“Rebuild, Recover, Insure: Your Guide to Car Insurance After a DUI.”

Understanding the Impact of a DUI on Car Insurance Rates

A DUI conviction can have significant consequences on various aspects of life, including the cost and availability of car insurance. Insurance companies assess risk when determining premiums, and a DUI is considered a major red flag. As a result, individuals with a DUI on their record often face higher insurance rates, policy restrictions, or even denial of coverage. Understanding how a DUI affects car insurance rates is essential for those seeking to reinstate or maintain coverage after such an incident.

One of the primary reasons a DUI leads to increased insurance costs is the heightened risk associated with drivers who have been convicted of impaired driving. Insurance providers rely on statistical data to assess the likelihood of a policyholder being involved in an accident. Since DUI offenders are statistically more likely to be involved in future incidents, insurers adjust their rates accordingly. This means that after a DUI, drivers can expect their premiums to rise significantly, sometimes doubling or even tripling in cost.

In addition to higher premiums, some insurance companies may choose to cancel a policy altogether. If an insurer deems a driver too risky to cover, they may issue a non-renewal notice, leaving the individual to find a new provider. This can be particularly challenging, as many standard insurance companies are hesitant to offer coverage to high-risk drivers. In such cases, individuals may need to seek out specialized insurers that cater to high-risk drivers, though these policies often come with even steeper rates.

Another factor to consider is the requirement for an SR-22 form, which is often mandated after a DUI conviction. An SR-22 is not an insurance policy itself but rather a certificate of financial responsibility that proves a driver carries the state’s minimum required insurance coverage. Many states require drivers with a DUI to maintain an SR-22 for a specified period, typically three years. Because filing an SR-22 signals to insurers that a driver has been convicted of a serious offense, it can further contribute to increased premiums.

While the financial impact of a DUI on car insurance is significant, there are steps individuals can take to mitigate the consequences. Shopping around for insurance quotes from multiple providers can help identify the most affordable option. Some insurers specialize in high-risk drivers and may offer more competitive rates than traditional companies. Additionally, maintaining a clean driving record after a DUI is crucial. Over time, as a driver demonstrates responsible behavior, insurance rates may gradually decrease.

Completing a defensive driving or DUI education course may also be beneficial. Some insurance companies offer discounts to drivers who voluntarily complete such programs, as they demonstrate a commitment to safer driving practices. Furthermore, improving one’s credit score and bundling insurance policies can sometimes lead to additional savings.

Ultimately, while a DUI conviction has a lasting impact on car insurance rates, it is not a permanent obstacle. By understanding the factors that influence insurance costs and taking proactive steps to improve their standing, drivers can work toward more affordable coverage over time. Remaining informed and responsible behind the wheel is the best way to rebuild trust with insurers and eventually secure lower premiums.

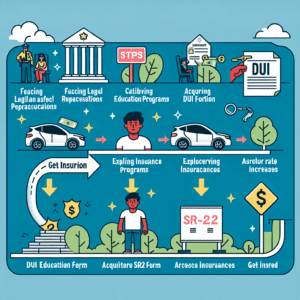

Steps to Finding Affordable Car Insurance After a DUI

Securing affordable car insurance after a DUI can be challenging, but it is not impossible. A DUI conviction typically results in higher insurance premiums, as insurers view individuals with such violations as high-risk drivers. However, by taking the right steps and exploring various options, it is possible to find a policy that fits within your budget while meeting legal requirements. The process begins with understanding how a DUI affects your insurance rates and what actions you can take to mitigate the financial impact.

The first step in finding affordable car insurance after a DUI is to compare multiple insurance providers. Not all insurers treat DUI convictions the same way, and some may offer more competitive rates than others. It is essential to request quotes from several companies to identify the most cost-effective option. Online comparison tools can be particularly useful in this regard, allowing you to review different policies and premiums quickly. Additionally, working with an independent insurance agent can provide valuable insights, as they have access to multiple carriers and can help you find the best possible rate.

Another important factor to consider is whether you need to file an SR-22 form. In many states, drivers with a DUI conviction are required to obtain an SR-22, which is a certificate of financial responsibility that proves they carry the minimum required insurance coverage. This form is typically filed by your insurance company with the state’s Department of Motor Vehicles. Because not all insurers offer SR-22 coverage, it may be necessary to switch providers to fulfill this requirement. While an SR-22 itself does not increase premiums, the underlying DUI conviction does, making it even more important to shop around for the best rates.

