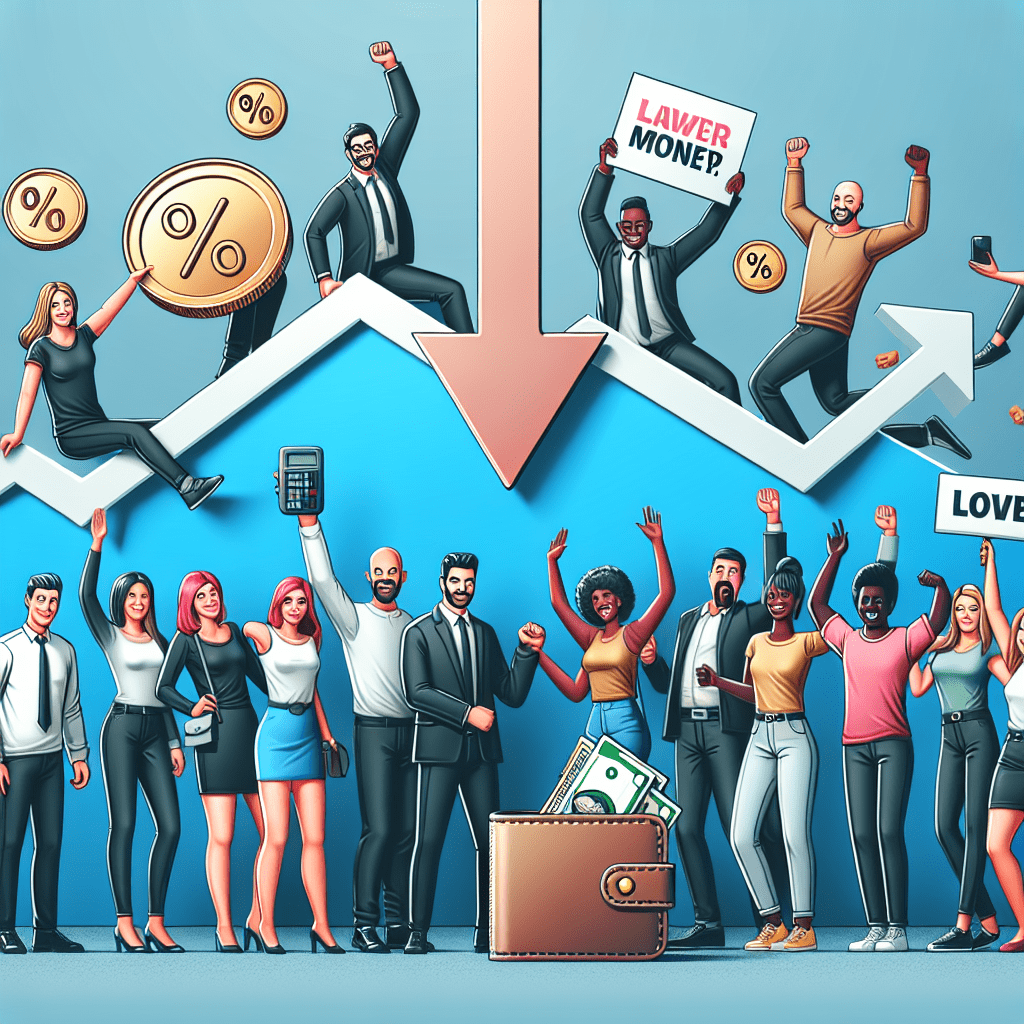

“Cut Costs, Not Coverage – Smart Tips to Lower Your Car Insurance Premium!”

Smart Shopping: Compare Quotes to Find the Best Rates

One of the most effective ways to lower your car insurance premium and save hundreds of dollars is by engaging in smart shopping. Comparing quotes from multiple insurance providers allows you to identify the best rates and coverage options that suit your needs. Since insurance companies use different criteria to determine premiums, shopping around ensures that you are not overpaying for coverage that you could obtain at a lower cost elsewhere. By taking the time to research and compare, you can make an informed decision that benefits both your budget and your financial security.

