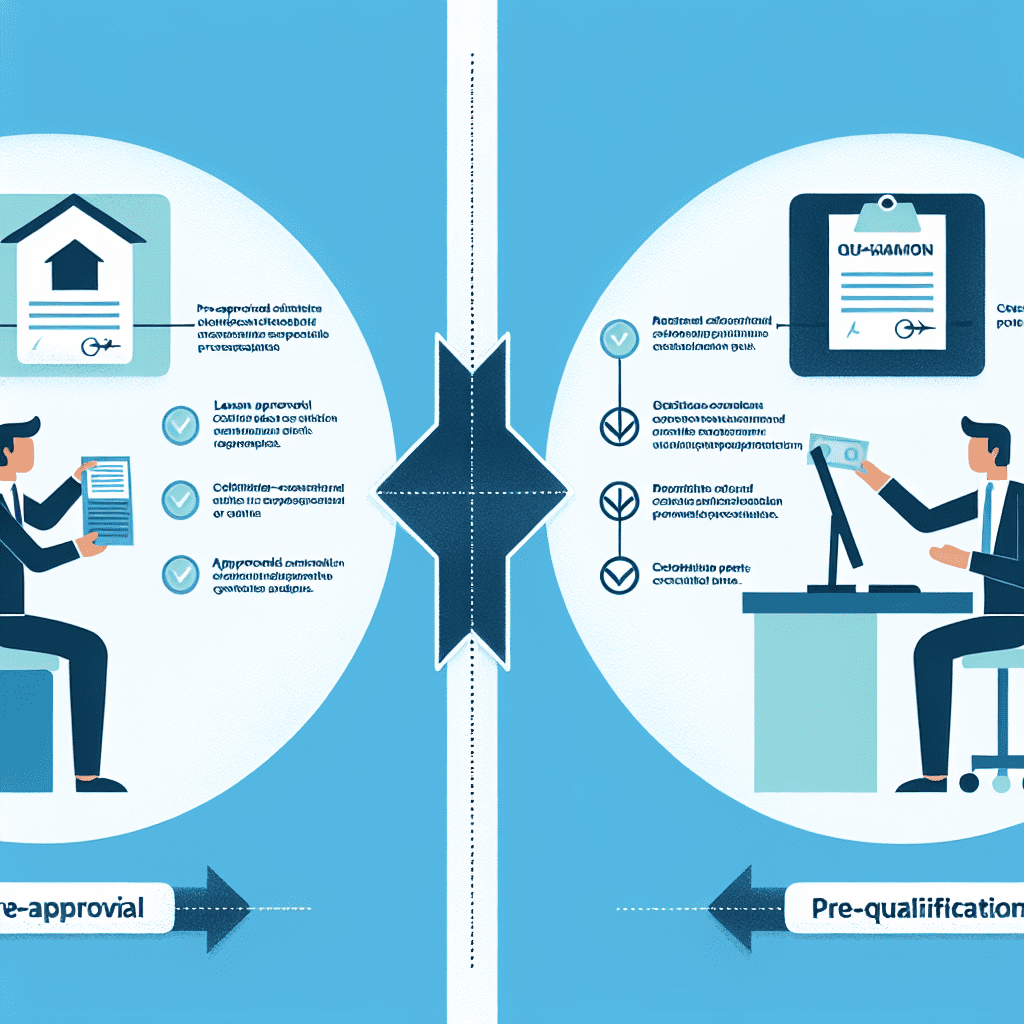

“Loan Pre-Approval vs. Pre-Qualification: Know the Difference, Secure Your Dream Home!”

Understanding Loan Pre-Approval vs. Pre-Qualification: Key Differences Explained

When applying for a mortgage, understanding the difference between loan pre-approval and pre-qualification is essential. While both processes help potential homebuyers assess their financial standing and borrowing capacity, they serve distinct purposes and carry different levels of credibility with lenders and sellers. Knowing how each works can help borrowers make informed decisions and improve their chances of securing a home loan.

Pre-qualification is often the first step in the mortgage process. It provides a general estimate of how much a borrower may be able to afford based on self-reported financial information. Lenders typically ask for details about income, assets, debts, and credit history but do not verify this information through documentation or a credit check. Because of this, pre-qualification is a relatively quick and informal process, often completed online or over the phone. While it can give borrowers a rough idea of their purchasing power, it does not carry significant weight with sellers or real estate agents since it is not a firm commitment from the lender.

On the other hand, pre-approval is a more thorough and formal process. It requires borrowers to submit financial documents such as tax returns, pay stubs, bank statements, and credit reports for verification. Lenders conduct a detailed review of the applicant’s financial background, including their credit score and debt-to-income ratio, to determine their eligibility for a loan. Once approved, the lender provides a pre-approval letter stating the maximum loan amount the borrower qualifies for. This letter demonstrates to sellers that the buyer is financially capable of securing financing, making their offer more competitive in a competitive housing market.

One of the key differences between pre-qualification and pre-approval is the level of commitment from the lender. Pre-qualification is based on unverified information and does not guarantee loan approval, whereas pre-approval involves a more rigorous assessment and indicates that the lender is willing to extend a loan, subject to final underwriting and property appraisal. Because of this, pre-approval carries more weight when making an offer on a home, as sellers are more likely to take an offer seriously if it comes from a pre-approved buyer.

Another important distinction is the impact on a borrower’s credit score. Since pre-qualification does not involve a credit check, it has no effect on credit standing. In contrast, pre-approval requires a hard inquiry on the borrower’s credit report, which may cause a temporary dip in their credit score. However, this impact is usually minimal and short-lived, especially if the borrower maintains good financial habits.

