“Slash Your Auto Insurance Costs – Keep the Coverage, Lose the Expense!”

Smart Discounts: Unlocking Hidden Savings on Your Auto Insurance

Auto insurance is a necessary expense for every driver, but that does not mean you have to overpay for coverage. Many policyholders are unaware of the numerous discounts available that can significantly reduce their premiums without sacrificing protection. By taking advantage of these smart discounts, you can unlock hidden savings and potentially cut your auto insurance bill in half. Understanding how these discounts work and how to qualify for them is key to maximizing your savings while maintaining the coverage you need.

One of the most effective ways to lower your premium is by bundling multiple policies with the same insurer. Many insurance companies offer substantial discounts when you combine your auto insurance with homeowners, renters, or even life insurance policies. This not only simplifies your insurance management but also results in significant cost savings. Additionally, insuring multiple vehicles under the same policy can lead to further discounts, making it a practical option for families or households with more than one car.

Another often-overlooked discount is the good driver discount. Insurance providers reward policyholders who maintain a clean driving record, free of accidents and traffic violations. If you have a history of safe driving, you may qualify for lower rates. Some insurers also offer usage-based insurance programs that track your driving habits through a mobile app or a telematics device. By demonstrating responsible driving behavior, such as avoiding hard braking and excessive speeding, you can earn additional discounts over time.

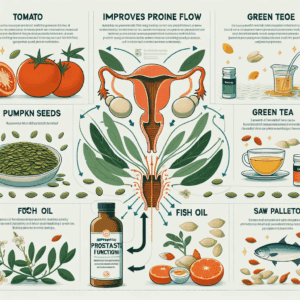

In addition to safe driving, your vehicle itself can play a role in reducing your insurance costs. Many insurers provide discounts for cars equipped with advanced safety features, such as anti-lock brakes, airbags, and anti-theft systems. If your vehicle has modern safety technology, it is worth checking with your insurer to see if you qualify for a discount. Furthermore, maintaining a low annual mileage can also lead to savings. If you drive fewer miles than the average driver, you may be eligible for a low-mileage discount, as insurers consider lower mileage to be associated with a reduced risk of accidents.

Your personal circumstances and affiliations can also unlock hidden savings. Many insurance companies offer discounts to members of certain professional organizations, alumni associations, or employer groups. Additionally, students with good grades may qualify for a good student discount, as insurers view academic success as an indicator of responsibility. If you or a family member on your policy is a student, providing proof of academic achievement could lead to lower premiums.

Another strategy to reduce your insurance costs is by adjusting your deductible. While this does not directly qualify as a discount, increasing your deductible—the amount you pay out of pocket before insurance coverage kicks in—can lower your monthly premium. However, it is important to ensure that you can afford the higher deductible in the event of a claim.

Finally, regularly reviewing your policy and shopping around for better rates can help you take advantage of new discounts and competitive pricing. Insurance companies frequently update their offerings, and a policy that was cost-effective a few years ago may no longer be the best option. By comparing quotes from multiple insurers and asking about available discounts, you can ensure that you are getting the best possible rate without compromising on coverage.

Policy Optimization: Adjusting Coverage to Maximize Savings

One of the most effective ways to reduce your auto insurance bill without sacrificing essential coverage is by optimizing your policy. Many drivers unknowingly pay for coverage they do not need or fail to take advantage of discounts that could significantly lower their premiums. By carefully evaluating your policy and making strategic adjustments, you can maximize savings while maintaining adequate protection.

To begin with, reviewing your current coverage is essential. Many policies include optional add-ons that may not be necessary for your specific situation. For instance, if you own an older vehicle with a low market value, carrying comprehensive and collision coverage may not be cost-effective. The cost of these coverages could exceed the potential payout in the event of a claim. In such cases, removing or reducing these coverages can lead to substantial savings. However, it is important to weigh the risks carefully and ensure that you are comfortable with the potential financial responsibility in the event of an accident.

Another way to optimize your policy is by adjusting your deductible. The deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can significantly lower your premium, as insurers view policyholders with higher deductibles as less likely to file small claims. While this strategy can lead to immediate savings, it is crucial to ensure that you have sufficient funds set aside to cover the deductible in case of an accident. A well-balanced approach is to select a deductible that provides meaningful savings without creating financial strain in the event of a claim.

