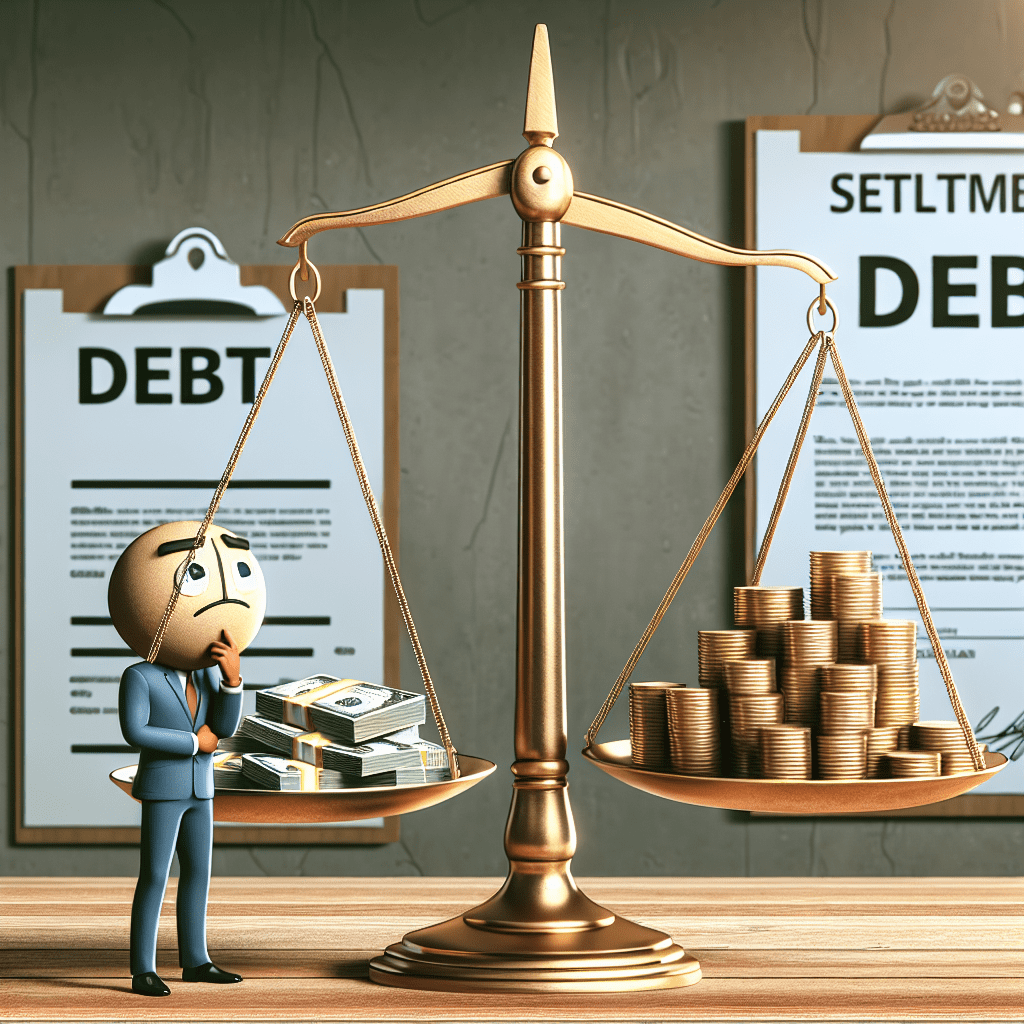

“Debt Settlement: Weigh the Risks Before You Commit!”

Pros And Cons Of Using A Debt Settlement Company

Debt settlement companies offer a potential solution for individuals struggling with overwhelming debt, promising to negotiate with creditors to reduce the total amount owed. While this approach may seem appealing, it is essential to weigh the advantages and disadvantages before making a decision. Understanding both the benefits and risks can help individuals determine whether debt settlement is the right choice for their financial situation.

One of the primary advantages of using a debt settlement company is the possibility of reducing the total debt amount. These companies negotiate with creditors on behalf of their clients, often securing agreements that allow individuals to pay a lower sum than what they originally owed. This can provide significant financial relief, especially for those facing high-interest debt that continues to grow over time. Additionally, debt settlement may offer a faster path to resolving outstanding balances compared to making minimum payments, which can take years to eliminate debt entirely.

Another potential benefit is the structured approach that debt settlement companies provide. Many individuals struggling with debt find it challenging to negotiate with creditors on their own, particularly when dealing with multiple accounts. Debt settlement companies have experience handling these negotiations and can leverage their expertise to secure favorable terms. Furthermore, working with a professional service can reduce the stress associated with managing debt, as the company takes on the responsibility of communicating with creditors and developing a settlement strategy.

Despite these advantages, there are also significant drawbacks to consider. One of the most notable concerns is the impact on an individual’s credit score. Debt settlement typically requires clients to stop making payments to creditors while negotiations are in progress. As a result, missed payments are reported to credit bureaus, leading to a decline in credit scores. This negative impact can make it more difficult to obtain loans, credit cards, or even secure housing in the future. Additionally, settled debts are often marked as “settled” rather than “paid in full” on credit reports, which may be viewed unfavorably by future lenders.

Another potential downside is the cost associated with debt settlement services. Most companies charge fees for their assistance, which can be a percentage of the total debt or the amount saved through settlement. These fees can be substantial, reducing the overall financial benefit of the settlement. In some cases, individuals may find that the cost of using a debt settlement company outweighs the savings achieved through negotiations. It is crucial to carefully review the fee structure and ensure that the potential benefits justify the expense.