To begin the process, gather relevant information about your vehicle, driving history, and coverage requirements. Insurance providers consider factors such as your age, location, driving record, and the type of car you drive when calculating premiums. Having this information readily available allows you to obtain accurate quotes and make meaningful comparisons. Additionally, consider the level of coverage you need. While it may be tempting to opt for the minimum required by law, ensuring that you have adequate protection can prevent significant financial burdens in the event of an accident.

Once you have determined your coverage needs, request quotes from multiple insurance companies. Many insurers offer online tools that allow you to receive estimates within minutes. However, it is also beneficial to speak directly with an insurance agent, as they can provide personalized recommendations and highlight potential discounts. When comparing quotes, pay close attention to the details of each policy, including deductibles, coverage limits, and exclusions. A lower premium may seem attractive, but if it comes with high deductibles or limited coverage, it may not be the best option in the long run.

In addition to comparing base rates, take advantage of available discounts. Many insurance providers offer discounts for safe driving, bundling multiple policies, maintaining a good credit score, or installing safety features in your vehicle. Some companies also provide lower rates for drivers who complete defensive driving courses. By inquiring about these discounts, you can further reduce your premium without sacrificing necessary coverage.

Another important factor to consider is the reputation and customer service of the insurance provider. While securing a low rate is important, it is equally essential to choose a company that offers reliable claims processing and responsive customer support. Reading customer reviews and checking ratings from independent agencies can help you assess the reliability of an insurer before making a commitment.

Furthermore, it is advisable to review your policy annually and compare new quotes to ensure you are still receiving the best rate. Insurance rates fluctuate based on market conditions, changes in your driving record, and adjustments in company policies. By reassessing your options regularly, you can take advantage of better deals and avoid unnecessary expenses.

Ultimately, smart shopping and comparing quotes empower you to make cost-effective decisions regarding your car insurance. By dedicating time to research, exploring discounts, and evaluating different providers, you can secure a policy that offers both affordability and comprehensive coverage. This proactive approach not only helps you save money but also ensures that you are adequately protected on the road.

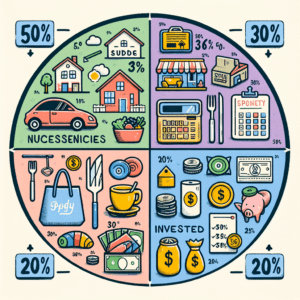

Discounts and Deductibles: Unlocking Hidden Savings

One of the most effective ways to lower your car insurance premium and save hundreds of dollars each year is by taking advantage of available discounts and adjusting your deductibles strategically. Many policyholders are unaware of the numerous discounts that insurance companies offer, which can significantly reduce overall costs. By understanding these opportunities and making informed decisions, you can unlock hidden savings while maintaining adequate coverage.

Insurance providers offer a variety of discounts based on factors such as driving history, vehicle safety features, and policy bundling. A good driving record is one of the most influential factors in determining your premium. Many insurers reward safe drivers with discounts for maintaining a clean record free of accidents and traffic violations. Additionally, some companies offer usage-based insurance programs that track driving habits through telematics devices or mobile apps. By demonstrating responsible driving behavior, policyholders can qualify for lower rates over time.

Another way to reduce costs is by taking advantage of vehicle-related discounts. Cars equipped with advanced safety features such as anti-lock brakes, airbags, and anti-theft systems often qualify for lower premiums. Insurance companies recognize that these features reduce the likelihood of accidents and theft, making the vehicle less risky to insure. If you are in the market for a new car, considering models with high safety ratings can lead to long-term savings on insurance.

Bundling multiple policies with the same insurer is another effective strategy for reducing premiums. Many companies offer discounts to customers who purchase both auto and home insurance from them. This not only simplifies policy management but also results in significant cost savings. Additionally, insuring multiple vehicles under the same policy can lead to further discounts, making it a practical option for families with more than one car.

