“Slash Your Mortgage Insurance Faster – Save More, Pay Less!”

Refinance Your Mortgage to Eliminate PMI Sooner

Private mortgage insurance (PMI) is an additional cost that many homeowners must pay when they purchase a home with a down payment of less than 20%. While PMI protects the lender in case of default, it can be a financial burden for borrowers. Fortunately, refinancing your mortgage can be an effective way to eliminate PMI sooner and reduce your overall housing costs. By understanding how refinancing works and when it makes sense, you can take strategic steps to remove this expense and improve your financial situation.

One of the primary reasons homeowners choose to refinance is to secure a lower interest rate, but it can also serve as a means to eliminate PMI. When you refinance, you replace your existing mortgage with a new loan, ideally with better terms. If your home has appreciated in value or you have paid down enough of your loan balance, you may be able to refinance into a new mortgage without PMI. This is because lenders typically require PMI only when the loan-to-value (LTV) ratio exceeds 80%. If your home’s value has increased or you have built sufficient equity, refinancing can help you reach this threshold and remove PMI from your monthly payments.

Before deciding to refinance, it is important to assess whether it is the right financial move for you. Start by determining your current home equity. You can do this by comparing your outstanding loan balance to your home’s current market value. If your LTV ratio is at or below 80%, you may qualify for a refinance without PMI. Additionally, check your credit score, as a higher score can help you secure a lower interest rate. Lenders typically offer the best rates to borrowers with strong credit histories, so improving your credit before refinancing can lead to greater savings.

Another key factor to consider is the cost of refinancing. While eliminating PMI can reduce your monthly expenses, refinancing comes with closing costs, which typically range from 2% to 5% of the loan amount. These costs may include application fees, appraisal fees, and other lender charges. To determine whether refinancing is worthwhile, calculate how long it will take to recoup these costs through your monthly savings. If you plan to stay in your home long enough to benefit from the savings, refinancing can be a smart financial decision.

Timing is also crucial when considering a refinance. If interest rates have dropped since you obtained your original mortgage, refinancing can provide additional benefits beyond eliminating PMI. A lower interest rate can reduce your monthly payments and save you thousands of dollars over the life of the loan. However, if rates have increased, refinancing solely to remove PMI may not be the best option. In such cases, it may be more beneficial to focus on making extra payments toward your principal balance to reach the 80% LTV threshold sooner.

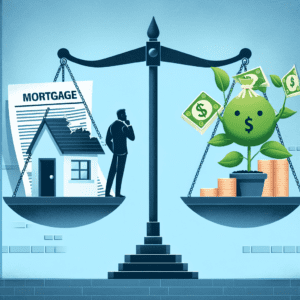

Ultimately, refinancing your mortgage can be an effective strategy to eliminate PMI and lower your overall housing costs. By carefully evaluating your home equity, credit score, and refinancing expenses, you can determine whether this option aligns with your financial goals. Taking the time to explore your options and make an informed decision can lead to significant long-term savings and greater financial stability.

Increase Your Home Equity Faster to Remove Mortgage Insurance

One of the most effective ways to eliminate mortgage insurance and reduce overall housing costs is by increasing your home equity at a faster pace. Mortgage insurance, whether private mortgage insurance (PMI) for conventional loans or mortgage insurance premiums (MIP) for FHA loans, is an additional expense that protects the lender in case of default. However, homeowners can take proactive steps to build equity more quickly, thereby reaching the threshold required to remove this extra cost.

A primary strategy to accelerate home equity growth is making extra principal payments. By paying more than the required monthly mortgage amount, homeowners can reduce the outstanding loan balance at a faster rate. Even small additional payments, such as rounding up the monthly payment or making one extra payment per year, can significantly shorten the loan term and increase equity. Some lenders allow borrowers to make biweekly payments instead of monthly payments, which results in an extra full payment each year. This approach not only helps in eliminating mortgage insurance sooner but also reduces the total interest paid over the life of the loan.

