“Save More, Even with a Rocky Road – Affordable Car Insurance for High-Risk Drivers!”

Tips to Lower Your Car Insurance Costs with a Bad Driving Record

Securing affordable car insurance with a bad driving record can be challenging, but there are several strategies that can help reduce costs. While insurers typically charge higher premiums for drivers with past violations or accidents, taking proactive steps can demonstrate responsibility and potentially lower rates over time. By understanding how insurance companies assess risk and implementing cost-saving measures, drivers can find ways to make coverage more affordable.

One of the most effective ways to lower car insurance costs is to compare quotes from multiple providers. Insurance companies use different criteria to determine premiums, meaning that rates can vary significantly between insurers. Shopping around allows drivers to identify the most competitive offers and select a policy that best fits their budget. Additionally, some insurers specialize in covering high-risk drivers and may offer more affordable options than traditional providers.

Another important factor to consider is the type of coverage selected. While maintaining adequate protection is essential, drivers with a bad record may benefit from adjusting their policy to eliminate unnecessary add-ons. For example, opting for a higher deductible can lower monthly premiums, though it is important to ensure that the deductible amount is manageable in the event of a claim. Additionally, reviewing coverage limits and removing optional features that are not essential can help reduce costs without compromising necessary protection.

Taking advantage of available discounts is another effective way to lower insurance expenses. Many insurers offer discounts for policyholders who complete defensive driving courses, as these programs demonstrate a commitment to safe driving. Additionally, bundling auto insurance with other policies, such as homeowners or renters insurance, can result in significant savings. Some companies also provide discounts for maintaining continuous coverage, even if past driving history includes violations or accidents.

Improving one’s credit score can also have a positive impact on insurance rates. Many insurers use credit history as a factor in determining premiums, as studies have shown a correlation between creditworthiness and the likelihood of filing claims. By paying bills on time, reducing outstanding debt, and monitoring credit reports for errors, drivers can gradually improve their credit score and potentially qualify for lower insurance rates.

Another strategy to consider is enrolling in a usage-based insurance program. Many insurers offer telematics programs that track driving behavior through a mobile app or a device installed in the vehicle. These programs monitor factors such as speed, braking habits, and mileage, and policyholders who demonstrate safe driving habits may receive discounts based on their performance. For drivers looking to rebuild their record, this can be an effective way to prove responsibility and earn lower premiums.

In addition to these measures, maintaining a clean driving record moving forward is crucial. While past violations and accidents may impact current rates, insurance companies typically review driving history over a set period, often three to five years. By avoiding further infractions, drivers can gradually see improvements in their insurance costs. Practicing safe driving habits, obeying traffic laws, and staying vigilant on the road can help rebuild a positive record and lead to more affordable coverage in the future.

Ultimately, while a bad driving record can make car insurance more expensive, there are several ways to mitigate costs. By comparing quotes, adjusting coverage, seeking discounts, improving credit, considering telematics programs, and maintaining safe driving habits, drivers can take control of their insurance expenses. Over time, these efforts can lead to lower premiums and more affordable coverage, even for those with a less-than-perfect driving history.

Best Insurance Companies for High-Risk Drivers: How to Find Affordable Rates

Finding affordable car insurance with a bad driving record can be challenging, but it is not impossible. Many insurance companies specialize in providing coverage for high-risk drivers, offering policies that balance cost and protection. While premiums for drivers with accidents, traffic violations, or DUIs tend to be higher, there are ways to secure a more affordable rate by researching the best insurance providers and taking advantage of available discounts.

One of the first steps in finding affordable car insurance as a high-risk driver is identifying companies that cater to individuals with less-than-perfect records. Some insurers specialize in high-risk coverage and may offer more competitive rates than standard providers. Companies such as Progressive, GEICO, and The General are known for their willingness to insure drivers with violations or accidents on their records. Additionally, non-standard insurers like Dairyland and National General focus on providing coverage for those who may struggle to obtain policies from traditional companies. Comparing quotes from multiple providers is essential, as rates can vary significantly based on location, driving history, and other personal factors.

