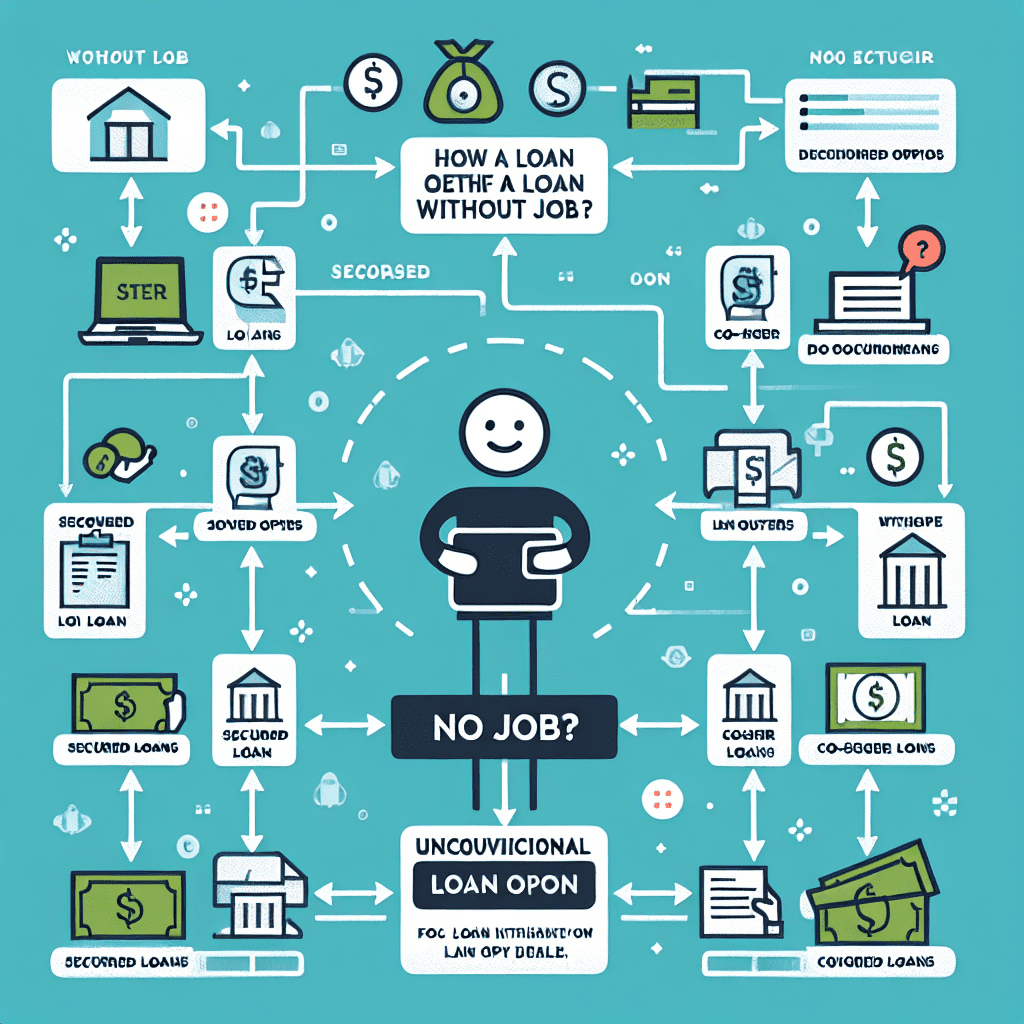

Finding yourself in need of a loan while unemployed can be stressful. Traditional lenders often require proof of income, making it difficult to secure financing. However, there are still ways to obtain a loan without a job. In this guide, we’ll explore alternative lending options, eligibility criteria, and tips to improve your chances of approval.

Can You Get a Loan Without a Job?

Yes, it is possible to get a loan without a job, but it may require alternative income sources or collateral. Lenders assess your ability to repay the loan, so demonstrating financial stability through other means is crucial.

Alternative Ways to Qualify for a Loan

If you don’t have a traditional job, lenders may consider other sources of income or financial backing. Here are some ways to improve your chances of approval:

- Alternative Income Sources: Social Security benefits, rental income, freelance work, or investments can serve as proof of income.

- Collateral-Based Loans: Secured loans, such as auto title loans or home equity loans, use assets as collateral.

- Co-Signer Support: A creditworthy co-signer can increase your chances of approval by guaranteeing the loan.

- Good Credit Score: A strong credit history can help you qualify for personal loans even without a job.

Types of Loans Available for the Unemployed

Several loan options cater to individuals without traditional employment. Below are some of the most accessible choices:

1. Personal Loans

Some lenders offer personal loans to unemployed individuals if they have alternative income sources or a co-signer. Online lenders and credit unions may be more flexible than traditional banks.

2. Payday Loans

Payday loans provide quick cash but come with high interest rates. These should be a last resort due to their short repayment terms and potential debt traps.

3. Title Loans

If you own a vehicle, a title loan allows you to borrow against its value. However, failure to repay could result in losing your car.

4. Credit Card Cash Advances

If you have a credit card, you may be able to take out a cash advance. While convenient, these advances often come with high fees and interest rates.

5. Peer-to-Peer (P2P) Lending

P2P lending platforms connect borrowers with individual investors. These platforms may have more flexible requirements than traditional banks.

How to Improve Your Chances of Loan Approval

To increase your likelihood of securing a loan without a job, consider the following strategies:

- Build Your Credit Score: A higher credit score can improve your loan terms and approval chances.

- Show Proof of Alternative Income: Provide documentation of any income sources, such as rental payments or government benefits.

- Offer Collateral: Secured loans are easier to obtain since they reduce the lender’s risk.

- Find a Co-Signer: A co-signer with a stable income and good credit can help you qualify for better loan terms.

- Apply with Online Lenders: Many online lenders have more flexible requirements than traditional banks.

Risks and Considerations

Before taking out a loan without a job, it’s essential to consider the risks involved:

- High Interest Rates: Unsecured loans for unemployed individuals often come with higher interest rates.

- Short Repayment Terms: Some loans, like payday loans, require quick repayment, which can be challenging without steady income.

- Risk of Losing Collateral: If you take out a secured loan, failure to repay could result in losing your asset.

- Potential Debt Cycle: Borrowing without a stable income can lead to a cycle of debt if not managed carefully.

Final Thoughts

Getting a loan without a job is possible, but it requires careful planning and consideration. Exploring alternative income sources, securing a co-signer, or opting for collateral-based loans can improve your chances of approval. However, it’s crucial to assess your ability to repay the loan to avoid financial difficulties.

Before applying, compare different lenders, read the terms carefully, and consider whether borrowing is the best option for your situation. If possible, explore other financial assistance options, such as government aid or temporary gig work, to bridge the gap until you secure stable employment.