In addition to comparing insurance providers, taking steps to improve your driving record can help lower your premiums over time. Many insurers offer discounts for drivers who complete defensive driving courses or DUI education programs. These courses demonstrate a commitment to safe driving and may help offset some of the increased costs associated with a DUI. Furthermore, maintaining a clean driving record moving forward is crucial. Avoiding additional traffic violations and accidents can gradually reduce your risk profile, leading to lower insurance rates in the future.

Another strategy to consider is adjusting your coverage options and deductible. While maintaining adequate coverage is essential, opting for a higher deductible can lower your monthly premium. However, it is important to ensure that you can afford the deductible in the event of an accident. Additionally, reviewing your policy to determine whether certain optional coverages, such as rental car reimbursement or roadside assistance, are necessary can help reduce costs.

Finally, improving your overall financial profile can also have a positive impact on your insurance rates. Some insurers take credit scores into account when determining premiums, so maintaining good credit can be beneficial. Paying bills on time, reducing outstanding debt, and monitoring your credit report for errors can contribute to a better financial standing, which may lead to lower insurance costs.

By following these steps, individuals with a DUI conviction can increase their chances of finding affordable car insurance. While premiums may initially be higher, taking proactive measures such as comparing providers, completing driving courses, and maintaining a clean record can help reduce costs over time. With patience and diligence, it is possible to secure a policy that meets both legal requirements and budgetary constraints.

Tips for Reducing Your Insurance Costs After a DUI

A DUI conviction can have a significant impact on your car insurance rates, often leading to higher premiums and limited coverage options. However, there are several strategies you can use to reduce your insurance costs and make coverage more affordable. By taking proactive steps, you can demonstrate to insurers that you are a responsible driver and potentially lower your rates over time.

One of the most effective ways to reduce your insurance costs after a DUI is to compare quotes from multiple providers. Insurance companies assess risk differently, meaning that some may offer more competitive rates than others. Shopping around allows you to find the best possible coverage at the lowest price. Additionally, working with an independent insurance agent can help you identify insurers that specialize in high-risk drivers and may offer more favorable terms.

Another important step is to take advantage of any available discounts. Many insurance companies offer discounts for completing defensive driving courses, maintaining a clean driving record after the DUI, or bundling multiple policies. Enrolling in a state-approved defensive driving or DUI education program can not only help you meet legal requirements but also demonstrate to insurers that you are committed to improving your driving habits. Some providers may even reduce your premium upon completion of such courses.

Maintaining continuous coverage is also essential in keeping your insurance costs manageable. A lapse in coverage can make you appear even riskier to insurers, leading to even higher premiums when you seek a new policy. If you are struggling to afford your current policy, consider adjusting your coverage levels or increasing your deductible to lower your monthly payments. However, it is important to ensure that you still meet your state’s minimum insurance requirements.

Improving your credit score can also have a positive impact on your insurance rates. Many insurers use credit-based insurance scores to determine premiums, and a higher credit score can result in lower costs. Paying bills on time, reducing outstanding debt, and monitoring your credit report for errors can help improve your financial standing and potentially lead to better insurance rates.

Additionally, driving a vehicle that is less expensive to insure can help reduce costs. High-performance or luxury vehicles typically come with higher insurance premiums, while more affordable, safe, and reliable cars tend to have lower rates. If you are considering purchasing a new vehicle after a DUI, researching insurance costs beforehand can help you make a more cost-effective decision.

Over time, demonstrating responsible driving behavior can also lead to lower premiums. Most insurance companies look at your driving history over a period of three to five years, meaning that as time passes without additional violations or accidents, your rates may gradually decrease. Practicing safe driving habits, obeying traffic laws, and avoiding further infractions can help rebuild your reputation as a responsible driver.

Finally, if you are struggling to find affordable coverage, consider seeking out non-standard insurance providers that specialize in high-risk drivers. While these policies may still be more expensive than standard coverage, they can provide the necessary protection while you work toward improving your driving record. By taking these steps, you can gradually reduce your insurance costs and regain financial stability after a DUI conviction.