“Car Insurance Claims: Timelines & Expectations – Know What to Expect!”

Understanding the Timeline: How Long Does a Car Insurance Claim Take?

The time it takes to process a car insurance claim can vary significantly depending on several factors, including the complexity of the claim, the responsiveness of the parties involved, and the specific policies of the insurance company. While some claims may be resolved within a few days, others can take weeks or even months to reach a final settlement. Understanding the typical timeline and the factors that influence it can help policyholders set realistic expectations and navigate the claims process more effectively.

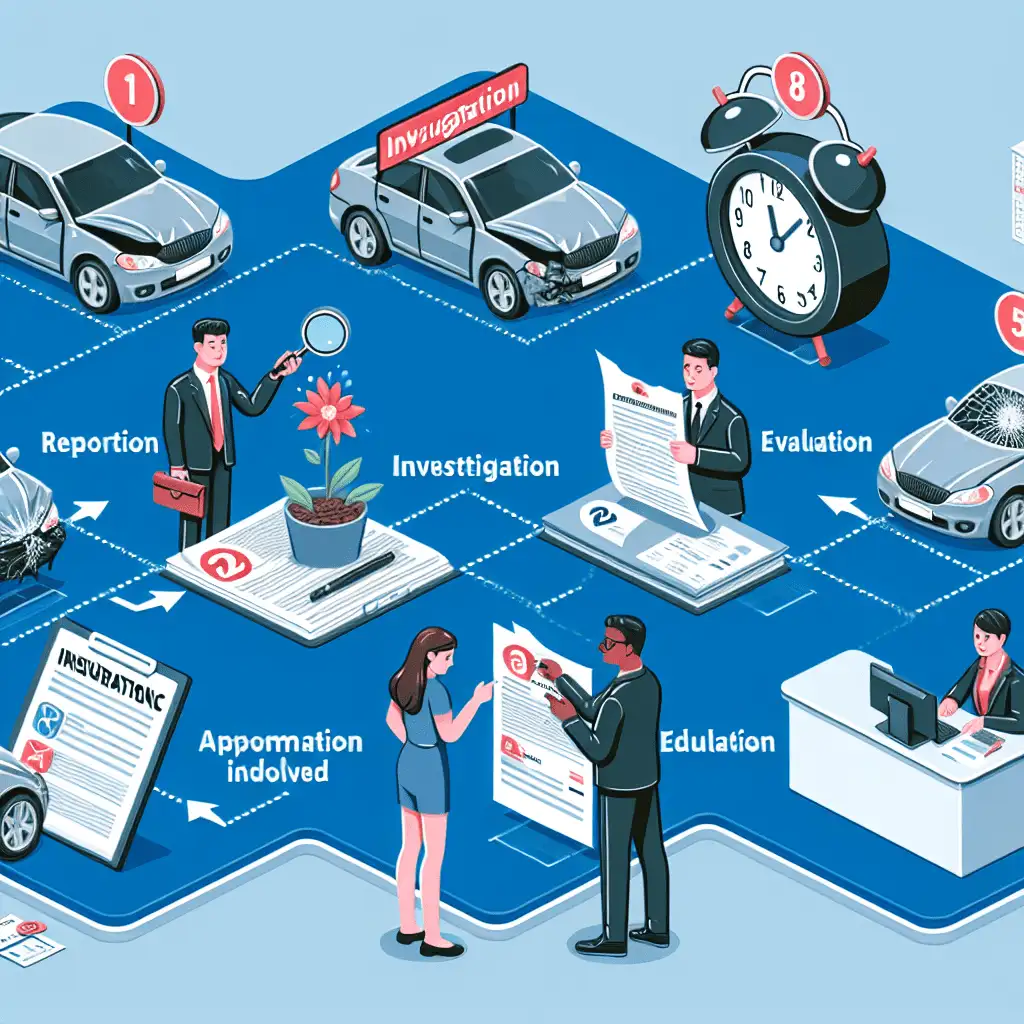

When a claim is first reported, the insurance company will begin by gathering essential information. This includes details about the accident, statements from the involved parties, and any available evidence such as photographs or police reports. The speed at which this initial step is completed depends largely on how quickly the policyholder and other involved parties provide the necessary documentation. In straightforward cases where liability is clear and damages are minimal, this phase may be completed within a few days. However, if there are disputes over fault or if additional evidence is required, the process may take longer.

Once the initial information is collected, the insurance company will typically assign an adjuster to assess the damages and determine the appropriate compensation. This step involves inspecting the vehicle, reviewing repair estimates, and, in some cases, consulting with mechanics or other experts. If the vehicle is drivable and repair estimates are straightforward, this evaluation may be completed within a week. However, if the car is severely damaged or declared a total loss, the process may take longer as additional assessments and negotiations are required.

In cases where medical claims are involved, the timeline can be extended further. If injuries were sustained in the accident, the insurance company may need to review medical records, consult with healthcare providers, and determine the extent of coverage for medical expenses. This process can take several weeks or even months, particularly if ongoing treatment is required. Additionally, if there are disputes over the severity of injuries or the necessity of certain medical procedures, negotiations between the insurance company and the claimant may prolong the resolution.

Another factor that can impact the duration of a claim is whether liability is contested. If both parties involved in the accident disagree on who was at fault, the insurance companies may need to conduct a more thorough investigation. This can involve reviewing traffic camera footage, obtaining witness statements, or even involving legal professionals to determine responsibility. Disputed claims often take longer to resolve, as both insurers must reach an agreement before compensation can be issued.

