“Crush Your Credit Card Debt Fast with These Proven Strategies!”

Create a Budget and Stick to It

One of the most effective ways to eliminate credit card debt faster is by creating a well-structured budget and adhering to it consistently. A budget serves as a financial roadmap, allowing individuals to track their income, expenses, and debt repayment progress. Without a clear plan, it becomes easy to overspend, accumulate more debt, and struggle to make meaningful progress toward financial freedom. By establishing a budget and committing to it, individuals can take control of their finances and accelerate their journey toward a debt-free life.

To begin, it is essential to assess one’s financial situation by calculating total income and listing all necessary expenses. This includes fixed costs such as rent or mortgage payments, utilities, insurance, and transportation, as well as variable expenses like groceries, entertainment, and dining out. Once all expenses are accounted for, it becomes easier to identify areas where spending can be reduced. Cutting back on non-essential purchases and redirecting those funds toward credit card payments can significantly speed up the debt repayment process.

After identifying areas for potential savings, the next step is to allocate a specific portion of income toward debt repayment. One effective approach is the 50/30/20 budgeting rule, which suggests allocating 50% of income to necessities, 30% to discretionary spending, and 20% to savings and debt repayment. However, for those focused on eliminating credit card debt quickly, adjusting these percentages to prioritize debt payments can be beneficial. For instance, reducing discretionary spending and increasing the amount allocated to debt repayment can lead to faster progress.

Furthermore, setting realistic and achievable financial goals is crucial for maintaining motivation. Establishing short-term milestones, such as paying off one credit card within a few months, can provide a sense of accomplishment and encourage continued commitment to the budget. Additionally, tracking progress regularly by reviewing monthly statements and monitoring outstanding balances can help individuals stay on course and make necessary adjustments to their spending habits.

Another important aspect of sticking to a budget is avoiding new debt. While it may be tempting to use credit cards for everyday purchases, doing so can counteract efforts to pay off existing balances. Instead, using cash or a debit card for transactions can help prevent further debt accumulation. Additionally, setting up automatic payments for credit card bills ensures that at least the minimum payment is made on time, avoiding late fees and potential damage to one’s credit score.

In some cases, individuals may find it beneficial to explore additional sources of income to accelerate debt repayment. Taking on a part-time job, freelancing, or selling unused items can generate extra funds that can be applied directly to outstanding balances. Even small additional payments can make a significant difference over time by reducing interest charges and shortening the repayment period.

Ultimately, creating a budget and adhering to it requires discipline and commitment. However, by prioritizing debt repayment, cutting unnecessary expenses, and staying focused on financial goals, individuals can successfully eliminate credit card debt faster. With a well-structured plan in place, financial stability becomes more attainable, paving the way for a future free from the burden of high-interest debt.

Use the Debt Snowball or Avalanche Method

Eliminating credit card debt can feel overwhelming, but with the right approach, it is possible to pay it off efficiently and regain financial stability. Two of the most effective strategies for tackling debt are the debt snowball and debt avalanche methods. Each approach offers a structured way to reduce outstanding balances, helping individuals stay motivated and make steady progress toward financial freedom. Understanding how these methods work and choosing the one that best suits your financial situation can significantly accelerate the debt repayment process.

The debt snowball method focuses on paying off the smallest debt first while making minimum payments on all other accounts. Once the smallest balance is cleared, the amount that was allocated to that debt is then applied to the next smallest balance. This process continues until all debts are eliminated. The primary advantage of this method is the psychological boost it provides. By quickly eliminating smaller debts, individuals experience a sense of accomplishment, which can serve as motivation to continue paying off larger balances. This approach is particularly beneficial for those who need encouragement to stay committed to their debt repayment plan.

On the other hand, the debt avalanche method prioritizes debts with the highest interest rates. Under this strategy, individuals make minimum payments on all debts while directing extra funds toward the balance with the highest interest rate. Once that debt is paid off, the payments are then applied to the next highest interest rate debt, and the process continues until all balances are cleared. The primary advantage of this method is that it minimizes the total amount of interest paid over time, making it the most cost-effective approach. While it may take longer to see initial progress compared to the debt snowball method, the long-term financial benefits can be substantial.

Choosing between these two methods depends on individual financial goals and personal motivation. Those who thrive on small victories and need encouragement to stay on track may find the debt snowball method more effective. Conversely, individuals who are focused on minimizing interest costs and are disciplined enough to stay committed may benefit more from the debt avalanche method. Regardless of the approach chosen, consistency and commitment are key to successfully eliminating credit card debt.

To maximize the effectiveness of either method, it is essential to create a budget that prioritizes debt repayment. Identifying areas where expenses can be reduced and redirecting those funds toward debt payments can accelerate progress. Additionally, finding ways to increase income, such as taking on a side job or selling unused items, can provide extra funds to pay off balances more quickly. Avoiding new debt is also crucial; using credit cards responsibly and resisting the temptation to accumulate additional balances will prevent setbacks in the repayment process.

Ultimately, both the debt snowball and debt avalanche methods offer structured and proven strategies for eliminating credit card debt. By selecting the approach that aligns best with personal financial habits and staying committed to the plan, individuals can achieve financial freedom more quickly. With discipline, persistence, and a clear strategy, becoming debt-free is an attainable goal that leads to greater financial security and peace of mind.

