“Small Spends, Big Impact: How Daily Expenses Drain Your Savings”

Understanding The Latte Factor: How Small Daily Expenses Drain Your Wealth

The concept of the Latte Factor, popularized by financial expert David Bach, illustrates how small, seemingly insignificant daily expenses can have a profound impact on long-term financial stability. Many individuals overlook minor purchases, such as a daily cup of coffee, a quick snack, or a subscription service, assuming that these expenditures are too trivial to affect their overall financial health. However, when accumulated over time, these small costs can significantly reduce savings and hinder wealth-building efforts. Understanding how these expenses add up and recognizing their long-term consequences is essential for anyone seeking financial security.

One of the key reasons why small daily expenses are so detrimental to savings is the power of compounding. When money is spent on non-essential items, it is not only the immediate cost that matters but also the lost opportunity for that money to grow. For instance, spending five dollars a day on coffee may seem harmless, but over a year, this amounts to approximately $1,825. If that same amount were invested in a retirement account or a high-yield savings account, it could generate significant returns over time. The longer these small amounts are invested, the greater the potential for wealth accumulation due to compound interest.

Moreover, small daily expenses often go unnoticed because they are habitual. Many people do not consciously track their minor purchases, making it easy to underestimate their impact. A few dollars spent here and there may not seem like much in isolation, but when combined with other discretionary spending, they can create a substantial financial drain. This pattern of spending can prevent individuals from reaching their financial goals, such as buying a home, paying off debt, or building an emergency fund. By identifying and eliminating unnecessary expenses, individuals can redirect their money toward more meaningful financial objectives.

Another important aspect to consider is the psychological effect of habitual spending. Many people justify small purchases by believing they are rewards for hard work or necessary indulgences. While occasional treats are not inherently problematic, consistently spending on non-essential items can create a mindset that prioritizes short-term gratification over long-term financial well-being. Developing financial discipline and making conscious spending decisions can help individuals break free from this cycle and focus on building lasting wealth.

To counteract the negative effects of the Latte Factor, individuals can adopt several strategies to manage their spending more effectively. One approach is to track daily expenses and identify patterns of unnecessary spending. By maintaining a budget and setting clear financial goals, individuals can become more aware of their spending habits and make informed decisions about where to cut back. Additionally, finding cost-effective alternatives, such as brewing coffee at home or preparing meals instead of dining out, can lead to significant savings over time.

Ultimately, the Latte Factor serves as a powerful reminder that small financial decisions can have a lasting impact on overall wealth. While it may not be necessary to eliminate all discretionary spending, being mindful of daily expenses and making intentional choices can lead to greater financial security. By recognizing the cumulative effect of minor expenditures and prioritizing long-term financial goals, individuals can take control of their finances and work toward a more stable and prosperous future.

The Hidden Cost of Daily Indulgences: Applying The Latte Factor to Your Budget

The concept of the Latte Factor, popularized by financial expert David Bach, highlights how small, seemingly insignificant daily expenses can have a profound impact on long-term financial stability. Many individuals overlook minor purchases, such as a daily cup of coffee, a quick snack, or a streaming subscription, assuming that these expenditures are too small to affect their overall financial health. However, when these costs accumulate over time, they can significantly reduce the amount of money available for savings and investments. By recognizing the hidden cost of these daily indulgences, individuals can make more informed financial decisions and take control of their financial future.

One of the primary reasons small expenses go unnoticed is that they are often habitual and routine. A person who spends five dollars on coffee each morning may not consider this a major financial decision, but over the course of a month, this expense amounts to approximately $150. Over a year, this figure rises to $1,800, and when compounded over several decades, the total cost becomes substantial. This pattern applies to various other discretionary expenses, such as dining out, purchasing bottled water, or subscribing to multiple entertainment services. While each individual expense may seem trivial, their cumulative effect can be significant, diverting funds away from savings, investments, or debt repayment.

Furthermore, the opportunity cost of these expenditures is often overlooked. Money spent on non-essential items could instead be allocated toward financial goals, such as building an emergency fund, contributing to a retirement account, or investing in assets that generate long-term wealth. For instance, if the same $5 spent on coffee each day were instead invested in a diversified portfolio with an average annual return of 7%, it could grow to tens or even hundreds of thousands of dollars over several decades. This demonstrates how small financial decisions, when made consistently, can either hinder or enhance financial security.

