“Breaking Big Tech: Will Antitrust Laws Reshape the Industry or Fall Short?”

The Power Struggle: How Anti-Trust Laws Could Dismantle Big Tech Giants

The growing dominance of major technology companies has sparked intense debate over whether existing anti-trust laws are sufficient to regulate their influence. Governments and regulatory bodies worldwide have scrutinized the market power of companies such as Amazon, Google, Apple, and Meta, arguing that their control over digital markets stifles competition and innovation. As a result, legal actions have been initiated to determine whether these corporations should be broken up to restore fair competition. However, the effectiveness of anti-trust laws in achieving this goal remains uncertain, as legal, economic, and political challenges complicate efforts to dismantle these tech giants.

One of the primary arguments in favor of breaking up big tech companies is their ability to dominate entire industries, often through acquisitions of potential competitors. By purchasing smaller firms, these corporations eliminate threats before they can grow into viable challengers. This practice has been particularly evident in the social media and e-commerce sectors, where large companies have absorbed emerging startups, consolidating their market power. Regulators argue that such behavior reduces consumer choice and limits innovation, as smaller firms struggle to compete against well-established giants with vast financial resources. Consequently, anti-trust lawsuits have been filed to challenge these monopolistic practices, with some advocating for the forced separation of business units to restore competition.

Despite these legal efforts, breaking up big tech companies is not a straightforward process. One of the key obstacles is the interpretation of existing anti-trust laws, which were primarily designed to regulate traditional industries rather than digital markets. Historically, anti-trust enforcement has focused on consumer harm, often measured through price increases. However, many tech services are offered for free, making it difficult to prove direct financial harm to consumers. Instead, regulators must demonstrate that these companies engage in anti-competitive behavior that restricts market access for rivals. This shift in legal strategy requires courts to adapt traditional anti-trust principles to the complexities of the digital economy, a challenge that has led to lengthy legal battles with uncertain outcomes.

Moreover, even if courts rule in favor of breaking up big tech firms, implementing such measures presents additional difficulties. The process of dismantling a company involves determining how to separate its various business units while ensuring that competition is genuinely restored. In some cases, forced divestitures may not lead to meaningful market changes if the newly independent entities continue to operate under similar business models. Additionally, companies may resist regulatory actions by leveraging their financial and legal resources to appeal decisions, further delaying enforcement. These factors raise concerns about whether breaking up big tech would achieve its intended goals or simply result in prolonged legal disputes with limited impact.

Furthermore, political considerations play a significant role in shaping anti-trust enforcement. Policymakers must balance the need for competition with concerns about economic stability and national security. Large technology firms contribute significantly to economic growth, employment, and innovation, making governments cautious about taking drastic actions that could disrupt these benefits. Additionally, lobbying efforts by tech companies influence legislative decisions, potentially weakening regulatory measures aimed at curbing their power. As a result, while anti-trust laws provide a framework for addressing monopolistic behavior, their effectiveness in dismantling big tech remains uncertain.

Ultimately, the power struggle between regulators and technology giants highlights the complexities of enforcing anti-trust laws in the digital age. While legal actions may lead to increased scrutiny and potential structural changes, the challenges of proving anti-competitive behavior, implementing breakups, and navigating political considerations make it unclear whether these efforts will succeed. As governments continue to refine their approach to regulating big tech, the outcome of ongoing legal battles will shape the future of competition in the digital economy.

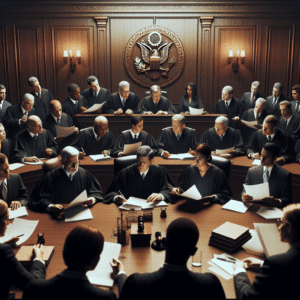

Legal Loopholes: Why Anti-Trust Efforts Might Fail to Break Up Big Tech

The ongoing debate over whether antitrust laws can effectively break up Big Tech companies has intensified in recent years, with regulators and lawmakers seeking to curb the dominance of industry giants such as Google, Amazon, Apple, and Meta. While proponents argue that breaking up these corporations is necessary to restore competition and protect consumers, significant legal loopholes may ultimately hinder these efforts. The complexity of existing antitrust laws, the evolving nature of digital markets, and the ability of tech companies to navigate regulatory challenges all contribute to the uncertainty surrounding the effectiveness of such measures.

One of the primary obstacles to breaking up Big Tech lies in the interpretation of antitrust laws, which were originally designed to address monopolistic practices in traditional industries. The Sherman Act and the Clayton Act, the cornerstone of U.S. antitrust legislation, focus on preventing anti-competitive behavior such as price-fixing, market allocation, and mergers that substantially lessen competition. However, the digital economy operates under a different paradigm, where many services are offered for free, and market dominance is often achieved through data accumulation rather than direct pricing strategies. This distinction complicates the application of traditional antitrust principles, making it difficult for regulators to prove consumer harm—a key requirement for legal action.