Another effective method is to consider refinancing the mortgage if financial conditions are favorable. If home values have appreciated or if the borrower has improved their credit score, refinancing to a loan with better terms may be a viable option. A new loan with a lower interest rate or a shorter term can help build equity more quickly while also reducing overall borrowing costs. However, it is essential to evaluate closing costs and ensure that the savings from refinancing outweigh the associated expenses.

In addition to making extra payments and refinancing, homeowners can also increase their home equity by improving the property’s value. Strategic home improvements, such as kitchen or bathroom renovations, energy-efficient upgrades, or landscaping enhancements, can boost the home’s market value. A higher appraised value means a lower loan-to-value (LTV) ratio, which can help homeowners reach the required equity threshold for mortgage insurance removal more quickly. However, it is important to focus on renovations that provide a strong return on investment to maximize the financial benefits.

Market appreciation also plays a crucial role in home equity growth. While homeowners cannot control market conditions, they can stay informed about local real estate trends and take advantage of rising property values. If home prices in the area have increased significantly, it may be possible to request a new appraisal to demonstrate a lower LTV ratio. In some cases, lenders may allow mortgage insurance removal based on a new appraisal rather than waiting for the loan balance to reach the required percentage of the original purchase price.

Finally, maintaining financial discipline and avoiding actions that could negatively impact home equity is essential. Taking out a home equity loan or line of credit reduces the available equity and may delay the removal of mortgage insurance. Additionally, ensuring timely mortgage payments and avoiding financial hardships that could lead to missed payments will help maintain a strong financial position.

By implementing these strategies, homeowners can accelerate their home equity growth and remove mortgage insurance sooner, ultimately lowering their overall housing costs. Taking a proactive approach not only provides financial relief but also strengthens long-term homeownership stability.

Request PMI Cancellation: Steps to Lower Your Monthly Costs

Private mortgage insurance (PMI) is an additional cost that many homeowners must pay when they purchase a home with a down payment of less than 20%. While PMI protects the lender in case of default, it can be a financial burden for borrowers. Fortunately, there are ways to eliminate PMI and reduce monthly mortgage costs. One of the most effective methods is to request PMI cancellation once certain conditions are met. Understanding the steps involved in this process can help homeowners save money and achieve financial stability more quickly.

