, and even a slight reduction in interest rates can result in significant savings.

Another effective strategy for managing debt is prioritizing repayment through structured methods such as the debt snowball or debt avalanche approach. The debt snowball method involves paying off the smallest debts first while making minimum payments on larger balances. This approach provides a psychological boost by creating a sense of accomplishment as smaller debts are eliminated. Conversely, the debt avalanche method focuses on paying off debts with the highest interest rates first, minimizing the overall cost of borrowing. Both strategies have their advantages, and selecting the most suitable approach depends on individual financial circumstances and personal motivation.

Beyond budgeting and repayment strategies, establishing an emergency fund is a critical component of financial planning. Unexpected expenses, such as medical emergencies or car repairs, can derail debt repayment efforts if there are no savings to cover them. Setting aside even a small amount each month can help build a financial cushion, reducing the reliance on credit cards or loans in times of need. Additionally, adopting responsible financial habits, such as using cash instead of credit for purchases and avoiding unnecessary debt, can prevent future financial difficulties.

Ultimately, becoming debt-free requires discipline, commitment, and a well-structured financial plan. By carefully managing income and expenses, prioritizing debt repayment, and making informed financial decisions, individuals can successfully reduce their debt without resorting to bankruptcy. While the process may take time, the long-term benefits of financial stability and independence make the effort worthwhile.