In addition to the financial impact, habitual spending on small indulgences can also reinforce a mindset that prioritizes short-term gratification over long-term financial well-being. Many individuals justify these expenses by believing they are too minor to make a difference, yet this mindset can extend to other areas of financial decision-making. By becoming more conscious of daily spending habits, individuals can develop a greater awareness of their financial priorities and make more intentional choices that align with their long-term goals.

However, applying the Latte Factor to one’s budget does not necessarily mean eliminating all discretionary spending. Instead, it encourages individuals to evaluate their expenses and determine which purchases truly add value to their lives. For some, a daily coffee may be a meaningful ritual that enhances their day, while for others, it may be an unnecessary expense that could be redirected toward more significant financial goals. The key is to strike a balance between enjoying life’s small pleasures and maintaining financial discipline.

Ultimately, understanding the hidden cost of daily indulgences empowers individuals to take control of their financial future. By identifying and minimizing unnecessary expenses, reallocating funds toward savings and investments, and adopting a more mindful approach to spending, individuals can build a stronger financial foundation. The Latte Factor serves as a reminder that even the smallest financial decisions can have a lasting impact, and by making intentional choices, individuals can achieve greater financial security and long-term prosperity.

How to Overcome The Latte Factor and Build Long-Term Financial Security

The concept of the Latte Factor highlights how small, seemingly insignificant daily expenses can accumulate over time and hinder long-term financial security. Many people spend money on minor indulgences, such as a daily coffee, dining out, or subscription services, without realizing the long-term impact on their savings. While these expenses may appear trivial on a day-to-day basis, they can add up to substantial amounts over months and years. Recognizing this pattern is the first step toward overcoming the Latte Factor and making more intentional financial decisions.

To break free from this cycle, it is essential to develop awareness of spending habits. Tracking daily expenses can provide valuable insight into where money is going and help identify areas where small adjustments can be made. By reviewing bank statements or using budgeting apps, individuals can pinpoint unnecessary expenditures and determine which purchases can be reduced or eliminated. This process not only highlights spending patterns but also encourages a more mindful approach to financial management.

Once spending habits are assessed, setting clear financial goals becomes crucial. Whether the objective is to build an emergency fund, invest for retirement, or save for a major purchase, having a defined goal provides motivation to cut back on non-essential expenses. Establishing a budget that prioritizes savings ensures that money is allocated toward long-term financial security rather than being spent on fleeting pleasures. Automating savings by setting up recurring transfers to a dedicated account can further reinforce this habit, making it easier to stay on track.

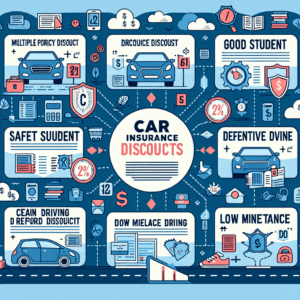

Another effective strategy for overcoming the Latte Factor is to find cost-effective alternatives to daily expenses. For instance, brewing coffee at home instead of purchasing it from a café can result in significant savings over time. Similarly, preparing meals at home rather than dining out frequently can reduce costs while promoting healthier eating habits. Evaluating subscription services and canceling those that are rarely used can also free up additional funds for savings. By making small adjustments to daily routines, individuals can redirect money toward more meaningful financial goals.

In addition to cutting back on discretionary spending, increasing income can further enhance financial security. Seeking opportunities for career advancement, taking on freelance work, or developing passive income streams can provide additional financial resources. When extra income is earned, directing a portion of it toward savings or investments can accelerate progress toward long-term financial stability. This approach not only mitigates the impact of small daily expenses but also strengthens overall financial resilience.

Ultimately, overcoming the Latte Factor requires a shift in mindset. Rather than viewing small purchases as harmless, individuals should recognize their cumulative effect and prioritize financial well-being. By making conscious spending choices, setting clear goals, and finding ways to increase income, it is possible to build long-term financial security. While occasional indulgences are not inherently detrimental, maintaining a balance between enjoying the present and planning for the future is essential. Through disciplined financial habits and a commitment to mindful spending, individuals can take control of their finances and work toward a more secure and prosperous future.