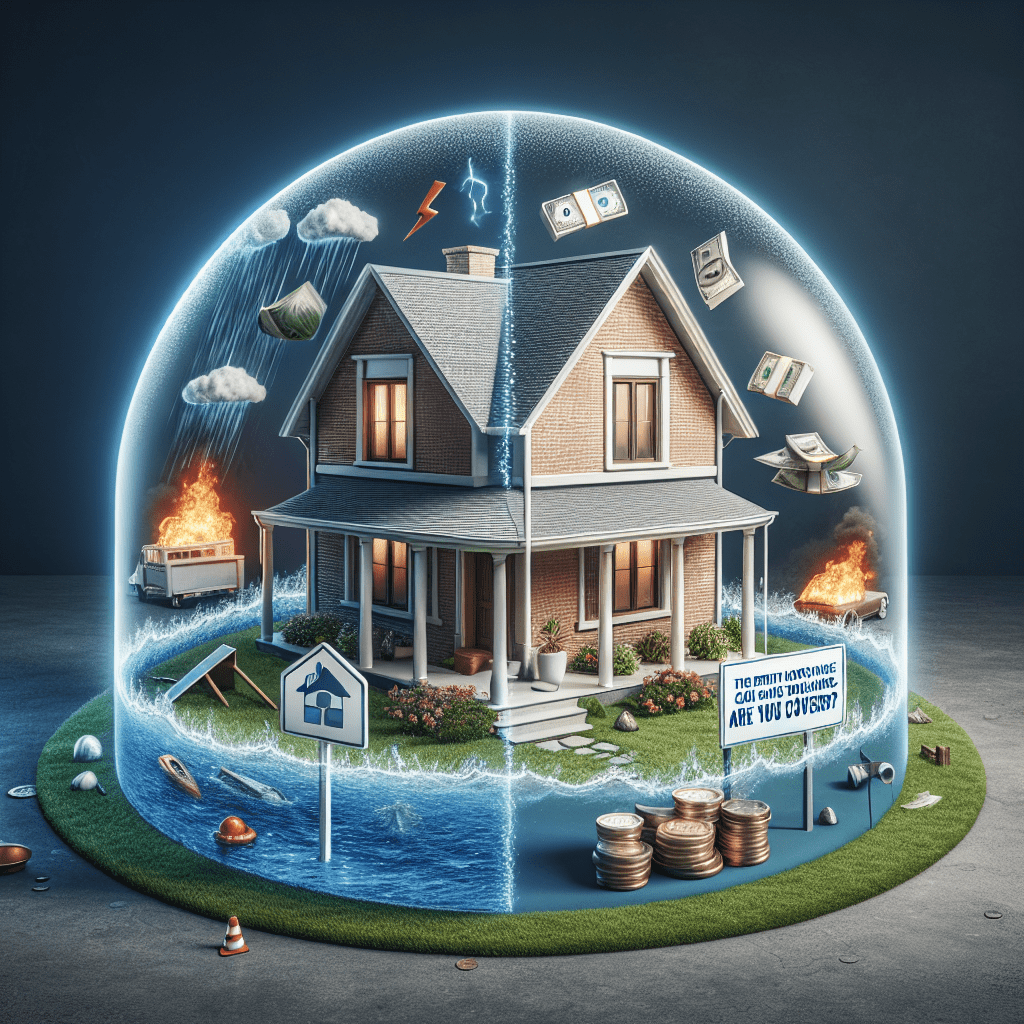

“Protect Your Home, Protect Your Wallet – Get Covered Today!”

Understanding Home Insurance: How the Right Coverage Can Save You Thousands

The importance of home insurance cannot be overstated, as it serves as a financial safeguard against unexpected events that could otherwise lead to significant financial loss. Homeowners invest substantial amounts in their properties, making it essential to protect that investment with the right insurance coverage. However, not all policies offer the same level of protection, and understanding the nuances of home insurance can mean the difference between a manageable situation and a financial disaster. By carefully selecting the right coverage, homeowners can ensure they are adequately protected while avoiding unnecessary expenses.

One of the primary reasons home insurance is so crucial is that it provides financial protection against a wide range of risks, including natural disasters, theft, and liability claims. Without adequate coverage, homeowners may find themselves responsible for costly repairs or replacements, which can quickly add up to thousands of dollars. For instance, if a fire damages a home, a comprehensive insurance policy can cover the cost of repairs or even a full rebuild, depending on the extent of the damage. Similarly, if a severe storm causes structural damage, the right policy can help cover the expenses, preventing homeowners from having to bear the financial burden alone.