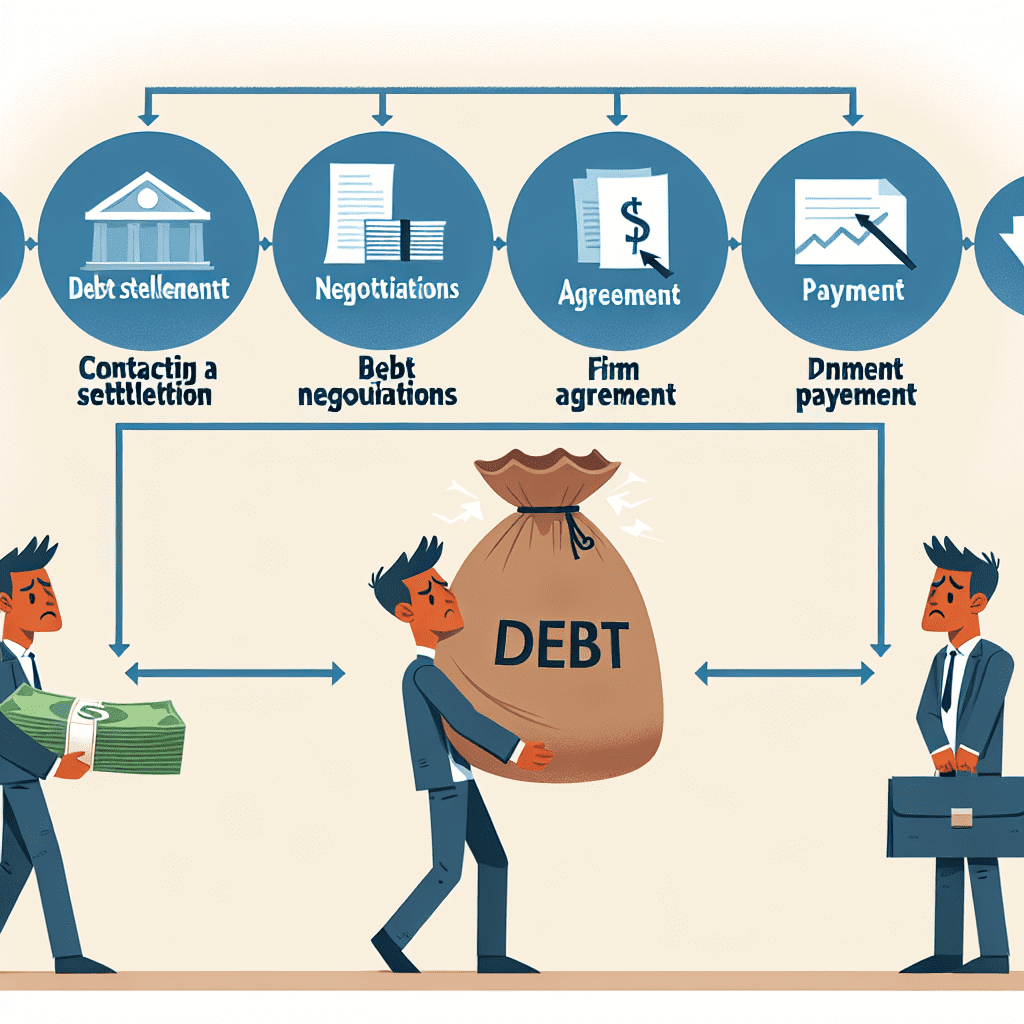

Negotiate Lower Interest Rates and Payment Plans

One of the most effective ways to accelerate the repayment of credit card debt is to negotiate lower interest rates and establish manageable payment plans. High-interest rates can significantly increase the total amount owed, making it more difficult to pay off balances quickly. By securing a lower rate, more of each payment goes toward reducing the principal rather than covering interest charges. Fortunately, many credit card issuers are willing to work with cardholders who demonstrate financial responsibility and a commitment to repaying their debt.

To begin the negotiation process, it is essential to assess your current financial situation. Reviewing your outstanding balances, interest rates, and minimum payments will provide a clear understanding of your obligations. Additionally, checking your credit score can be beneficial, as a higher score may strengthen your position when requesting a lower rate. Once you have gathered this information, contacting your credit card issuer directly is the next step. Speaking with a customer service representative or a retention specialist can open the door to potential rate reductions or alternative payment arrangements.

When initiating the conversation, it is important to remain polite and professional. Clearly explain your request and provide reasons why a lower interest rate would be beneficial. If you have a history of making on-time payments, highlight this as evidence of your reliability. Additionally, mentioning competitive offers from other credit card companies may encourage your issuer to match or beat those terms. In some cases, simply asking for a lower rate can result in an immediate reduction, while in others, persistence may be required. If the first representative is unable to assist, requesting to speak with a supervisor may yield better results.

Beyond negotiating interest rates, exploring alternative payment plans can also be advantageous. Some credit card companies offer hardship programs for individuals facing financial difficulties. These programs may include temporarily reduced interest rates, waived fees, or extended repayment terms. While enrolling in such a program may have an impact on credit reporting, it can provide much-needed relief and prevent further financial strain. Before agreeing to any new terms, carefully review the details to ensure they align with your long-term financial goals.

If direct negotiations with your credit card issuer do not produce the desired outcome, considering a balance transfer may be a viable alternative. Many credit card companies offer promotional periods with low or zero percent interest on transferred balances. By moving high-interest debt to a lower-rate card, you can reduce the amount paid in interest and accelerate debt repayment. However, it is crucial to factor in any balance transfer fees and ensure that the promotional rate lasts long enough to make a significant impact.

Ultimately, negotiating lower interest rates and securing favorable payment plans can be powerful tools in the journey toward financial freedom. By taking a proactive approach, maintaining open communication with creditors, and exploring all available options, individuals can reduce the burden of credit card debt more efficiently. While the process may require persistence and strategic planning, the potential savings and financial relief make it a worthwhile endeavor.