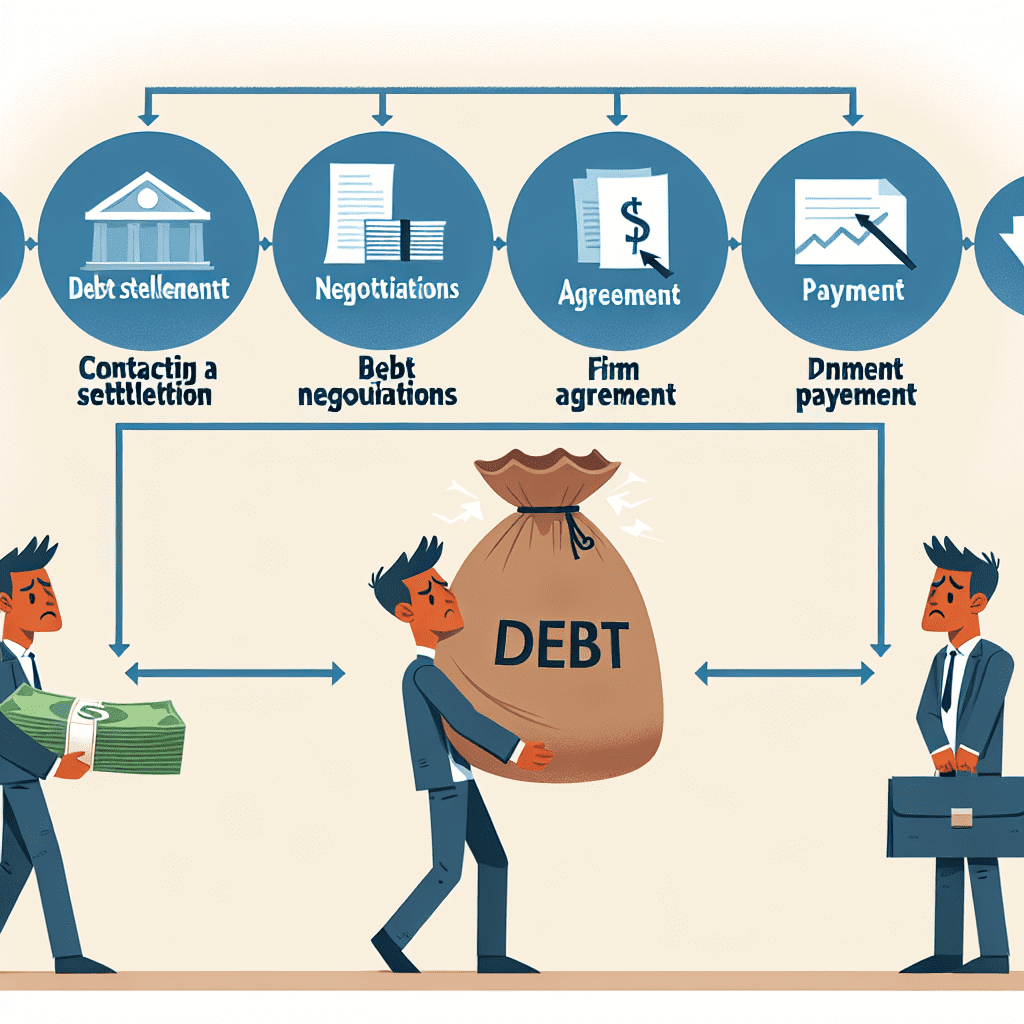

To begin with, homeowners should monitor their loan balance and home value to determine when they are eligible for PMI cancellation. Lenders are required to remove PMI automatically once the loan balance reaches 78% of the original home value, but borrowers can request cancellation earlier when the balance reaches 80%. This means that making extra payments toward the principal can accelerate the process and lead to earlier savings. Keeping track of mortgage statements and payment history is essential to knowing when the 80% threshold is reached.

Once the loan balance is at or below 80% of the home’s original value, the next step is to submit a formal request to the lender. This request should be in writing and include relevant details such as the loan account number and a statement confirming that the borrower has met the necessary conditions. Lenders may also require proof that the home has not declined in value, which often involves obtaining a professional appraisal. While this may come with a cost, it can be a worthwhile investment if it leads to the removal of PMI and long-term savings.

In addition to meeting the loan-to-value (LTV) requirement, borrowers must ensure that their mortgage payments are in good standing. Lenders typically require a history of timely payments before approving a PMI cancellation request. Any late payments or financial issues could delay the process, so maintaining a strong payment record is crucial. Furthermore, some lenders may have additional requirements, such as a minimum period of mortgage payments, which should be reviewed in the loan agreement.

For homeowners whose property values have increased significantly, another option is to request PMI cancellation based on the current market value rather than the original purchase price. If the home’s value has appreciated enough to bring the LTV ratio below 80%, refinancing or obtaining a new appraisal may provide an opportunity to eliminate PMI sooner. However, this approach requires careful consideration of refinancing costs and interest rate changes to ensure that the overall financial benefits outweigh the expenses.

If a lender denies a PMI cancellation request, homeowners should ask for a detailed explanation and review their options. In some cases, waiting a few more months to meet additional requirements may be necessary. Alternatively, refinancing with a new lender could provide a path to removing PMI while securing a lower interest rate. Comparing different lenders and loan terms can help determine the best course of action.

By taking proactive steps to request PMI cancellation, homeowners can reduce their monthly mortgage costs and allocate those savings toward other financial goals. Understanding the process, maintaining good financial habits, and staying informed about home values are key factors in successfully eliminating PMI and achieving greater financial freedom.