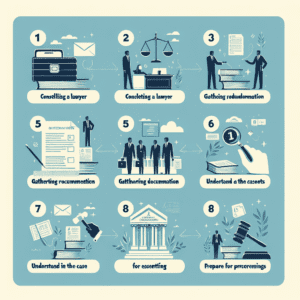

Beyond property damage, home insurance also offers liability protection, which can be invaluable in certain situations. If someone is injured on a homeowner’s property, the medical expenses and potential legal fees can be overwhelming. A well-structured home insurance policy includes liability coverage, ensuring that homeowners are not left to cover these costs out of pocket. This aspect of home insurance is particularly important, as legal claims can be both time-consuming and financially draining. By having the right coverage in place, homeowners can protect themselves from unexpected legal and medical expenses.

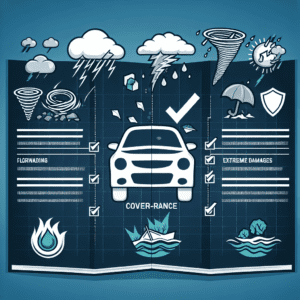

While the benefits of home insurance are clear, selecting the right policy requires careful consideration. Many homeowners make the mistake of choosing a policy based solely on price, without fully understanding the extent of the coverage provided. While affordability is an important factor, it should not come at the expense of comprehensive protection. It is essential to evaluate the specific risks associated with a property and choose a policy that adequately addresses those risks. For example, homeowners in areas prone to flooding should consider adding flood insurance, as standard policies often do not cover flood-related damages. Similarly, those living in regions with high earthquake activity may need additional coverage to ensure full protection.

Another critical aspect of home insurance is understanding policy limits and deductibles. A policy’s coverage limit determines the maximum amount an insurer will pay for a covered loss, while the deductible is the amount the homeowner must pay out of pocket before insurance coverage kicks in. Striking the right balance between a reasonable deductible and sufficient coverage limits is key to ensuring financial security. Opting for a lower premium with a high deductible may seem cost-effective initially, but it can lead to significant out-of-pocket expenses in the event of a claim.

Ultimately, home insurance is an essential investment that can save homeowners thousands of dollars in the long run. By carefully assessing coverage options, understanding policy details, and selecting a plan that aligns with their specific needs, homeowners can ensure they are adequately protected. Taking the time to choose the right insurance policy today can provide peace of mind and financial security for years to come.

Common Home Insurance Mistakes That Could Cost You Money

The Right Home Insurance Can Save You Thousands – Are You Covered?

When it comes to protecting your home, having the right insurance policy is essential. However, many homeowners make common mistakes that can lead to financial losses when disaster strikes. Understanding these pitfalls and taking proactive steps to avoid them can save you thousands of dollars in the long run.

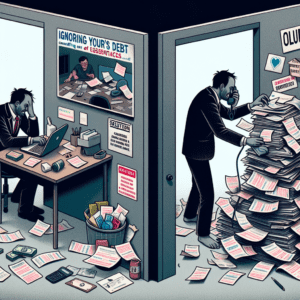

One of the most frequent mistakes homeowners make is underinsuring their property. Many people assume that their policy should only cover the market value of their home, but this can be a costly miscalculation. The true cost of rebuilding a home after a disaster often exceeds its market value, especially when factoring in labor, materials, and potential code upgrades. Failing to insure your home for its full replacement cost could leave you paying out of pocket for significant expenses. To avoid this, it is crucial to work with your insurance provider to determine an accurate replacement cost and ensure your policy reflects that amount.

Another common oversight is neglecting to update coverage as circumstances change. Home improvements, renovations, and even inflation can impact the value of your home and its contents. If you have recently remodeled your kitchen, added a new room, or upgraded appliances, your current policy may not provide adequate coverage. Regularly reviewing your policy and updating it to reflect these changes can prevent gaps in coverage and ensure that you are fully protected in the event of a loss.