Additionally, there is no guarantee that creditors will agree to settle debts. Some lenders refuse to negotiate with debt settlement companies, which means that individuals may still be responsible for the full amount owed. If a creditor declines to settle, the missed payments during the negotiation process can leave individuals in a worse financial position than before. Moreover, forgiven debt may be considered taxable income by the IRS, potentially leading to an unexpected tax liability.

Given these factors, individuals considering debt settlement should carefully evaluate their financial situation and explore alternative options. Credit counseling, debt consolidation, or negotiating directly with creditors may provide more favorable outcomes without the risks associated with debt settlement. Before making a decision, it is advisable to research reputable debt settlement companies, understand the potential consequences, and consider seeking professional financial advice.

Key Factors To Consider Before Signing Up For Debt Settlement

Debt settlement can be an appealing option for individuals struggling with overwhelming financial obligations, but before committing to a debt settlement company, it is essential to carefully evaluate several key factors. Understanding the potential benefits and risks associated with this approach will help ensure that you make an informed decision that aligns with your financial goals.

One of the most important considerations is the financial impact of debt settlement on your overall credit health. While settling a debt for less than the full amount owed may provide immediate relief, it can also have long-term consequences on your credit score. When you enroll in a debt settlement program, you typically stop making payments to your creditors, which can result in late fees, increased interest rates, and negative marks on your credit report. These factors can significantly lower your credit score, making it more difficult to obtain loans, credit cards, or even favorable interest rates in the future. Therefore, it is crucial to weigh the potential damage to your credit against the benefits of reducing your debt burden.

Another critical factor to consider is the cost of using a debt settlement company. While these companies often advertise their ability to negotiate lower balances on your behalf, their services are not free. Most debt settlement firms charge fees based on a percentage of the total debt enrolled in the program or the amount saved through negotiations. Additionally, some companies require upfront fees before any settlements are reached, which can add to your financial strain. It is essential to carefully review the fee structure and ensure that the potential savings outweigh the costs associated with the service.

In addition to fees, the legitimacy and reputation of the debt settlement company should be thoroughly researched. Unfortunately, the debt relief industry has seen its share of fraudulent companies that make unrealistic promises or fail to deliver results. To protect yourself from scams, it is advisable to check whether the company is accredited by organizations such as the American Fair Credit Council (AFCC) or the Better Business Bureau (BBB). Reading customer reviews and complaints can also provide valuable insight into the company’s track record and reliability. Furthermore, verifying that the company complies with federal and state regulations can help ensure that you are working with a legitimate service provider.

Beyond financial and reputational concerns, it is also important to consider the potential legal implications of debt settlement. When you stop making payments to creditors, there is a risk that they may take legal action against you to recover the outstanding balance. Some creditors may choose to file lawsuits, which could result in wage garnishments or other legal consequences. While debt settlement companies may attempt to negotiate with creditors to prevent such actions, there is no guarantee that all creditors will agree to a settlement. Understanding this risk is crucial before deciding whether debt settlement is the right option for you.

Finally, it is essential to explore alternative debt relief options before committing to a settlement program. Depending on your financial situation, other solutions such as credit counseling, debt consolidation, or even bankruptcy may be more suitable. Consulting with a financial advisor or a nonprofit credit counseling agency can help you assess all available options and determine the best course of action. By carefully considering these key factors, you can make a well-informed decision that supports your long-term financial stability.

How Debt Settlement Affects Your Credit Score And Financial Future

Debt settlement can be an appealing option for individuals struggling with overwhelming financial obligations, but it is essential to understand how it affects your credit score and long-term financial future before making a decision. While settling a debt for less than what is owed may provide immediate relief, the consequences can be significant and long-lasting.

One of the most immediate and noticeable effects of debt settlement is the impact on your credit score. When you enroll in a debt settlement program, you typically stop making payments to your creditors, which leads to missed payments being reported to credit bureaus. Since payment history is the most significant factor in determining your credit score, these delinquencies can cause a substantial drop in your score. Even after a settlement is reached, the account will be marked as “settled” rather than “paid in full,” which signals to future lenders that you did not fulfill the original terms of the agreement. This notation can remain on your credit report for up to seven years, making it more difficult to obtain new credit, secure favorable interest rates, or even qualify for certain financial opportunities.

Beyond the immediate credit score impact, debt settlement can also influence your financial future in other ways. For instance, while settling a debt may reduce the total amount you owe, it does not eliminate all financial risks. The forgiven portion of the debt may be considered taxable income by the IRS, meaning you could owe taxes on the amount that was written off. This unexpected tax liability can create additional financial strain, particularly if you are not prepared for it.

Additionally, working with a debt settlement company often involves paying fees for their services. These fees can be substantial and may reduce the overall savings you achieve through the settlement process. Some companies charge a percentage of the total debt enrolled in the program, while others take a portion of the amount saved through settlement. It is crucial to carefully review the terms and conditions before committing to a debt settlement program to ensure that the potential benefits outweigh the costs.

Another important consideration is the potential for legal action from creditors. Since debt settlement requires you to stop making payments while negotiations take place, some creditors may choose to pursue legal action to recover the outstanding balance. This could result in wage garnishment, bank account levies, or other legal consequences that may further complicate your financial situation. While not all creditors take this approach, the risk exists and should be factored into your decision-making process.

Despite these challenges, debt settlement may still be a viable option for individuals who have exhausted other alternatives and are facing financial hardship. However, it is essential to explore all available options, such as credit counseling, debt consolidation, or negotiating directly with creditors, before committing to a settlement program. Each approach has its own advantages and drawbacks, and understanding the full scope of potential consequences can help you make an informed decision that aligns with your long-term financial goals.

Ultimately, while debt settlement can provide relief in the short term, its impact on your credit score and financial future should not be overlooked. Careful consideration, thorough research, and professional guidance can help you determine whether this approach is the right solution for your financial situation.