For policyholders who are waiting for a settlement, maintaining open communication with the insurance company can help expedite the process. Providing all requested documentation promptly, following up on the status of the claim, and cooperating with any investigations can prevent unnecessary delays. Additionally, understanding the specific terms of the insurance policy, including coverage limits and deductibles, can help manage expectations regarding the final payout.

Ultimately, while some car insurance claims can be resolved within a matter of days, others may take weeks or months depending on the circumstances. By understanding the factors that influence the timeline and taking proactive steps to facilitate the process, policyholders can navigate their claims more efficiently and work toward a timely resolution.

Factors Affecting Your Claim: What to Expect During the Process

The time it takes to process a car insurance claim can vary significantly depending on several factors. Understanding these factors can help set realistic expectations and prepare policyholders for what lies ahead. While some claims may be resolved within a few days, others can take weeks or even months, depending on the complexity of the situation. Various elements influence the duration of the claims process, including the type of claim, the extent of the damage, the cooperation of involved parties, and the efficiency of the insurance company.

One of the most significant factors affecting the timeline of a car insurance claim is the type of claim being filed. Simple claims, such as minor vehicle damage with clear liability, tend to be processed more quickly. In contrast, claims involving severe accidents, injuries, or disputes over fault can take considerably longer. If a claim requires an extensive investigation, such as reviewing police reports, witness statements, or surveillance footage, the process may be prolonged. Additionally, claims involving multiple parties or third-party insurers can introduce further delays, as coordination between different insurance companies may take time.

Another crucial factor is the extent of the damage to the vehicle. If the damage is minor and does not require significant repairs, the claim may be settled relatively quickly. However, if the vehicle has sustained substantial damage or is deemed a total loss, the process can take longer. In such cases, an insurance adjuster must assess the damage, determine repair costs, and decide whether the vehicle is repairable or should be replaced. If repairs are necessary, the availability of replacement parts and the workload of the repair shop can also impact the timeline. Delays in obtaining necessary parts or scheduling repairs can extend the overall duration of the claim.

The cooperation of all parties involved plays a vital role in determining how long a claim will take. If the policyholder promptly provides all required documentation, such as accident reports, photographs, and repair estimates, the process can move forward more efficiently. However, if there are delays in submitting necessary information or if additional details are required, the claim may take longer to resolve. Additionally, if the other party involved in the accident is uncooperative or disputes liability, the insurance company may need to conduct a more thorough investigation, further extending the timeline.

The efficiency of the insurance company handling the claim is another important consideration. Some insurers have streamlined processes and digital tools that allow for faster claim resolution, while others may have more traditional procedures that take longer. The responsiveness of the claims adjuster assigned to the case can also impact the speed of the process. If the adjuster is handling a high volume of claims or requires additional time to review the details, the claim may take longer to finalize.

Ultimately, while some claims can be resolved within a few days, others may take weeks or even months, depending on the circumstances. Policyholders can help expedite the process by promptly providing all necessary information, maintaining open communication with their insurer, and following up regularly on the status of their claim. By understanding the factors that influence the timeline, individuals can better manage their expectations and navigate the claims process with greater confidence.

Tips to Speed Up Your Car Insurance Claim and Avoid Delays

Filing a car insurance claim can be a stressful experience, especially when you are unsure how long the process will take. While the timeline for resolving a claim varies depending on the complexity of the case, the efficiency of the insurance company, and the availability of necessary documentation, there are several steps you can take to help speed up the process and avoid unnecessary delays. By understanding what is required and being proactive, you can ensure that your claim is processed as quickly and smoothly as possible.

One of the most effective ways to expedite your car insurance claim is to report the incident to your insurer as soon as possible. Delays in notifying your insurance company can slow down the entire process, as insurers need time to assess the situation, gather information, and determine liability. When reporting the claim, provide all relevant details, including the date, time, and location of the accident, as well as the names and contact information of any other parties involved. Additionally, if there were witnesses, their statements can be valuable in supporting your claim.

Another crucial step in avoiding delays is to document the accident thoroughly. Taking clear photographs of the damage to your vehicle, the accident scene, and any other relevant details can provide essential evidence for your claim. If law enforcement was involved, obtaining a copy of the police report can also help substantiate your case. The more information you can provide upfront, the less time your insurer will need to spend gathering additional details, which can significantly speed up the claims process.

In addition to providing thorough documentation, maintaining open and prompt communication with your insurance company is essential. Responding quickly to any requests for additional information or clarification can prevent unnecessary hold-ups. If your insurer requires estimates for vehicle repairs, obtaining these as soon as possible from approved repair shops can also help move the process along. Some insurance companies have preferred repair facilities that can streamline the approval process, so checking with your insurer about recommended options may be beneficial.

Understanding your policy coverage and the claims process can also help you avoid delays. Familiarizing yourself with the terms of your policy, including deductibles, coverage limits, and any exclusions, can prevent misunderstandings that might slow down the resolution of your claim. If you have any questions about your coverage, reaching out to your insurance representative for clarification can help ensure that you are fully informed about what to expect.

Furthermore, staying organized throughout the claims process can make a significant difference in how quickly your claim is resolved. Keeping all relevant documents, such as claim forms, repair estimates, medical bills (if applicable), and correspondence with your insurer in one place can help you stay on top of any required actions. If you experience any delays, following up with your insurance adjuster regularly can help keep your claim moving forward.

By taking these proactive steps, you can help minimize delays and ensure that your car insurance claim is processed as efficiently as possible. While some factors may be beyond your control, being well-prepared, responsive, and informed can make a significant difference in the overall timeline of your claim.