In addition to underinsuring their homes, many homeowners also underestimate the value of their personal belongings. Standard policies typically include coverage for personal property, but limits may not be sufficient to replace everything in the event of a fire, theft, or natural disaster. Conducting a home inventory and documenting valuable possessions can help you determine whether additional coverage is necessary. High-value items such as jewelry, electronics, and artwork may require special endorsements or riders to be fully covered. Without these additions, you may receive only a fraction of their actual worth in a claim settlement.

Another costly mistake is assuming that all types of damage are covered under a standard policy. While homeowners insurance provides protection against many risks, it does not cover everything. For example, damage caused by floods and earthquakes typically requires separate policies. Many homeowners only realize this after experiencing a disaster, leaving them with significant repair costs. If you live in an area prone to these risks, purchasing additional coverage can provide peace of mind and financial security.

Furthermore, many policyholders fail to understand their deductibles and how they impact claims. Choosing a higher deductible can lower monthly premiums, but it also means paying more out of pocket before insurance coverage kicks in. In contrast, a lower deductible results in higher premiums but reduces immediate financial strain when filing a claim. Striking the right balance between affordability and financial protection is key to ensuring that your policy meets your needs.

Finally, failing to shop around for the best policy can also lead to unnecessary expenses. Many homeowners simply renew their existing policy each year without comparing rates or coverage options. Insurance providers frequently adjust their pricing and offerings, so reviewing multiple quotes and negotiating better terms can result in significant savings. Additionally, bundling home and auto insurance or taking advantage of discounts for security systems and other safety features can further reduce costs.

By avoiding these common mistakes, homeowners can ensure they have the right coverage in place to protect their most valuable asset. Taking the time to review policies, update coverage as needed, and understand the details of your insurance can prevent financial hardship in the future. In the end, being proactive about home insurance is not just about saving money—it is about securing peace of mind.

Key Factors to Consider When Choosing the Right Home Insurance Policy

The process of selecting the right home insurance policy requires careful consideration, as the right coverage can protect homeowners from significant financial losses. With numerous options available, it is essential to evaluate key factors to ensure that the policy meets individual needs. One of the most important aspects to consider is the type of coverage offered. Home insurance policies typically include dwelling coverage, which protects the structure of the home, and personal property coverage, which safeguards belongings inside the home. Additionally, liability coverage is crucial, as it provides financial protection in case someone is injured on the property. Understanding these components helps homeowners determine whether a policy offers comprehensive protection.

Beyond coverage types, policy limits and deductibles play a significant role in determining the effectiveness of a home insurance plan. Policy limits refer to the maximum amount an insurer will pay for a covered loss, and selecting appropriate limits ensures that homeowners are not left with out-of-pocket expenses in the event of a disaster. Similarly, deductibles—the amount a policyholder must pay before insurance coverage kicks in—should be carefully chosen. While higher deductibles often result in lower premiums, they can also lead to higher costs when filing a claim. Striking the right balance between affordability and adequate protection is essential.

Another critical factor to consider is whether the policy covers specific risks relevant to the home’s location. Standard home insurance policies typically cover common perils such as fire, theft, and vandalism. However, certain natural disasters, such as floods and earthquakes, may require additional coverage. Homeowners in high-risk areas should assess whether they need supplemental policies to ensure full protection. Failing to secure coverage for these risks can lead to devastating financial consequences in the event of a disaster.

In addition to coverage considerations, the reputation and reliability of the insurance provider should not be overlooked. A financially stable insurer with a strong track record of customer service can make a significant difference when it comes to filing claims. Researching customer reviews, financial ratings, and claim settlement histories can provide valuable insights into an insurer’s reliability. Choosing a reputable provider ensures that claims are processed efficiently and fairly, reducing stress during difficult times.

Cost is another important factor, but it should not be the sole determinant when selecting a policy. While it may be tempting to opt for the lowest premium available, inadequate coverage can lead to substantial financial losses in the long run. Comparing quotes from multiple insurers and evaluating the value of coverage provided can help homeowners make an informed decision. Additionally, many insurers offer discounts for bundling home and auto insurance, installing security systems, or maintaining a claims-free history. Taking advantage of these discounts can help reduce costs without compromising coverage.

Finally, reviewing the policy details carefully before making a decision is essential. Understanding exclusions, limitations, and conditions can prevent unexpected surprises when filing a claim. Homeowners should also reassess their insurance needs periodically, as changes in property value, renovations, or new possessions may require policy adjustments. By considering these key factors, homeowners can select a policy that provides comprehensive protection, ensuring financial security and peace of mind.