In addition to adjusting coverage levels, taking advantage of available discounts can further reduce your insurance costs. Many insurers offer discounts for policyholders who bundle multiple policies, such as auto and home insurance. Additionally, maintaining a clean driving record, completing defensive driving courses, and installing safety features in your vehicle can qualify you for further discounts. Some insurers also provide lower rates for drivers who drive fewer miles annually or participate in usage-based insurance programs that monitor driving habits. By exploring these options, you can identify opportunities to lower your premium without compromising coverage.

Furthermore, periodically shopping around for insurance quotes can help ensure that you are getting the best possible rate. Insurance companies use different criteria to determine premiums, and rates can vary significantly between providers. Comparing quotes from multiple insurers allows you to identify more competitive pricing and potentially switch to a provider that offers the same coverage at a lower cost. However, when considering a switch, it is important to review the policy details carefully to ensure that you are not losing essential coverage or benefits.

Finally, maintaining a strong credit score can also contribute to lower insurance premiums. Many insurers use credit-based insurance scores to assess risk, and policyholders with higher credit scores often receive lower rates. By managing your credit responsibly, paying bills on time, and reducing outstanding debt, you can improve your credit score and potentially qualify for better insurance rates.

By carefully evaluating your policy, adjusting coverage levels, taking advantage of discounts, and maintaining good financial habits, you can effectively reduce your auto insurance bill without compromising essential protection. Implementing these strategies ensures that you are not overpaying for coverage while still maintaining the financial security needed in case of an accident.

Shopping Around: Comparing Providers for the Best Rates

One of the most effective ways to reduce your auto insurance bill without sacrificing coverage is by shopping around and comparing providers. Many drivers remain with the same insurance company for years, assuming they are receiving the best possible rate. However, insurance premiums can vary significantly between providers, and failing to explore other options may result in overpaying for the same level of coverage. By taking the time to compare rates, policyholders can identify more affordable options that still meet their coverage needs.

To begin the process, it is essential to gather quotes from multiple insurance companies. Many insurers offer online tools that allow drivers to receive estimates within minutes. However, while online quotes provide a general idea of pricing, speaking directly with an insurance representative can offer additional insights into potential discounts and policy adjustments. When requesting quotes, it is important to ensure that the coverage limits, deductibles, and policy features are consistent across all providers. This ensures an accurate comparison and prevents the risk of selecting a lower-priced policy that offers less protection.

In addition to comparing base rates, it is beneficial to evaluate the discounts available from each provider. Many insurance companies offer discounts for safe driving records, bundling multiple policies, maintaining good credit, or even completing defensive driving courses. Some insurers also provide lower rates for customers who drive fewer miles annually or use telematics programs that monitor driving habits. By identifying and taking advantage of these discounts, policyholders can further reduce their premiums without compromising coverage.

While price is a crucial factor, it is equally important to consider the reputation and financial stability of an insurance provider. A lower premium may not be worthwhile if the company has a history of poor customer service or delayed claims processing. Researching customer reviews, complaint records, and financial strength ratings from independent agencies can help ensure that the chosen insurer is reliable and capable of handling claims efficiently. Additionally, speaking with friends or family members about their experiences with different providers can offer valuable insights.

Another key consideration when comparing insurance providers is the flexibility of their policies. Some companies offer more customizable coverage options, allowing drivers to tailor their policies to better suit their needs. For example, a provider that allows for higher deductibles in exchange for lower premiums may be a better fit for a driver who rarely files claims. Similarly, some insurers offer optional coverages, such as accident forgiveness or new car replacement, which may be beneficial depending on individual circumstances. Understanding these options can help drivers make informed decisions that balance affordability with adequate protection.

Once a suitable provider has been identified, switching insurance companies is a straightforward process. However, before canceling an existing policy, it is crucial to confirm that the new coverage is active to avoid any lapse in protection. Additionally, reviewing the cancellation policy of the current insurer can help avoid potential fees or penalties. By carefully comparing providers and making an informed switch, drivers can significantly reduce their auto insurance costs while maintaining the coverage they need.