“Save More, Live More: 25 Easy Ways to Cut Costs Without Cutting Fun!”

**Smart Budgeting Hacks: 25 Simple Ways to Cut Expenses Without Losing Fun**

One of the most effective ways to achieve financial stability is by managing expenses wisely. However, cutting costs does not mean sacrificing enjoyment. By implementing smart budgeting strategies, it is possible to reduce monthly expenses while still maintaining a fulfilling lifestyle. The key lies in making intentional choices that maximize savings without diminishing quality of life.

A great starting point is to evaluate recurring expenses. Subscription services, for instance, can add up quickly. Reviewing all active subscriptions and canceling those that are rarely used can free up a significant amount of money each month. Additionally, opting for bundled services or family plans can help reduce costs without eliminating entertainment options. Similarly, reassessing utility bills can lead to substantial savings. Simple adjustments such as using energy-efficient appliances, unplugging devices when not in use, and switching to LED bulbs can lower electricity costs. Moreover, negotiating with service providers for better rates on internet, cable, or phone plans can result in considerable savings.

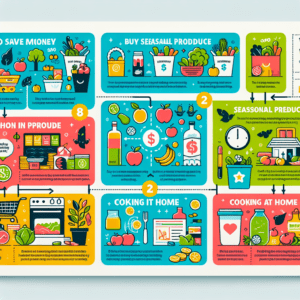

Another effective way to cut expenses is by making smarter choices when it comes to food. Dining out frequently can be costly, so preparing meals at home is a practical alternative. Meal planning and cooking in batches not only save money but also reduce food waste. Additionally, purchasing groceries in bulk and taking advantage of discounts or loyalty programs can further lower costs. For those who enjoy dining out, opting for lunch specials, using coupons, or choosing restaurants with reward programs can help maintain the experience without overspending.

Transportation costs can also be minimized with a few strategic changes. Carpooling, using public transportation, or biking instead of driving can significantly reduce fuel expenses. Additionally, maintaining a vehicle properly—such as keeping tires inflated and staying on top of routine maintenance—can improve fuel efficiency and prevent costly repairs. For those who rely on ride-sharing services, using promotions or opting for shared rides can help cut costs.

Entertainment and leisure activities do not have to be expensive to be enjoyable. Many communities offer free or low-cost events such as concerts, outdoor movie nights, or museum days. Taking advantage of these opportunities can provide entertainment without straining the budget. Additionally, exploring hobbies that require minimal investment, such as hiking, reading, or learning a new skill online, can be both fulfilling and cost-effective. Instead of paying for expensive gym memberships, considering home workouts or outdoor exercises can be a great alternative.

Shopping habits also play a crucial role in managing expenses. Before making a purchase, comparing prices, looking for discounts, and considering second-hand options can lead to significant savings. Additionally, practicing mindful spending by distinguishing between needs and wants can prevent unnecessary expenses. Using cashback apps or credit card rewards can also help maximize savings on essential purchases.

Finally, setting financial goals and tracking expenses can provide a clear picture of spending habits. Utilizing budgeting apps or maintaining a simple spreadsheet can help identify areas where adjustments can be made. By making small but intentional changes, it is possible to cut monthly expenses without compromising on enjoyment. With a strategic approach, financial stability and a fulfilling lifestyle can go hand in hand.

**Frugal Living Made Easy: How to Save Money While Enjoying Life**

Living frugally does not mean giving up the things that bring joy and fulfillment. Instead, it involves making intentional choices that allow for financial stability while still enjoying life’s pleasures. By adopting simple strategies, it is possible to reduce monthly expenses without feeling deprived. Small adjustments in daily habits can lead to significant savings over time, making it easier to achieve financial goals while maintaining a satisfying lifestyle.

One of the most effective ways to cut costs is by reassessing recurring expenses. Subscription services, for example, can quickly add up, often without being fully utilized. Reviewing monthly charges and canceling unnecessary memberships can free up funds for more meaningful experiences. Similarly, negotiating bills such as internet, phone, and insurance can lead to lower rates. Many providers offer discounts or promotions that can be accessed simply by inquiring about available options.

Another practical approach to saving money is by making smarter choices when it comes to food. Cooking at home instead of dining out can significantly reduce expenses while also promoting healthier eating habits. Meal planning and grocery shopping with a list help prevent impulse purchases and food waste. Additionally, buying in bulk and taking advantage of store discounts can further stretch a food budget. For those who enjoy dining out, opting for lunch specials, using coupons, or choosing restaurants with loyalty programs can make the experience more affordable.

