Leasing a car comes with several financial responsibilities, including securing the right car insurance. Unlike owning a vehicle outright, leasing requires specific insurance coverage to protect both you and the leasing company. Understanding these requirements and additional recommended coverages can help you avoid costly mistakes and ensure peace of mind.

Why Do Leased Vehicles Require Special Insurance?

When you lease a car, you don’t own it—the leasing company does. Because of this, they set strict insurance requirements to protect their investment. If the vehicle is damaged or totaled, the leasing company wants to ensure they are compensated for their loss.

Required Insurance Coverage for Leased Vehicles

Most leasing companies mandate specific types of insurance coverage. Below are the standard requirements:

- Liability Insurance: This covers bodily injury and property damage if you cause an accident. Most lease agreements require higher liability limits than state minimums, typically:

- $100,000 per person for bodily injury

- $300,000 per accident for bodily injury

- $50,000 for property damage

- Collision Coverage: Pays for repairs or replacement of your leased vehicle if it’s damaged in an accident, regardless of fault.

- Comprehensive Coverage: Covers non-collision-related damages, such as theft, vandalism, fire, or natural disasters.

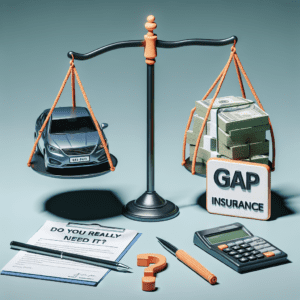

- Gap Insurance: If your leased car is totaled, gap insurance covers the difference between what your insurance pays and what you still owe on the lease.

Recommended Insurance Coverage for Leased Vehicles

While the above coverages are required, additional policies can provide extra protection and financial security.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re hit by a driver who has little or no insurance.

- Personal Injury Protection (PIP) or Medical Payments Coverage: Helps cover medical expenses for you and your passengers after an accident.

- Roadside Assistance: Covers towing, battery jump-starts, and other emergency services.

- Lease-End Protection: Helps cover excess wear and tear charges when returning the vehicle.

How Much Does Insurance for a Leased Car Cost?

Insurance for a leased vehicle is often more expensive than for a financed or owned car due to the higher coverage requirements. On average, full coverage insurance for a leased vehicle can range from $1,500 to $3,000 per year, depending on factors such as:

- Your driving history

- Location

- Vehicle make and model

- Deductible amounts

To get the best rate, compare quotes from multiple insurers and ask about discounts for bundling policies, safe driving, or low mileage.

What Happens If You Don’t Meet Lease Insurance Requirements?

Failing to maintain the required insurance can have serious consequences, including:

- The leasing company purchasing insurance on your behalf (often at a much higher cost).

- Penalties or termination of your lease agreement.

- Financial liability if an accident occurs and you lack proper coverage.

To avoid these issues, always ensure your policy meets the lease agreement’s requirements and keep proof of insurance updated.

Final Thoughts: Protecting Your Leased Vehicle

Leasing a car comes with specific insurance obligations, but understanding what’s required and what’s recommended can help you make informed decisions. At a minimum, you’ll need liability, collision, comprehensive, and gap insurance. However, adding uninsured motorist coverage, medical payments, and roadside assistance can provide extra peace of mind.

Before signing a lease, review the insurance requirements carefully and compare quotes from multiple providers to find the best coverage at the most affordable rate. By securing the right insurance, you can enjoy your leased vehicle with confidence, knowing you’re fully protected.