Furthermore, Big Tech companies have developed sophisticated legal and business strategies to shield themselves from antitrust scrutiny. By structuring their operations across multiple subsidiaries and jurisdictions, these corporations create layers of complexity that make regulatory intervention challenging. For instance, when faced with antitrust investigations, companies may argue that their various business segments operate independently, thereby avoiding classification as monopolies. Additionally, tech firms frequently engage in lobbying efforts to influence legislation and regulatory policies, ensuring that any proposed reforms do not significantly threaten their market positions.

Another significant challenge is the lengthy and resource-intensive nature of antitrust litigation. Legal battles against major corporations can take years, if not decades, to resolve, during which time the companies in question continue to expand their influence. Even when regulators succeed in proving anti-competitive behavior, the remedies imposed may be insufficient to restore competition. In some cases, companies agree to minor concessions, such as altering certain business practices or paying fines, without fundamentally changing their market dominance. This raises concerns that even if antitrust lawsuits are successful, they may not lead to the structural breakups that some policymakers envision.

Moreover, the global nature of Big Tech further complicates enforcement efforts. While the U.S. government may pursue antitrust actions domestically, these companies operate on an international scale, often complying with different regulatory frameworks in various countries. This creates inconsistencies in enforcement, as actions taken in one jurisdiction may not necessarily translate to meaningful changes worldwide. Additionally, some governments may be reluctant to impose strict antitrust measures due to economic considerations, fearing that breaking up major tech firms could have unintended consequences for innovation and investment.

Despite these challenges, there remains significant political and public pressure to rein in Big Tech’s power. However, unless existing legal frameworks are updated to address the unique characteristics of digital markets, antitrust efforts may struggle to achieve their intended goals. Without substantial legislative reform, the legal loopholes that currently exist could allow these corporations to maintain their dominance, ultimately undermining efforts to promote fair competition in the digital economy.

The Future of Competition: Will Anti-Trust Laws Rein in Big Tech or Fall Short?

The growing dominance of major technology companies has sparked intense debate over whether existing anti-trust laws are sufficient to maintain fair competition in the digital marketplace. As companies such as Amazon, Google, Apple, and Meta continue to expand their influence across multiple industries, regulators and lawmakers face increasing pressure to intervene. While some argue that anti-trust enforcement could lead to the breakup of these tech giants, others contend that legal and structural challenges may prevent meaningful action. The future of competition in the technology sector will largely depend on how effectively these laws are applied and whether they can adapt to the complexities of the digital economy.

One of the primary arguments in favor of anti-trust intervention is that large technology firms have amassed significant market power, often to the detriment of smaller competitors and consumers. These companies control vast ecosystems that include search engines, social media platforms, e-commerce marketplaces, and app stores, creating barriers to entry for new players. Critics argue that such dominance stifles innovation, limits consumer choice, and allows these firms to engage in anti-competitive practices such as self-preferencing, data monopolization, and predatory pricing. By enforcing anti-trust laws, regulators could potentially dismantle monopolistic structures, fostering a more competitive environment that benefits both businesses and consumers.

However, breaking up Big Tech is not a straightforward process. Unlike traditional monopolies, which often control tangible goods or essential services, technology companies operate in highly dynamic and interconnected markets. Many of their services are offered for free, making it difficult to apply conventional anti-trust principles that focus on price manipulation. Additionally, these firms argue that their size and integration provide efficiencies that benefit consumers, such as seamless user experiences and improved security. As a result, regulators must navigate complex legal and economic considerations when determining whether and how to intervene.

Recent legal actions against major technology firms highlight both the potential and the limitations of anti-trust enforcement. In the United States, the Department of Justice and the Federal Trade Commission have launched lawsuits against companies like Google and Meta, accusing them of engaging in anti-competitive behavior. Similarly, the European Union has imposed significant fines and introduced regulations aimed at curbing the power of dominant tech firms. While these efforts signal a growing willingness to challenge Big Tech, they also underscore the difficulties in achieving lasting structural change. Legal battles can take years to resolve, and even when companies are found guilty of anti-competitive practices, the remedies imposed may not be sufficient to restore competition.

Moreover, the global nature of the technology industry presents additional challenges. Many of these companies operate across multiple jurisdictions, each with its own regulatory framework. Coordinating anti-trust enforcement on an international scale requires cooperation among governments, which is often complicated by differing economic interests and policy priorities. Without a unified approach, tech firms may find ways to circumvent regulations, limiting the effectiveness of anti-trust measures.

Ultimately, the success or failure of anti-trust laws in reining in Big Tech will depend on how well they adapt to the realities of the digital economy. While there is growing momentum for stronger enforcement, structural and legal obstacles remain significant. If regulators can modernize anti-trust frameworks and implement effective remedies, they may succeed in fostering greater competition. However, if these efforts fall short, Big Tech’s dominance is likely to persist, raising further concerns about market concentration and its broader implications for innovation, privacy, and consumer choice.