Transportation costs can also be minimized with a few strategic changes. Carpooling, using public transportation, or biking instead of driving can lead to substantial savings on fuel and maintenance. If owning a car is necessary, regular maintenance and mindful driving habits can improve fuel efficiency and reduce repair costs. Additionally, shopping around for better auto insurance rates can result in lower premiums without sacrificing coverage.

Entertainment and leisure activities do not have to be expensive to be enjoyable. Many communities offer free or low-cost events such as concerts, outdoor movie nights, and museum days. Exploring local parks, hiking trails, and public libraries provides opportunities for recreation without spending money. Streaming services can be shared among family or friends to reduce costs, and taking advantage of free trials can provide temporary access to premium content.

When it comes to shopping, adopting a more mindful approach can prevent unnecessary spending. Waiting 24 hours before making non-essential purchases allows time to evaluate whether an item is truly needed. Buying secondhand or refurbished products can provide quality items at a fraction of the cost. Additionally, using cashback apps, discount codes, and loyalty programs can make necessary purchases more affordable.

Reducing energy consumption is another effective way to lower monthly expenses. Simple actions such as turning off lights when leaving a room, unplugging unused electronics, and using energy-efficient appliances can lead to noticeable savings on utility bills. Adjusting the thermostat by a few degrees and using ceiling fans can also help reduce heating and cooling costs.

By implementing these strategies, it is possible to maintain a fulfilling lifestyle while keeping expenses under control. Making small, intentional changes can lead to long-term financial benefits without sacrificing enjoyment. With careful planning and mindful spending, frugal living becomes an easy and rewarding way to achieve financial stability while still embracing life’s pleasures.

**Save More, Enjoy More: 25 Practical Tips to Reduce Expenses Without Sacrifice**

Finding ways to reduce monthly expenses without compromising enjoyment may seem challenging, but with a few strategic adjustments, it is entirely possible. By making small yet effective changes in daily habits, individuals can save money while still maintaining a fulfilling lifestyle. The key lies in identifying areas where spending can be minimized without feeling deprived.

One of the most effective ways to cut costs is by reviewing subscription services. Many people unknowingly pay for multiple streaming platforms, magazines, or memberships they rarely use. Canceling unnecessary subscriptions or sharing accounts with family members can lead to significant savings. Similarly, evaluating mobile phone plans and switching to a more affordable provider can reduce monthly bills without sacrificing service quality.

Another practical approach is to be mindful of energy consumption. Simple actions such as turning off lights when leaving a room, unplugging electronics when not in use, and using energy-efficient appliances can lower utility bills. Additionally, adjusting the thermostat by a few degrees and utilizing natural light during the day can contribute to further savings.

Grocery shopping is another area where expenses can be reduced without compromising quality. Planning meals in advance, creating a shopping list, and sticking to it can prevent impulse purchases. Buying in bulk, opting for store brands, and taking advantage of discounts or coupons can also help lower costs. Moreover, preparing meals at home instead of dining out frequently not only saves money but also promotes healthier eating habits.

Transportation costs can also be minimized with a few adjustments. Carpooling with colleagues, using public transportation, or biking instead of driving can significantly reduce fuel expenses. Additionally, maintaining a vehicle properly by keeping tires inflated and scheduling regular tune-ups can improve fuel efficiency and prevent costly repairs in the long run.

Entertainment and leisure activities do not have to be expensive to be enjoyable. Exploring free or low-cost community events, visiting local parks, or taking advantage of library resources can provide entertainment without straining the budget. Many museums, theaters, and cultural centers offer discounted or free admission on certain days, making it possible to enjoy enriching experiences at a lower cost.

Shopping habits also play a crucial role in managing expenses. Before making a purchase, considering whether the item is a necessity or a luxury can prevent unnecessary spending. Comparing prices, waiting for sales, and using cashback or rewards programs can further maximize savings. Additionally, buying second-hand items, such as clothing, furniture, or electronics, can provide quality products at a fraction of the cost.

Reducing expenses does not mean eliminating social activities. Hosting gatherings at home instead of dining out, organizing potluck dinners, or participating in free fitness classes with friends can maintain social connections while keeping costs low. Furthermore, exploring do-it-yourself projects for home decor, gifts, or personal care products can be both cost-effective and rewarding.

By implementing these practical strategies, individuals can successfully cut monthly expenses without sacrificing enjoyment. Small changes in spending habits, energy use, and lifestyle choices can lead to substantial savings over time. Ultimately, being mindful of financial decisions allows for greater financial security while still enjoying life’s pleasures.