Beyond selecting the right insurance company, there are several strategies to lower premiums. One effective approach is to take advantage of discounts that insurers offer. Many companies provide discounts for completing defensive driving courses, which can demonstrate a commitment to safer driving and potentially reduce rates. Additionally, bundling auto insurance with other policies, such as homeowners or renters insurance, can lead to significant savings. Some insurers also offer discounts for maintaining continuous coverage, even if the policy is with a different provider.

Another way to reduce insurance costs is by adjusting coverage options. While maintaining adequate protection is crucial, high-risk drivers may consider raising their deductible to lower monthly premiums. A higher deductible means paying more out of pocket in the event of a claim, but it can significantly reduce overall insurance costs. Additionally, reviewing policy details and eliminating unnecessary coverage, such as rental car reimbursement or roadside assistance, can help lower expenses. However, it is important to ensure that essential coverage, such as liability and comprehensive insurance, remains in place to avoid financial risks.

Improving one’s driving record over time is another key factor in securing lower insurance rates. While past violations and accidents may impact premiums for several years, practicing safe driving habits can gradually lead to lower costs. Avoiding further infractions, obeying traffic laws, and maintaining a clean record can demonstrate responsibility to insurers. Some companies also offer usage-based insurance programs that track driving behavior through a mobile app or telematics device. Safe driving habits, such as avoiding hard braking and maintaining consistent speeds, can result in discounts and lower premiums over time.

Finally, working with an independent insurance agent can be beneficial for high-risk drivers seeking affordable coverage. Independent agents have access to multiple insurance providers and can help compare policies to find the best rates. They can also provide guidance on available discounts and coverage options tailored to individual needs. By exploring different insurers, taking advantage of discounts, adjusting coverage, and improving driving habits, high-risk drivers can find affordable car insurance despite a less-than-perfect record.