Beyond discounts, adjusting your deductible can also have a substantial impact on your premium. The deductible is the amount you pay out of pocket before your insurance coverage takes effect in the event of a claim. Generally, choosing a higher deductible results in lower monthly premiums. However, it is essential to ensure that you can afford the deductible amount in case of an accident. Striking the right balance between affordability and savings is key to optimizing your policy.

Moreover, maintaining a good credit score can also contribute to lower insurance costs. Many insurers use credit-based insurance scores to assess risk, and individuals with higher credit scores often receive better rates. By paying bills on time, reducing outstanding debt, and monitoring your credit report for errors, you can improve your financial standing and potentially lower your premium.

Finally, periodically reviewing your policy and comparing quotes from different insurers can help you identify additional savings opportunities. Insurance rates vary between providers, and switching to a company that offers better discounts or lower base rates can result in significant cost reductions. It is advisable to reassess your policy at least once a year to ensure you are getting the best possible deal.

By taking advantage of available discounts, adjusting deductibles wisely, and maintaining good financial habits, you can effectively lower your car insurance premium and save hundreds of dollars annually. Making informed decisions and staying proactive in managing your policy will ensure that you receive the best coverage at the most affordable price.

Safe Driving Habits: How Your Behavior Affects Your Premium

One of the most effective ways to lower your car insurance premium is by practicing safe driving habits. Insurance companies assess risk based on your driving behavior, and a history of responsible driving can significantly reduce your rates. By understanding how your actions behind the wheel influence your premium, you can take proactive steps to maintain a clean record and save hundreds of dollars each year.

A key factor that insurers consider is your driving history. If you have a record free of accidents and traffic violations, you are viewed as a lower-risk driver, which often results in lower premiums. On the other hand, frequent speeding tickets, reckless driving citations, or at-fault accidents can lead to higher rates. Insurance providers use this information to determine the likelihood of future claims, and a history of unsafe driving suggests a greater risk of costly incidents. Therefore, obeying traffic laws, maintaining a safe following distance, and avoiding aggressive driving behaviors can help you keep your insurance costs down.

In addition to maintaining a clean driving record, avoiding distracted driving is crucial. Many accidents occur due to distractions such as texting, eating, or adjusting in-car entertainment systems. Insurance companies recognize the dangers of distracted driving and may increase premiums for drivers who have been cited for such offenses. By staying focused on the road and minimizing distractions, you not only reduce your risk of an accident but also demonstrate to insurers that you are a responsible driver.

Another important aspect of safe driving is adhering to speed limits. Speeding not only increases the likelihood of accidents but also results in costly fines and potential insurance rate hikes. Many insurers monitor driving behavior through telematics programs, which track speed, braking patterns, and overall driving habits. Enrolling in such programs can be beneficial if you consistently follow speed limits and drive cautiously, as some insurance companies offer discounts for safe driving.

Defensive driving techniques can also contribute to lower insurance premiums. By anticipating potential hazards, maintaining awareness of other drivers, and reacting appropriately to road conditions, you reduce the risk of collisions. Some insurance providers even offer discounts for completing defensive driving courses, as these programs reinforce safe driving habits and demonstrate a commitment to responsible behavior.

Furthermore, limiting the number of miles you drive each year can positively impact your insurance rates. The more time you spend on the road, the higher the likelihood of an accident. Many insurers offer low-mileage discounts for drivers who use their vehicles less frequently. If possible, consider carpooling, using public transportation, or working remotely to reduce your annual mileage and take advantage of potential savings.

Finally, maintaining a good relationship with your insurance provider by consistently demonstrating safe driving habits can lead to long-term benefits. Some companies offer accident forgiveness programs, which prevent your premium from increasing after your first at-fault accident. Additionally, staying with the same insurer for an extended period while maintaining a clean record may qualify you for loyalty discounts.

By prioritizing safe driving habits, you not only protect yourself and others on the road but also create opportunities to lower your car insurance premium. Avoiding traffic violations, minimizing distractions, adhering to speed limits, and practicing defensive driving can all contribute to significant savings. Over time, these responsible behaviors can help you maintain affordable insurance rates while ensuring a safer driving experience.