While both pre-qualification and pre-approval can be useful, pre-approval provides a stronger foundation for homebuyers who are serious about purchasing a property. It not only gives a clearer picture of affordability but also enhances credibility in the eyes of sellers and real estate agents. By obtaining pre-approval before house hunting, buyers can streamline the home-buying process and position themselves as serious contenders in a competitive market. Understanding these differences allows borrowers to navigate the mortgage process with confidence and make informed financial decisions.

Loan Pre-Approval vs. Pre-Qualification: Which One Do You Need?

When navigating the home-buying process, understanding the difference between loan pre-approval and pre-qualification is essential. Both terms are often used interchangeably, yet they serve distinct purposes and carry different levels of commitment from lenders. Knowing which one you need can help streamline your home search and improve your chances of securing the right mortgage.

Pre-qualification is typically the first step in the mortgage process. It provides a general estimate of how much a borrower may be able to afford based on self-reported financial information. Lenders conduct a basic review of income, assets, debts, and credit history without performing a thorough verification. Since this process does not involve a hard credit check or detailed financial analysis, it is a quick and convenient way for potential buyers to gauge their purchasing power. However, because the information is not verified, pre-qualification does not guarantee loan approval. It serves more as an initial assessment rather than a firm commitment from the lender.

On the other hand, pre-approval is a more comprehensive and formal process. It requires borrowers to submit financial documents such as tax returns, pay stubs, bank statements, and credit reports for thorough evaluation. Lenders conduct a detailed review of the applicant’s financial situation, including verifying employment history and assessing debt-to-income ratios. Unlike pre-qualification, pre-approval involves a hard credit inquiry, which may have a temporary impact on the borrower’s credit score. Once approved, the lender provides a conditional commitment for a specific loan amount, giving buyers a clearer understanding of their budget and strengthening their position in negotiations.

One of the key advantages of obtaining pre-approval is that it demonstrates to sellers that a buyer is financially prepared and serious about purchasing a home. In competitive real estate markets, where multiple offers are common, having a pre-approval letter can give buyers an edge over those who are only pre-qualified. Sellers are more likely to consider offers from pre-approved buyers because it reduces the risk of financing issues later in the transaction. Additionally, pre-approval allows buyers to move quickly when they find a home they want, as much of the financial vetting process has already been completed.

While both pre-qualification and pre-approval have their benefits, the choice between the two depends on the buyer’s stage in the home-buying journey. For those who are just beginning to explore their options and want a rough estimate of their borrowing capacity, pre-qualification may be sufficient. It provides a general idea of affordability without requiring extensive documentation. However, for buyers who are ready to make an offer and want to demonstrate financial credibility, pre-approval is the preferred option. It not only provides a more accurate assessment of loan eligibility but also enhances the buyer’s negotiating power.

Ultimately, understanding the distinction between pre-qualification and pre-approval can help buyers make informed decisions and navigate the mortgage process with confidence. By choosing the right option based on their needs and financial readiness, prospective homeowners can position themselves for a smoother and more successful home purchase.

How Loan Pre-Approval and Pre-Qualification Impact Your Home Buying Journey

When beginning the home buying process, understanding the differences between loan pre-approval and pre-qualification is essential. Both steps provide insight into a borrower’s financial standing and help determine how much they may be able to borrow. However, they serve distinct purposes and carry different levels of credibility in the eyes of lenders and sellers. Recognizing how each impacts the home buying journey can help prospective buyers make informed decisions and improve their chances of securing a mortgage.

Pre-qualification is often the first step in the mortgage process. It is a relatively quick and informal assessment of a borrower’s financial situation based on self-reported information. Lenders typically ask for details about income, assets, debts, and credit history but do not verify the information provided. As a result, pre-qualification offers a general estimate of how much a borrower may be eligible to borrow. While this step can be useful for individuals who are just beginning to explore their home buying options, it does not carry significant weight when making an offer on a property. Since the lender has not conducted a thorough review of the borrower’s financial background, sellers may not view a pre-qualification letter as a strong indication of financial readiness.

In contrast, pre-approval is a more comprehensive and formal process. It requires borrowers to submit financial documents, such as tax returns, pay stubs, bank statements, and credit reports, for verification by the lender. The lender then conducts a detailed analysis of the borrower’s financial health, including their creditworthiness and debt-to-income ratio. If approved, the borrower receives a pre-approval letter stating the maximum loan amount they qualify for, which can be a powerful tool when making an offer on a home. Because pre-approval involves a thorough financial review, sellers and real estate agents often view it as a more reliable indication that the buyer is financially prepared to complete the purchase.

The impact of pre-qualification and pre-approval on the home buying journey extends beyond their differences in credibility. Pre-qualification can be beneficial for buyers who are in the early stages of their search and want to understand their potential budget. It allows them to explore different loan options and make preliminary financial plans without committing to a specific lender. However, since it does not guarantee loan approval, buyers who rely solely on pre-qualification may face challenges when competing with others who have already secured pre-approval.

On the other hand, obtaining pre-approval can provide buyers with a competitive advantage in a competitive housing market. Sellers are more likely to take offers from pre-approved buyers seriously, as it demonstrates financial readiness and reduces the risk of financing-related delays. Additionally, pre-approval allows buyers to act quickly when they find a home they want to purchase, as they have already completed a significant portion of the mortgage application process. This can be particularly advantageous in fast-moving markets where homes receive multiple offers.

Ultimately, both pre-qualification and pre-approval play important roles in the home buying journey. While pre-qualification provides an initial assessment of borrowing potential, pre-approval offers a more concrete and credible indication of financial readiness. By understanding the distinctions between the two, buyers can better navigate the mortgage process and position themselves for success in securing their dream home.