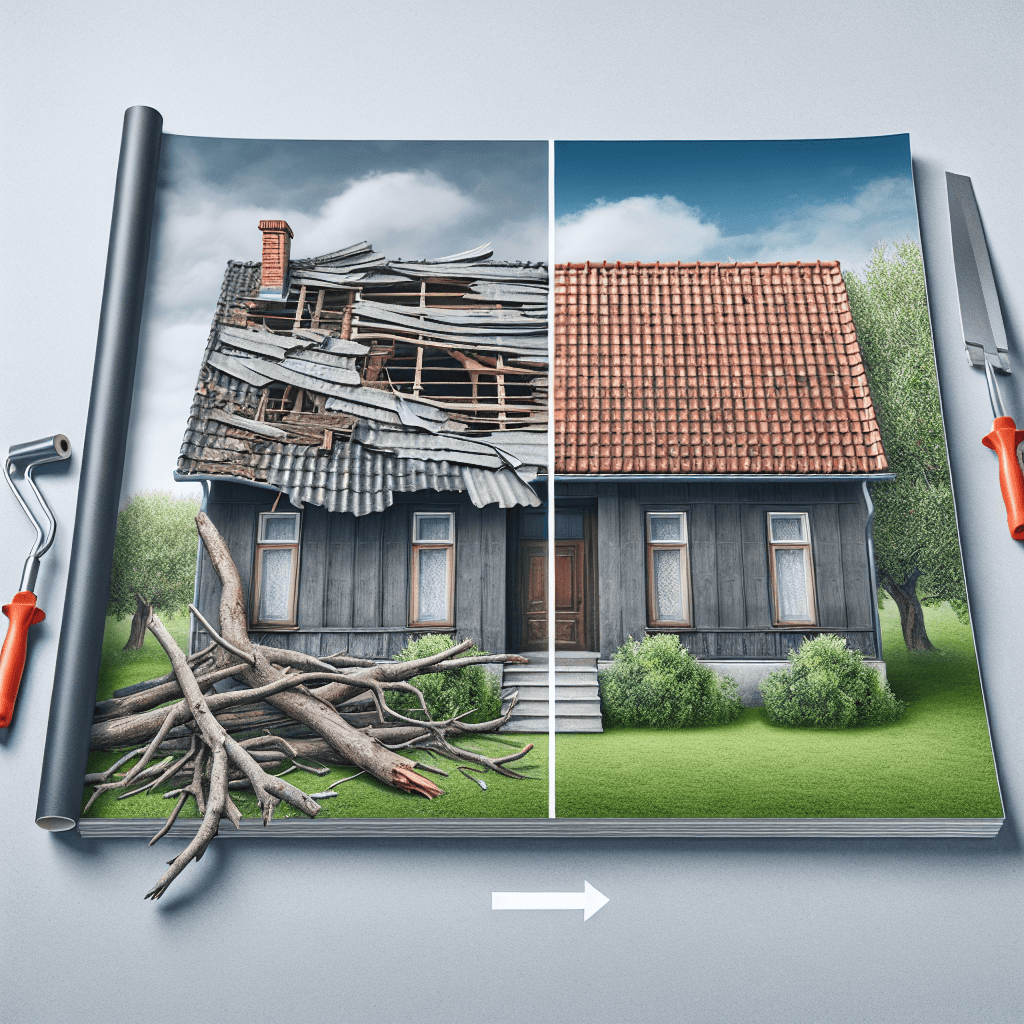

Steps to Improve Your Driving Record and Reduce Insurance Premiums

Improving your driving record and reducing your insurance premiums may seem like a challenging task, especially if you have past violations or accidents on your record. However, by taking proactive steps and demonstrating responsible driving behavior, you can gradually rebuild your reputation as a safe driver and secure more affordable car insurance rates. The process requires patience and commitment, but with the right approach, you can make significant progress over time.

One of the most effective ways to improve your driving record is to practice safe and defensive driving habits consistently. Avoiding traffic violations, such as speeding, running red lights, or reckless driving, is essential in maintaining a clean record. Insurance companies assess risk based on your driving history, so the longer you go without infractions, the more favorably they will view you. Additionally, obeying traffic laws and staying vigilant on the road can help prevent accidents, which not only keeps you safe but also prevents further increases in your insurance premiums.

Another important step is to take a defensive driving course. Many insurance providers offer discounts to drivers who complete an approved defensive driving program. These courses teach valuable skills, such as hazard awareness, proper following distances, and techniques for handling adverse driving conditions. In some cases, completing a defensive driving course may also allow you to remove points from your driving record, depending on your state’s regulations. By demonstrating a commitment to improving your driving skills, you can show insurers that you are taking steps to become a lower-risk driver.

In addition to improving your driving habits, it is crucial to regularly check your driving record for any inaccuracies. Errors in your record, such as incorrectly reported violations or accidents, can negatively impact your insurance rates. By obtaining a copy of your driving history from your state’s Department of Motor Vehicles (DMV), you can review the information and dispute any inaccuracies. Correcting these errors can lead to a more favorable assessment by insurance companies and potentially lower premiums.

Furthermore, maintaining continuous auto insurance coverage is essential in securing better rates over time. A lapse in coverage, even for a short period, can be viewed as a red flag by insurers, leading to higher premiums when you reinstate your policy. If you are struggling to afford your current insurance plan, consider adjusting your coverage levels or exploring different providers to find a more affordable option. Some insurers specialize in offering policies to high-risk drivers and may provide more competitive rates.

Another strategy to reduce your insurance costs is to increase your deductible. The deductible is the amount you pay out of pocket before your insurance coverage takes effect in the event of a claim. By opting for a higher deductible, you can lower your monthly premium. However, it is important to ensure that you have enough savings to cover the deductible if an accident occurs. This approach can be particularly beneficial for drivers looking to reduce costs while working on improving their driving record.

Finally, consider bundling your auto insurance with other policies, such as homeowners or renters insurance, to take advantage of multi-policy discounts. Many insurance companies offer discounts to customers who purchase multiple types of coverage from the same provider. Additionally, maintaining a good credit score can also positively impact your insurance rates, as some insurers use credit history as a factor in determining premiums. By taking these steps and remaining committed to safe driving, you can gradually improve your record and secure more affordable car insurance.